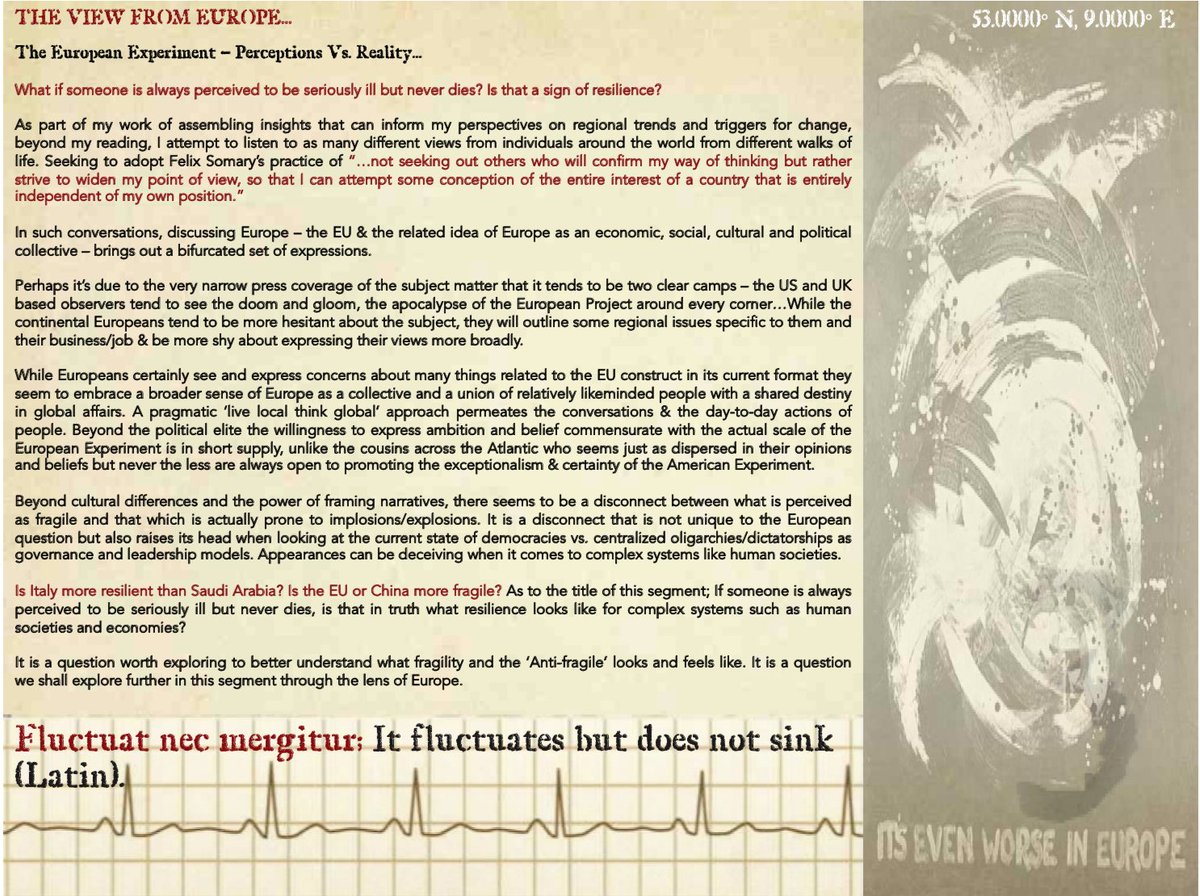

Just finished writing my section on #Europe for the Q4 Outlook, during the process I reread some of my older sections...This one stood out as worth revisiting not just in the context of Europe but for its broader applications...#Systems #Fragility #GlobalTrends (1/7)

2/7 "Fragility is quite measureable, risk not so at all, particularly risk associated with rare events." - NN Taleb #Risk #Fragility #Systems

3/7 "Complex systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks. In fact, they tend to be too calm & exhibit minimal variability as silent risks accumulate beneath the surface." - Taleb/Blythe

4/7 "...there is no freedom without noise & no #stability without volatility." - Taleb/Smythe #Risk #Systems #Fragility

5/7 #SocialConflict "Repeated punishment, while it crushes the hatred of a few, stirs the hatred of all..just as trees that have been trimmed throw out again countless new branches." - Seneca #Systems #Fragility #Risk

6/7 "Trigger analysis should focus on contexts instead of specific events." - JE Margolis #Systems #Analysis #Risk

7/7 "As an architect you design for the present, with an awareness of the past, for a future which is essentially unknown." - N. Foster #Systems #Risks #Fragility #EU

• • •

Missing some Tweet in this thread? You can try to

force a refresh