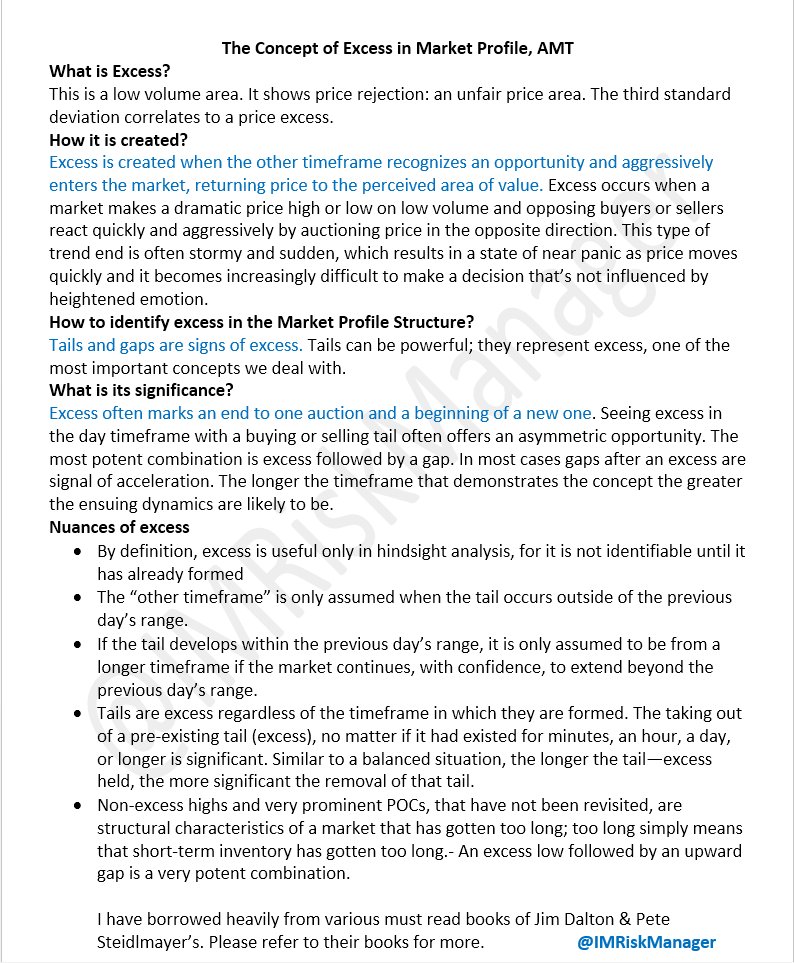

#mp_amt

#LearningTogether

Feedback/corrections most welcome.

@assortZ @Thakker_Inv @sweetspottrader @StoicTrader

find the link document here- goo.gl/0ePtqT

#mp_amt

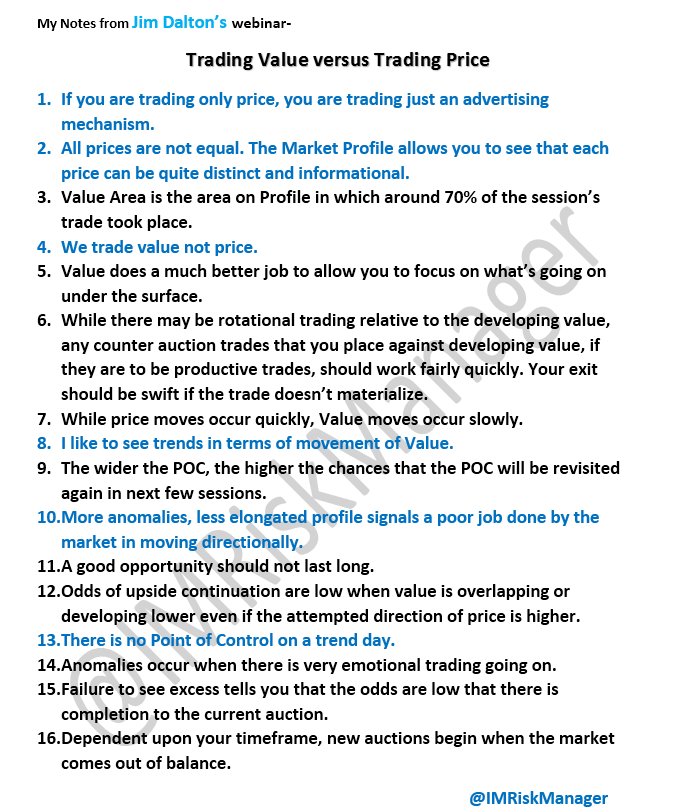

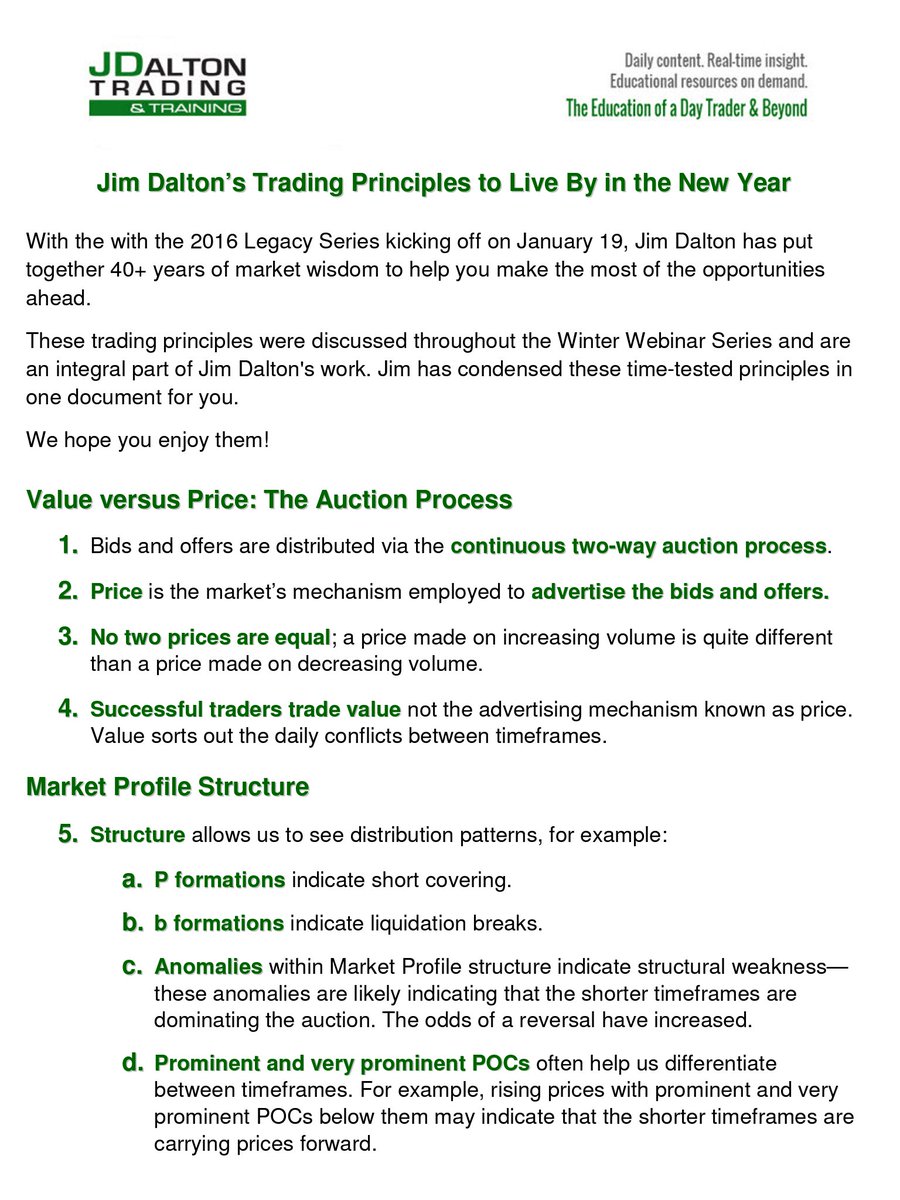

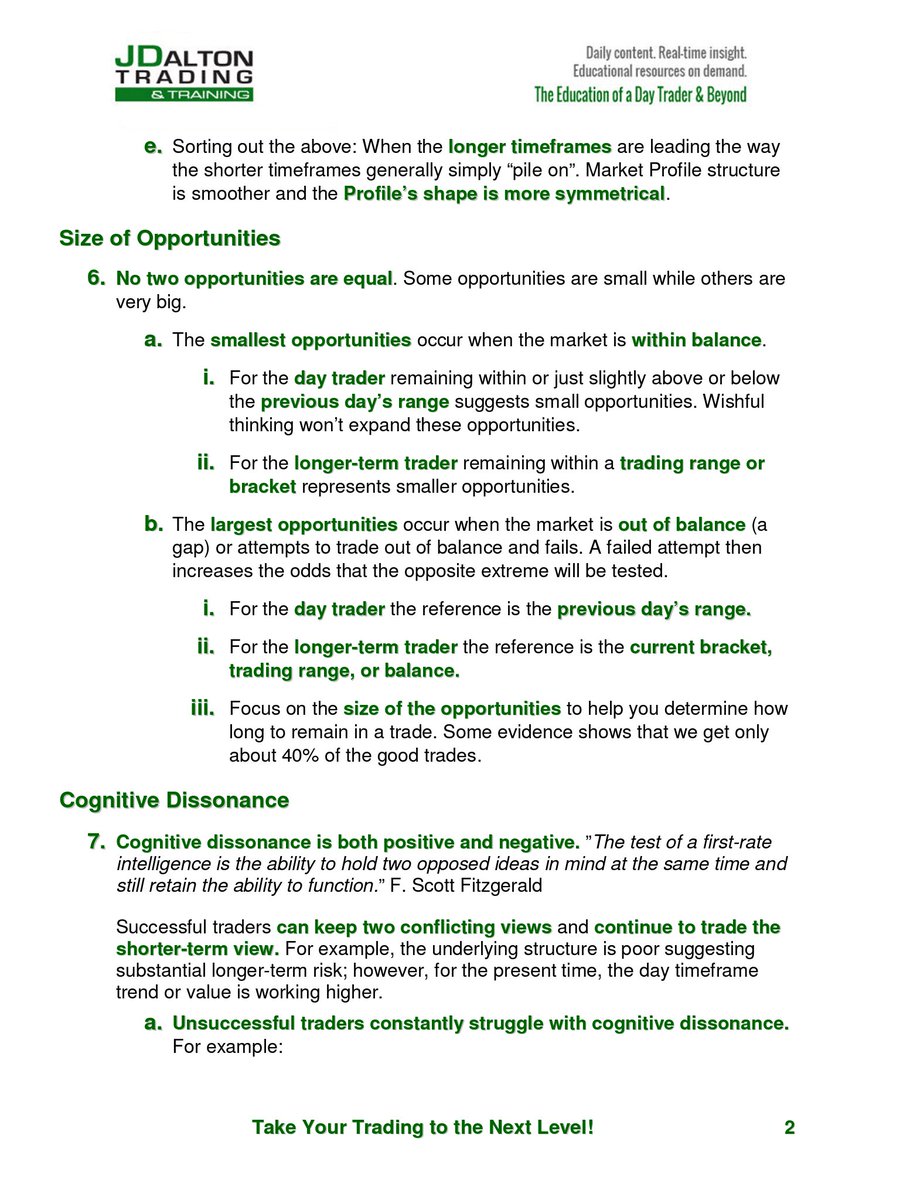

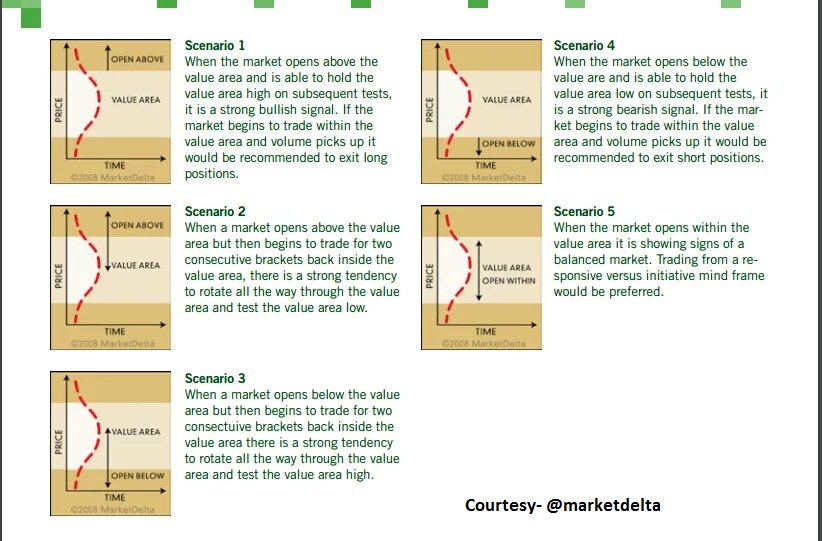

We Trade Value not Price

#mp_amt

goo.gl/MrQEv1

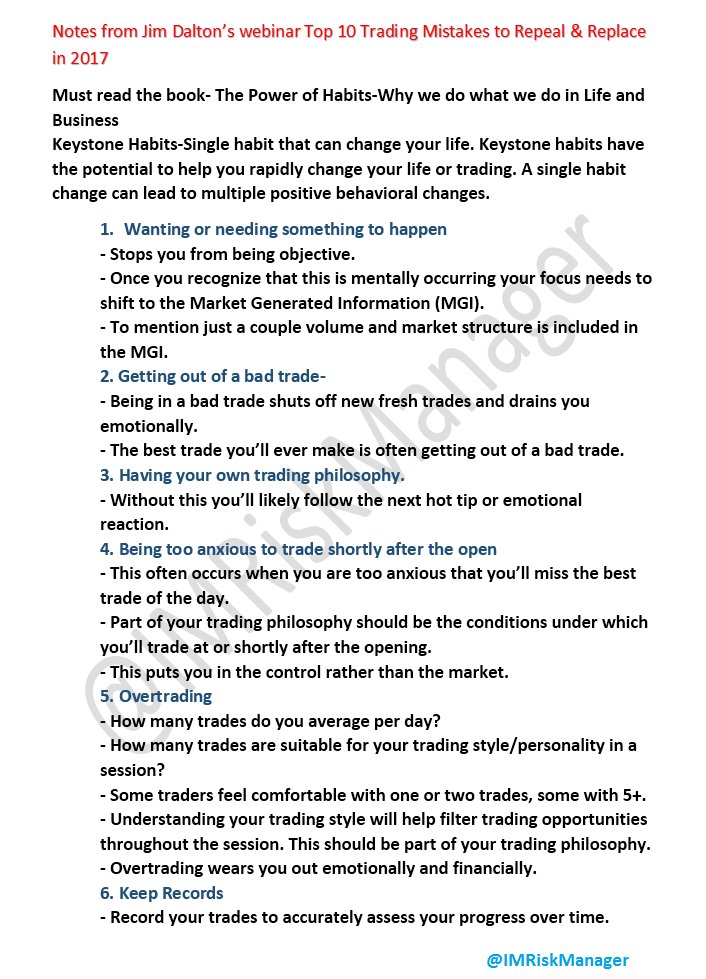

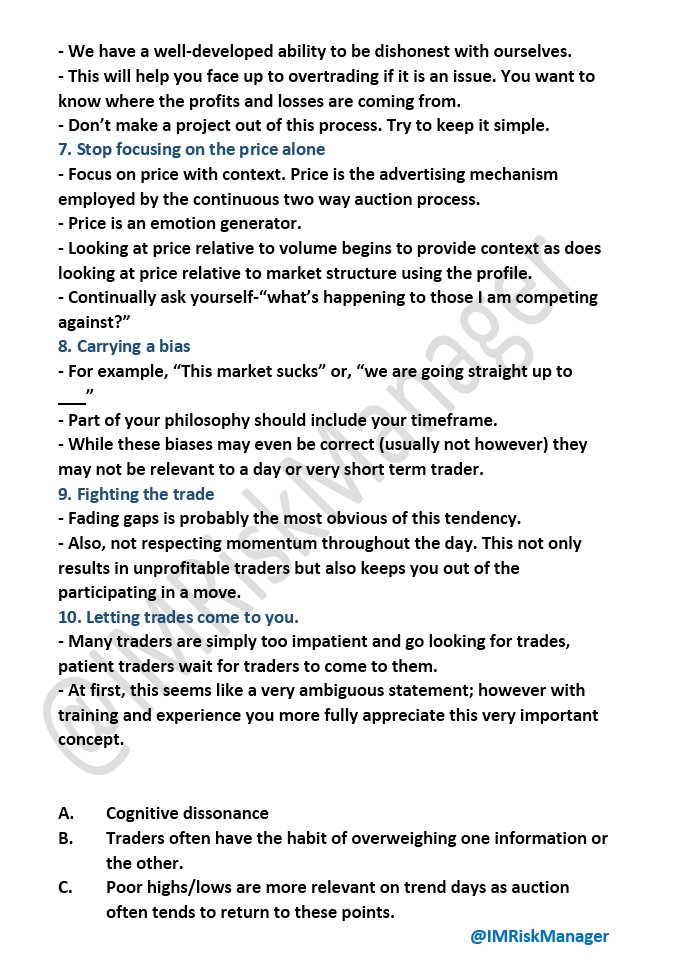

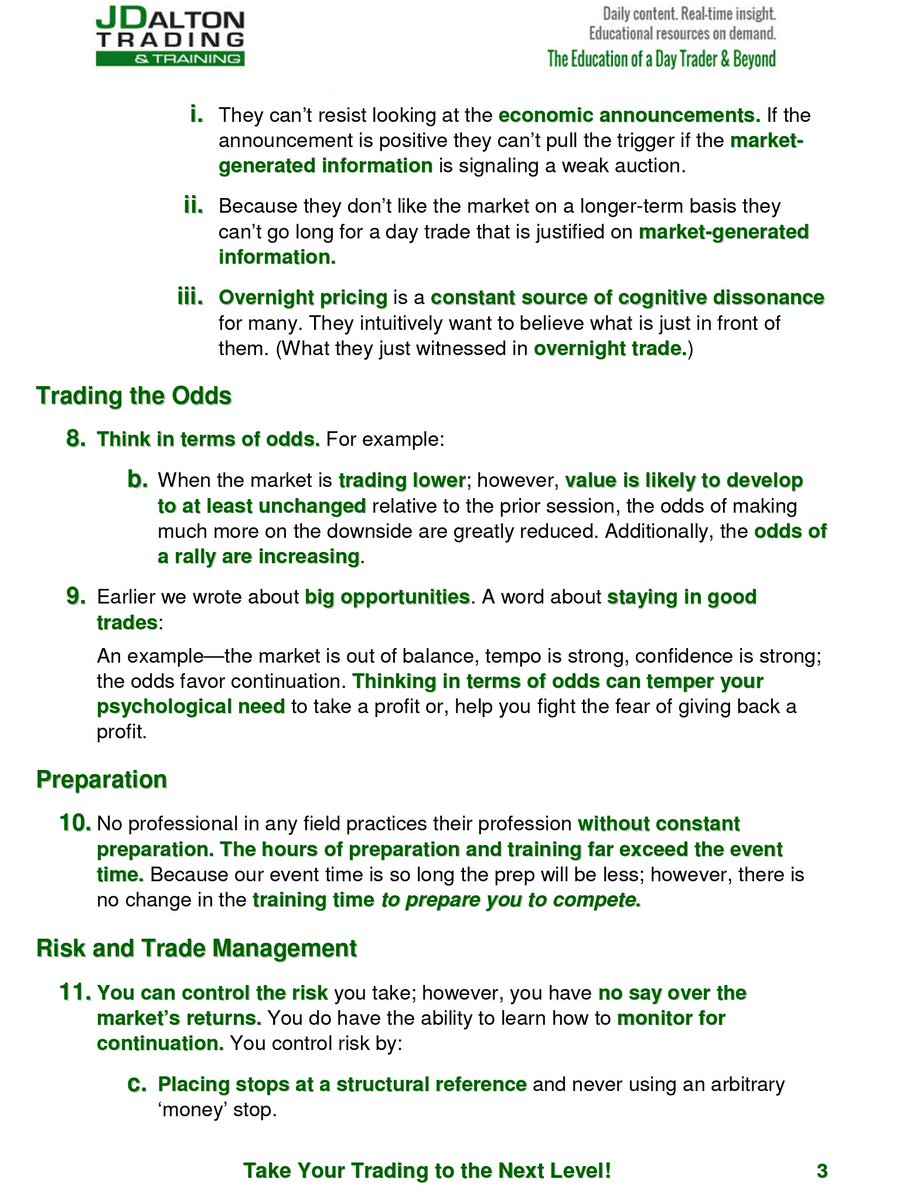

Top 10 Trading Mistakes to Repeal & Replace in 2017

#mp_amt

In point Q. please read 'importance of Emotional capital' instead of financial capital.

training.jdaltontrading.com/wp-content/upl…

#mp_amt

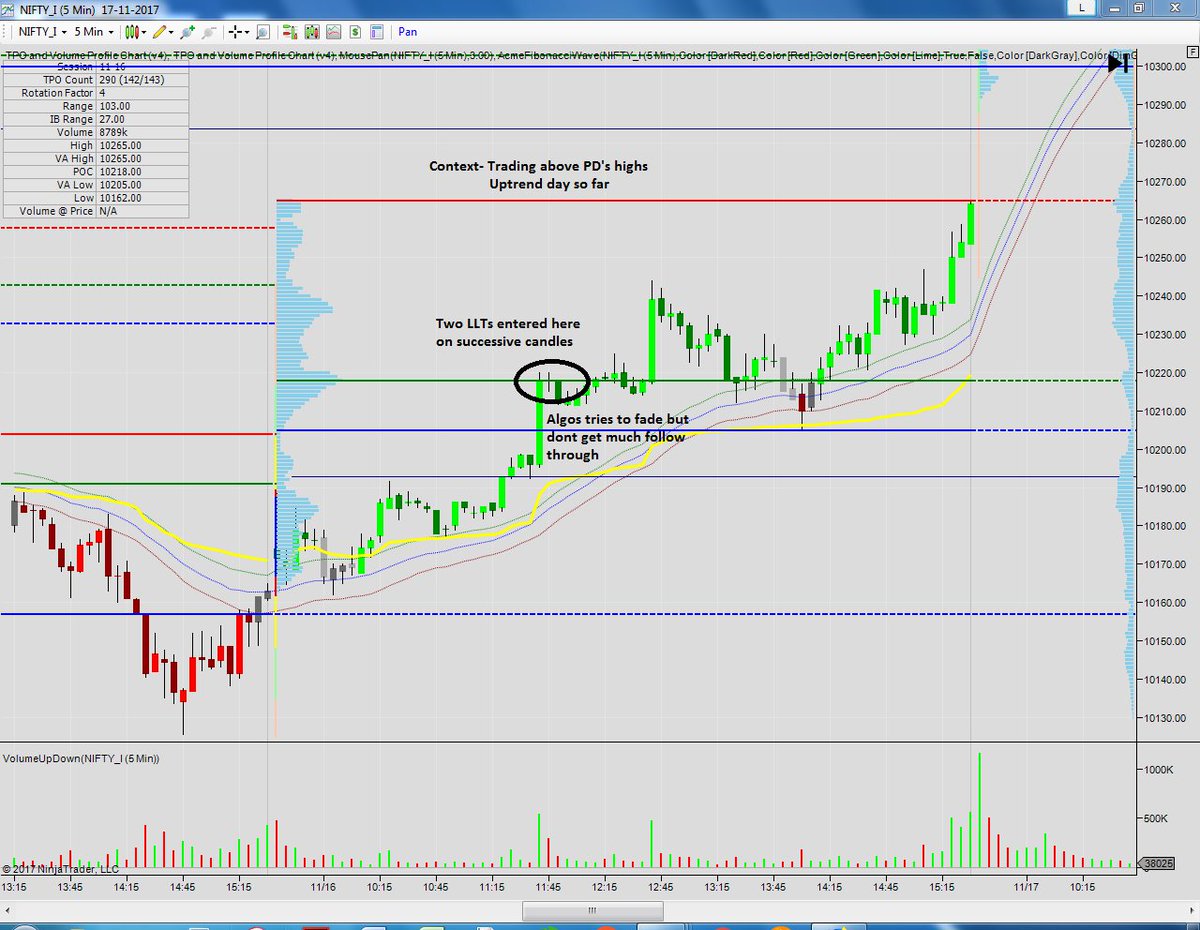

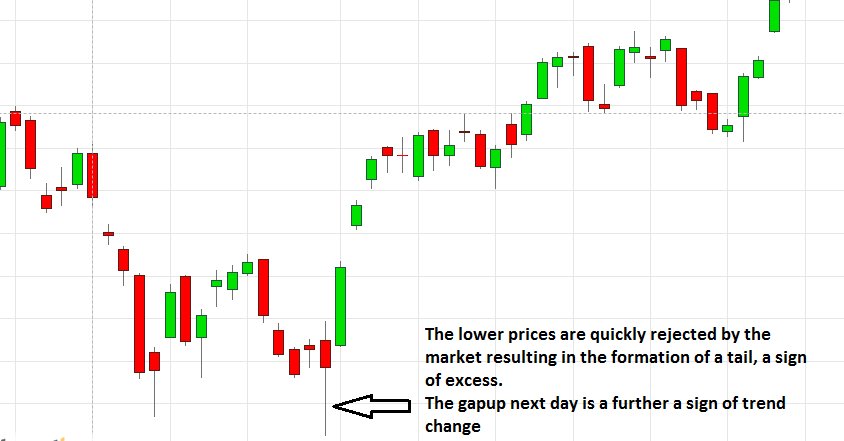

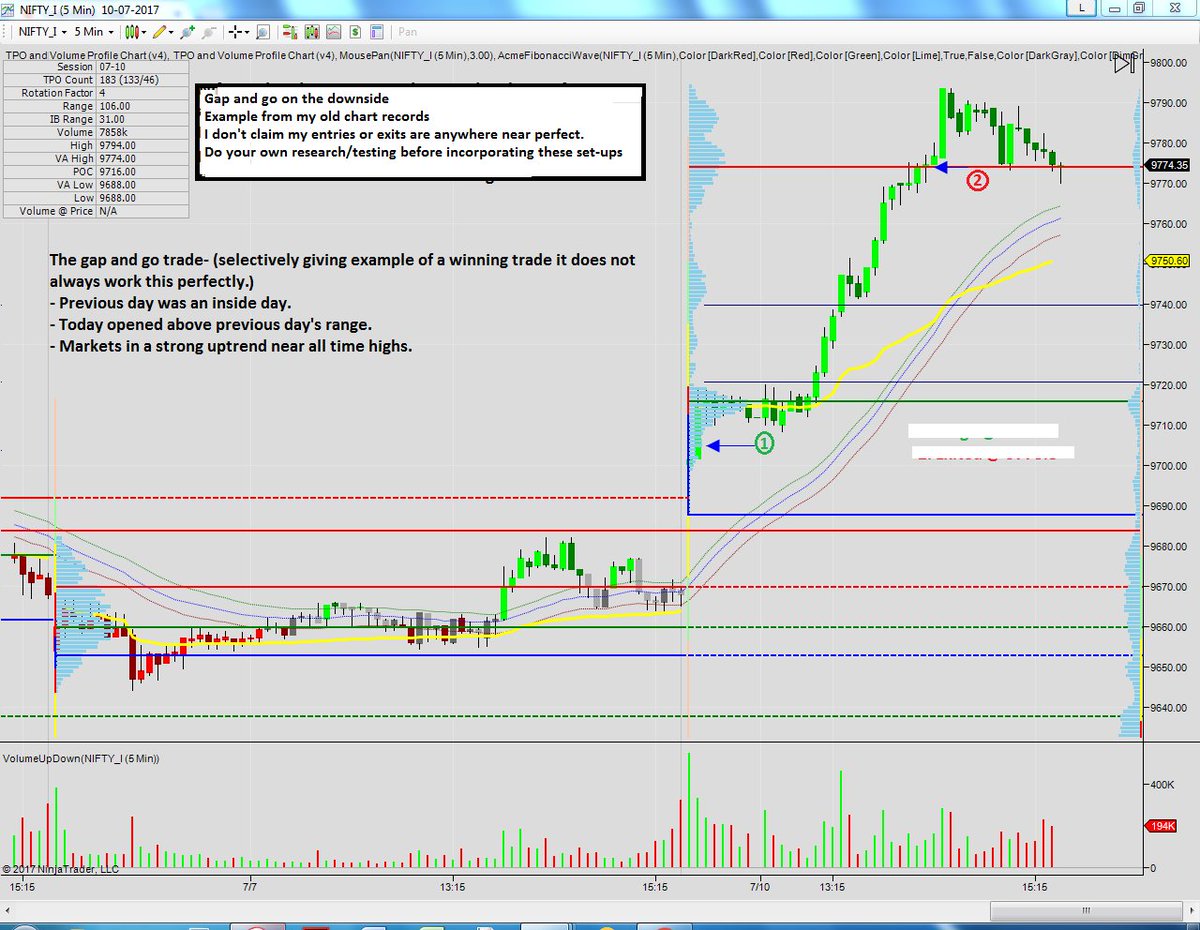

Sharing only carefully selected examples from my winning trade charts and so these setups don't always work.

Sharing for educational purpose only, do your own research

Corrections/feedback most welcome

#mp_amt

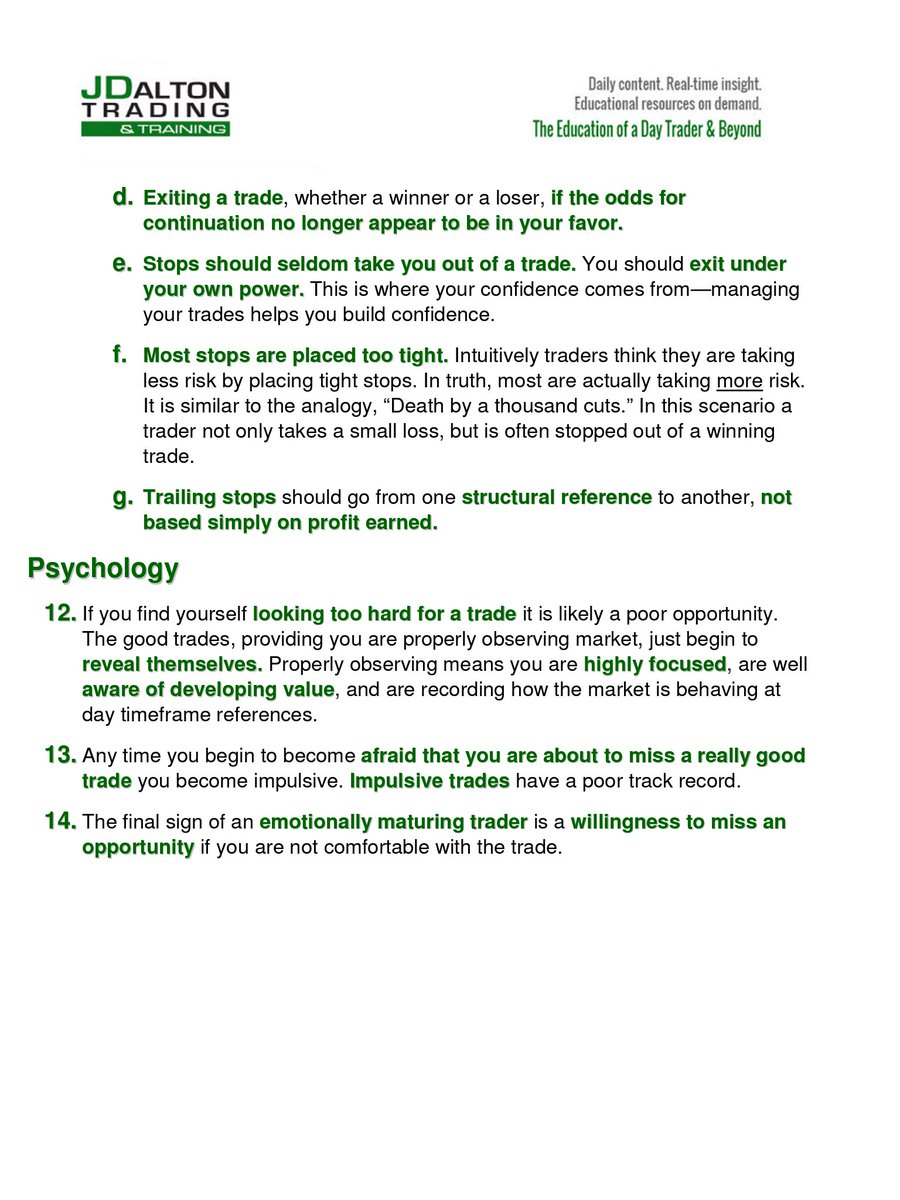

Chart 2 Gap and go on the downside (in downtrend)

Chart 3 Trading with overlapping range

#mp_amt

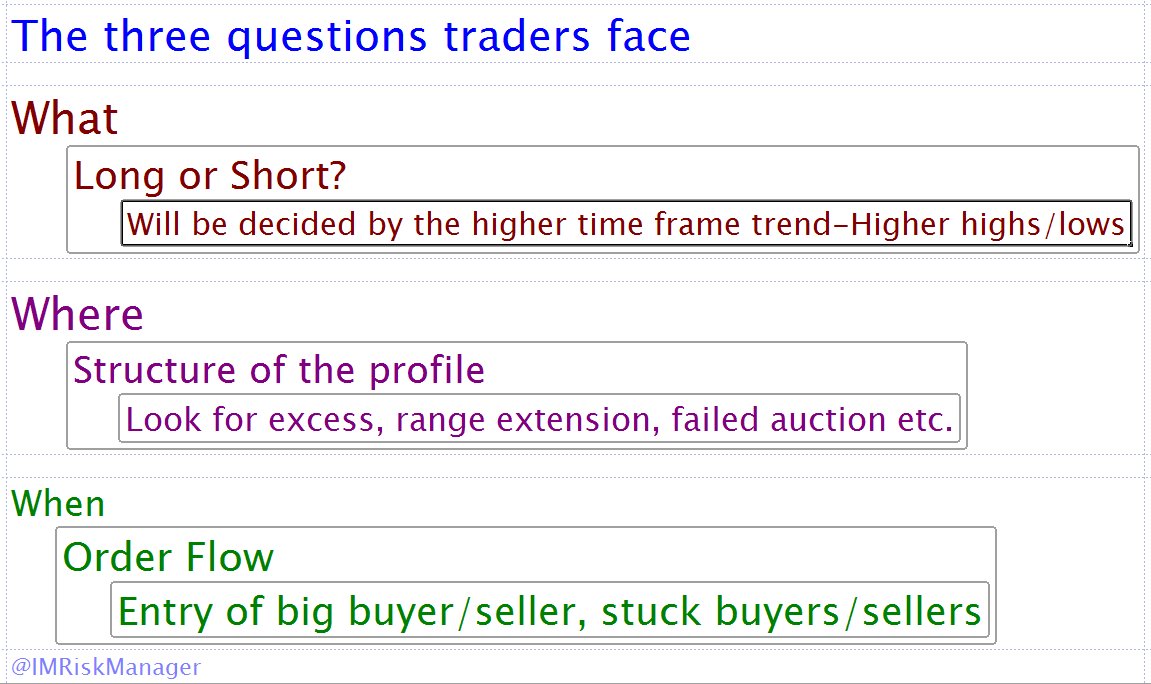

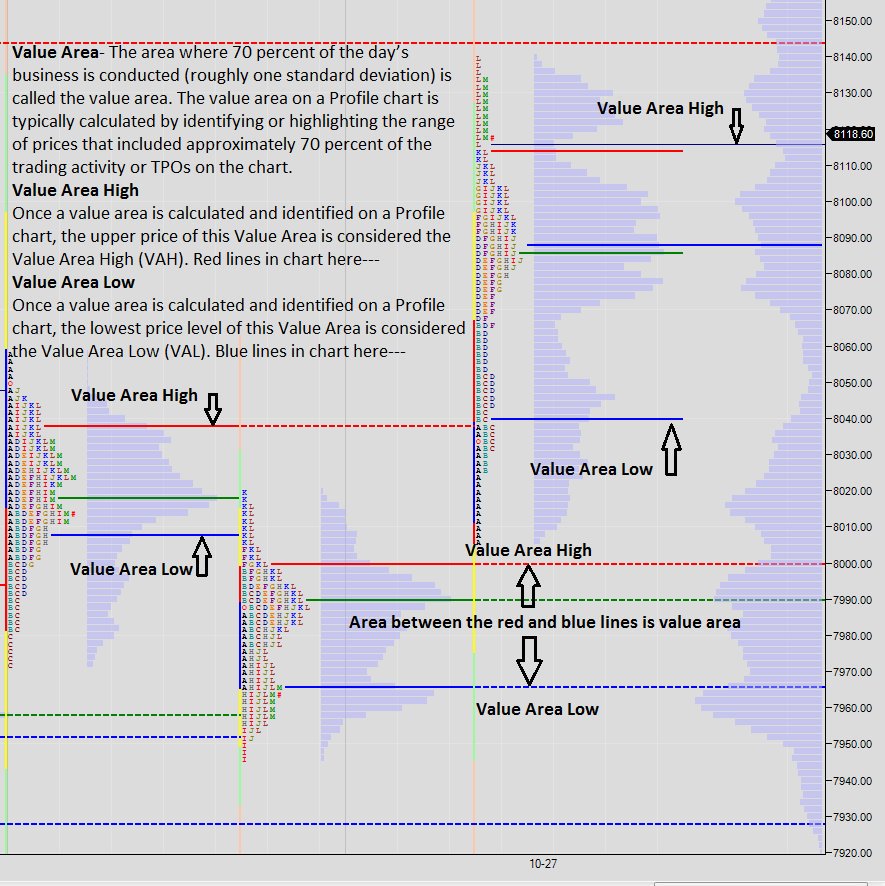

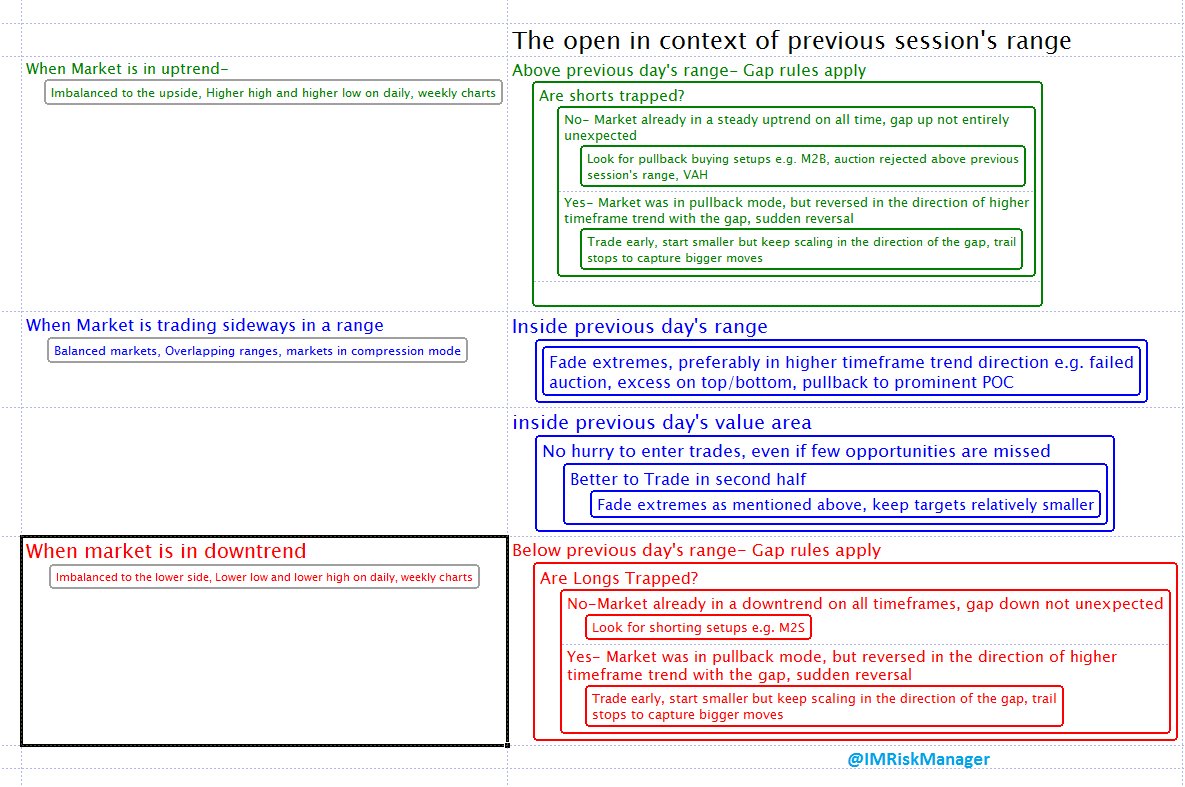

What to do- Long or short?

Where to enter?

When to enter?

#MarketProfile and #OrderFlow may have the answers

#mp_amt