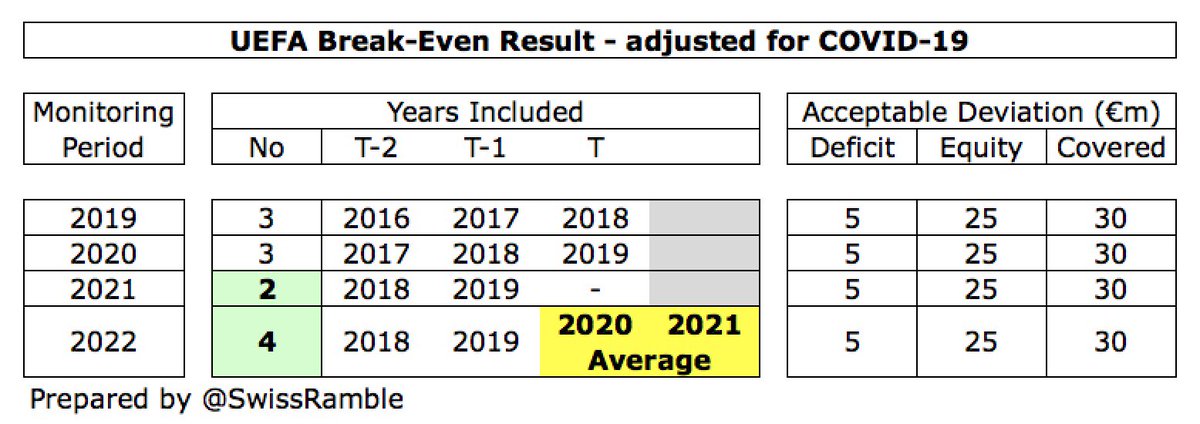

However, they emphasised that these measures were to address revenue shortfall due to COVID-19 and not financial mismanagement.

Even after the changes, UEFA want the emergency measures to still “retain the spirit and intent of FFP for football’s long-term viability”.