In case anyone is interested, a few slides from my Construction & Brexit update presentation this week...

#ukconstruction

#ukconstruction

Only 24% of construction products used in UK construction are imported but of those 61% come from the EU & it is not just about the imported products but also the imported materials & components used in UK manufactured construction products...

#ukconstruction

#ukconstruction

The key construction products that are likely to affected by a 'No Deal' would be products in which demand already exceeds supply due to the sharp recovery in housing new build & refurb after the first lockdown; timber, roofing products & white goods...

#ukconstruction

#ukconstruction

Firms are still not clear on what they need to prepare for. Many firms can't stockpile as demand for those products already exceeds supply & some won't stockpile after the stockpiling cost prior to the March & October 2019 deadlines & hit to margin afterwards...

#ukconstruction

#ukconstruction

If there were to be 'No Deal', tariffs on construction products are low (0%-10%) but additional financial/admin costs & Sterling depreciations that would accompany a 'No Deal', raising import costs, may lead to cost rises of 20% or more on some products overall...

#ukconstruction

#ukconstruction

Delays are likely to be greatest at ports with the most lorry traffic (goods & drivers being checked) on the South coast. Most construction products come in to ports on the East coast but there are already delays at many ports due to Covid-19-related issues...

#ukconstruction

#ukconstruction

... & even with a Free Trade Agreement with the EU, admin/certifications are likely to exacerbate current port delays particularly for construction products in which there is currently excess demand...

#ukconstruction

#ukconstruction

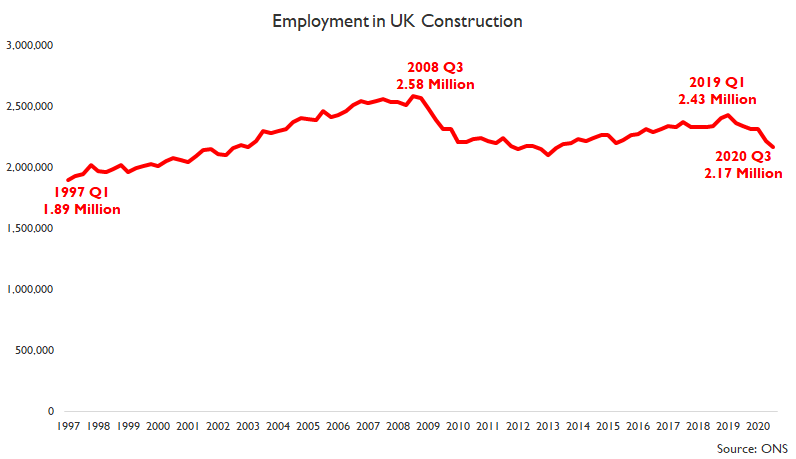

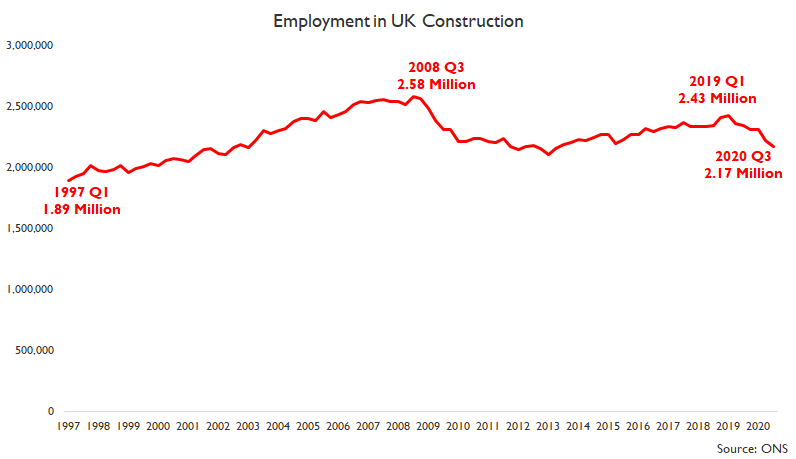

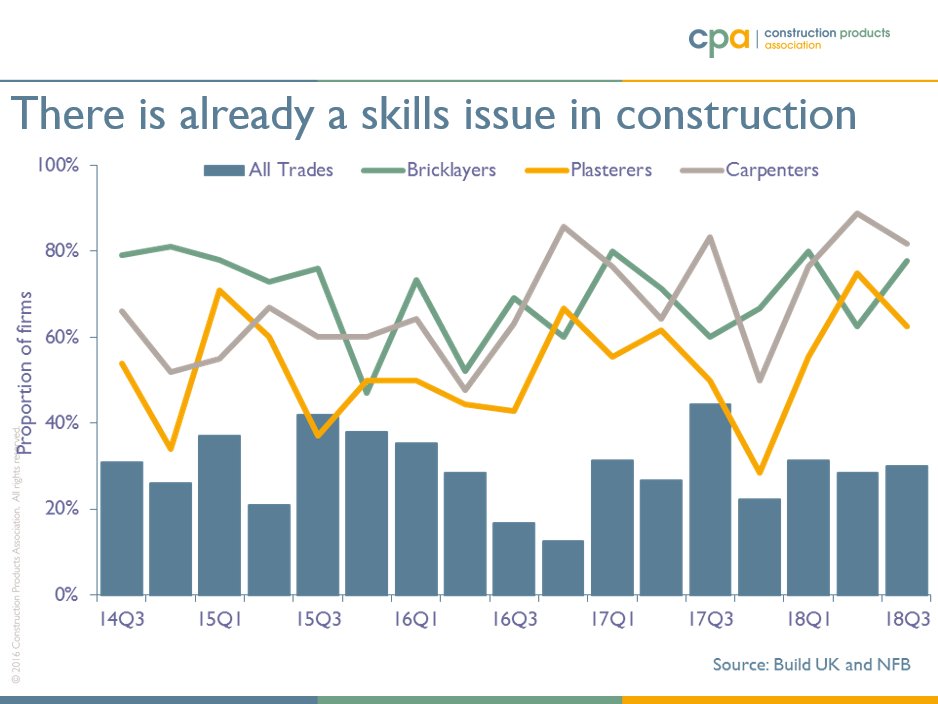

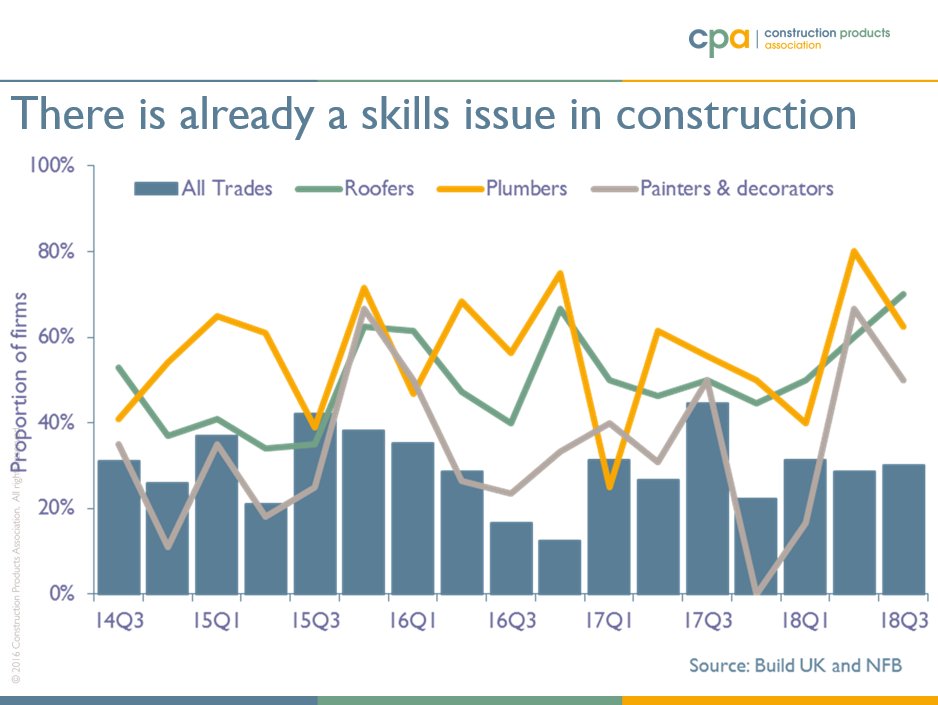

It is also worth highlighting construction labour issues. The number of EU-born construction workers in London fell by 54% between 2018 Q2 & 2020 Q3. After 31 December, the UK has an employer-sponsored points-based immigration system...

#ukconstruction

#ukconstruction

... which does not lend itself to construction given that 41% of UK construction workers are self-employed & 86% of UK construction employment is in small & medium-size firms plus many trades do not meet the skills & wage requirements...

#ukconstruction

#ukconstruction

... so if construction activity in London recovers next year then it may attract construction workers from other parts of the UK, although that leads to further cost inflation, but it would also lead to construction labour issues outside the capital.

#ukconstruction

#ukconstruction

• • •

Missing some Tweet in this thread? You can try to

force a refresh