*Link (Chinese): bit.ly/2Tr5h3o

reuters.com/article/us-chi…

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

xinhuanet.com/english/2019-0…

bloomberg.com/news/articles/…

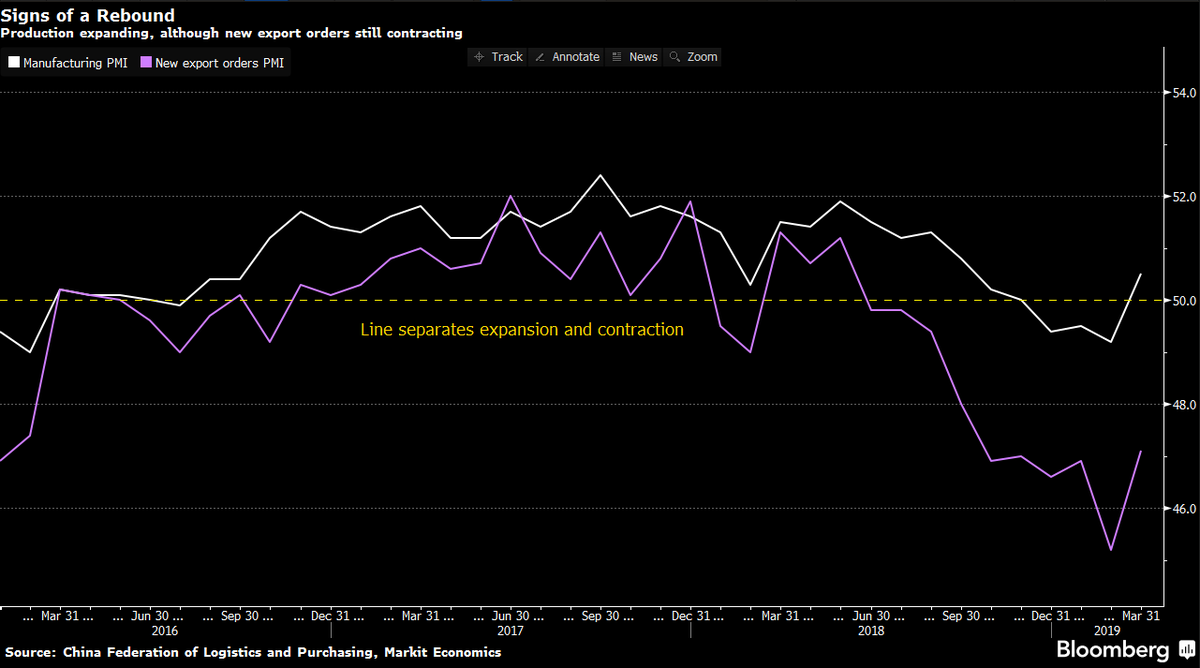

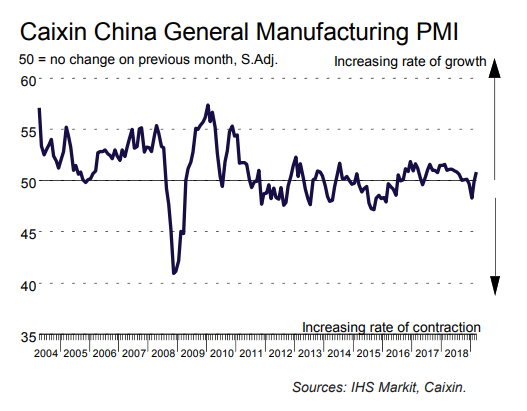

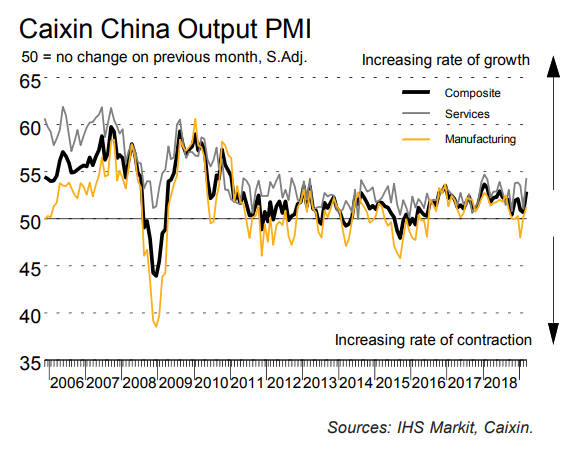

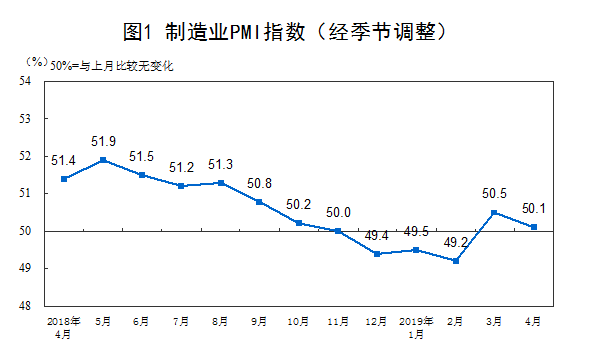

*Production: 52.7 v 49.5 (6-month high)

*New orders: 51.6 v 50.6 (6-month high

*New export orders: 47.1 v 45.2 (6-month high)

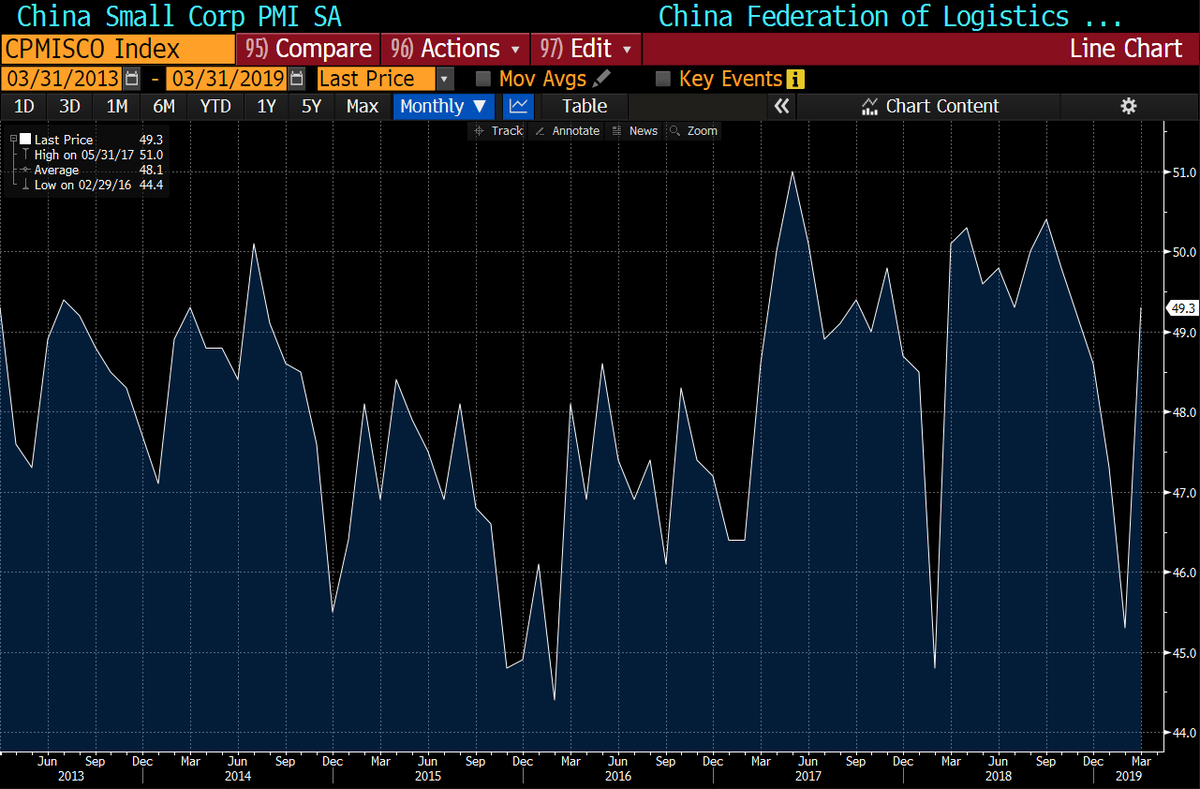

*Medium Corp: 49.9 v 46.6 prior (7-month high)

*Small Corp: 49.3 v 45.3 prior (5-month high)

➡ Large Corp are mainly benefiting from the increase in public spending though the gap with SMEs is shrinking.

1/ Seasonal adjustment factors associated to the official 🇨🇳 PMI create more volatility in Jan.-Mar. data.

2/ March data may overstate the ⬆ in activity as it usually the case when the Lunar New Year holiday took place in Feb.

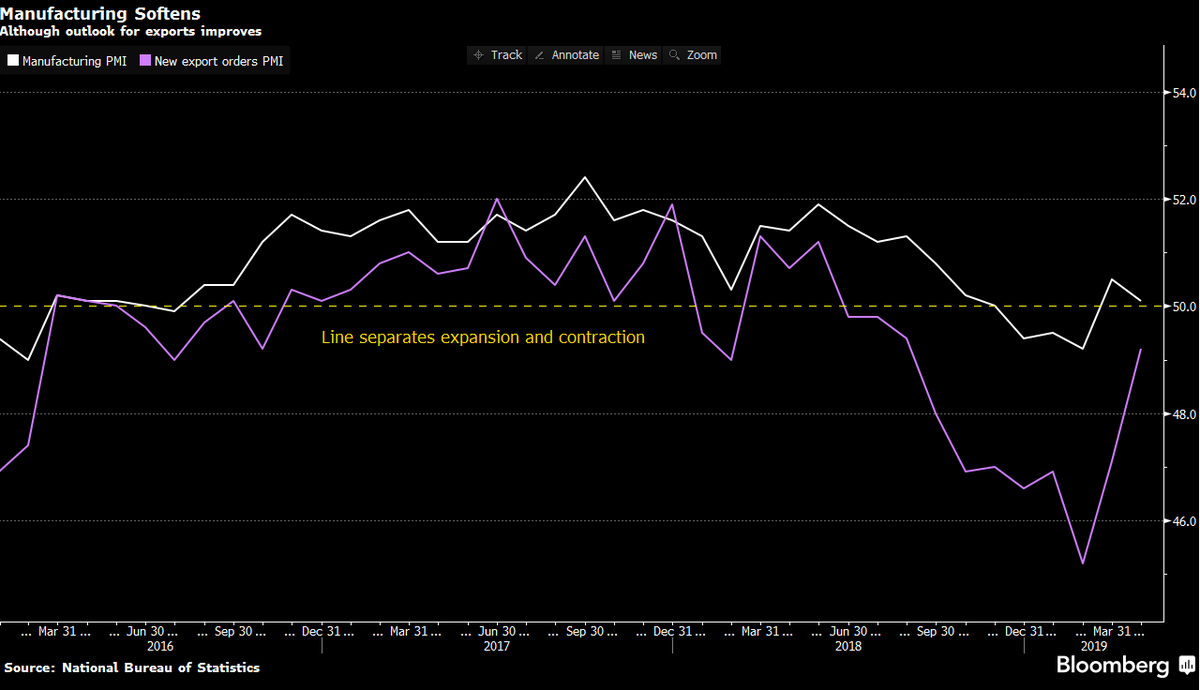

4/ Metrics linked to trade remained in contractionary territory.

*New export orders rose slightly after a fall in February.

*Link: bit.ly/2FFPzMR

*Link: bit.ly/2uIiGKE

The securities regulator may raise ceiling of new share sales to 50% of total pre-sale shares, from 20% currently.

*Link (Chinese): bit.ly/2FTtQ5F

*Link: bloom.bg/2FLKDpS

scmp.com/economy/china-…

reuters.com/article/us-chi…

*books, magazines, food, beverage, gold & silver, furniture, toys and some drugs to 13%

*sports equipment excluding golf-related products, textile products, television cameras and bicycles to 20%

*MOF: bit.ly/2UKwx1G

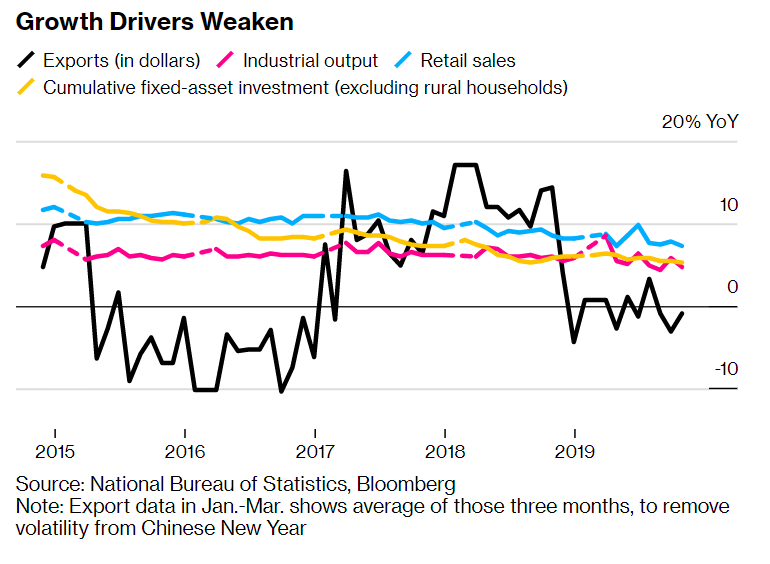

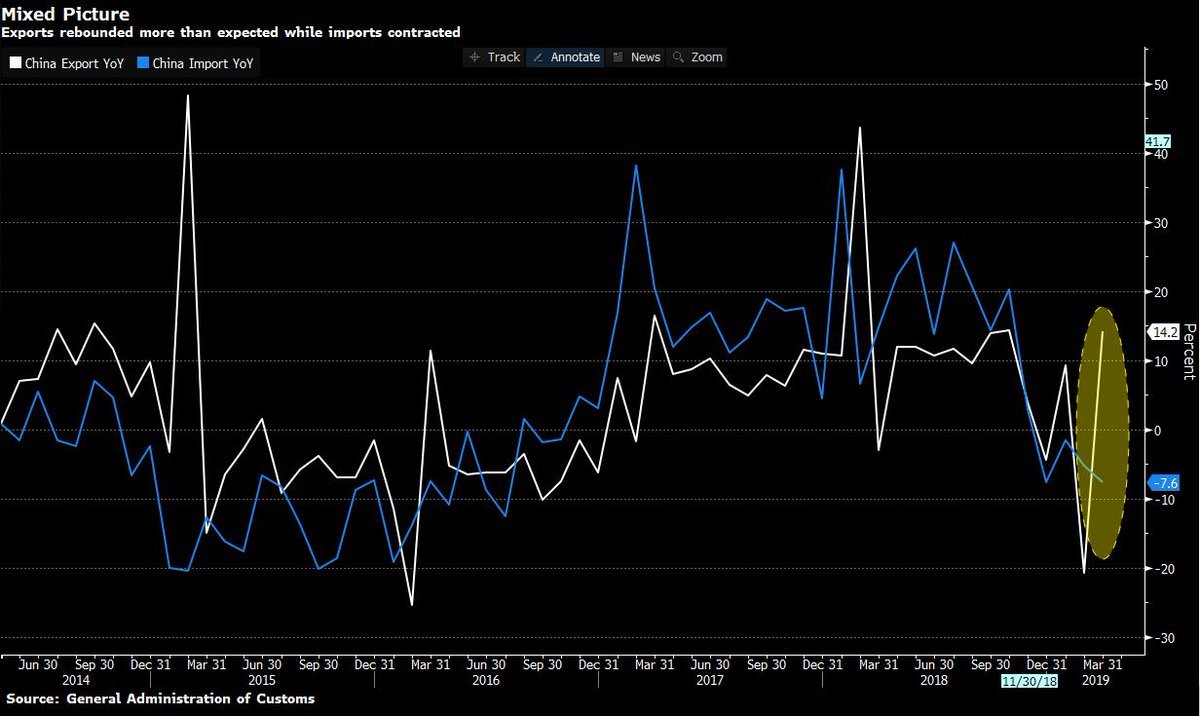

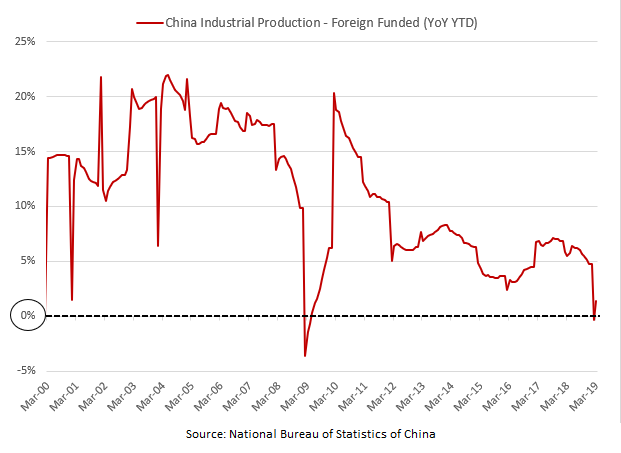

- Exports Y/Y: +14.2% v -20.8% prior (largest ⬆ since Feb. 2018)

- Imports Y/Y: -7.6% v -5.2% prior (largest ⬇ since Dec. 2018)

*Link: bloom.bg/2Ks0lvJ

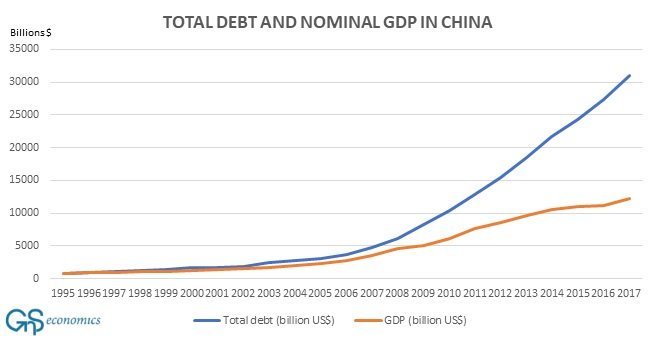

CHINA MAR NEW YUAN LOANS (CNY): 1.69T V 1.25TE

CHINA MAR M2 MONEY SUPPLY Y/Y: 8.6% V 8.2%E

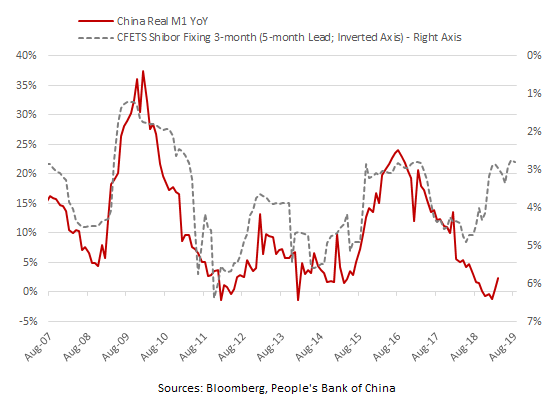

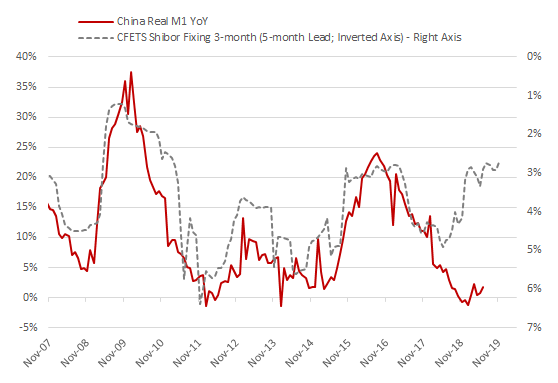

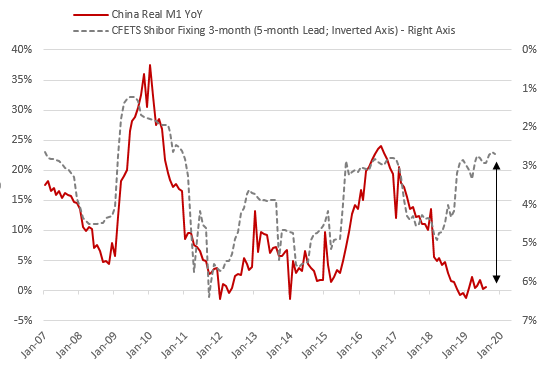

*Real M1 ⬆ 2.3% YoY v 0.5% in Feb.

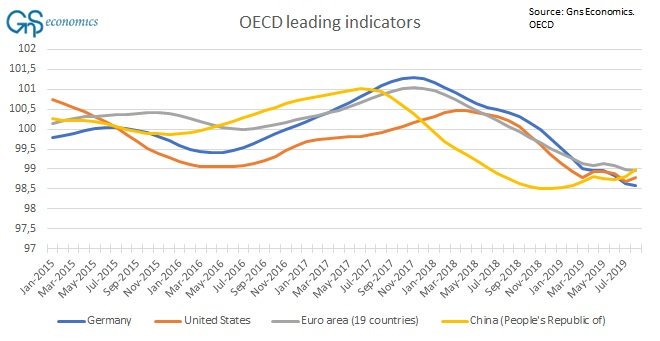

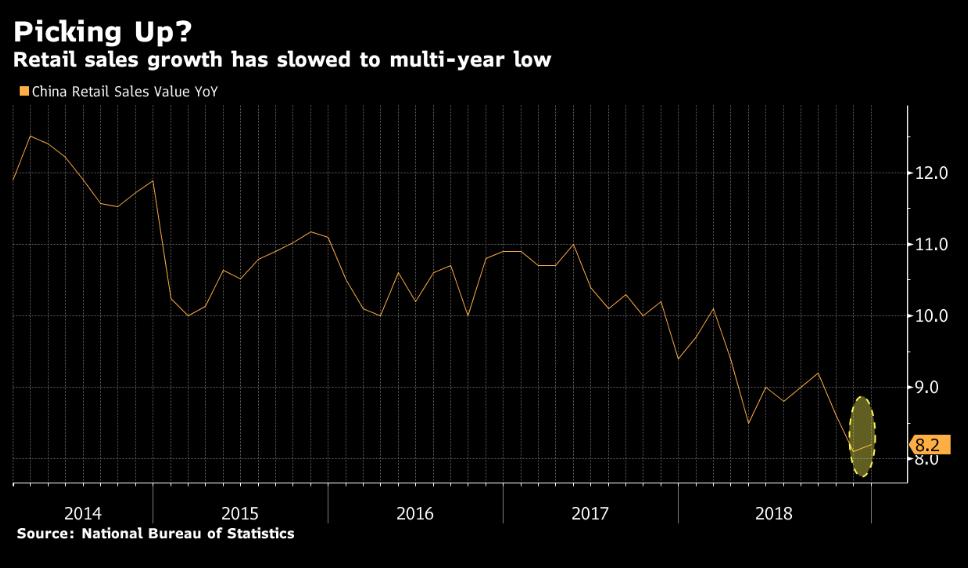

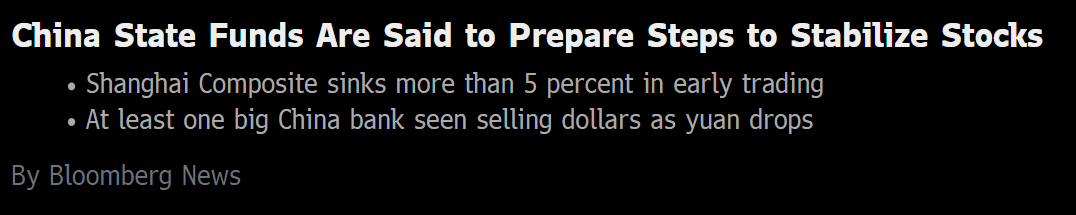

➡ Figures confirm that Chinese economy may have bottomed in 1Q19 and is likely to rebound in 2H19.

*This morning:

*VOLKSWAGEN SALES CHIEF SAYS CHINA DEMAND PICKED UP IN APRIL - BBG

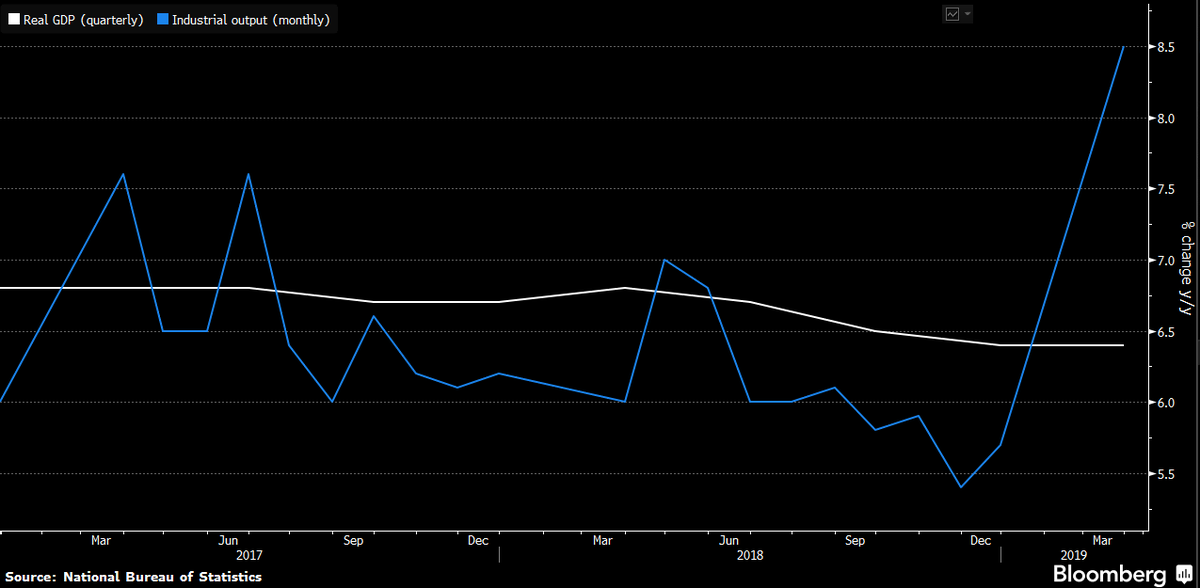

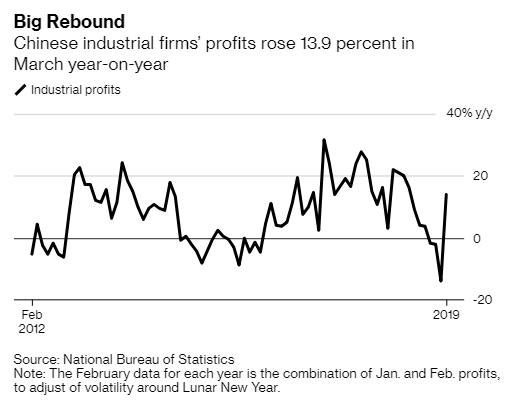

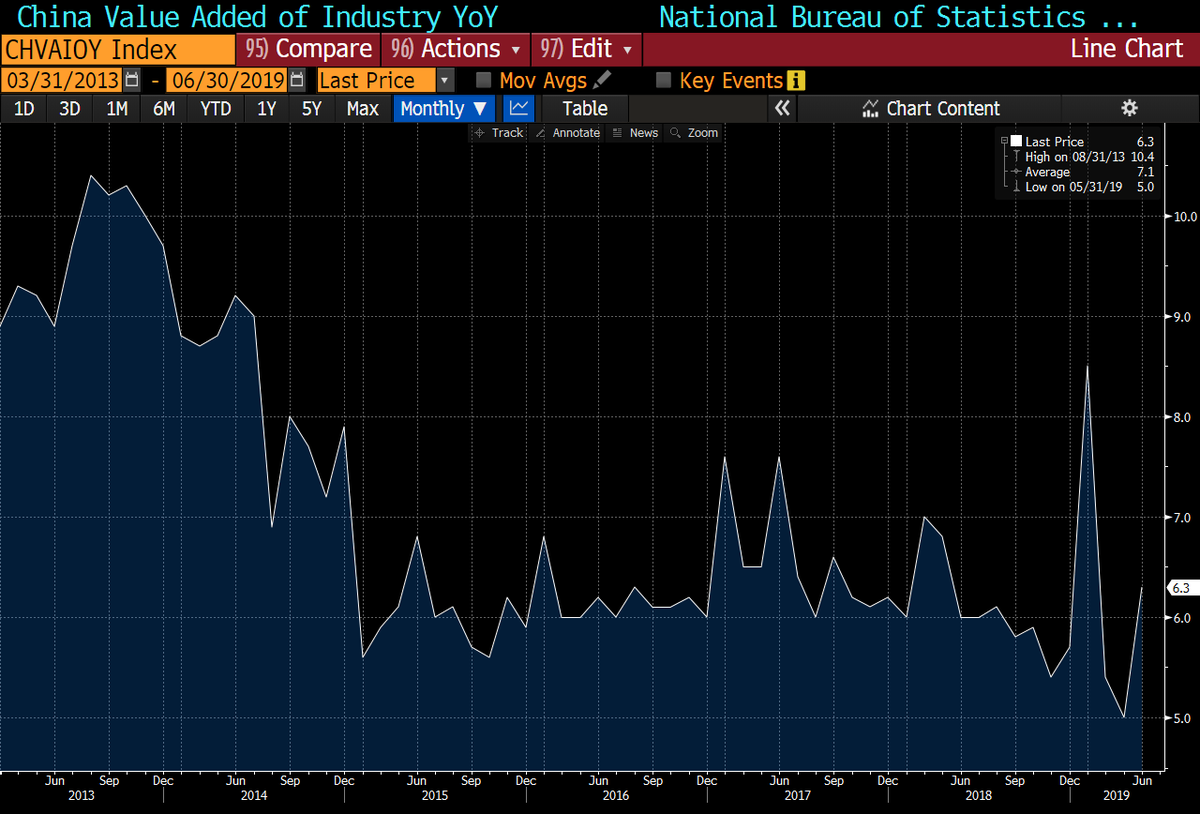

MAR INDUSTRIAL PRODUCTION Y/Y: 8.5% V 5.9%E (fastest since July 2014)

*Motor Vehicles output: -2.6% vs -5.3% in the first two months of the year

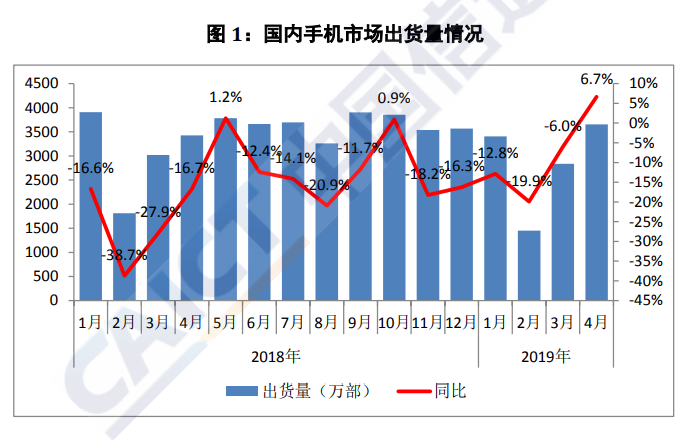

*Mobile Phones output: -7.0% vs -12.3% in the first two months of the year

*Production by state-owned enterprises accelerated to +4.5% YoY YTD in Mar. (vs +4.4% in Feb.) which confirms public support is also gaining traction.

*Proposal could spur sales of cars, electronics, smartphones

*Plan is said to be at consultation stage and could be changed

bloomberg.com/news/articles/…

reuters.com/article/us-chi…

bloomberg.com/news/articles/…

reuters.com/article/china-…

*Link: bloom.bg/2vmgjxk

reuters.com/article/us-chi…

*Large Corp: 50.8 v 51.1 (4-month low)

*Medium Corp: 49.1 v 49.9 prior (2-month low)

*Small Corp: 49.8 v 49.3 prior (6-month high)

*Link: bit.ly/2VHvjEV

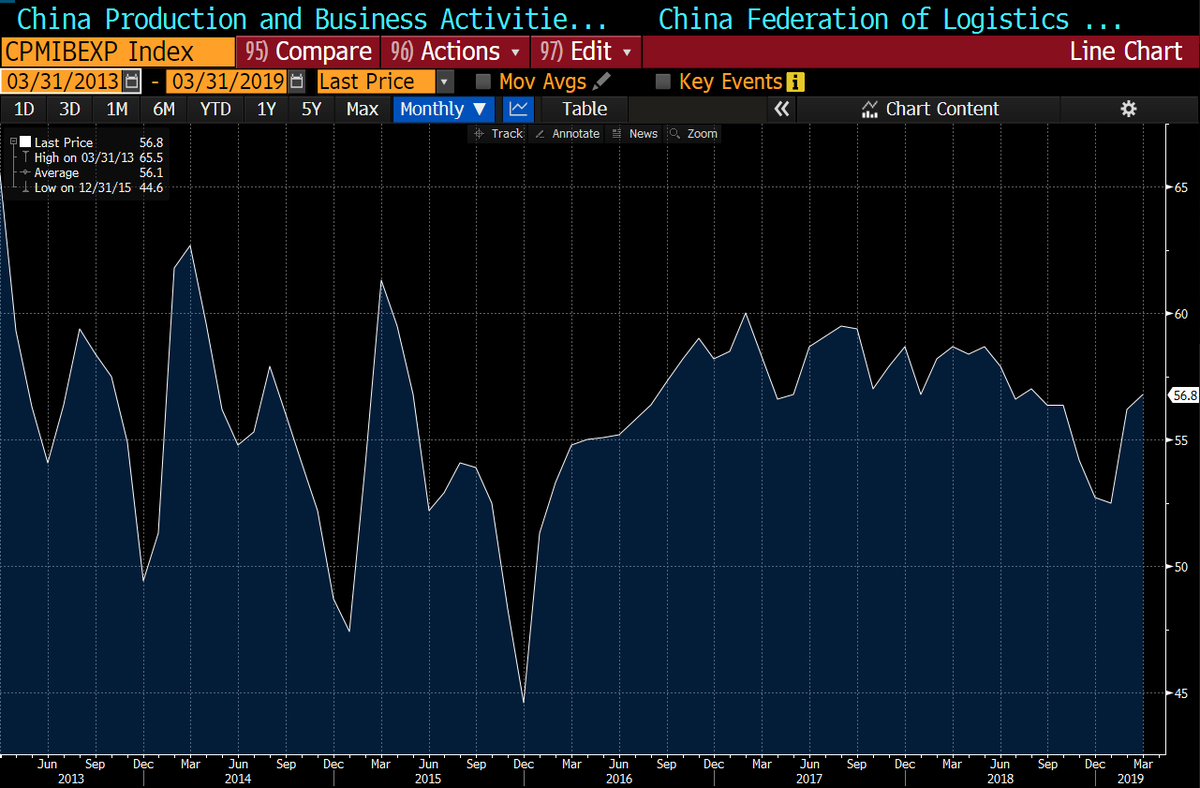

*Apr. New Export orders: 49.2 v 47.1 prior (highest since Aug. 2018)

*Apr. Imports: 49.7 v 48.7 prior (highest since June 2018)

*In addition, business expectations were resilient with Markit gauge reaching a 11-month high (bit.ly/2UO5Dlj)

*CHINA TO SPEND 100B YUAN TO BOOST EMPLOYMENT: STATE COUNCIL

reuters.com/article/us-chi…

uk.reuters.com/article/us-chi…

*Link (Chinese): bit.ly/2VJdeGd

reuters.com/article/us-chi…

scmp.com/economy/china-…

chinadaily.com.cn/a/201905/07/WS…

*Link: bit.ly/2vNbOMs

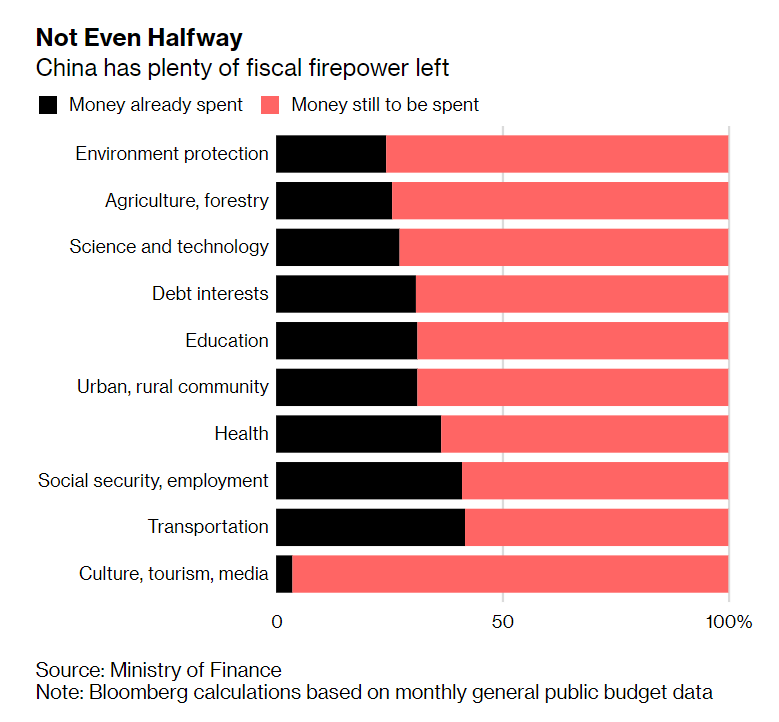

*China has fiscal expenditure left the size of German GDP

*Link: bloom.bg/2Q8uFL3

globaltimes.cn/content/115149…

*Link: bloom.bg/2W9HivW

*CHINA TO OFFER MORE TAX BREAKS TO KINDERGARTENS: CCTV

bloomberg.com/news/articles/…

cnbc.com/2019/06/02/reu…

*Link (Chinese): cs.com.cn/xwzx/hg/201906…

bloomberg.com/news/articles/…

caixinglobal.com/2019-06-06/chi…

*Plan includes banning local govts to introduce any new curbs on car purchases

*Link (Chinese): bit.ly/2KBcOvw

reuters.com/article/us-chi…

bloomberg.com/news/articles/…

wsj.com/articles/chine…

scmp.com/business/banki…

chinadaily.com.cn/a/201906/25/WS…

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

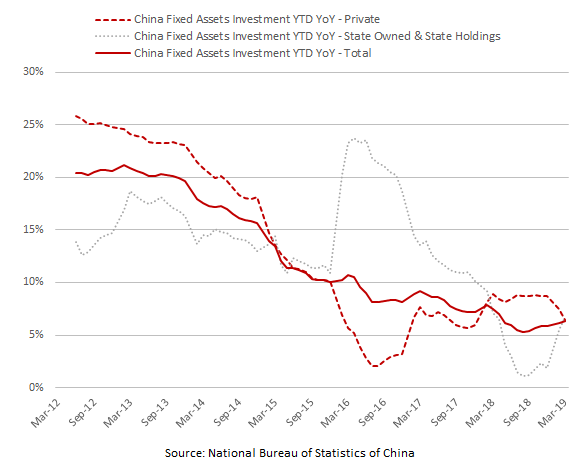

*The total amount of local debt issued in 1H19 was CNY2.84Trn of which new bonds accounted for CNY2.18Trn (70.77%❗ of the 2019 quota).

*Time-Weekly (Chinese): bit.ly/2J918iQ

bloomberg.com/news/articles/…

cnbc.com/2019/07/07/chi…

*CHINA CAR SALES RISE FOR FIRST TIME IN 13 MONTHS, PCA SAYS

My proxies show that car passenger sales ⬆ in the last 3 weeks of June amid larger discounts and gvt supportive measures

*CHINA JUNE PASSENGER VEHICLE WHOLESALES 1.73M UNITS: CAAM

*Real M1 ⬆ 1.7% YoY (3-month high) v +0.7% YoY prior.

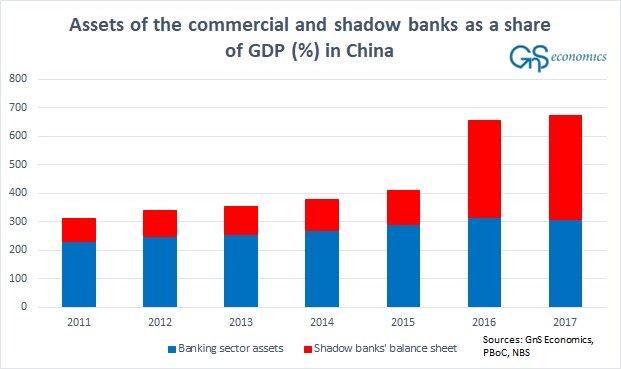

*Undiscounted Bankers Acceptances ⬇ CNY131.1B (v ⬇ CNY77.0B in May)

*Entrusted loans ⬇ CNY82.5B (v ⬇ CNY63.1B in May)

*Trust loans ⬆ CNY1.5B (v ⬇ CNY5.2B in May)

*Cars output YoY: -16.8% vs -23.8% prior (lowest decline since March 2009)

*Industrial output by SOEs YoY: 6.2% vs 6.0% prior (highest since July 2018)

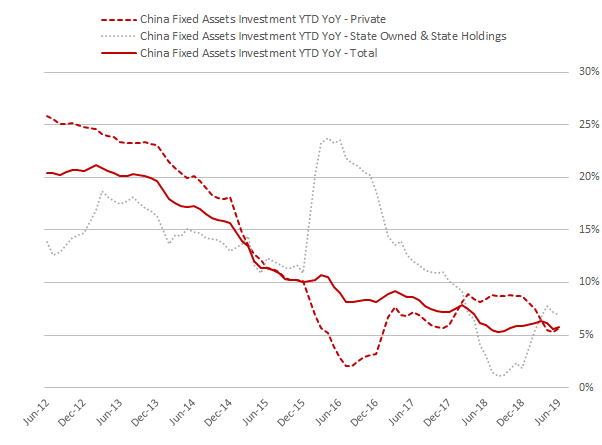

*State Owned & State Holdings FAI: 6.9% v 7.2% prior (3-month low)

*Private FAI: 5.7 v 5.3% (3-month high)

reuters.com/article/us-chi…

*CHINA ENCOURAGES FOREIGN CAPITAL IN WEALTH UNITS OF LENDERS

*CHINA ALLOWS FOREIGN INVESTORS IN PENSION MANAGEMENT SECTOR

*Statement (Chinese): bit.ly/2LuXh1X

bloomberg.com/news/articles/…

*The 25-member top leadership group, headed by President Xi Jinping, is expected to gather before the end of July to discuss plans for the next six months.

scmp.com/economy/china-…

asia.nikkei.com/Editor-s-Picks…

*CHINA MAKES PLAN FOR 2H ECONOMIC WORK IN MEETING: XINHUA

*CHINA SHOULD IMPLEMENT PROACTIVE FISCAL POLICY: POLITBURO

*CHINA TO SPEED UP CLEANUP OF 'ZOMBIE COMPANIES': POLITBURO

*CHINA WON'T USE PROPERTY AS SHORT-TERM ECO STIMULUS: POLITBURO

reuters.com/article/us-chi…

bloomberg.com/news/articles/…

*China will encourage the application of new technologies including big-data to prop up the development of customized consumption

xinhuanet.com/english/2019-0…

*Link (Chinese): mofcom.gov.cn/article/ae/ai/…

asia.nikkei.com/Politics/China…

*Link (Chinese): bit.ly/2yMHeUM

uk.reuters.com/article/uk-chi…

bloomberg.com/news/articles/…

*Link (Chinese): bit.ly/30e4aYS

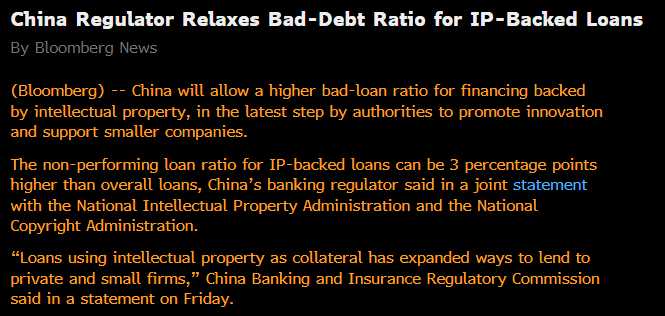

*The NPL ratio for IP-backed loans can be 3 percentage points higher than overall loans according to the China’s banking regulator.

*Link (Chinese): bit.ly/33ysNSe

reuters.com/article/us-chi…

scmp.com/news/china/pol…

scmp.com/economy/china-…

*Policy makers may raise the annual quota for so-called special bonds from the current level of 2.15 trillion yuan ($305 billion)

bloomberg.com/news/articles/…

*Link (Chinese): weibo.com/tv/v/I34s9hzCo…

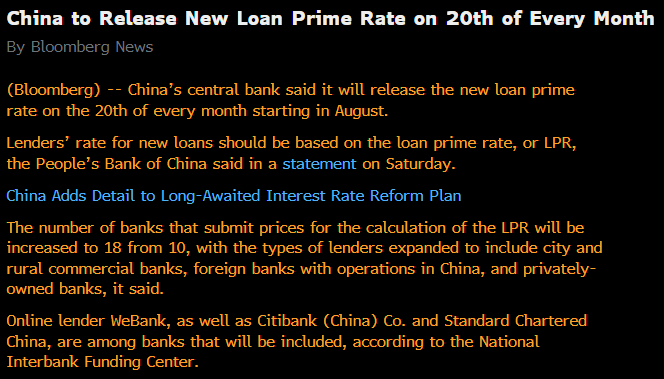

*The lower reading for the 1-year LPR essentially amounts to a rate cut for new corporate loans (most corporate loans have terms within 3 years).

reuters.com/article/us-chi…

*Link (Chinese): bit.ly/2Z7Foxm

reuters.com/article/us-chi…

*Link (Chinese): bit.ly/2PhhFGw

*There is a possibility that these provinces could use unused quotas from last year.

*Link (Chinese): bit.ly/2LqgKOT

reuters.com/article/us-chi…

asia.nikkei.com/Business/Autom…

scmp.com/economy/china-…

*Link (Chinese): bit.ly/2lvwVkA

*Note: There will be 441.5 billion yuan of MLFs maturing this month, including 176.5 billion yuan maturing on Sept. 7 and 265 billion yuan maturing on Sept. 17.

*CHINA TO SPEED UP LOCAL GOVT SPECIAL BOND USE: RADIO

*CHINA TO CONTINUE PRUDENT MONETARY POLICY: CCTV

*CHINA CUTS RESERVE RATIO BY 0.5 PPT

*CHINA CENTRAL BANK SAYS SOME QUALIFYING BANKS WILL GET AN ADDITIONAL RRR REDUCTION OF 100 BPS - RTRS

*FTSE CHINA A50 FUTURES EXTEND GAIN TO 0.7% AFTER RRR CUT

*PBOC SAYS EXTRA 1 PPT RRR CUT EFFECTIVE OCT. 15, NOV. 15

➡ CHINA SAYS RRR CUTS TO RELEASE 900B YUAN IN LIQUIDITY

*China to make sure funds raised can be used and take effect at the beginning of 2020.

*Link (Chinese): bit.ly/2m768LG

CHINA AUG NEW YUAN LOANS (CNY): 1.210T V 1.200TE

CHINA AUG AGGREGATE FINANCING (CNY): 1.98T V 1.605TE

*Despite short-term rates remained low, real M1 only ⬆ 0.6% YoY (2-month high) v +0.3% YoY prior (which is not a surprise: bit.ly/2ktZKOh)

scmp.com/economy/china-…

*Link (Chinese): bit.ly/2kI1NOx

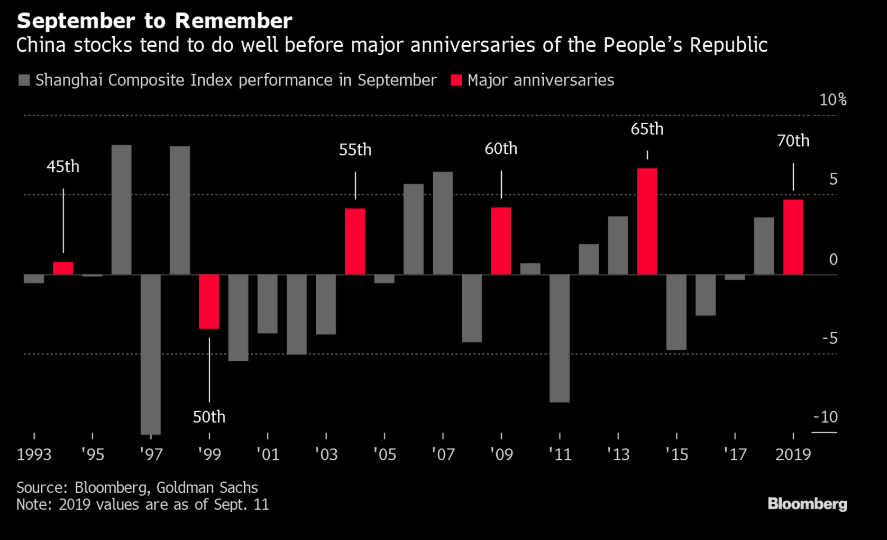

*As a reminder, that date marks the 70th anniversary of the People’s Republic.

*Central #China’s #Henan province should strengthen construction of major infrastructure projects, President Xi Jinping said at a meeting with local officials.

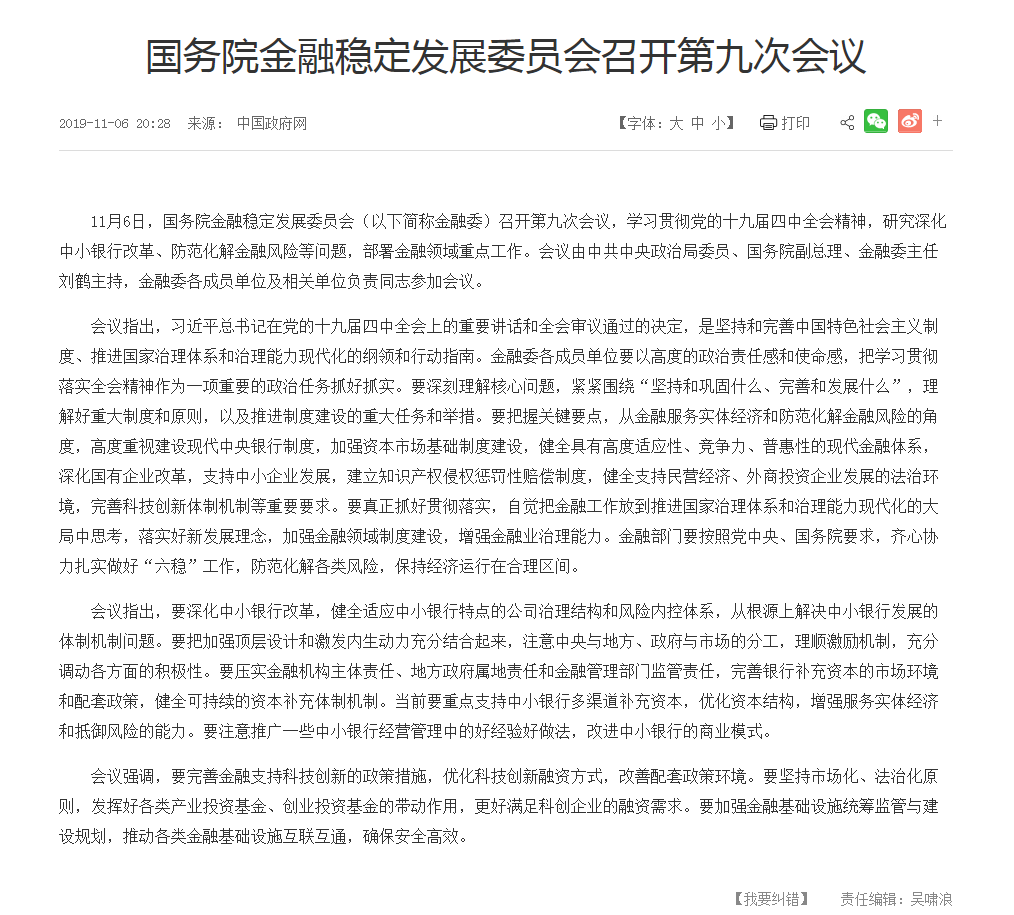

*CHINA TO KEEP REASONABLY AMPLE LIQUIDITY: FINANCIAL COMMITTEE

reuters.com/article/us-chi…

scmp.com/economy/china-…

bloomberg.com/news/articles/…

scmp.com/economy/china-…

bloomberg.com/news/articles/…

*CHINA TO ADOPT NEW POLICY TO BOOST TRADE DEVELOPMENT: CAIXIN

*Link (Chinese): economy.caixin.com/2019-10-23/101…

*CHINA TO BOOST IMPORTS OF CONSUMER GOODS, EQUIPMENTS: CCTV

*CHINA TO IMPROVE EXPORT REBATES POLICY: CCTV

*CHINA TO TAKE MEASURES TO IMPROVE FOREX MANAGEMENT: CCTV

xinhuanet.com/english/2019-1…

reuters.com/article/china-…

*One-year medium-term lending facility rate is reduced to 3.25% from 3.3%

wsj.com/articles/china…

reuters.com/article/us-chi…

*Link (Chinese): bit.ly/32ubss9

*As of the end of September, local governments had issued 3.04 trillion yuan of new bonds this year, accounting for 99.43% of the annual new bond quota, MOF data showed.

*Link: bit.ly/34Egkfz

uk.reuters.com/article/us-chi…

uk.reuters.com/article/us-chi…

bloomberg.com/news/articles/…

reuters.com/article/us-chi…

bloomberg.com/news/articles/…

*State Council has relaxed the minimum capital ratio requirement for some infrastructure projects to 20% from 25 %

scmp.com/economy/china-…

*That pace was down from +236% YoY in the first three quarters.

*CHINA PREMIER LI KEQIANG HOLDS MEETING WITH LOCAL OFFICIALS: TV

*Link (Chinese): bit.ly/2NOlz6V

*Link: bloom.bg/2XlVxuT

*PBoC link (Chinese): bit.ly/2r2dkeh