With Peacock investor day this week, thought I'd take a look at NBCU.

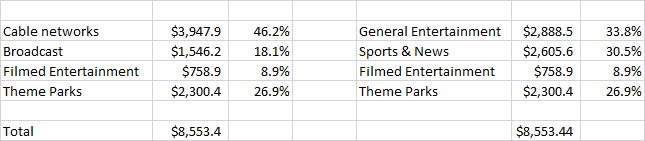

For Broadcast, I put majority of value of affiliate fees towards Live, and for advertising looked at GRPs by type at the Network (Local is mostly sports/news)

Netflix has usurped the job of General Entertainment that broadcast and TNT, USA, Bravo, etc once did.

Meanwhile, Sports & News are likely to remain with NBC, DIS, FOX, etc for the forecast horizon.