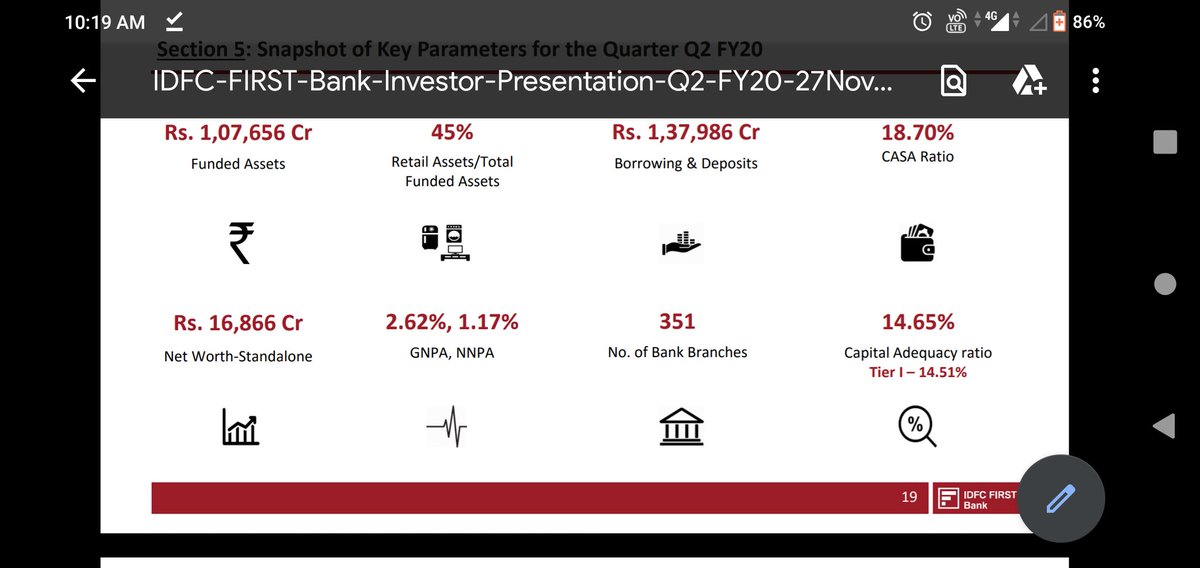

4. Gross & Net NPA are 2.6% & 1.2%..2/n

6. Price to Book is 1X. Again shows bank is available cheap as compared to peers. HDFC Bank PB is 4X

7. It has 351 branches which is less as compared to HDFC and Axis. HDFC has 5000+ & Axis has 4000+, ICICI has 5000+....4/n

IDFC First is a good turnaround story with limited downside risk.

If one has patience of 2 to 4 years it can give you good returns. The stock.....5/n

Downside risk is very limited.

Disclosure : i am invested in the stock since 2016.......n/n