understanding few basic concepts

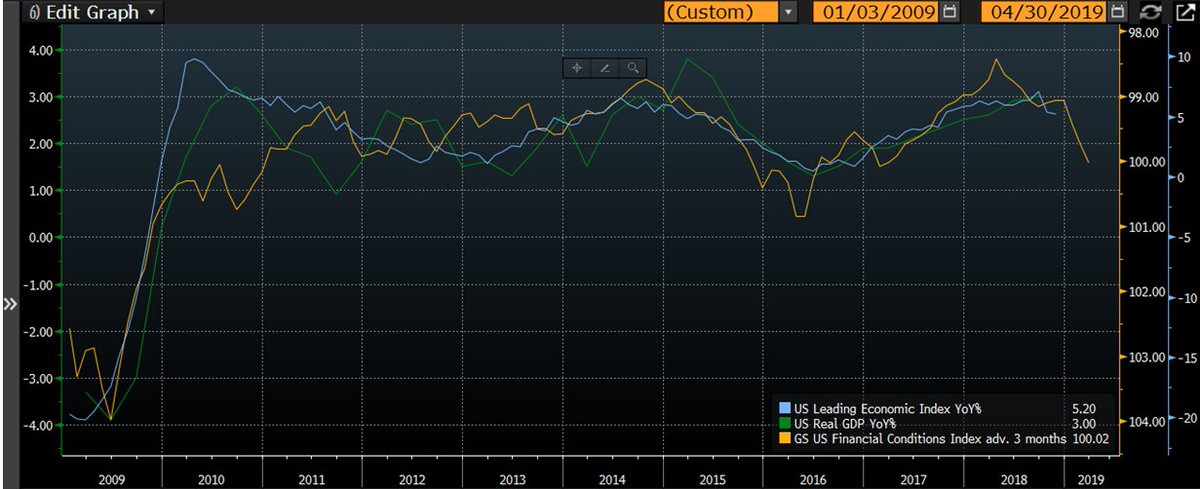

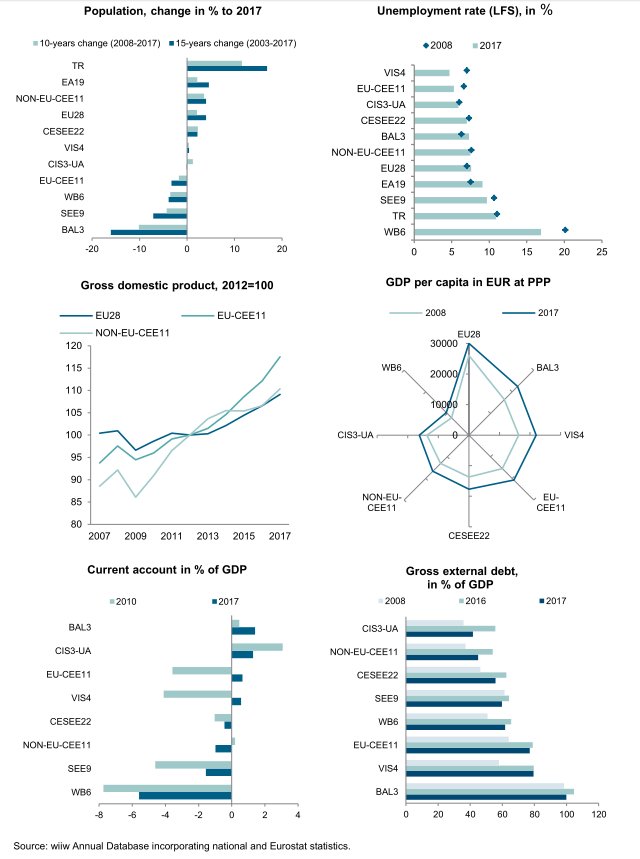

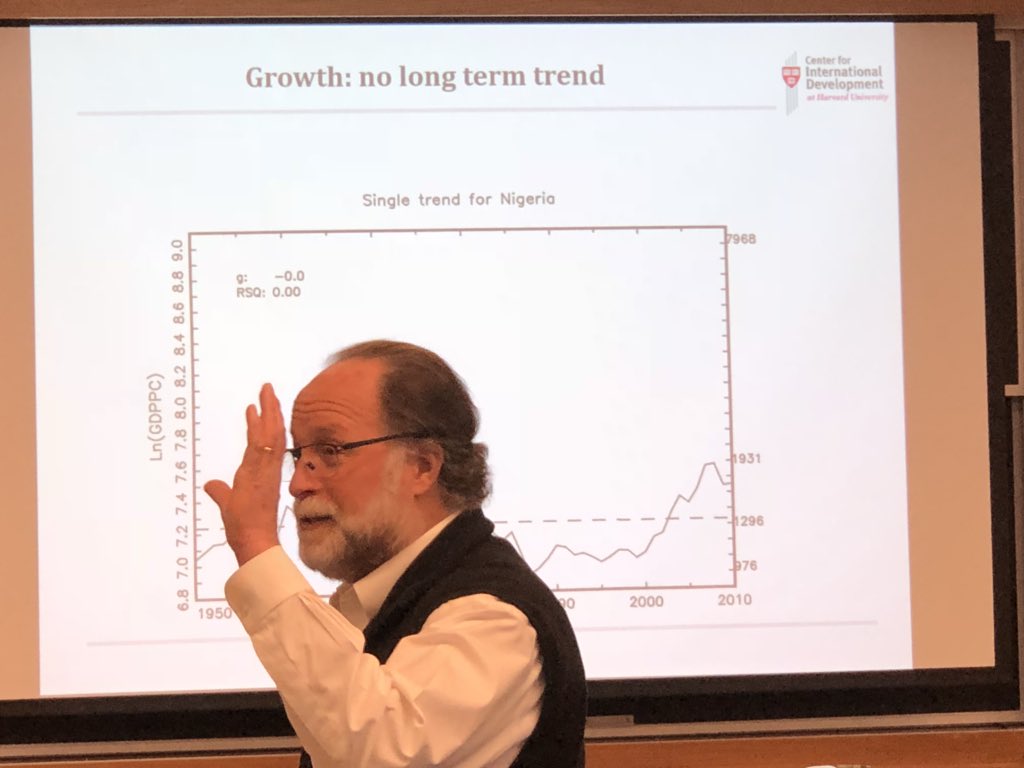

In the last 4-5 yrs the GDP growth has disappointed. (1/n)

1) the industrialist themselves

2) RBI might help by lowering interest rates or use other ways to increase economic activity if the industrialist themselves cannot increase their earnings .(3/n)

going back where i invested in nifty on 29th june 2012, nifty was at 5278 and the PE ratio was 17.51

Price = Earning * PE ratio

(4/n)

Today when the Nifty is trading at 11724 and Pe ratio is 29.26

Earnings today are (11724/29.26)= 400.68

If you calculate the growth in earnings , CAGR 4.17%.

(5/n)

Now the million Dollar question Should we sell today, considering your CAGR including dividends would be close to 15%.

(6/n)

(7/n)

Remember Warren says Interest rate is to the stock market what gravity is to objects on the planet. If the gravity is low, objects move up and if gravity is high, the objects go down.

(8/n)

(9/n)

(10/n)

(11/n)

(12/n)

(13/n)

current mcap to gdp is somewhere near .8 to .9

in 2008 it was 1.5 so

2 points

a) u just cannot compare pe ratio of 2008 with 2019 to show market is expensive as at that point earnings were at top nd here its at bottom

(14/n)

so mcap to gdp is very low so far

so again we just cannot compare situation of 2008 nd current on base of just PE which i guess almost is doing

(15/n)

we r somewhere reasonably valued.

So we are not selling, though if the earnings don’t come in next few quarters the sentiment might get hurt which might take the price lower.

(16/n)

(17/n)

(18/n)

But yes, anything that you require in next 5 yrs should not be in the stock market, not because of the levels of market today

(19/n)

so keep sipping nd keep investing, dnt wait for burst.

#investing

#pe

#nifty

#ETFS