Biggest thing I am looking for is the Snaps Created per Day metric (will probly have to wait for the 10-Q), updates on Bitmoji, content plans, and hints on the long-term AR strategy.

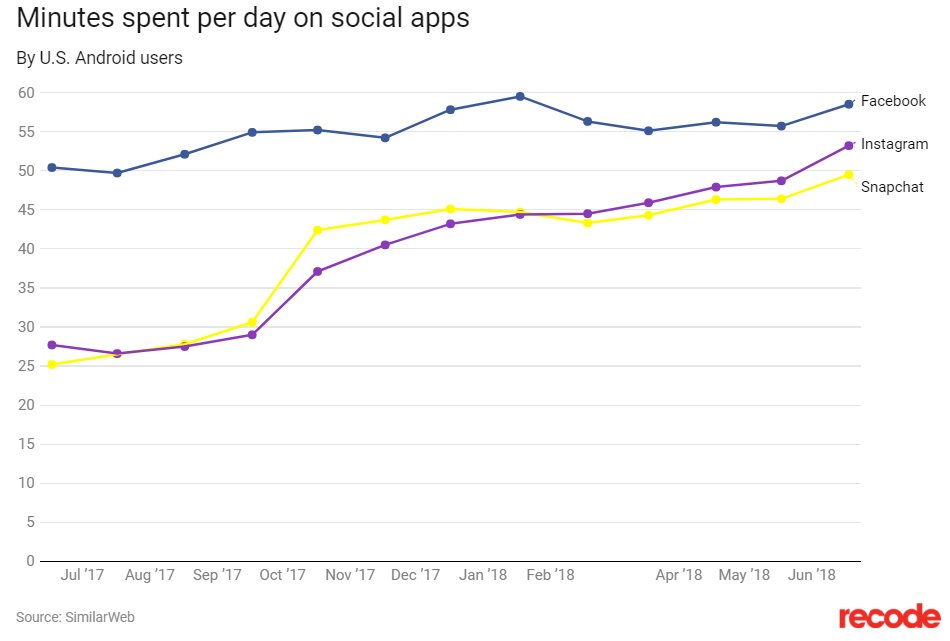

1) Slowing/declining usage in North America and EU

2) Anticipated drop in FBs margins as it invests in things Snap did years ago

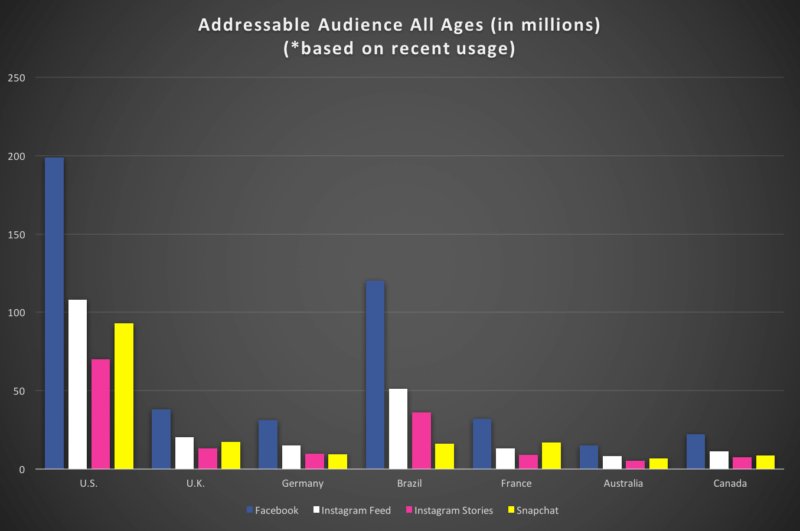

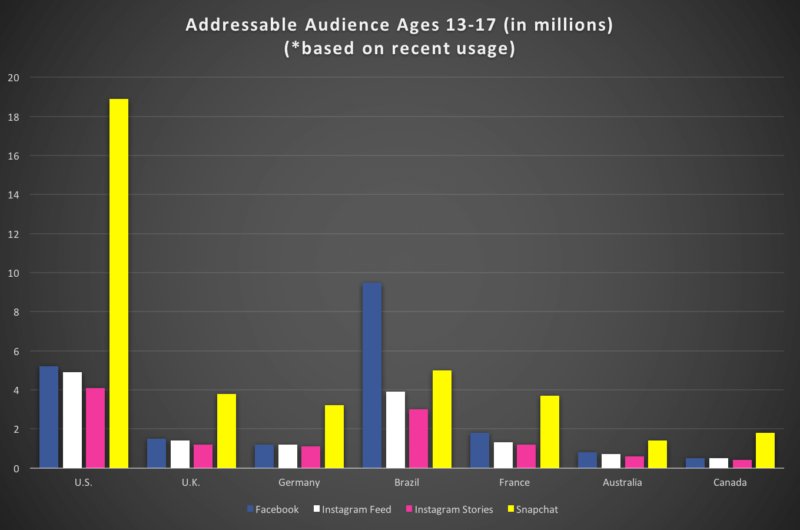

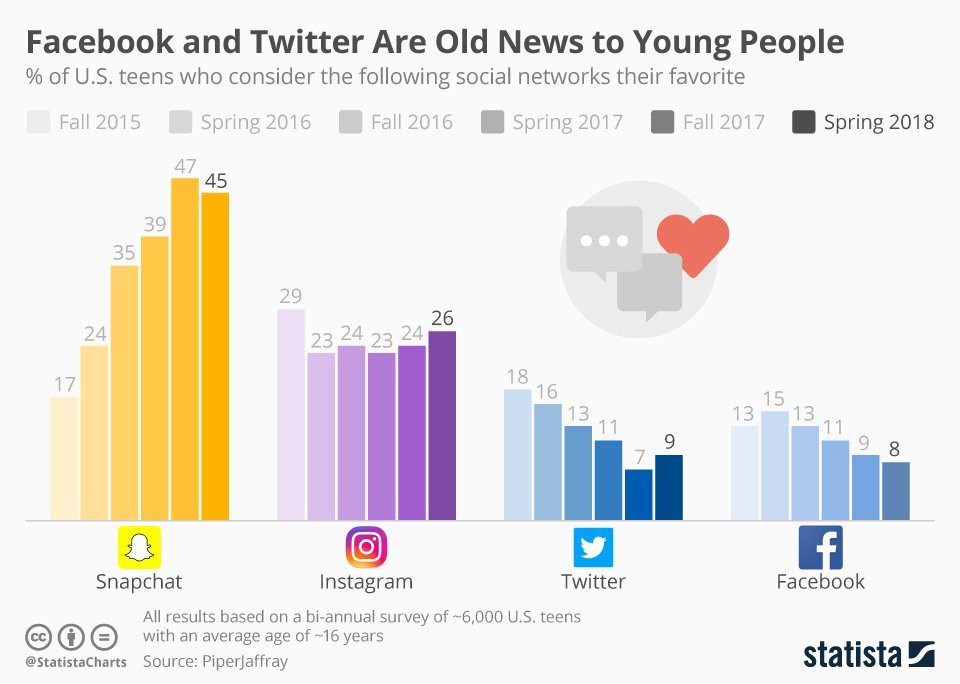

Snap's reach in the US/EU compares to FB and IG, which are the only ad markets that matter. Snap also crushes them in Gen Z.

marketingland.com/facebooks-inst…

Despite this five-market audience being 10% of FB’s reach in 8 of its 10 largest markets, total ad spend is 10x higher.

-96% of Gen Z parents say their teens influence family spending

-70% of Gen Z consider their friends to be like family

-85% would prefer having a few very close friends rather than a large group they’re not as close to.

forbusiness.snapchat.com/blog/true-to-s…

Snapchat captured the hardest to reach demographic.

businesswire.com/news/home/2018…

recode.net/2018/6/25/1750…

“Nearly half of American teens are online ‘almost constantly.’ And that’s about double what it was three years ago.

What are they doing? Mostly using Snapchat and YouTube.”

recode.net/2018/5/31/1740…

I still think the recent redesign was a good move (increased ad impressions and spurred Bitmoji adoption).

“Snapchat CPM’s are $1.88 vs. $14-17 and $19 on FB/IG” @herrmanndigital

“Cost per Acq is 50% lower than FB/IG since using Snap Pixel”

“The ad product is fairly easy to use. Anyone disagreeing is asinine”

digiday.com/marketing/supe…

adexchanger.com/ad-exchange-ne…

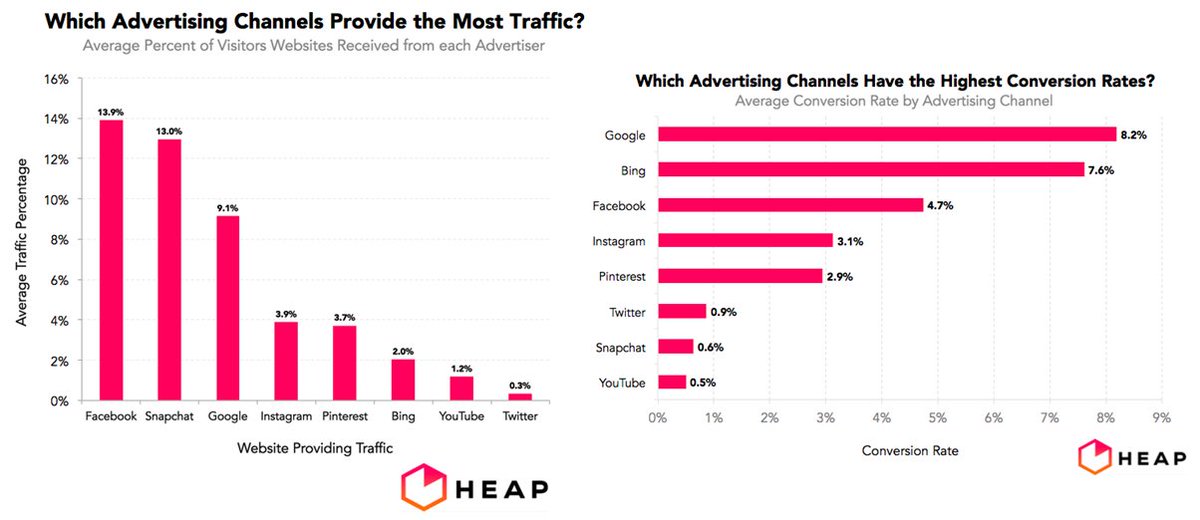

Snap’s conversion rates are historically terrible; however it’s made improvements and younger users convert better on mobile.

heapanalytics.com/blog/data-stor…

Snapchat’s userbase is the prime demographic for direct response advertisers, and Snapchat has become so central to their lives that its unlikely new apps significantly cannibalize Snapchat usage.

The relative valuation between Snap ($17B) and IG (~$100B) is very interesting.

Extrapolated, it’s more than all estimated digital photos taken globally in 2017, excluding Snapchat.

mylio.com/true-stories/t…

-50% of US 13-34 yr olds play w/ Snapchat AR weekly

-Bitmoji = AR/VR Profiles

-Spectacles = SmartGlasses

-Snap Map = HUD

-Snap Lenses = AR apps

-Lens Studio = App dev

-Lens Explorer = AR app store

-Snap Codes = Bridges b/wn phys/digital world

nytimes.com/2018/06/14/mov…

1) Short-term: Turning every piece of content into video ad inventory

2) Long-term: AR (also synergizes with video because all AR can become video, at least right now on mobile)

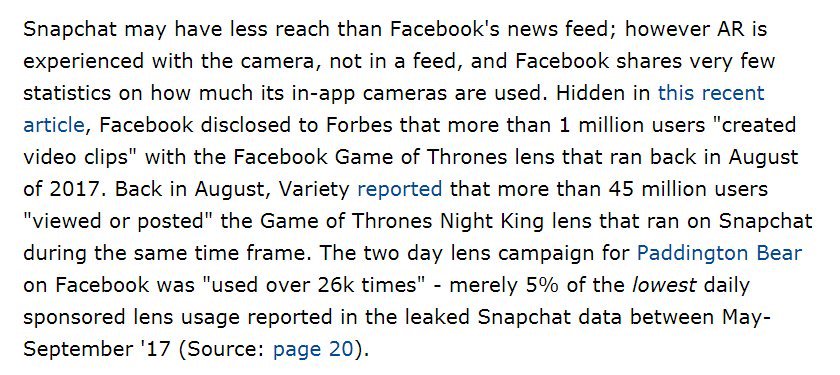

To do this, $FB must own consumers camera usage.

seekingalpha.com/article/416650…

“Tap for this AR ad” as you quickly scroll feed is a completely different experience than intentionally interacting and playing w/ a lens in a camera, regardless if it’s an ad or not.

adweek.com/digital/facebo…

An increase in headcount from ~200 to 3,069 over past 3 yrs for same things FB just announced have historically been biggest profitability drag; but management’s comments indicate hiring should slow going forward

Will try to add some thoughts post-earnings.

-DAU's fell, but MAU's were actually up in Q2 [bigger #'s shown to advertisers]

-Disclosed over 100 million MAU's in the US & Canada

-Hinted that DAU growth historically declines QoQ in Q3

-More Discover & Shows views in July than any other month in history [higher ad prices than Stories]

-11 Snap Shows reached monthly audience of over 10 million users in Q2, up from 7 in Q1 2018

-Hosting costs are included in COGS as opposed to CapEx for FB/GOOG, etc, and likely to decrease as GOOG/AMZN compete on price (also hinted this in IPO road show)

-Revenue will also grow much faster than OpEx as ~60% is employee cost

bloomberg.com/news/articles/…

-Going forward, its capital light business model should lend to high EBITDA to FCF conversion as revenue growth falls to the bottom-line (again, low CapEx due to multi-cloud hosting strategy)

Big investments like this hint Snap could secure big private placements w/ institutional investors if revenue is slow to ramp.

cnbc.com/2018/08/07/pri…

Also asked about Snaps per Day ["over 3 billion per day"]