(Another) thread about $XRP, #Ripple & why what they did was so despicable. It's not about them getting a fee & walking free, nor about whether the token will go up or down in value. It's about people understanding what this organization did to them. #crypto #bitcoin #XRP

1 - #Ripple sold something to the public that the public could not get information about. There are regulations that ensure that investors can understand what is happening with their funds and what they are investing in.

2 – Due to the information vacuum, people who bought $XRP could not know for sure what insiders do with their holdings. There was no way to see that the only thing they did was sell.

3 - #Ripple distributed the entire 100bn $XRP to themselves and their founders. They then set out to build a market for it by generating hype around a use that was never likely to happen, nor were the people being sold to those that could use it according to the original usecase.

4 – As #XRP has absolutely no use, #Ripple did not get any revenues, so instead they dumped more onto retail investors not sufficiently educated who were drawn into the hype of “#bitcoin for banks”.

5 – But not only did #Ripple the company keep selling $XRP, so did the two main figureheads. The insiders dumped alongside the company, clearly showing they knew there was no value to their holdings.

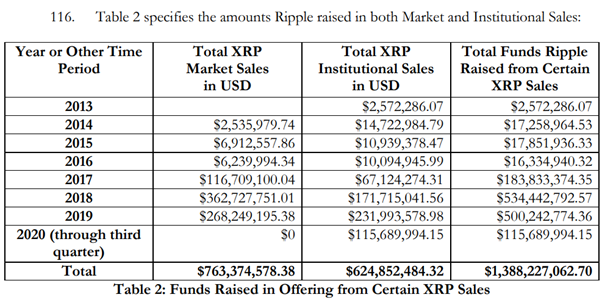

6 – This was no small operation so far and may well continue. #Ripple and its cronies have sild a total of c. $1.4bn of $XRP to investors that were due a lot more information than they received. The below is ASIDE from the #XRP dumped by insiders.

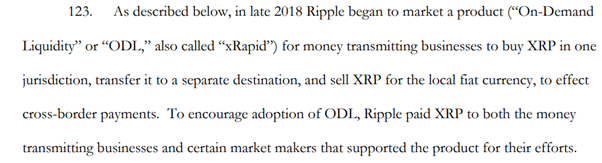

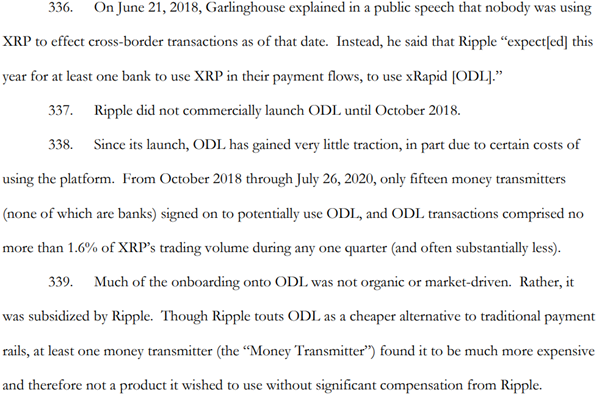

7 – As it dawned on #Ripple that their token is entirely useless for banks to actually do anything with it (and SWIFT is faster and cheaper, by the way), they decided to manufacture another use which I have seen fool many on CT into defending them.

8 – I note doing this as late as 2018, while having already dumped $700m onto followers is quite telling,but it is even more telling that #Ripple had to either pay off the users to use the service or coerce them into it by buying a stake in their equity (financed with #XRP sales)

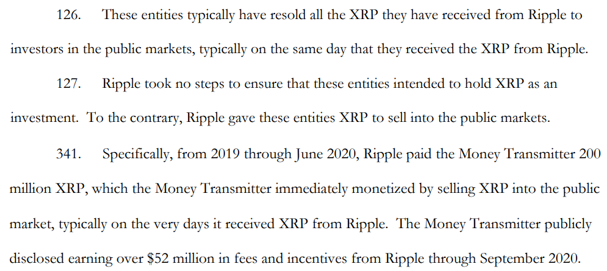

9 – The failure of any kind of usecase that comes from the token’s utility is so apparent, it is breathtaking anyone would still defend their actions. The only users of this service were paid off OR #Ripple took a stake in them to “encourage” them to use their platform

10 – As I said at the beginning, this isn’t about whether $XRP is a security or what kind of a fine #Ripple will get, nor about whether the price will go up or down. This is a summary to illustrate the behaviour of #Ripple the company and its executives.

11 – It is to show to CT (again), this company has nothing in common with values in #crypto & they are running a centralized scheme with one purpose: enrich themselves. Don’t support them. Ideally, don’t buy #XRP, but if you have to, don’t pretend this isn’t what is going on.

12 – TL,DR: #Ripple & its executives have sold $XRP to people they purposefully misinformed and the US SEC is making exactly that case. #XRP has no use that isn’t paid for by Ripple. They do not deserve your support.

END – NONE of this is advice. Almost all is taken directly from the SEC’s suit (liked below), so all this is "alleged". I can be wrong and I can make mistakes. I may even misinterpret facts. This is just my personal opinion and absolutely nothing more. sec.gov/litigation/com…

• • •

Missing some Tweet in this thread? You can try to

force a refresh