🇺🇸 #GDP thread

The strongest GDP advance on record rings hollow.

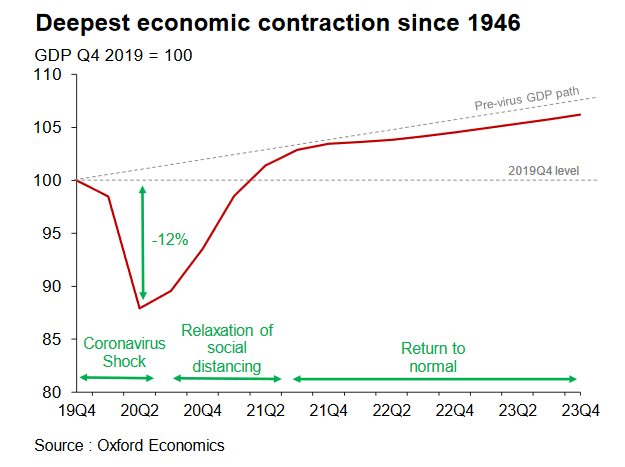

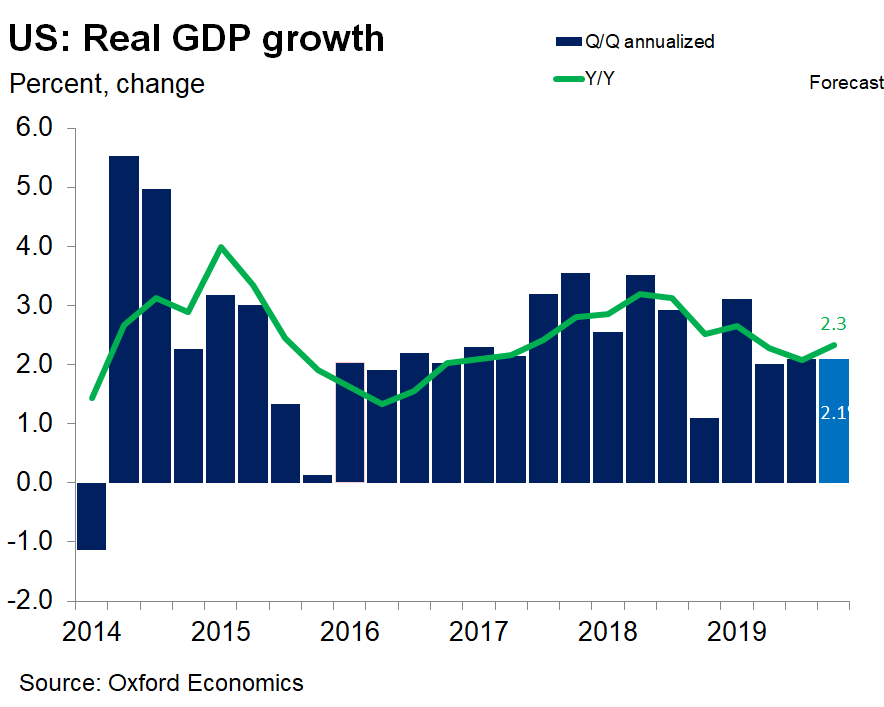

The economy grew 7.4% (or, 33.1% annualized) in Q3 – recouping two thirds of the #Covid output loss – but it remains 3.5% smaller than at the end of 2019.

The strongest GDP advance on record rings hollow.

The economy grew 7.4% (or, 33.1% annualized) in Q3 – recouping two thirds of the #Covid output loss – but it remains 3.5% smaller than at the end of 2019.

The strong #GDP performance gives a false impression of the economy’s true health.

Much of the Q3 gain came from carry-over effects from fast progress in May-July while real GDP remained down 2.9% y/y in Q3.

Much of the Q3 gain came from carry-over effects from fast progress in May-July while real GDP remained down 2.9% y/y in Q3.

Comparing the Global Coronavirus Recession with the Global Financial Crisis is quite telling:

Despite the strong Q3 rebound, real 🇺🇸GDP is now where it was at the trough of the Great Recession.

(*I know Q4 2007 is the start of GFC, but doesn't change the levels much)

Despite the strong Q3 rebound, real 🇺🇸GDP is now where it was at the trough of the Great Recession.

(*I know Q4 2007 is the start of GFC, but doesn't change the levels much)

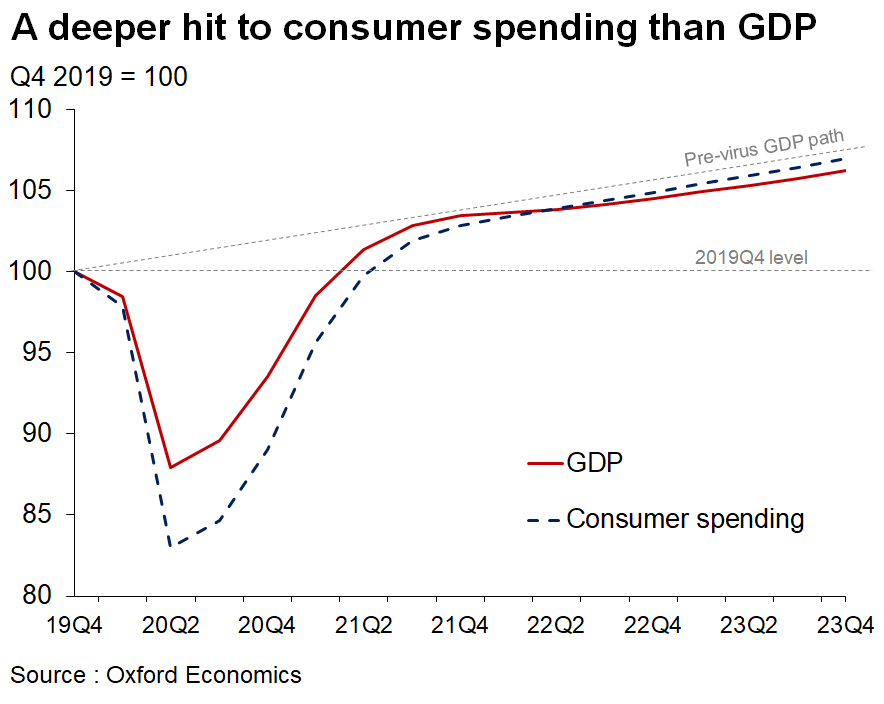

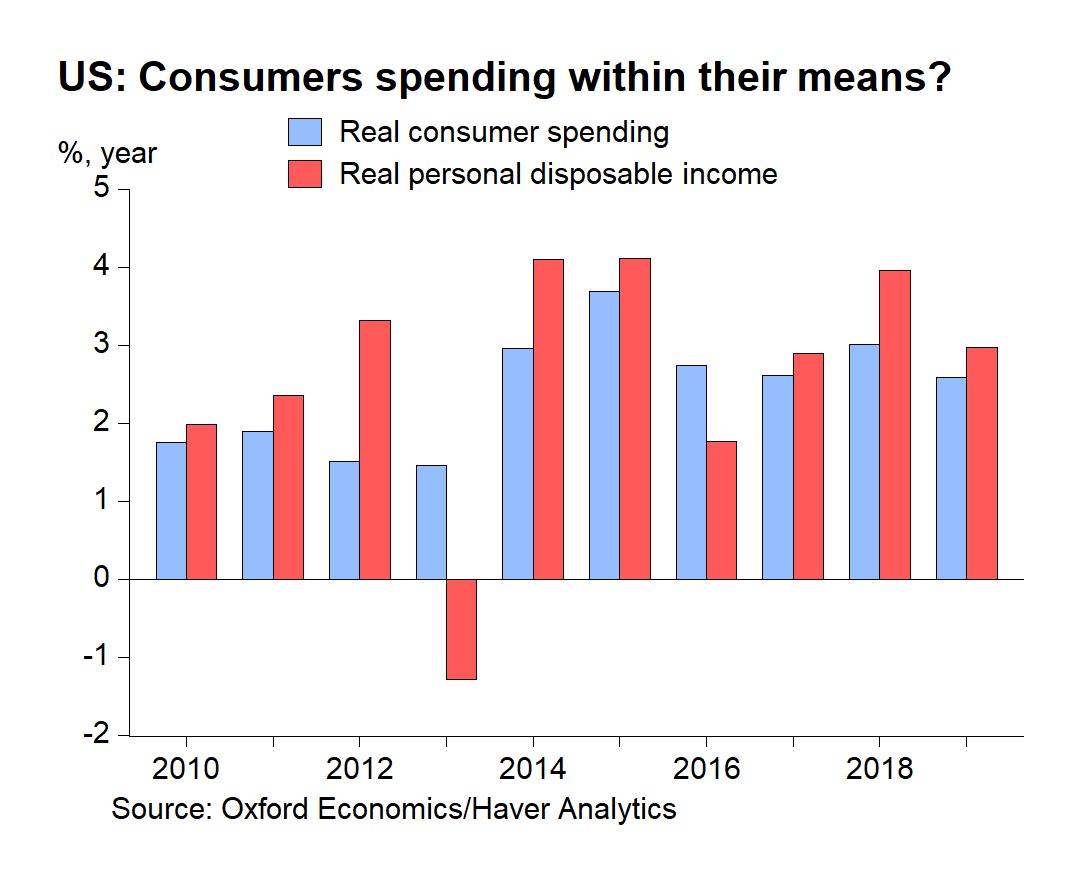

The Q3 advance was led by a record shattering 8.9% (or, 40.6% annualized) surge in #consumer spending led by the demand for goods, and a red-hot #housing market driven by fiscally stimulated income growth and historically low interest rates.

> This won't be repeated in Q4

> This won't be repeated in Q4

Business #investment also rebounded firmly, up 5.1% driven by equipment outlays as energy-sector activity remained stuck in a rut.

Monthly shipments data points to decent though cooling momentum in early Q4 -- encouraging given the still-large shortfall relative to pre #COVID19

Monthly shipments data points to decent though cooling momentum in early Q4 -- encouraging given the still-large shortfall relative to pre #COVID19

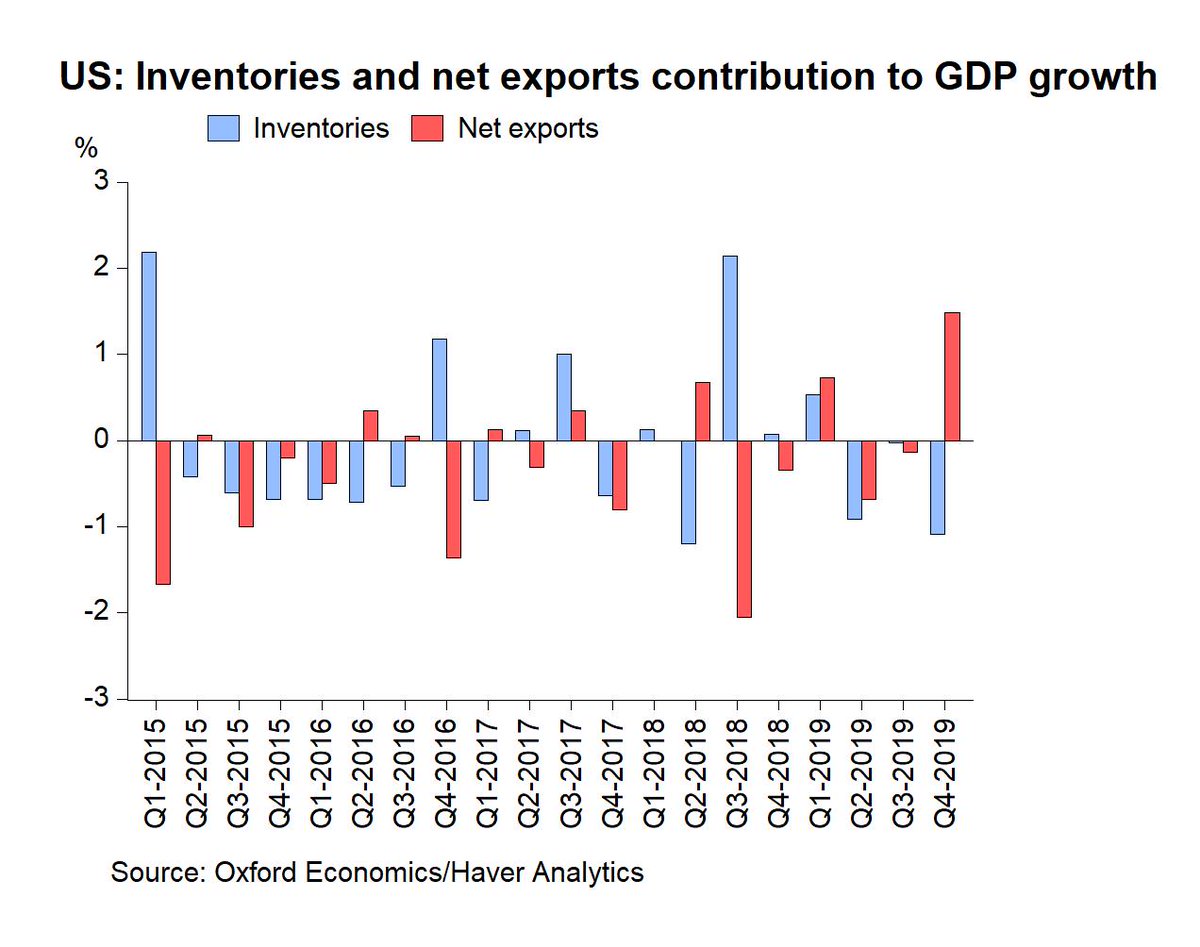

#Trade flows rebounded sharply, but importers were much busier responding to strong domestic goods demand than exporters were to still-lackluster global activity.

Government spending meanwhile fell 1.2% (or, 4.9% annualized) as nondefense spending was reigned in and constrained state and local budgets forced a cut back on outlays.

• • •

Missing some Tweet in this thread? You can try to

force a refresh