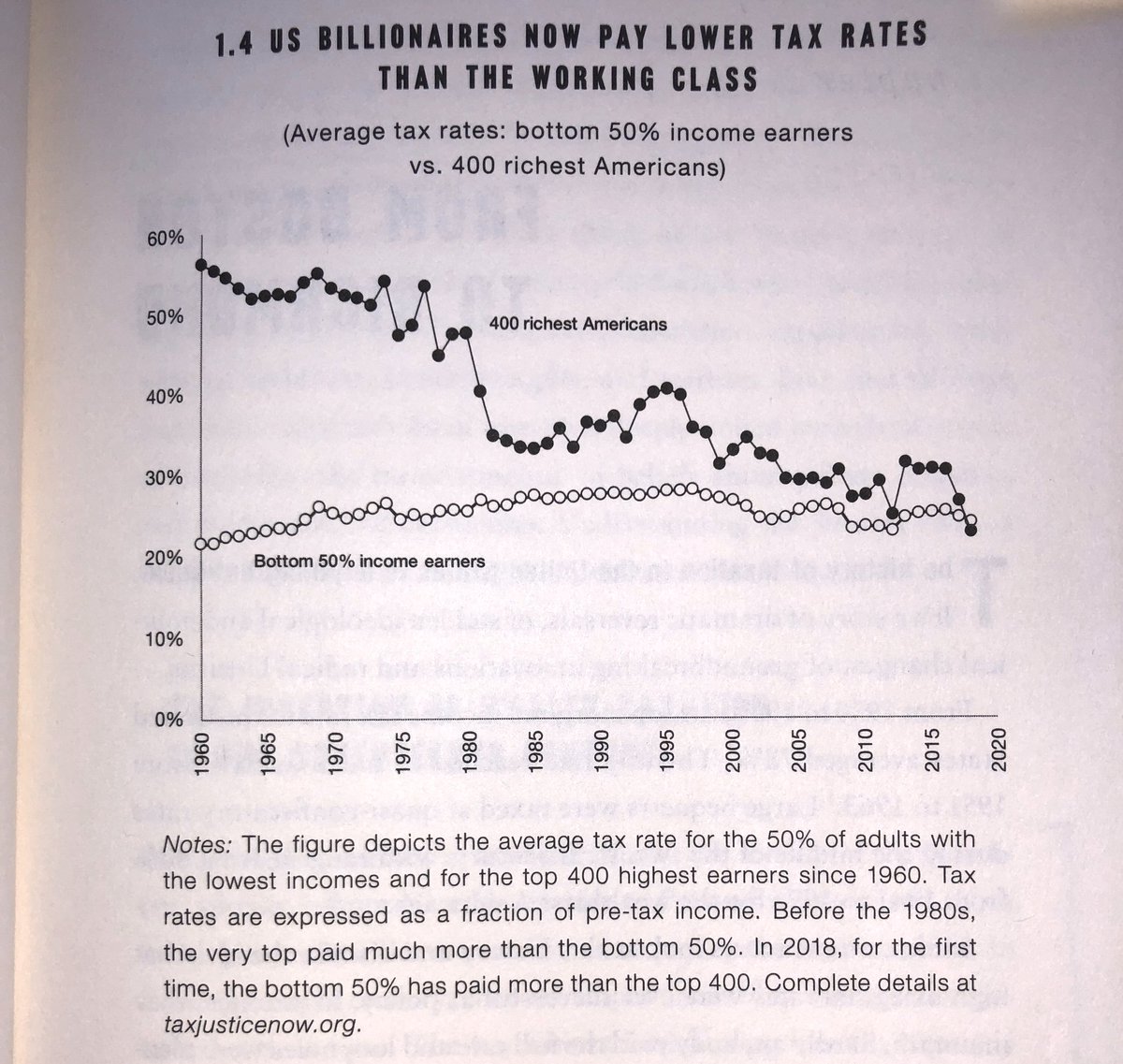

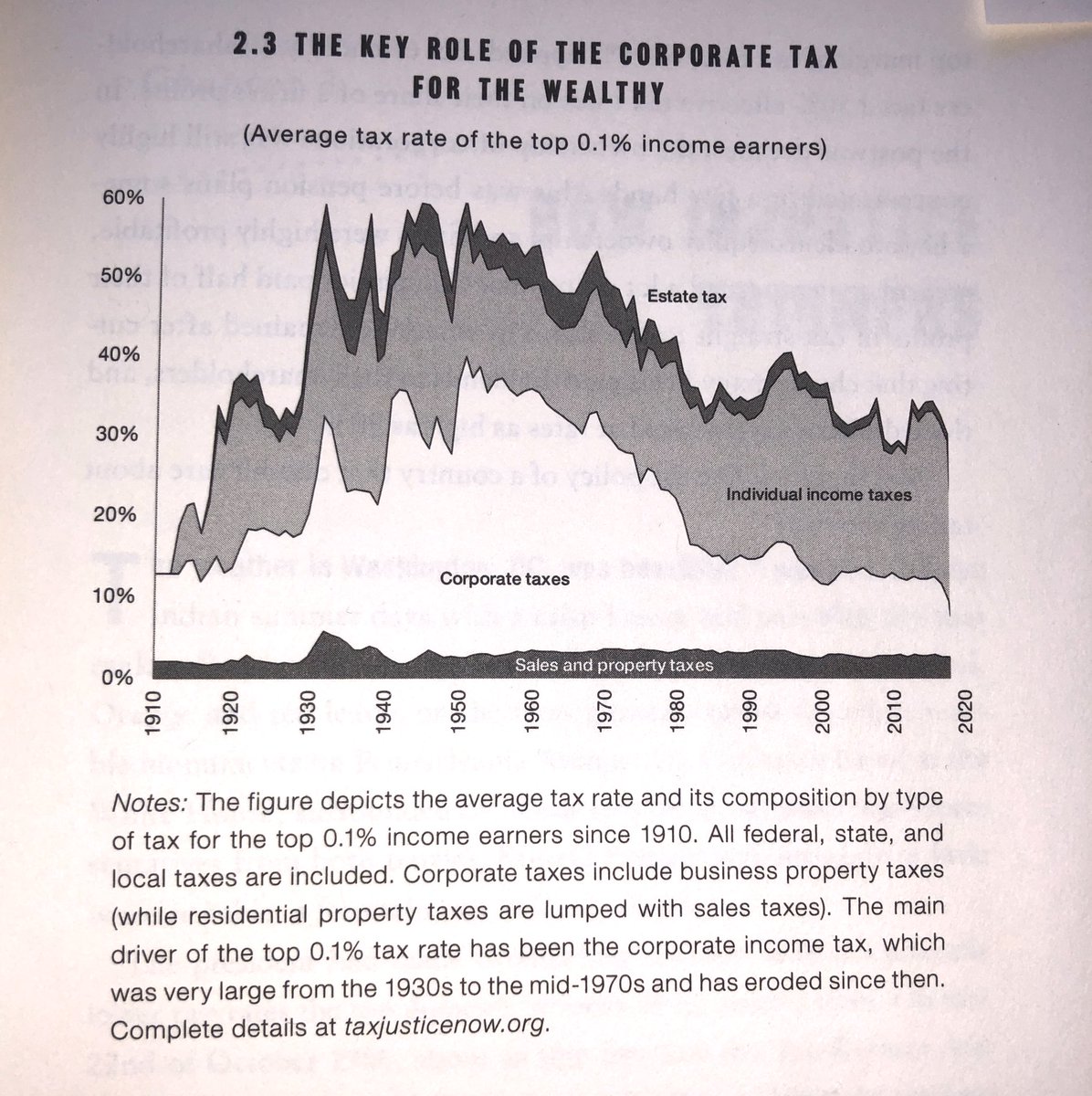

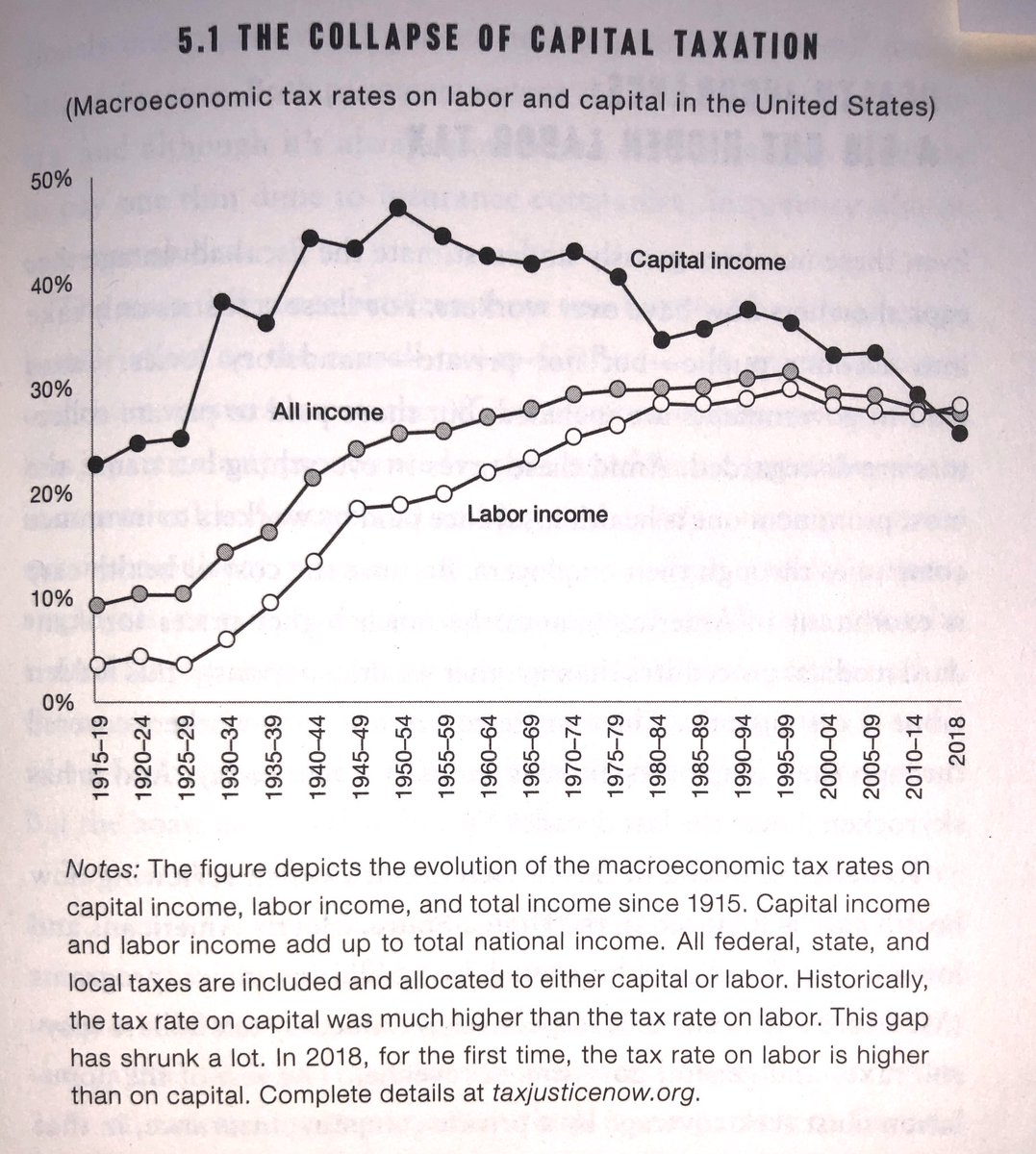

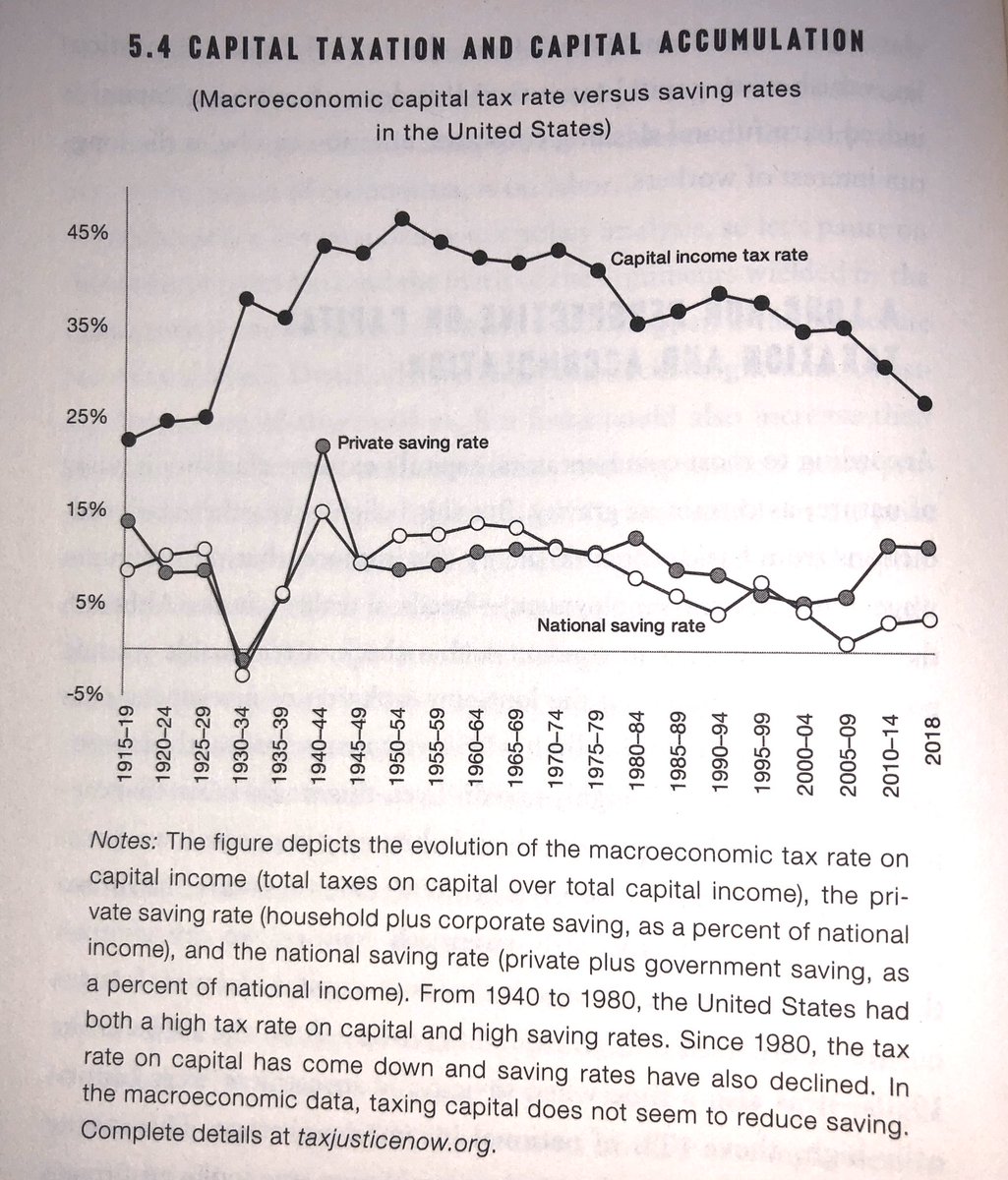

—"In 2018, following the Trump tax reform, and for the first time in the last hundred years, billionaires have paid less than steel workers, schoolteachers, and retirees."

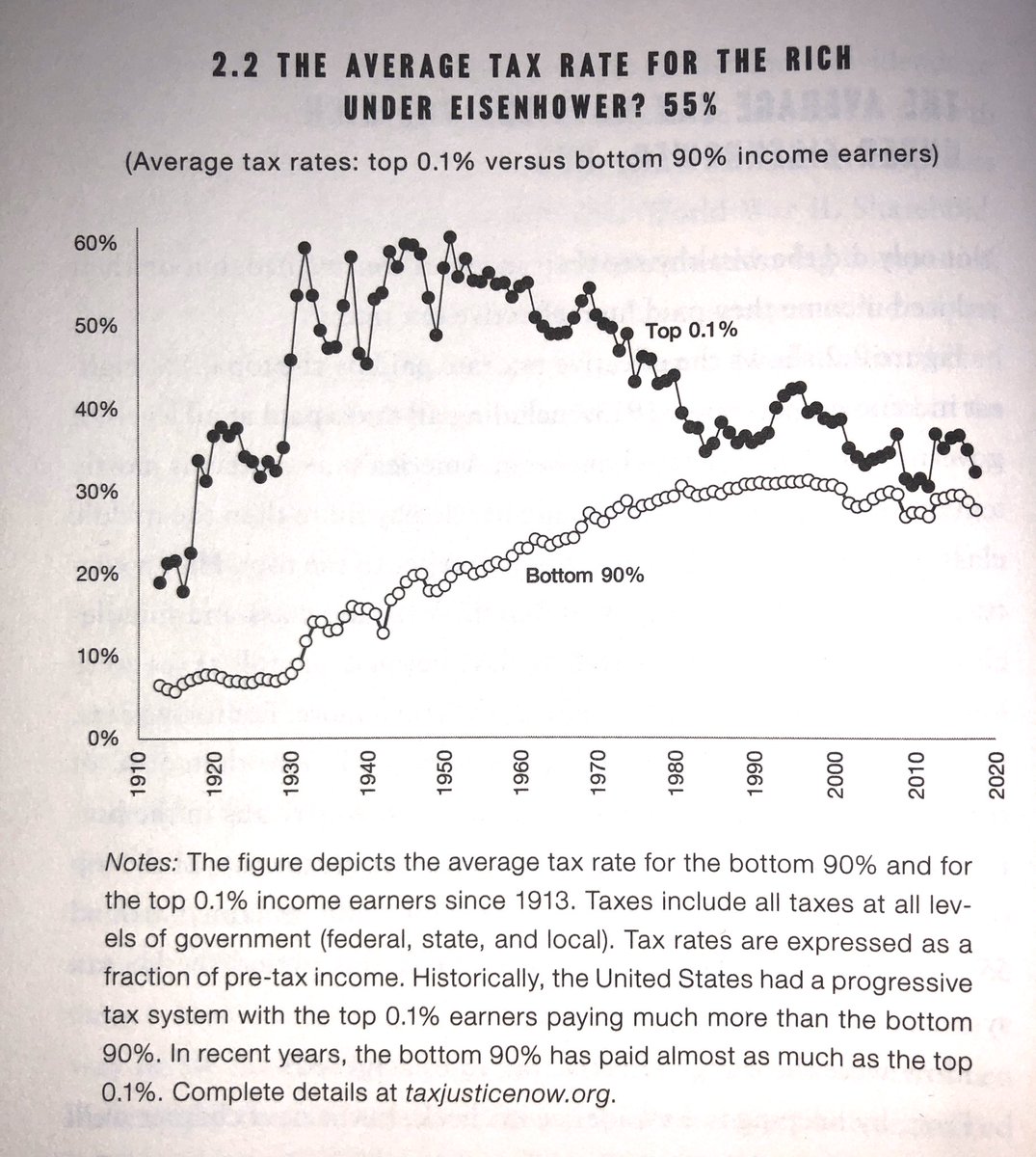

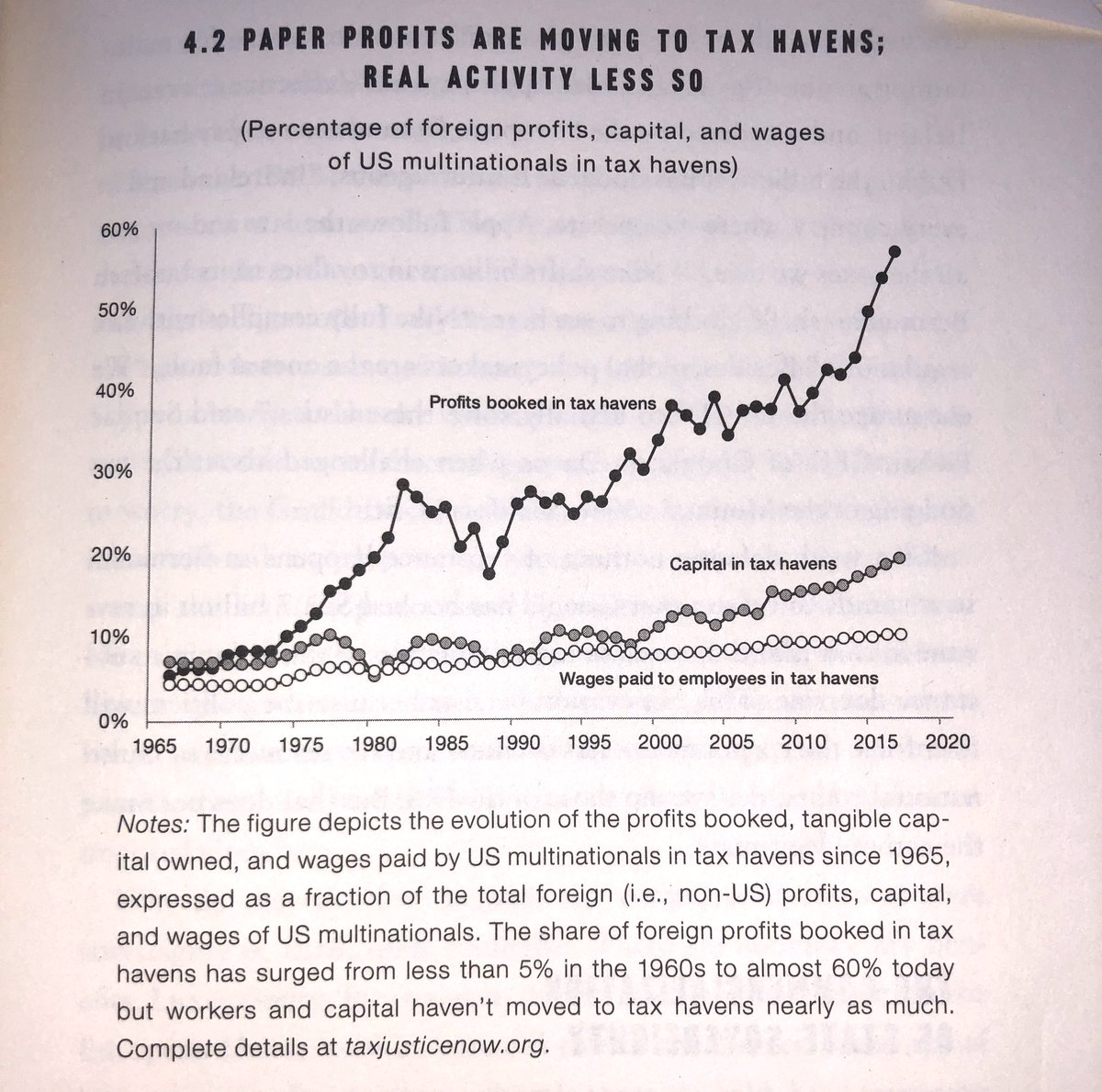

"Eisenhower-era top marginal tax and corporate tax rates, trans-national financial information-sharing agreements, and increased IRS resources and enforcement!"

"When do we want it?"

"The next legislative session!"

(Not an actual quote from the book.)