1/

Time preference is different per individual and isn't fixed as we have different stages in our lives. ...

As parents, you sacrifice your needs for those of your kids. You save money to provide.

-Elderly, ironically, at the end of a long life approach zero time preference (but always positive).

Time preference and its rate of change differs per individual.

...

-We, are born at the peak of Time Preference Mountain and slide down uncontrollably fast

- Over time, as the mountain levels off, we are able to slow down, walk and look around.

- We have a career and at some point in life you're comfortable to think about settling down.

...

Enter fiat inflationism and debt.

As you frolic at the peak of TP Mountain certain choices trigger a snowball reaction: you get indebted

You cut yourself some slack here and there. You deserve a holiday. Everyone does it.

Onwards...

Every one feels the pressure. Taxes are used to pay interest on national interest of previous spending.

People without debt don't have much to run from, but due to inflation have to pay increasingly higher prices just to get by. Excluding unexpected expenses.

Even people with a university degree feel the pressure: even though they earn enough money to either decrease debt or outrun it, they pay more in taxes and are seduced to more lavish spending habits. TP Mountain is always slippery.

@TraceMayer

QE has been described as socialism for the rich who own assets

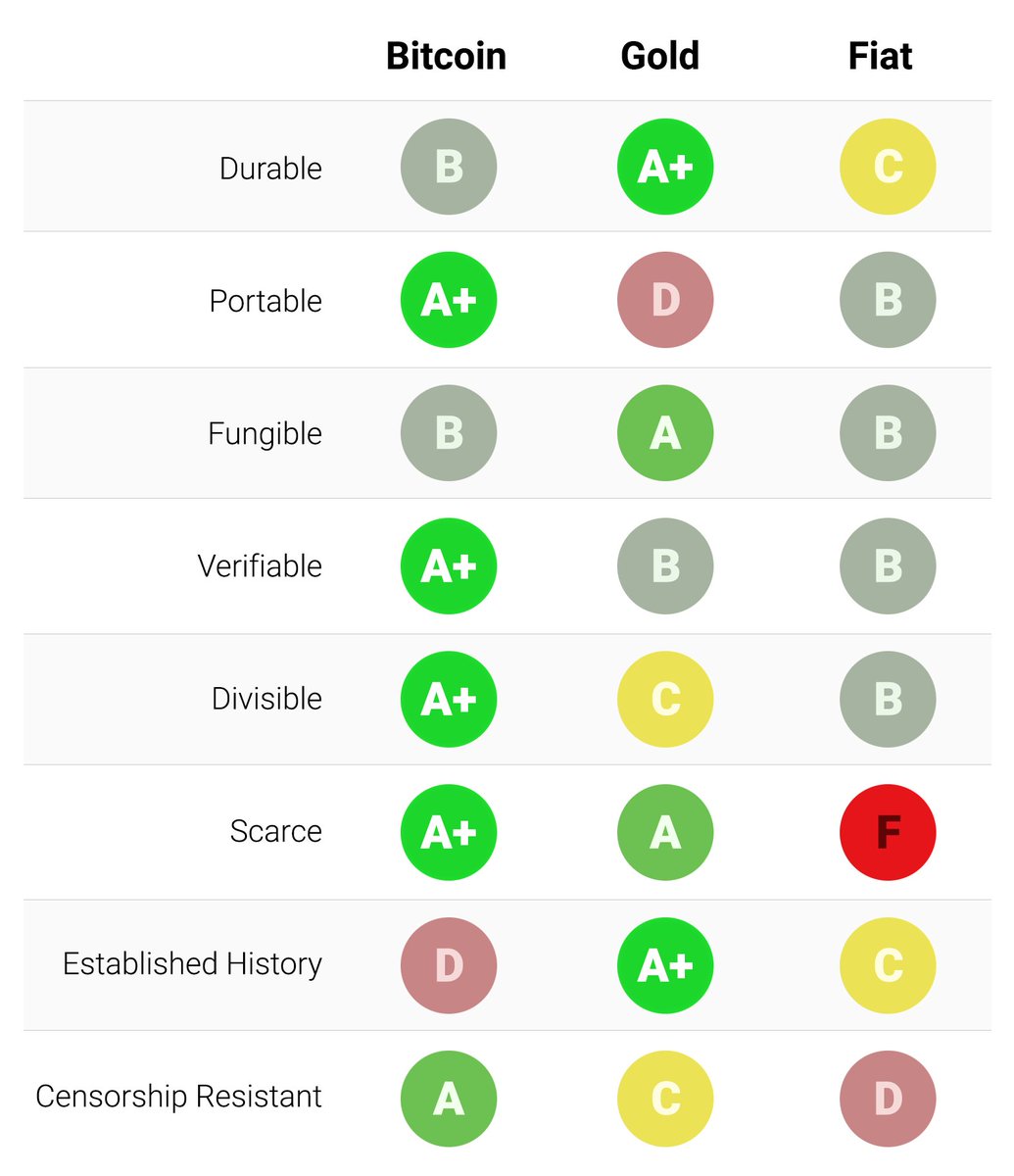

Bitcoin, with the best monetary properties we've ever seen has the potential to put a stop to rampant fiat inflationism and reverse the effects of the debt fuelled spending habits.

(please read the src @real_vijay's Bullish case for Bitcoin:)

Bitcoin's inherent monetary policy is protected by individuals that run nodes (Verifiability).

Miners 'mine' Bitcoin, but they do this as a paid service to the network (nodes). All actors 'entering' Bitcoin agree to certain Terms of Service (Consensus rules). If miners violate the ToS, their block will not be accepted by the network and they don't get paid Bitcoin.

Strugglers are not able to invest in Bitcoin. They either simply don't have the money, don't have the time to wait (speculate) or have more pressing matters to deal with: health, food, kids, etc.

i.e. Pre-mine, hard to run a full node, centralization. All High time preference design trade-offs.

With a new means to effectively Store Value, old money and high earners will slowly allocate to this new hard money. Plus, there's no Cantillon-drip. This takes the pressure off prices of all other 'hard assets': Stocks and Real Estate.

Everyone is able to better store the fruits of their labour into the future, have to gradually pay less for their day-today, and housing is more affordable.

If they're not outright scams.