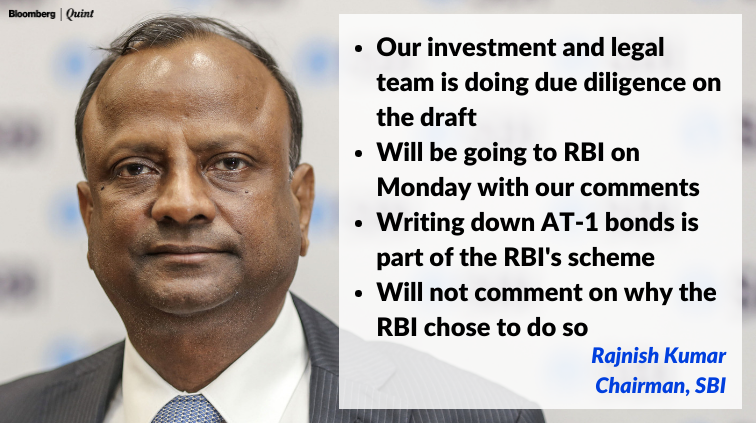

3) This can lead to a potential escalation in yields. Raising Cost of capital in future for other players

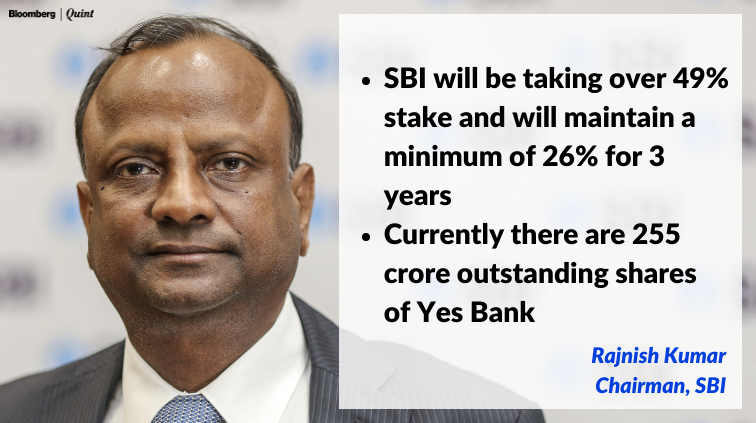

4) There have been cases of PSU bank mergers previously as well

5) Completely marking down the value to zero and keeping equity at 10Rs is not a legally tenable course of action.

7) Not sure how deeply it will impact PSU banks in future who raise a lot of AT1 capital. Cost will increase dramatically and will hit them badly.

9) Debt investment for HNIs in this country are gradually becoming taboo with so many defaults. Why should anyone invest in debt (read credit) products

#YesBankcrises #RBI #Banking

#wealthmanagement #bonds

#personalfinance