I have made it easy for beginner to understand

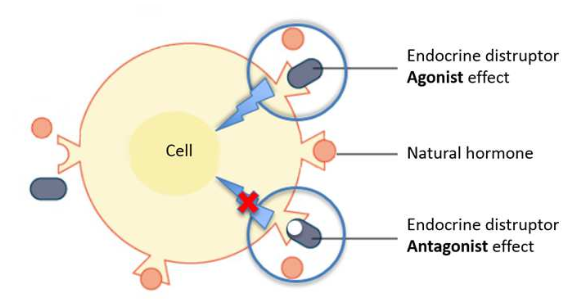

P/E ratio simply means how much money you are paying to generate 1% returns.

For Example: If a share is quoting at P/E 25, it means you are paying Rs 25 to earn 1 from that company.

(1/n)

Let us explore

Imagine u purchased RBI Bond with an interest of 7.75%.

It means you pay 100 & u get ₹ 7.75 as interest credited in your bank account (2/n)

In our GOI bond’s case: Market Value is ₹ 100 and Earning is ₹ 7.75

P/E ratio = 100 / 7.75 = 12.90

12.90 is the benchmark to compare whether markets are overvalued or undervalued.

(3/n)

When invested in markets, taking risk of uncertainty, I shall get more than RBI Bonds returns a.k.a risk free returns.

Equity Returns [ 100/ Market P/E ] >Risk free return

By re-arranging the above. Market P/E < [100/RISK Free]

(4/n)

The above calculation is for Current/Historic PE ratio, I am of the opinion that while investing today v s'd incorporate expected earnings growth.

Market P/E<[ 100/ (Risk Free–Dividend Yield)]x(1+earnings growth)

(6/n)

Fair Market Valuation = 17.23

In the above equation, Risk Free Interest rate is considered as 7.75% RBI Bonds, dividend yield as 1.25 and expected growth from equities at 12%

If market P/E is > fair market valuation, (7/n)

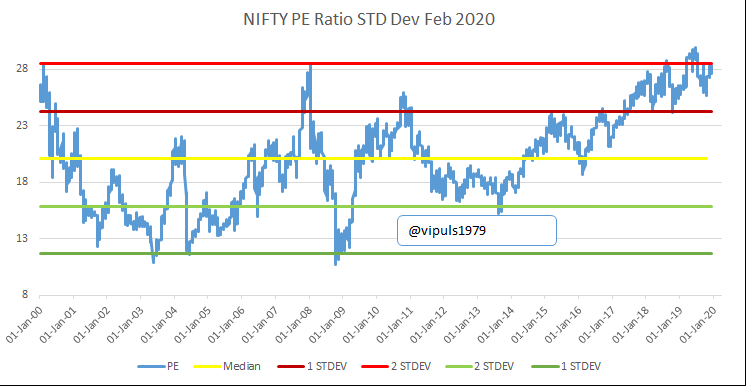

Increase your allocation to equities when NIFTY 50 PE ratio is below fair PE (Yellow Line) & its a screaming buy when it is 2 STDEV below the fair price like in 2008-2009

(9/n)

Have any questions happy to address those.............