As #tech sold off in the last 2 weeks, there were still places that were resilient during this time period. Whether tech gets through the consolidation phase or breaks lower, time will tell.

Meanwhile few ideas on longs and shorts going forward. 1/

Meanwhile few ideas on longs and shorts going forward. 1/

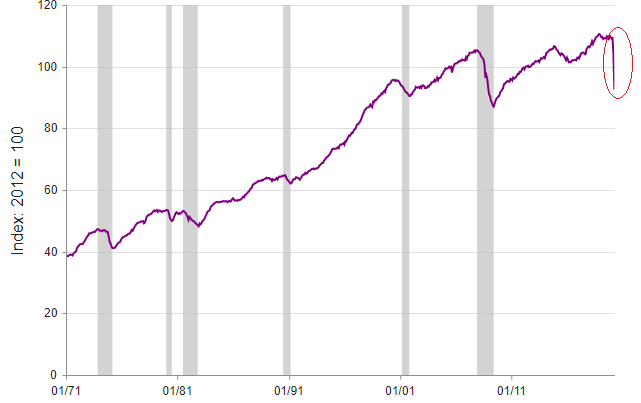

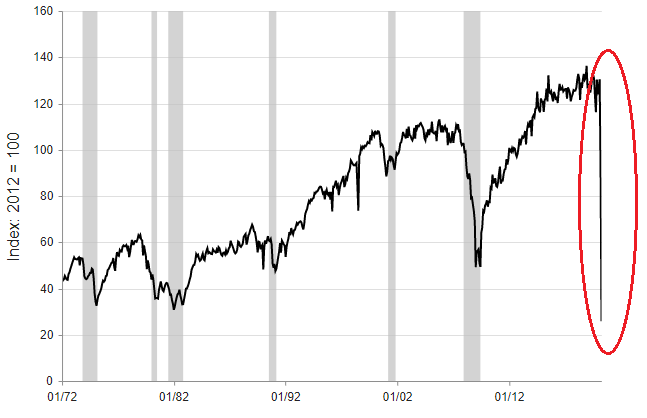

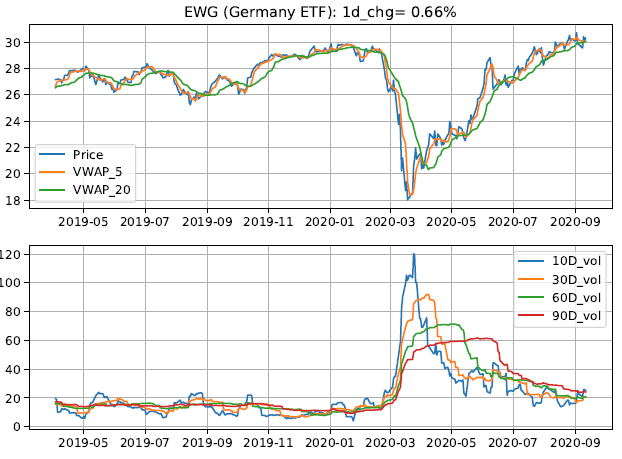

On the long side, equity exposure in #transports, #materials and int'l mkts like #Germany and #Korea worked well. Exposure in these areas continues to stay bullish.

Vols are showing upticks as well, so should stay careful.

$IYT $XLB $EWG $EWY

2a/

Vols are showing upticks as well, so should stay careful.

$IYT $XLB $EWG $EWY

2a/

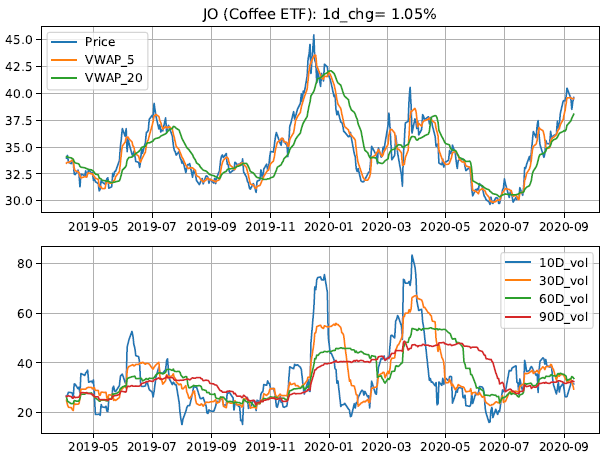

Commodities in bullish trend while #Gold and #Silver are consolidating for the time being: #Palladium, #Copper, #Coffee, #SoyBeans

$CPER, $PALL, $JO, $SOYB

2b/

$CPER, $PALL, $JO, $SOYB

2b/

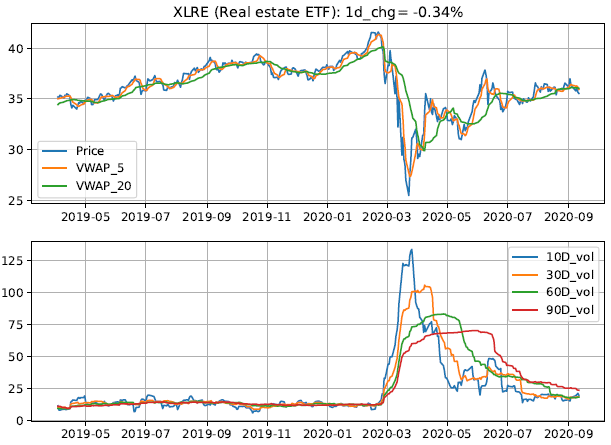

On the short side, #Energy, #Realestate, #Aerospace remain in a downtrend.

$XLE $XOP $XLRE $ITA $THD

3a/

$XLE $XOP $XLRE $ITA $THD

3a/

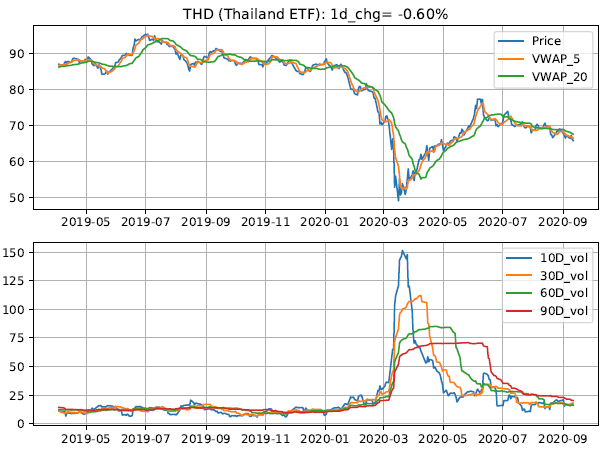

Int'l equities in #Thailand continue to pay short-sellers.

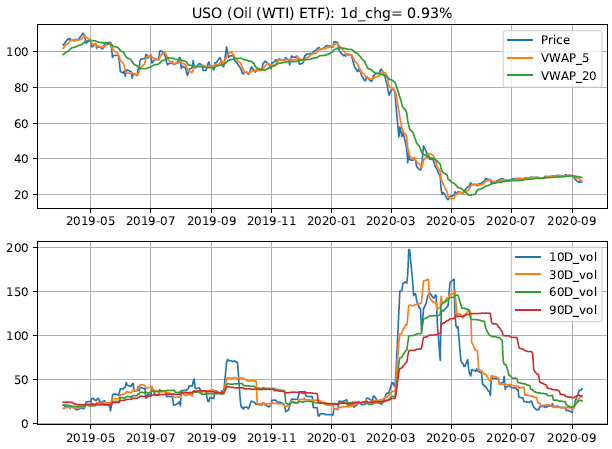

Commodities starting to turn down if one wants to hedge the commodity exposure a bit - #sugar and #oil.

$THD $SGG $USO $BNO

3b/

Commodities starting to turn down if one wants to hedge the commodity exposure a bit - #sugar and #oil.

$THD $SGG $USO $BNO

3b/

I am not sure what to make of oil's recent move, it's certainly bringing up some fears about glut of rapid price decline as travel season ends. It somehow coincides with the mkt decline for last 2 weeks in leading tech sector.

Next 2-3 weeks should be very interesting. 4/ end

Next 2-3 weeks should be very interesting. 4/ end

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh