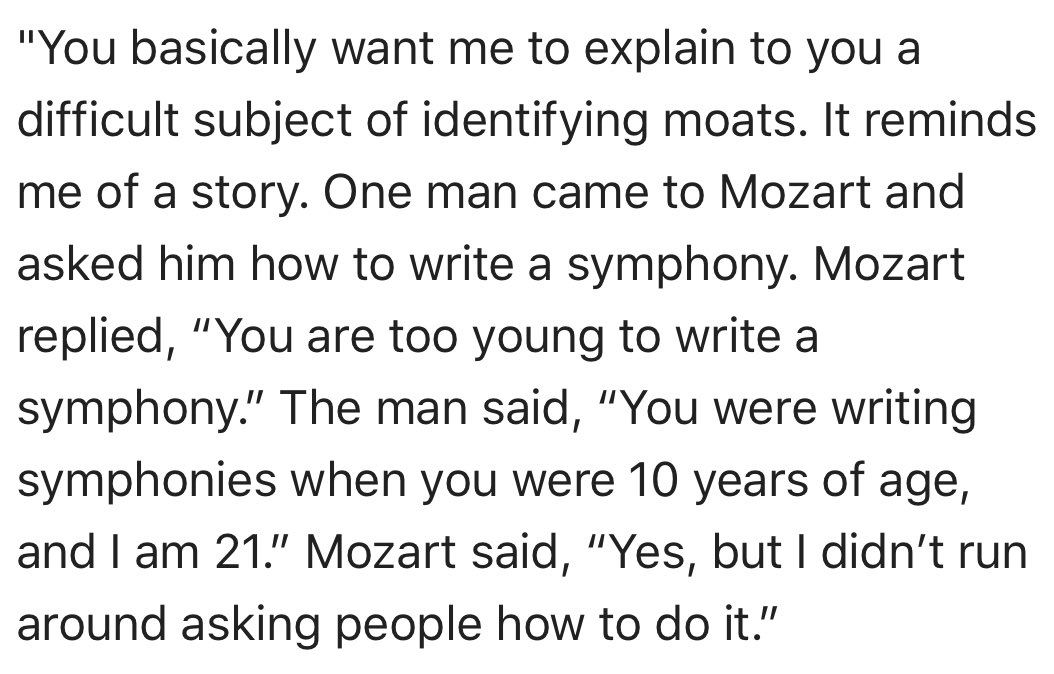

"The key to investing is ... determining the competitive advantage of any given company and, above all, the durability of that advantage." W. Buffett

Charlie Munger has the answer: "Everyone has the idea of owning good companies. The problem is that they have high prices in relation to assets and earnings."

The skill is in understanding how the moat will change as time passes.

Munger is looking for an analytical edge vs markets.

Would making that prediction have been in your circle of competence? Would you have had enough of an analytical, behavioral or informational edge over markets to have a margin of safety? searchengineland.com/a-eulogy-for-m…