But the government must do more to make the switch to clean energy:

bloomberg.com/amp/opinion/ar…

If it accelerates renewables transition we could be well on track to a below 2°C future.

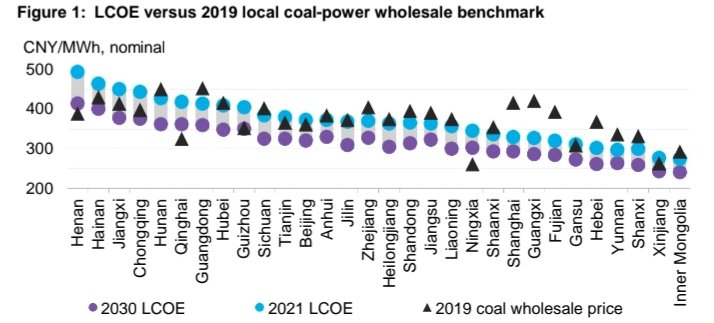

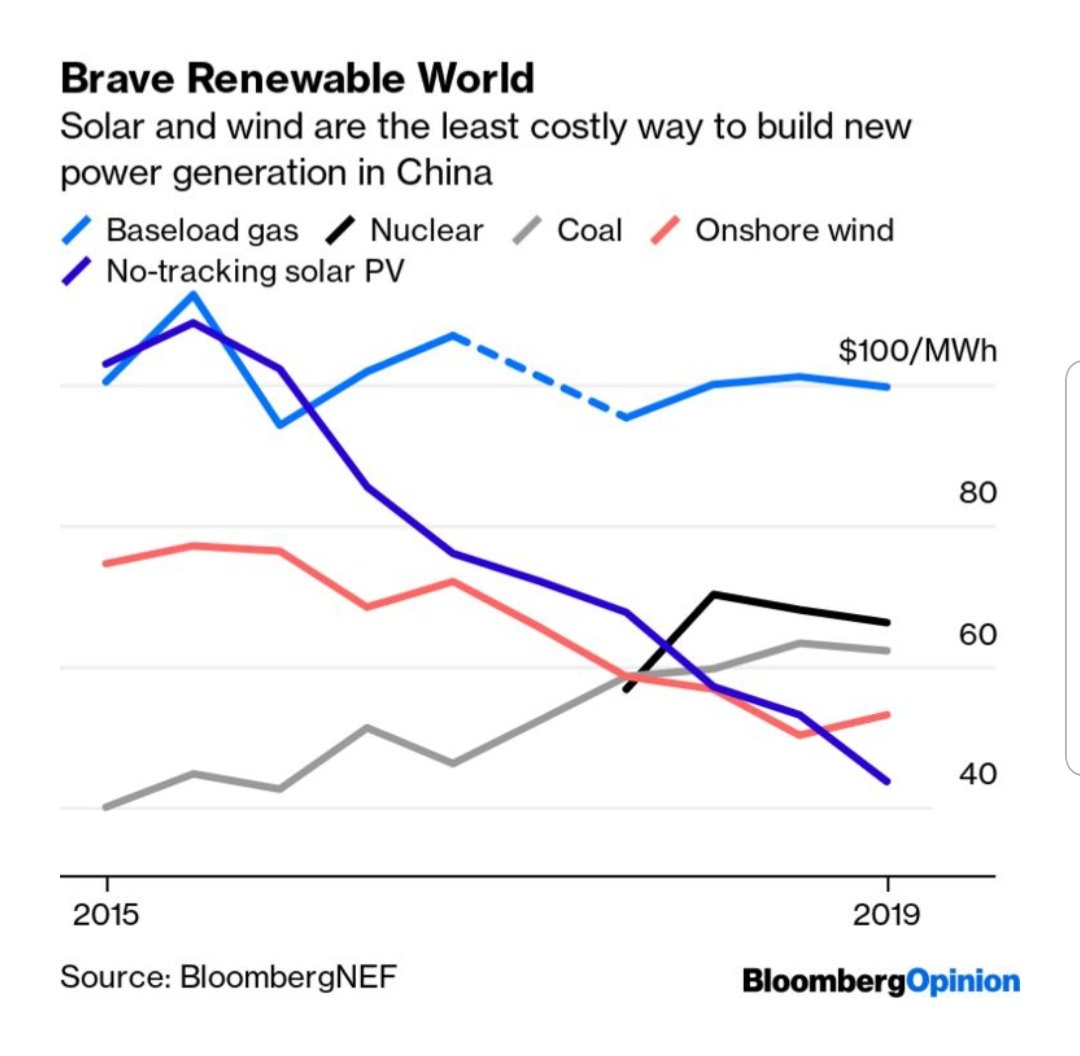

Until recently it was considered a big deal that *new* renewables were cheaper than *new* coal.

But now, new renewables are cheaper than *existing* coal across China's industrial heartlands.

That should make renewables the most viable option for *all* generation.

Coal is dead?

1. Those "benchmark" power prices aren't the same as operating costs. They're usually artifically high, designed to keep coal generators profitable. With deregulation, they're likely to fall and squeeze renewables' margin advantage.

The best option for their finances is often to hold no auction and keep cheaper renewables out of the market to prop up existing coal-fired plant.

Accelerating the switch should lower power prices; reduce the health burden from fossil pollution; and support the environmental objectives that Xi sees as one of the country's three biggest challenges.

They'll probably mostly just switch old subcritical coal for new supercritical and ultra-supercritical coal, with little net effect on emissions.

Non-nuclear power generation is wide-open to foreign investors if they can be tempted in.

China is in a grim, autarkic moment right now, so while it's pushing hard on electrifying transport (because most petroleum is imported), coal reserves are domestic and politically favoured.

The loss of cooperative climate leadership from the U.S., and the trade war more broadly, make the more carbon-intensive future more likely.

Anywhere the blue circle is below the black triangle, new wind power should be cheaper than benchmark coal *now*.