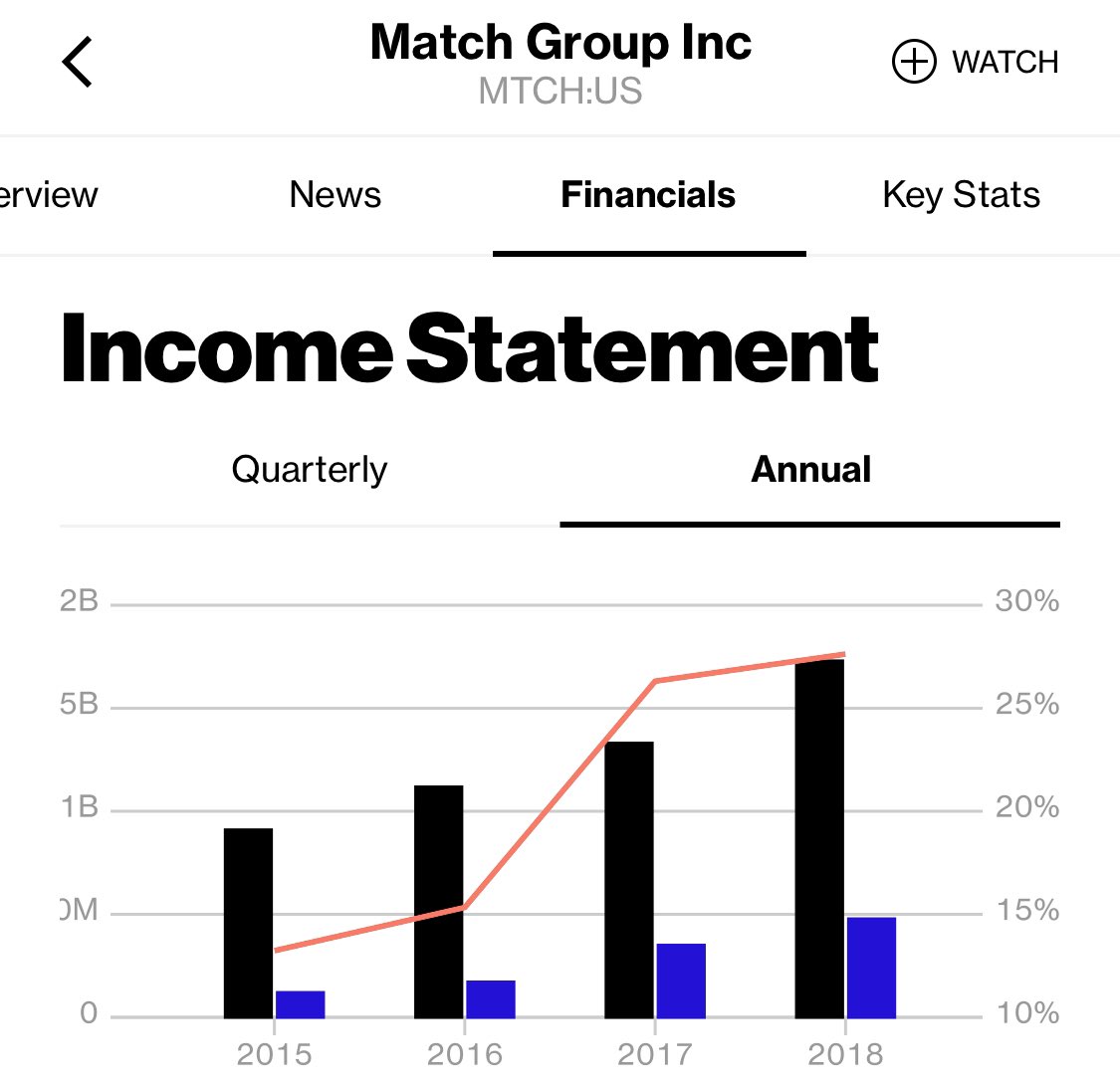

1) Tinder! If you’re single, try it. Women get a ton of attention, while men get to fish where the fish are, spending boatloads of money to stand out. 5 mil. subscribers, and thus IMO a very, very long growth runway. $MTCH

gallery.mailchimp.com/2506bda6ca9a8b…