Sunday #Pharma Brew!

Attended amazing session by @AdityaKhemka5 and have compiled key understandings and takeaways in a small thread!🧵

Thanks @AdityaKhemka5 sir for such insights!

Attended amazing session by @AdityaKhemka5 and have compiled key understandings and takeaways in a small thread!🧵

Thanks @AdityaKhemka5 sir for such insights!

1/ Pharma Industry

-Only sector where India has global competitive advantage, companies in this sector are one of the best in the world with ace qualities.

-Global pharma market is $1100 billion.

-#US market accounts for $500 billion (5% population covers 40-45% of total markt)

-Only sector where India has global competitive advantage, companies in this sector are one of the best in the world with ace qualities.

-Global pharma market is $1100 billion.

-#US market accounts for $500 billion (5% population covers 40-45% of total markt)

-#China is a $150 billion market (15% population covers 15% of total market)

-#India is only $20 billion compared to strong global pharma market (15% population covers only 2% of total market). This leaves a huge #growth.

-#India is only $20 billion compared to strong global pharma market (15% population covers only 2% of total market). This leaves a huge #growth.

2/ Indian Pharma

-Costs are cheaper here along with conducive costs policies coupled with govt schemes like PLI, etc.

-Under #AyushmanBharat 10-15 Cr families will be taken to 50-60 Crs.

-Market is growing at 8-10% in which organized market is gaining m'share at stronger pace.

-Costs are cheaper here along with conducive costs policies coupled with govt schemes like PLI, etc.

-Under #AyushmanBharat 10-15 Cr families will be taken to 50-60 Crs.

-Market is growing at 8-10% in which organized market is gaining m'share at stronger pace.

-85% of diagnostic market is unorganized & 80% of pharma market is unorganized.

-India is most unorganized (30-40%) is unorganized with 80% of patient population going to private segment.

-India is most unorganized (30-40%) is unorganized with 80% of patient population going to private segment.

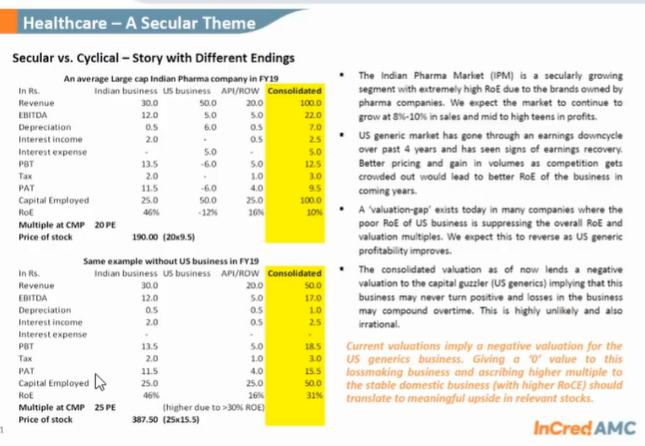

3/ How to Analyze?

-If we've 100cr sales, break them into US & India

-India is at 40% ebitda bcz it is a #branded generic mrkt

-Prescription here says brand name not drug/API.

-This is similar to FMCG, you own brand as well as price

-This is why India is able to charge premium.

-If we've 100cr sales, break them into US & India

-India is at 40% ebitda bcz it is a #branded generic mrkt

-Prescription here says brand name not drug/API.

-This is similar to FMCG, you own brand as well as price

-This is why India is able to charge premium.

-Indian biz contributes higher margin due to branded products preference.

-Indian business has strong cash inflows which earn huge interest income due to FMCG nature and operating leverage starts to kick in, Depreciation is also lower due to strong regulatory structure.

-Indian business has strong cash inflows which earn huge interest income due to FMCG nature and operating leverage starts to kick in, Depreciation is also lower due to strong regulatory structure.

-US, you are not allowed to brand the product.

-They all have to sell by API name, eg. paracetamol

-So if you are in America you will buy medicine of lowest price unlike India.

-M'share goes to lowest priced co.

-They all have to sell by API name, eg. paracetamol

-So if you are in America you will buy medicine of lowest price unlike India.

-M'share goes to lowest priced co.

-Doctor prescribes paracetomal not crocin/calpol etc.

-Pharmacy gives the option of the drug companies & patient chooses the lowest price which makes it the commodity market like Steel or Cement.

-That's why margins are lower.

-So in US key point is not brand, but pricing point.

-Pharmacy gives the option of the drug companies & patient chooses the lowest price which makes it the commodity market like Steel or Cement.

-That's why margins are lower.

-So in US key point is not brand, but pricing point.

-Now the company which operates in both countries, US biz losses are overcome by Indian biz.

-And if we anticipate (US loss*20 multiple), loss will increase loss every next year.

-Negative US commodity like Pharma biz should be valued at 0 and rate your valuation at Branded biz

-And if we anticipate (US loss*20 multiple), loss will increase loss every next year.

-Negative US commodity like Pharma biz should be valued at 0 and rate your valuation at Branded biz

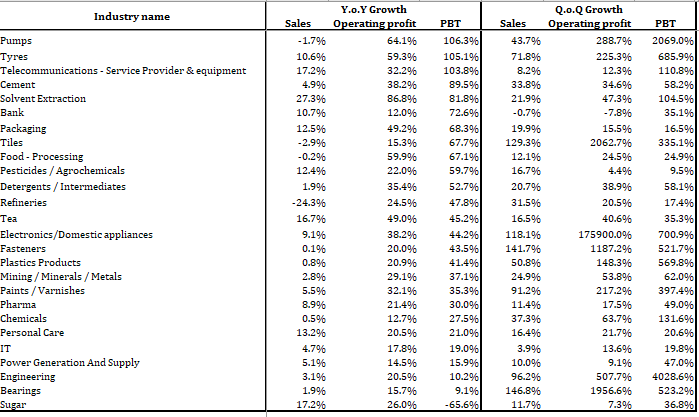

4/ Industry So Far

-In 2009-2015, US was able to take price up in commodity like biz, margins and multiples went up.

-In 2015-2016 when you make such returns, you invite competition. Prices, margins & multiples crashed. Losses from US.

-In 2009-2015, US was able to take price up in commodity like biz, margins and multiples went up.

-In 2015-2016 when you make such returns, you invite competition. Prices, margins & multiples crashed. Losses from US.

-US has drug shortages bcz no company wants to sell due to lowest prices. Supply went out.

-Many International companies have filed for bankruptcy due to negative ROE as they have high cost of production & low product pric.

-Now pricing taking up,better ROE since last 6 month

-Many International companies have filed for bankruptcy due to negative ROE as they have high cost of production & low product pric.

-Now pricing taking up,better ROE since last 6 month

-Large cash today comes from US

-Now biz are growing bcz US pharma losses have stopped coupled with growing Indian branded biz

-Now biz are growing bcz US pharma losses have stopped coupled with growing Indian branded biz

5/ Best Time to Invest?

-Best time is earnings and valuation at the bottom

-Second best time is valuation at average and earnings at the bottom

-ROE should improve from here on due to increase in prices due to supply shortage

-Best time is earnings and valuation at the bottom

-Second best time is valuation at average and earnings at the bottom

-ROE should improve from here on due to increase in prices due to supply shortage

6/ API Story

-API story is secular

-China exports 40 billion whereas India exports 4 billion.

-Not all API companies are good, check the factors and details about customers, finished products etc

-Story of API will take time, definitely a structural play.

-API story is secular

-China exports 40 billion whereas India exports 4 billion.

-Not all API companies are good, check the factors and details about customers, finished products etc

-Story of API will take time, definitely a structural play.

7/ Sustainable Valuations?

-High US commodity revenue generating business may not be sustainable.

-Give low multiple to US commodity business and high to low segment with high ROE

-High US commodity revenue generating business may not be sustainable.

-Give low multiple to US commodity business and high to low segment with high ROE

8/ USFDA

-USFDA creates problem mainly with Indian plants bcz people dont care about govt rules in general sense here so how would they be able to take serious measures in their Pharma plants.

-USFDA creates problem mainly with Indian plants bcz people dont care about govt rules in general sense here so how would they be able to take serious measures in their Pharma plants.

-Why small companies dont have problems with USFDA:

because small plants and easier setups have small scope for errors compared to large plants, more people etc

-Quality of drugs is phenomenal by Indian manufacturers at this cost.

because small plants and easier setups have small scope for errors compared to large plants, more people etc

-Quality of drugs is phenomenal by Indian manufacturers at this cost.

-Problem lies when Indian players use shortcuts to manufacture rather than following the process.

-Secular biz and Branded biz are same things.

-Secular biz and Branded biz are same things.

9/ Keeping a check

-Make friends with local pharmacies- which brands, why these brands, question your friends & families?

-Identify good brands & look at secular & commodity stories.

-Make friends with local pharmacies- which brands, why these brands, question your friends & families?

-Identify good brands & look at secular & commodity stories.

10/ What to look?

-In Indian biz look at companies which has strong branding & in commodity like US biz look at Cost competitive advantages.

-In Indian biz look at companies which has strong branding & in commodity like US biz look at Cost competitive advantages.

• • •

Missing some Tweet in this thread? You can try to

force a refresh