“We expect to be cutting a lot out of Dodd-Frank b/c, frankly, I have so many people, friends of mine, who have nice businesses who can’t borrow money. They just can’t get any money b/c the banks just won’t let them borrow.”

thehill.com/policy/finance…

The idea was simple:

Force companies to act responsibly by not allowing them to over-leverage.

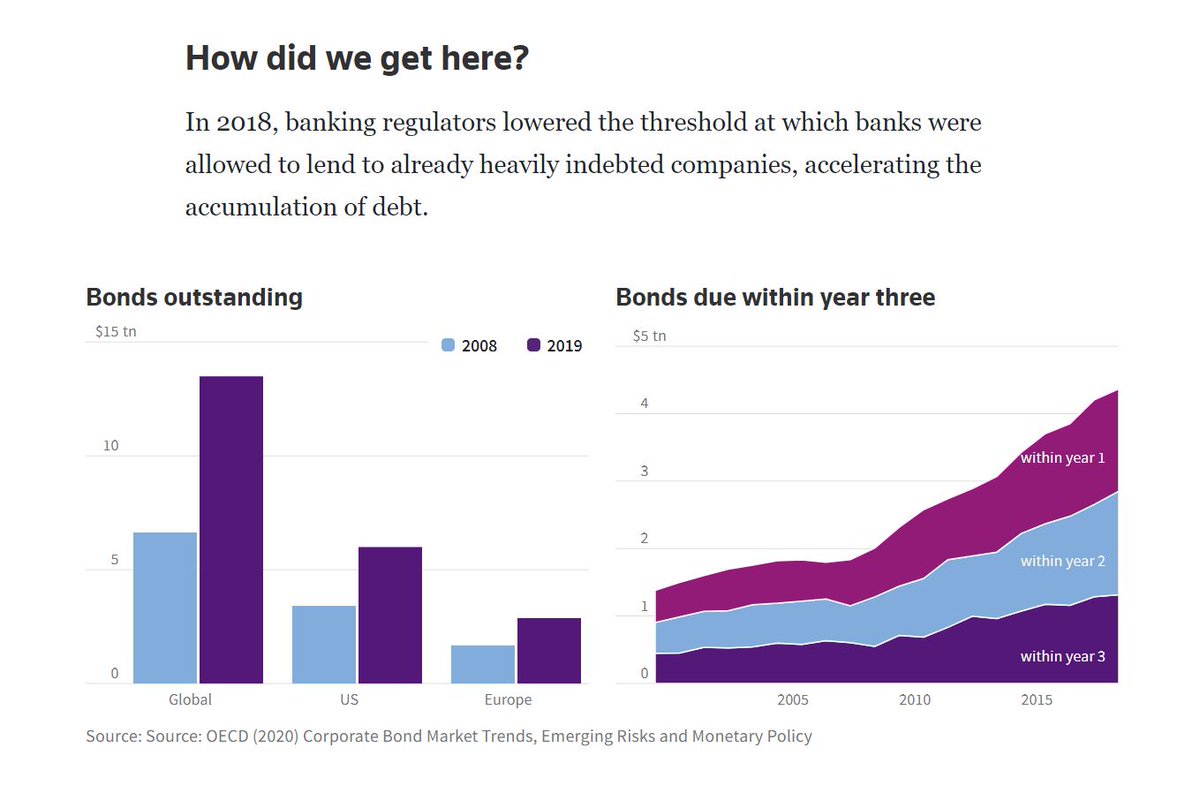

Trump signs a bill, fast tracked through the still @GOP-controlled House and Senate, that allows banks to make riskier short-term bets.

politico.com/story/2018/05/…

The Trump admin relaxes oversight on financial institutions and gives banks a free pass on even riskier bets while also decreasing the percentage of capital banks needed on-hand to cover those bets.

1. Companies that SHOULDN'T be borrowing more money (b/c they can't service the debt if profits don't keep rising) ARE.

2. Banks that SHOULDN'T be taking those bets b/c they're too risky, ARE.

3. Nobody is watching b/c of reduced oversight.

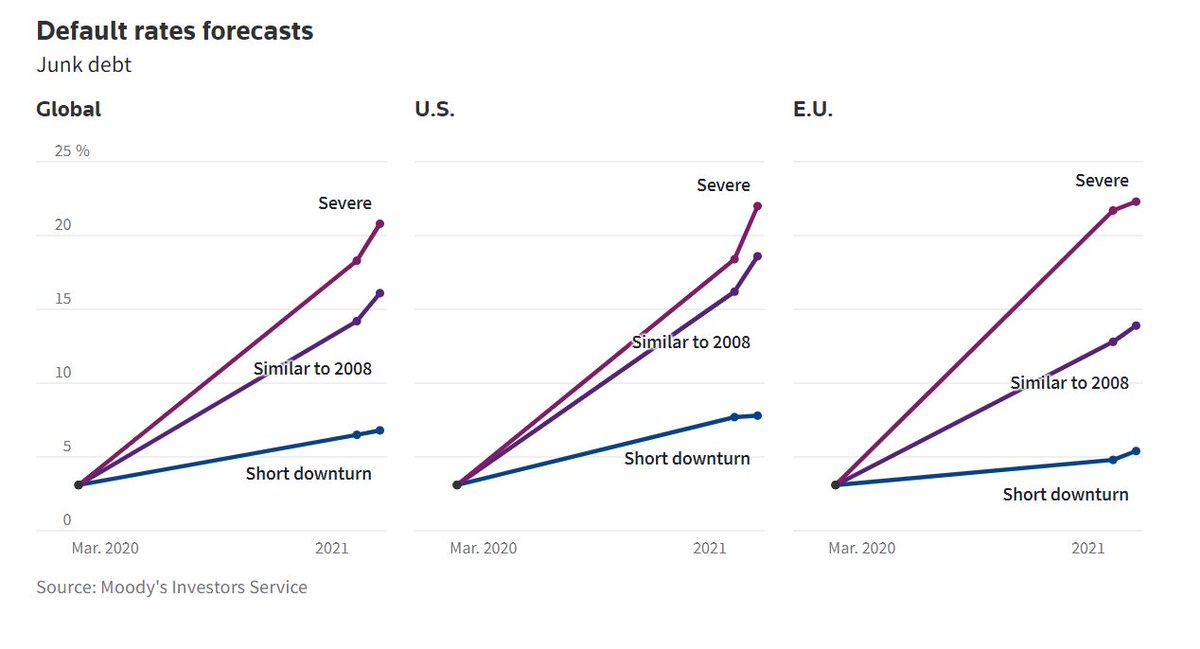

As long as it CONTINUES to grow, the accumulating debt won't be a problem.

What WE need to do is elect reps who won't boost their short-term numbers with a proven recipe for disaster.