#Fed Beige Book:

👍Modest to moderate activity

👎Some regions slowing

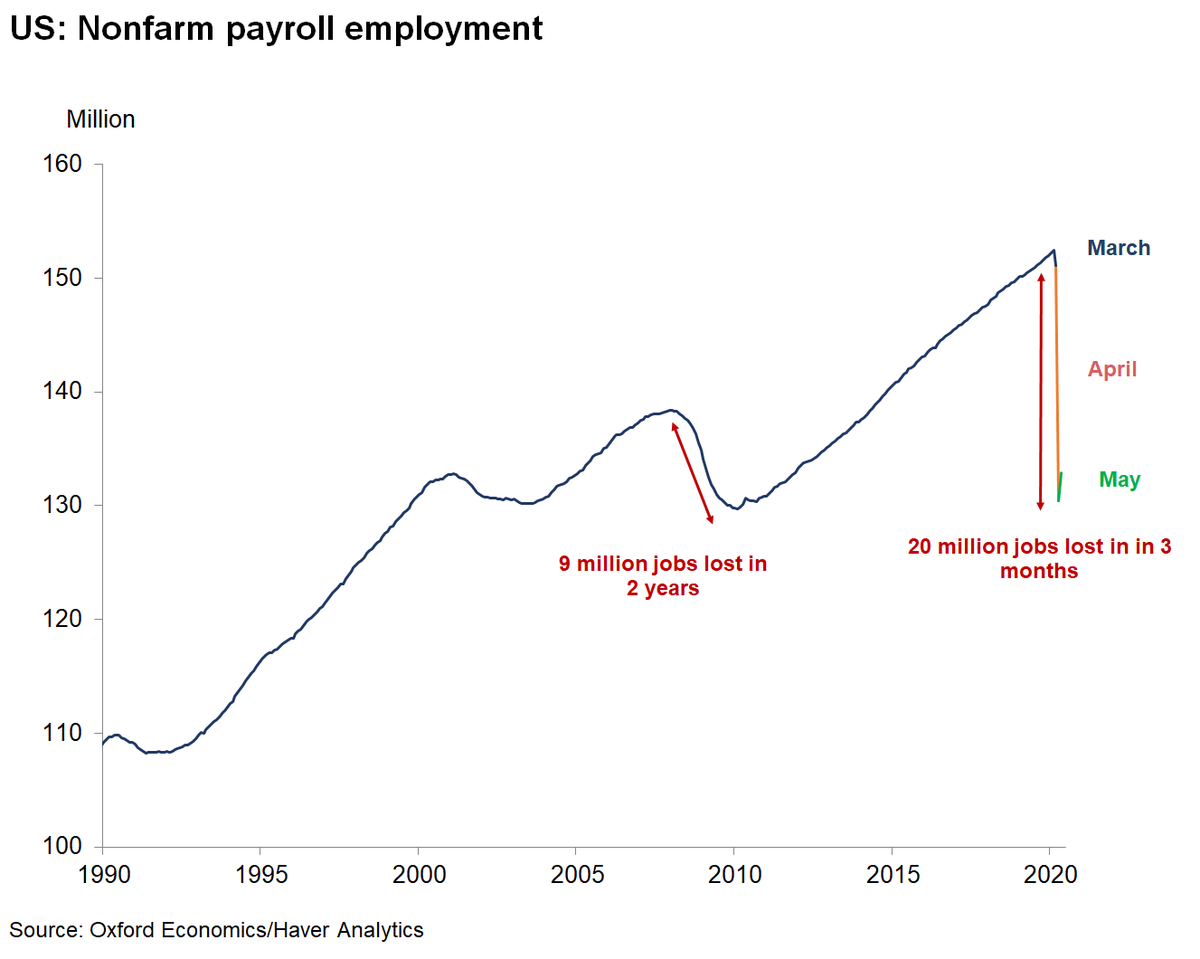

👎Recovery incomplete

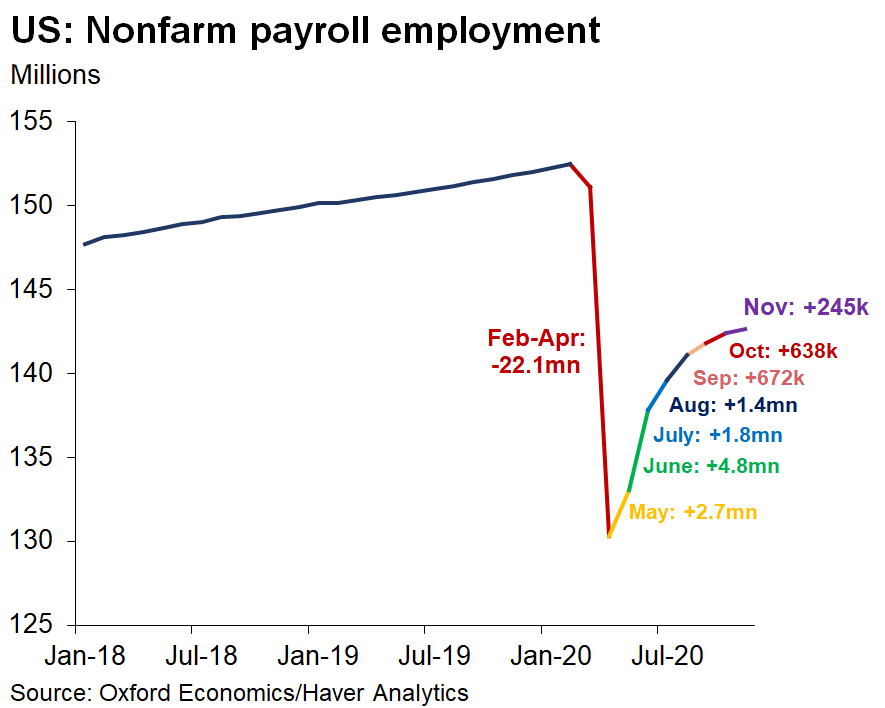

👎 Employment growth slowing (at best)

👎Labor supply issues

👍Outlooks remained positive

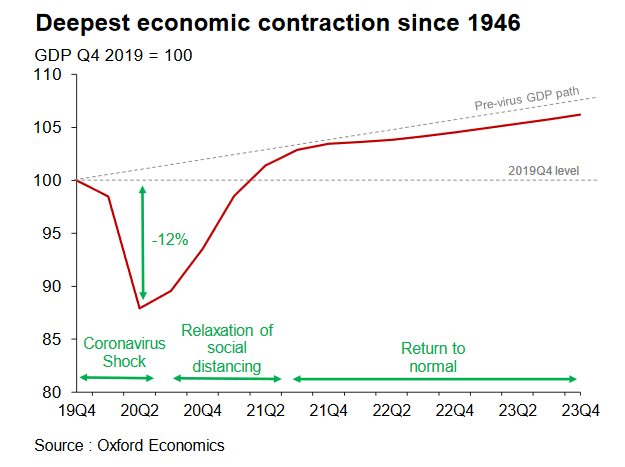

👎Optimism has waned

👎 Concerns: #Covid fear, lockdowns, fiscal policy cliffs

👍Modest inflation

👍Modest to moderate activity

👎Some regions slowing

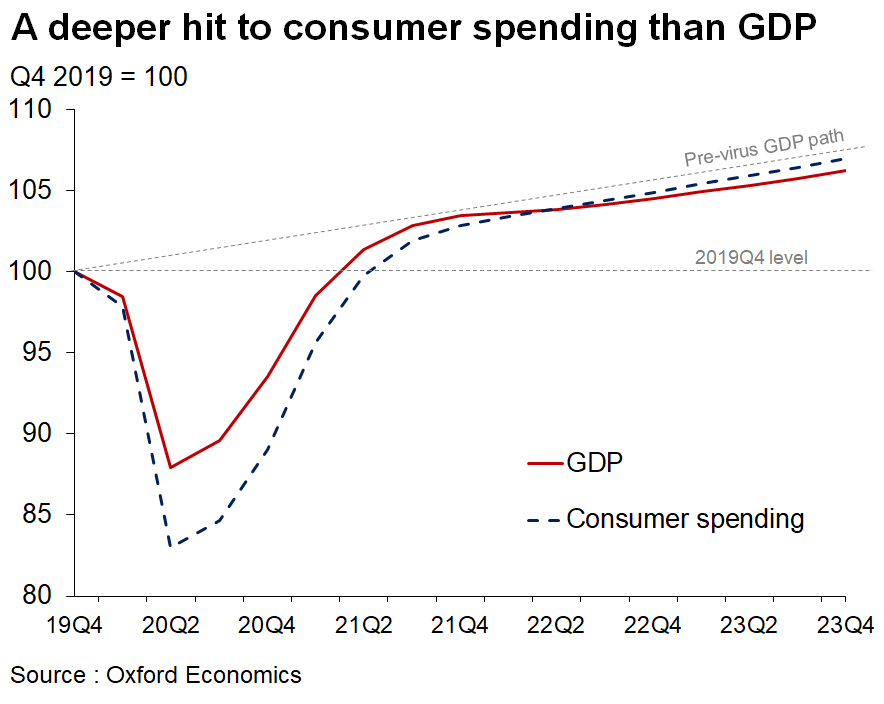

👎Recovery incomplete

👎 Employment growth slowing (at best)

👎Labor supply issues

👍Outlooks remained positive

👎Optimism has waned

👎 Concerns: #Covid fear, lockdowns, fiscal policy cliffs

👍Modest inflation

Initial signs of financial sector stress and expectations of rising delinquencies:

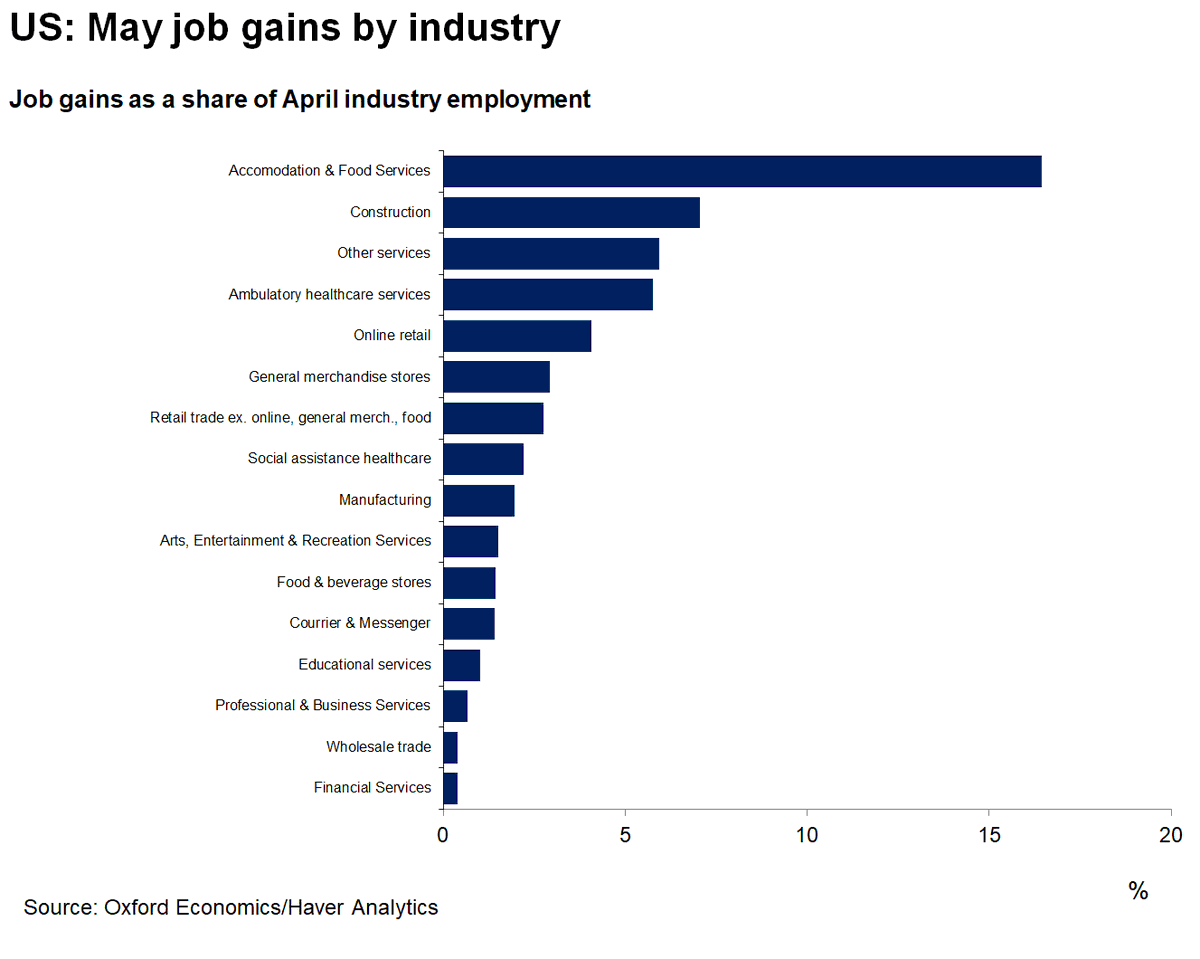

"...deterioration of loan portfolios, particularly for commercial lending into the retail and leisure and hospitality sectors. An increase in delinquencies in 2021 is more widely anticipated..."

"...deterioration of loan portfolios, particularly for commercial lending into the retail and leisure and hospitality sectors. An increase in delinquencies in 2021 is more widely anticipated..."

"...more school & plant closings, & renewed fears of

infection, which have further aggravated labor supply problems, including absenteeism & attrition

Providing for childcare & virtual schooling was widely cited as a significant & growing issue for the workforce, esp. for women"

infection, which have further aggravated labor supply problems, including absenteeism & attrition

Providing for childcare & virtual schooling was widely cited as a significant & growing issue for the workforce, esp. for women"

"In several Districts, firms feared that employment levels would **fall** over the winter before recovering further..."

https://twitter.com/GregDaco/status/1334133557795696640

• • •

Missing some Tweet in this thread? You can try to

force a refresh