1. Look at loan book, the bigger the loan book higher the revenues it will generate.

2. In loan book consider the composition of corporate loans, retail loans and SME loans. If corporate loans are higher the bank....1/n

3. Retail loans have higher margins than corporate & SME loans.

4. Check for Net Interest Margins. Higher the NIMs better is the profitability.....2/n

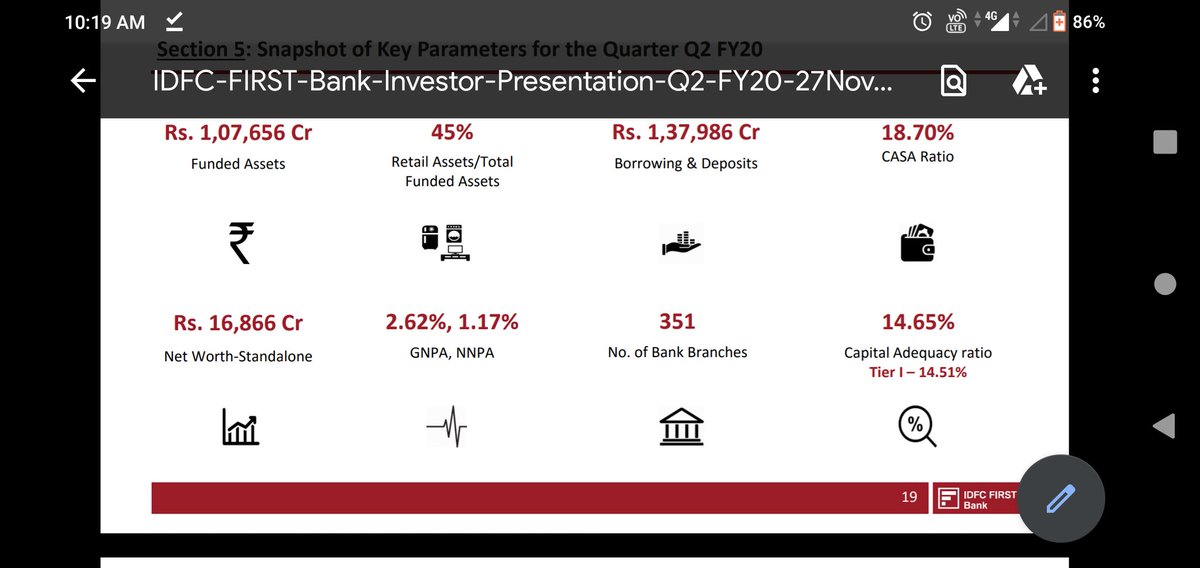

5. Check for gross and net NPAs. The lower the ratios better is the bank which means lesser losses on loans that go bad......3/n

7. Check for CASA ratio. CASA is current n saving account balances. Higher the CASA better for the bank as cost of funds gets reduced. On current account balances banks pay Nil interest......4/n

8. Check for cost of funds, lower the cost of funds better it is for the bank.

9. Check for geographical spread of branches, it is all over India or concentrated in a region.

10. Check for product suite.....5/n

10. Check for QoQ revenue growth is it going up or down.

11. Check for interest income & fee income. What is the composition of interest & fee income. Both should show a rising trend......6/n

13. Check how many customer complaints they received n how many got resolved.