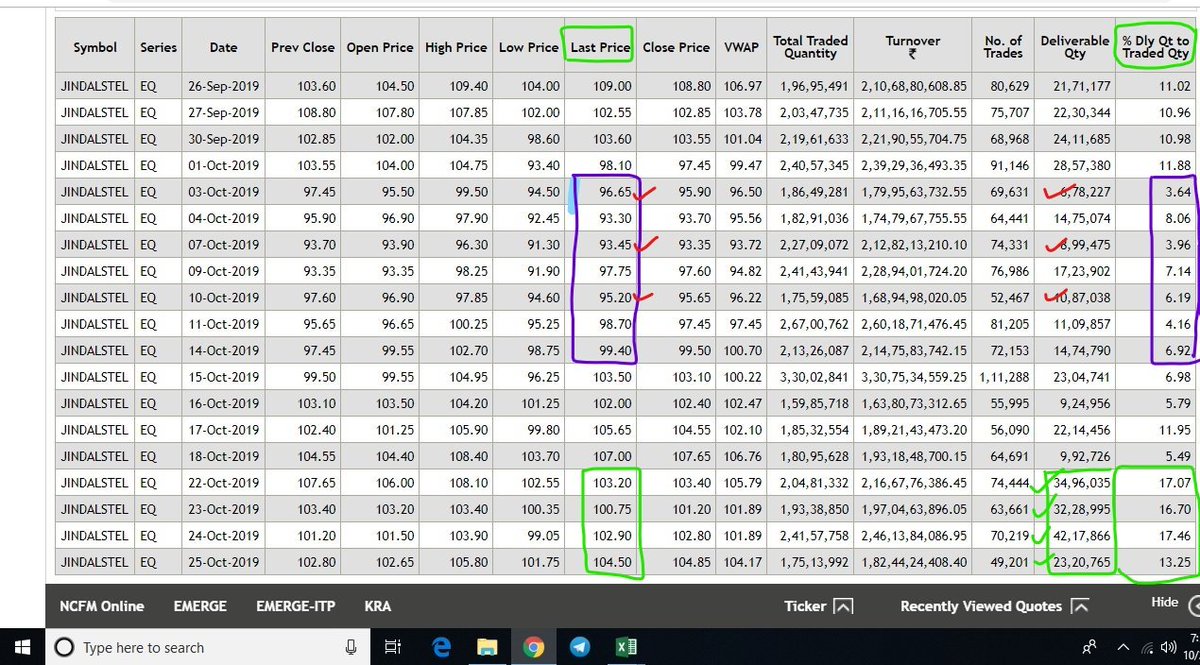

A case study. ...... for learning purposes. Please record your observations

An Option Chain Theory and practical.

*** For those who want to detailed study... here we go.

bseindia.com/corporates/Ins…

Check who is in Charge, who will get the benefits, How and when..... Don't ask... Don't tell....

Here, I am recording my observations....for my learning/future references.

1. When 110 CE & 125 PE buyer/ seller will in profit.

2. What amount is at stake?

3. What I saw? What's shown? What's purpose? What's understanding?

***

110 CE added at 1000 hrs. 125 PE added at 1140 & 1415 hrs.

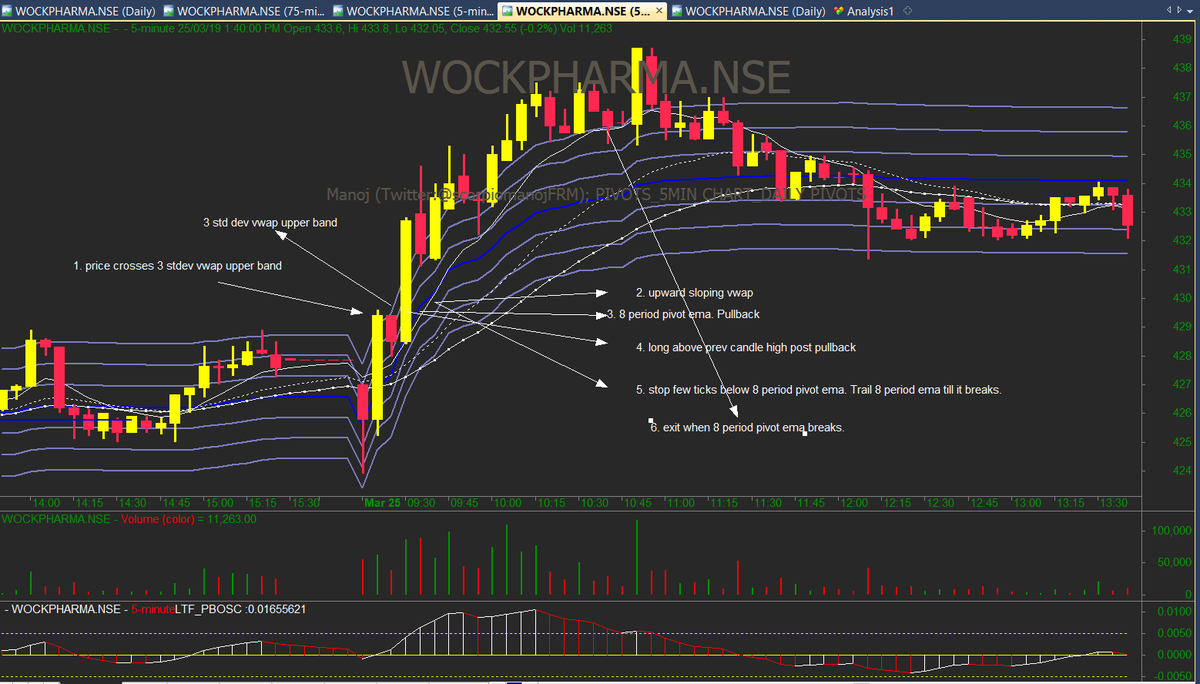

Lets do some Advance TA.

TA is mine, Money is yours. No buy/sell or hold recommendation. Shared exclusively for Learning purposes. One can search Coppock curve on Google.