#TweetStorm - Nifty up But Stocks are Down !!. Time for Stocks to Catch Up in coming years. Read the Full Post on this link - nooreshtech.co.in/2020/11/nifty-… Another Post - March 24th 2020 nooreshtech.co.in/2020/03/equity…

2020 move did some things very differently. No euphoric move in end of 2020 like 2007. The fall has seen no relief rallies of any sort. If this is the case the historical expectation of a sideways consolidation & a retest may not happen. So the recovery can even be very ferocious

Nifty was at 10730 on 15th January 2020.

Nifty made a top on 20th Jan 2020 hitting a high of 12430.

Nifty made a bottom on 24th March 2020 hitting a low of 7511.

Nifty made a new high on 2 days back on 9th Nov 2020 and is today (11th Nov 2020) trading at new highs at 12749

Nifty made a top on 20th Jan 2020 hitting a high of 12430.

Nifty made a bottom on 24th March 2020 hitting a low of 7511.

Nifty made a new high on 2 days back on 9th Nov 2020 and is today (11th Nov 2020) trading at new highs at 12749

What did the Market do ?

In normal terms the Market is considered to be Sensex and Nifty and they do comprise almost 50-70% of Indias total market cap.

We would look at the Full Universe of all the Listed Companies on NSE.

In normal terms the Market is considered to be Sensex and Nifty and they do comprise almost 50-70% of Indias total market cap.

We would look at the Full Universe of all the Listed Companies on NSE.

1) The Fall From peak of 2018 to Nov 2020

Nifty up 19%

15% stocks only are trading above its Jan 2018 prices

85% stocks are trading below its Jan 2018 prices

74% stocks are down more than 25% from the Jan 2018 prices.

55% stocks are down more than 50% from the Jan 2018 prices.

Nifty up 19%

15% stocks only are trading above its Jan 2018 prices

85% stocks are trading below its Jan 2018 prices

74% stocks are down more than 25% from the Jan 2018 prices.

55% stocks are down more than 50% from the Jan 2018 prices.

2) The Fall from 20th January 2020 to 24th March 2020.

· Nifty down (36%)

· 71% of the stocks were down more than Nifty

· 26% of the stocks were down less than Nifty

· 98% gave negative returns

86% of the stocks fell more than 25%

· Only 2% stocks gave positive returns

· Nifty down (36%)

· 71% of the stocks were down more than Nifty

· 26% of the stocks were down less than Nifty

· 98% gave negative returns

86% of the stocks fell more than 25%

· Only 2% stocks gave positive returns

3 ) The Rise from March Lows

24th March 2020 to 11th November 2020

Nifty is up 63%

52% stocks were up more than Nifty

43% stocks gave return less than Nifty returns

95% gave positive returns

5% stocks gave negative return despite huge rise

24th March 2020 to 11th November 2020

Nifty is up 63%

52% stocks were up more than Nifty

43% stocks gave return less than Nifty returns

95% gave positive returns

5% stocks gave negative return despite huge rise

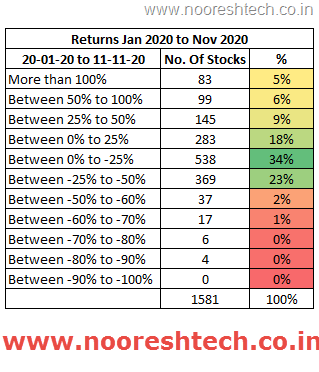

4) January 2020 to November 2020 –

20th Jan 2020 to 11th November 2020

Nifty is up 4%

40% stocks only are trading above its Jan prices

60% stocks are trading below its Jan prices

0.4% stocks or only 6 stocks are at par with their Jan prices

20th Jan 2020 to 11th November 2020

Nifty is up 4%

40% stocks only are trading above its Jan prices

60% stocks are trading below its Jan prices

0.4% stocks or only 6 stocks are at par with their Jan prices

85% of stocks are below the 2018 highs. 74% of the stocks are down more than 25% from January 2018.

The structure of the market is extremely narrow, Nifty most of the move bcoz of a handful of stocks.

Smallcap Indices are close to a breakout. Could eventually trend higher.

The structure of the market is extremely narrow, Nifty most of the move bcoz of a handful of stocks.

Smallcap Indices are close to a breakout. Could eventually trend higher.

Market tends to start breaking a lot of such beliefs in every new cycle. I specifically call it Belief & not Consensus. Consensus changes very quickly with prices but a belief is tough to change.

Belief =an acceptance that something exists or is true, especially one without proof

Belief =an acceptance that something exists or is true, especially one without proof

2017 – All of us whether technicals, fundamentals or even an individual saw Jio- a new product and a price breaking a 8 year high. Everyone traded but 8 year performance of Reliance and 3-4 year smallcaps move = Belief Large Money is made only by Investing in Smallcaps !!

Reliance is a 4x and is the Largest Company in India. What are the few top new belief or faith. ( Long term Return 5-10-15-20 years )

According to me these are the Top 3 Beliefs which may be challenged and can get broken.

According to me these are the Top 3 Beliefs which may be challenged and can get broken.

1) Smallcaps/Microcaps in the end lose money. Long Term Return is equivalent to LargeCaps. Do not buy Microcaps/Smallcaps.

2) Quality Companies, Super Growth Cos can be bought at any Valuations. In the Long run they give Returns.

2) Quality Companies, Super Growth Cos can be bought at any Valuations. In the Long run they give Returns.

3) PSU companies, Utilities, Cyclicals are wealth Destroyers and not to be touched forever. My Personal Biased or Bruised View - The most hated space for investing today is Microcaps – Most outsized returns can be made here in next 1-3-5 years and will take care of last 3 years

Other Beliefs

Value Investing is Dead.

Index Investing, Passive Investing is Nirvana.

Real Estate is a low return Asset Class

Growth at Cost of Profitability is the Only way to do Business.

Only Large Scale Businesses Survive every one else will Die. Bigger the Better. PLZ ADD

Value Investing is Dead.

Index Investing, Passive Investing is Nirvana.

Real Estate is a low return Asset Class

Growth at Cost of Profitability is the Only way to do Business.

Only Large Scale Businesses Survive every one else will Die. Bigger the Better. PLZ ADD

• • •

Missing some Tweet in this thread? You can try to

force a refresh