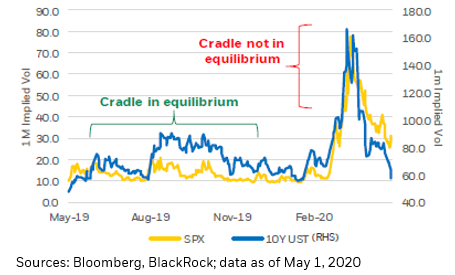

Under normal circumstances, the #economy might be said to resemble a Newton’s cradle, with moderate and somewhat predictable feedback loops reverberating through #policy actions, the #financial economy and the real economy; resulting in a system of reasonable equilibrium.

Over the past few months, however, as the #coronavirus pandemic encircled the globe and drastic responses to it got underway, this regular dynamic was thrown into disarray, crushing the real #economy and the #capital stack, and sending #volatility to dramatic heights.

Yet, these massive disruptions to the #economy have been met with an extraordinary #fiscal and monetary policy response, as illustrated in the current and expected growth of the #Fed’s balance sheet, which to our mind can go some distance toward offsetting lost growth potential.

These rescue measures are certainly not without costs, and many argue the burgeoning Federal #debt burden to be a huge headwind to future U.S. #growth, but while the aggregate numbers are large, some context about where things stood heading into the #crisis may assuage fears.

Yet, despite quintupling in size since 2000, the @USTreasury index offers less #income today (on a yield basis) than nearly at any time over the last 30 years, which gets to one of the central problems #investors face today: how does one source #yield in an age of #YieldScarcity?

These are all topics we plan to engage more with in the days ahead, since while the #economic system appears to be stabilizing for now in aggregate, we think there will be tremendous dispersion, both within and between #asset classes, and continued #uncertainty in months ahead.

• • •

Missing some Tweet in this thread? You can try to

force a refresh