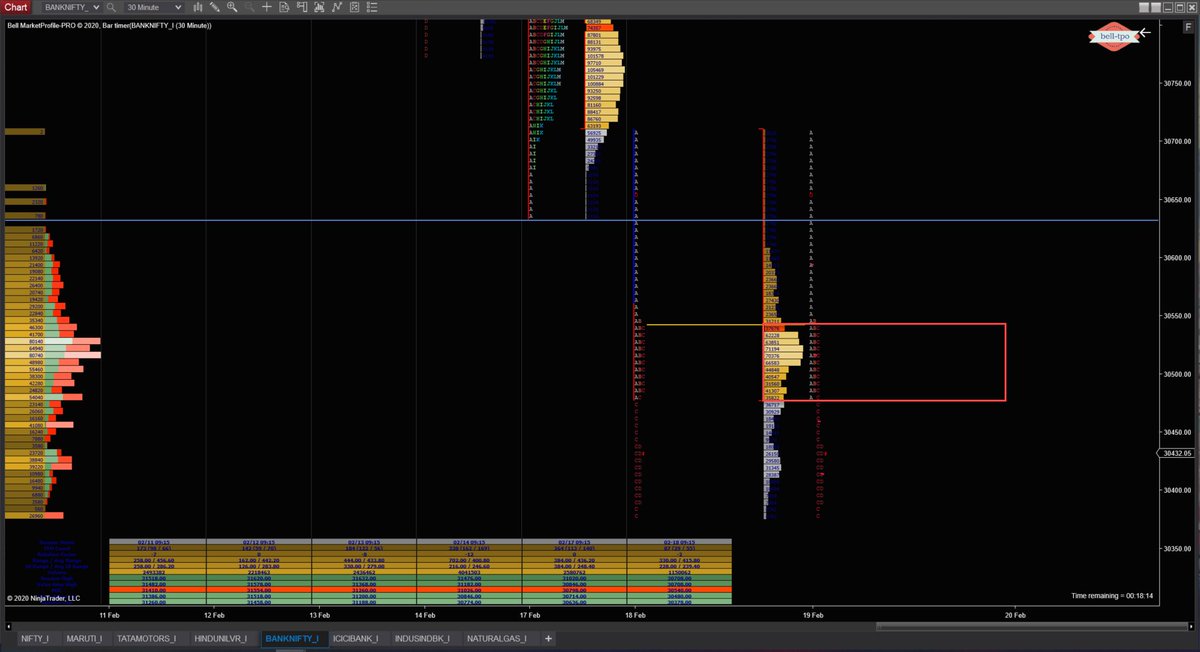

Why does Market Profile fascinate me?-In contrast to what candlesticks offer,MP gives a 3D view of looking at price action - Price, Time & Volume. Is this a holy grail? Well, absolutely not! Here are some basics #MPPaatshaala- (1/n)

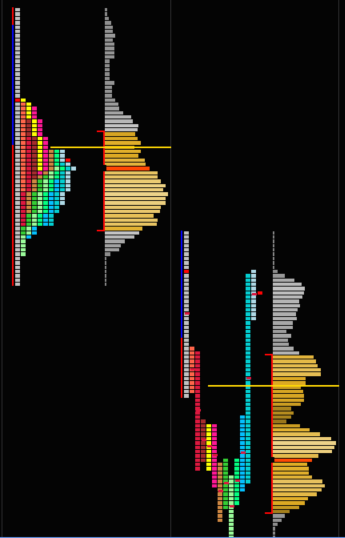

1) DTF - Day time frame traders

2) OTF - Other time frame traders

DTF are intraday, short term players who has short term interests in the market while OTF have intermediate/long term view on markets - 8/n)

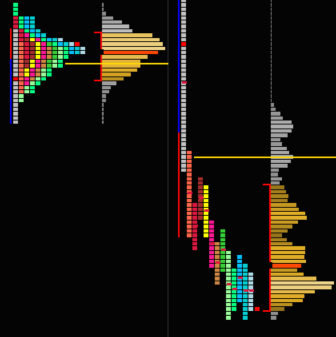

1) Normal Day

2) Neutral Day

3) Non-Trend Day

- (9/n)

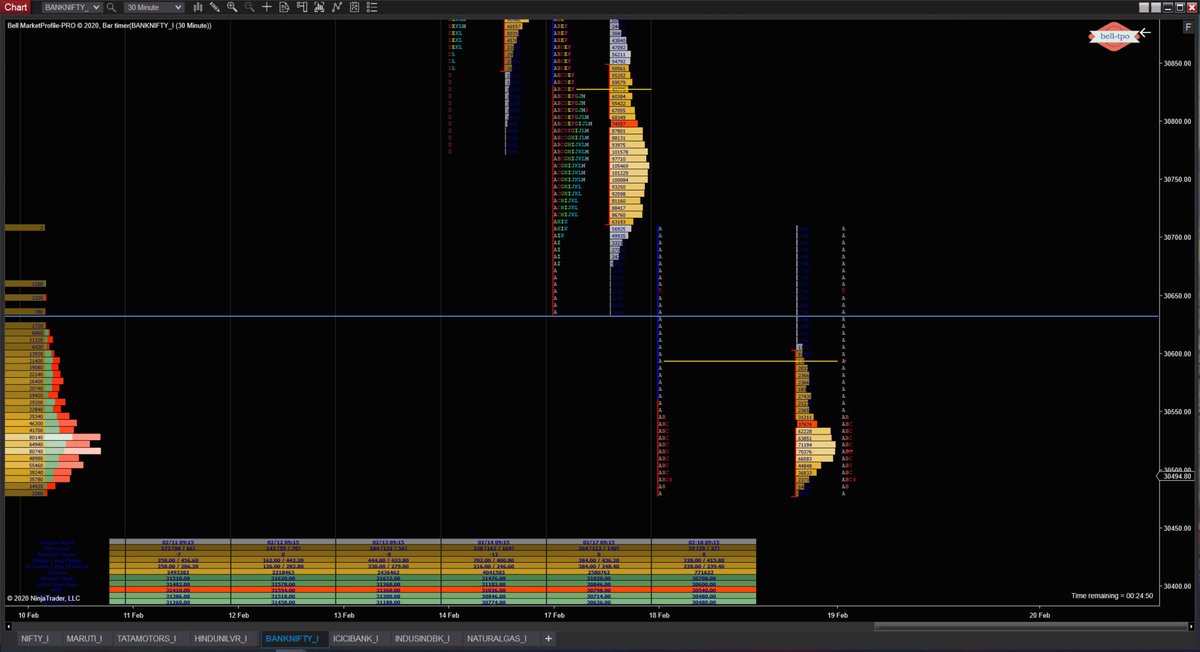

1) Trend Day - Very high confidence

2) Normal Variation Day - Good confidence

3) Neutral Extreme Day - Decent confidence

- (13/n)