Part 1 – Introduction

1) In college I studied history, and I am interested in the evolution of money. When I was introduced to bitcoin in 2015, I viewed it as the next logical version of money.

When I speak with investors, we have to answer the following question: “Why does bitcoin have value?” I believe in the following five arguments:

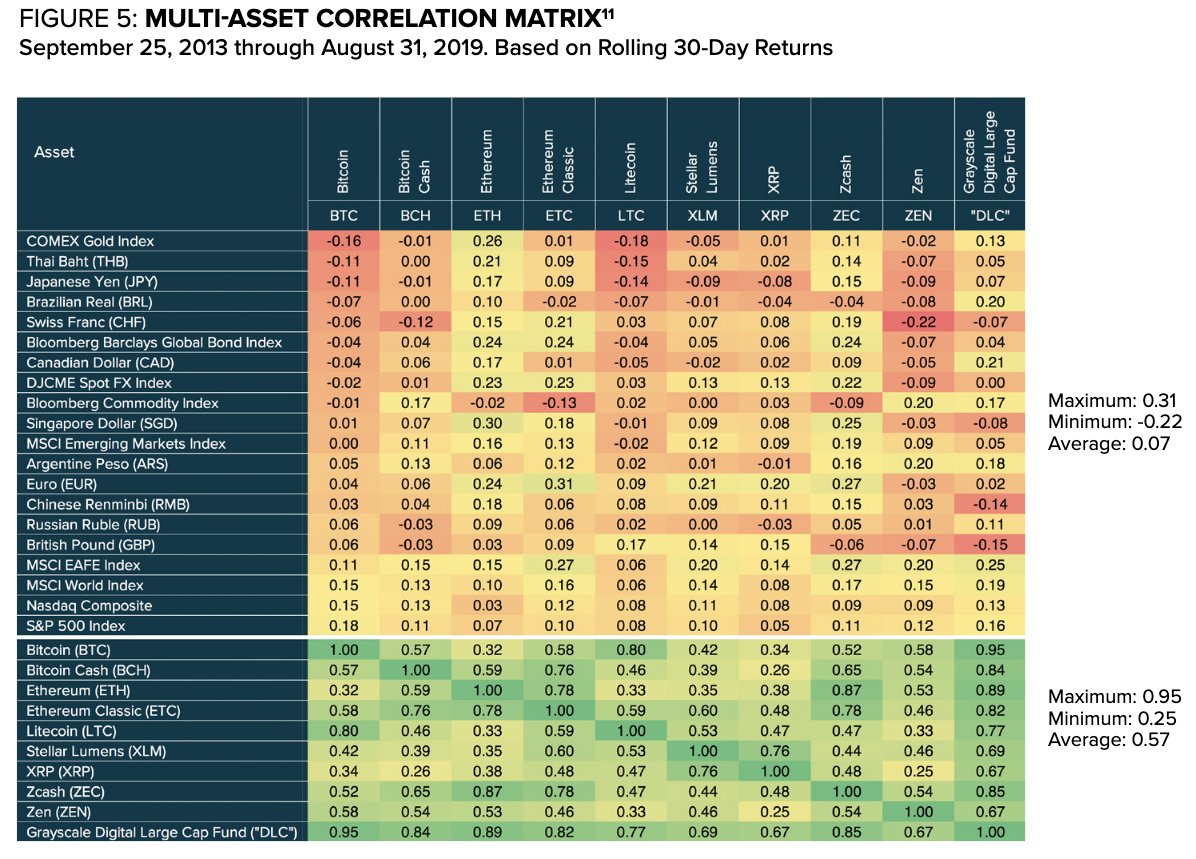

1) Bitcoin is uncorrelated to traditional asset classes, and it deserves a place in diversified portfolios. The chart below tracks the performance of bitcoin and traditional asset classes from 2013-2019.