1. If you are making up to 200k, your tax rates will be exactly the same as today. 1/

bernietax.com/#0;0;s

4. Even then, since this is a marginal tax, someone would pay 42% on the portion of their income that is above 500k and not on the whole. 4/

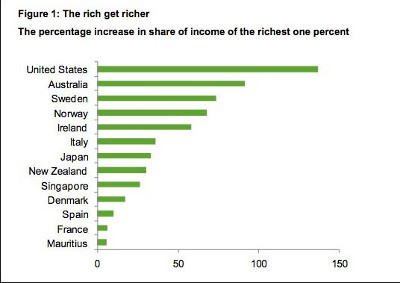

What happened? In 1981, Reagan significantly reduced the maximum tax rate, which affected the highest income earners, 8/

A. Taking out the insurance corporations that eat up billions for parasitizing. Why would you need middlemen if you don't try to deny or restrict peoples' health services? 12/

B. By controlling drug prices. Currently there is a law that prohibits Medicare from negotiating drug prices with the pharma industry. 13/