OFAC settlement w/@BitGo for apparently failing to prevent users accessing their online hot-wallet service via Crimea, Cuba, Iran, Sudan, & Syria IP addresses; service appears to be a non -custodial online wallet. Violaton of OFAC regs, NOT BSA . Let's look at the regs: /1

31 CFR 515.201, (i.e. Cuban Assets Control Regulations) prohibits transactions by foreign countries and their nationals including "...transfers, withdrawals, or exportations of, any property," /2

31 CFR 560.204 regarding Iran (defined as the Territority of Iran) also prohibits "exportation, reexportation, sale, or supply, ....from the United States....of any goods, technology, or services to Iran or the Government of Iran" /3

31 C.F.R. §538.205- Sudanese Sanctions prohibits exportation of goods or services to Sudan without a license or other authorization

Syrian Sanctions Regulations, 31 C.F.R. §542.207 prohibit exportation sale or supply of services to Syria.

Syrian Sanctions Regulations, 31 C.F.R. §542.207 likewise prohibits "exportation, reexportation, sale, or supply, directly or indirectly, from the United States, or by a United States person, wherever located, of any services to Syria."

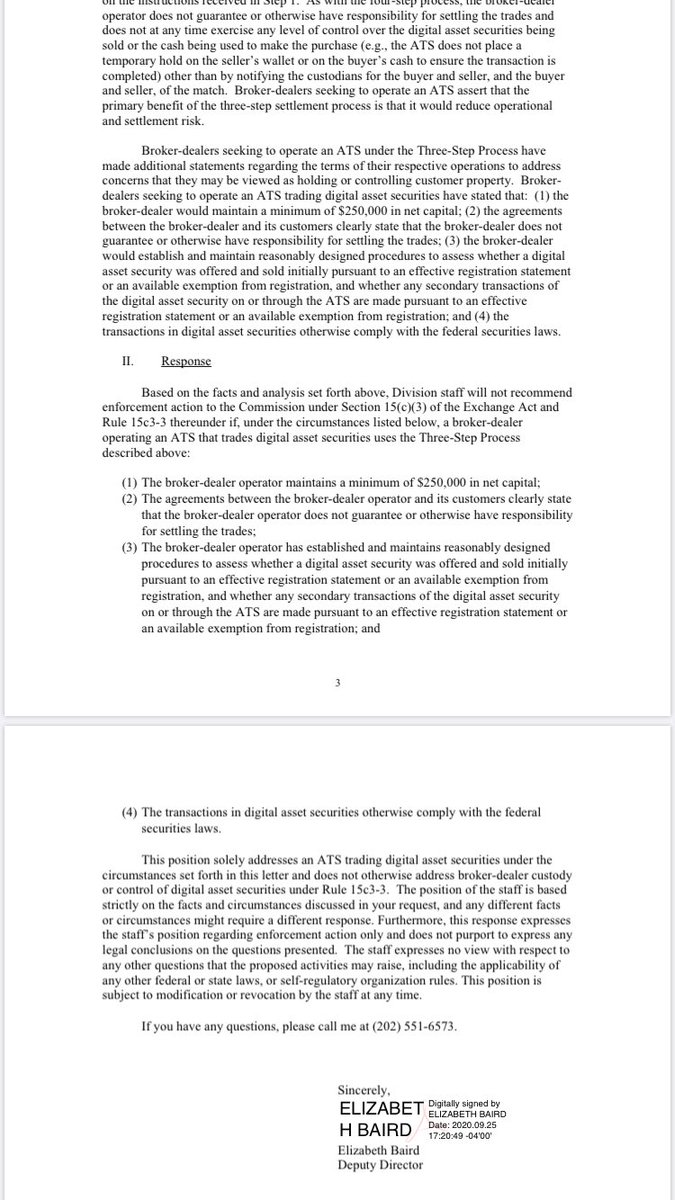

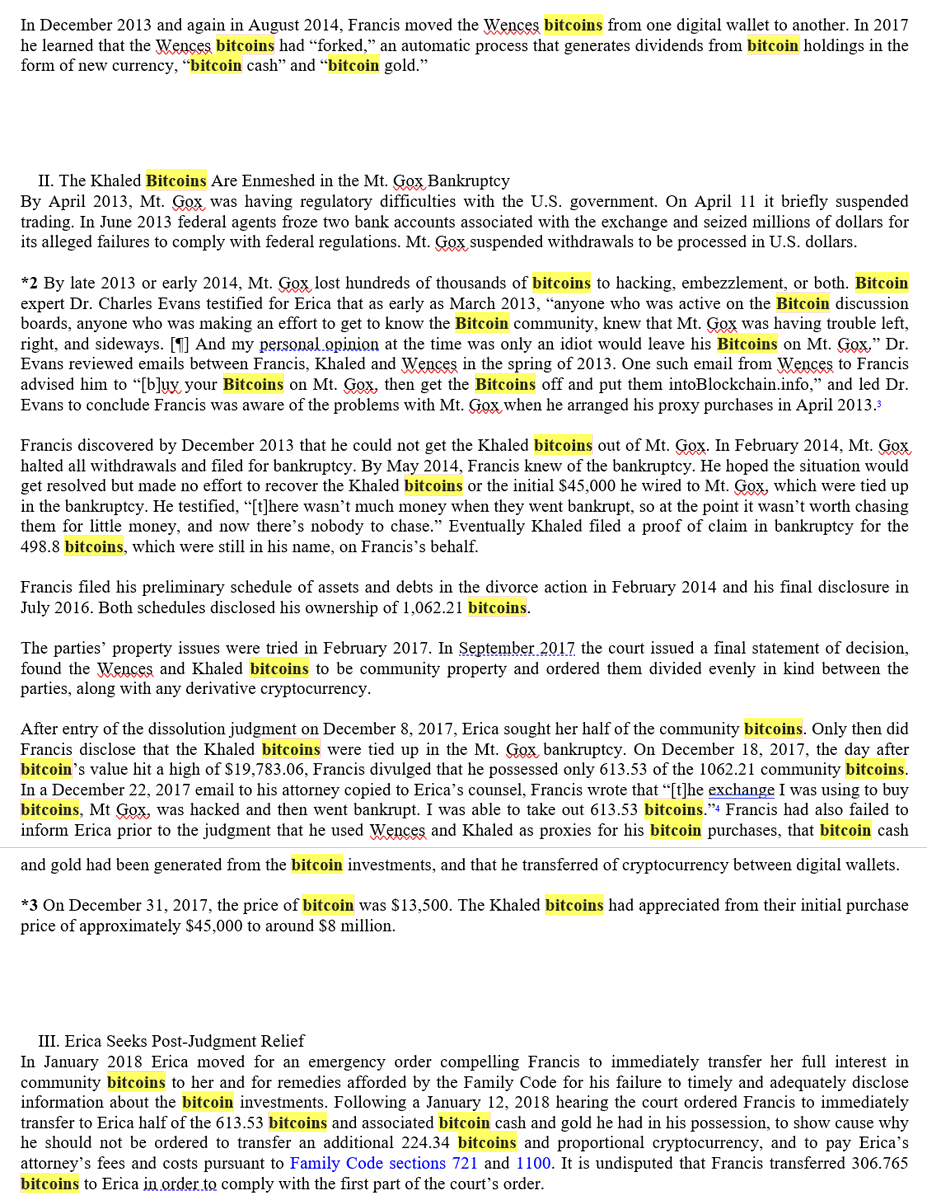

Taken together, these statutes tell us a few things. First, custodial or otherwise, if you're "directly or indirectly" participating in these transfers providing goods or services, you're in the trouble. Same issue discussed here, in 2017 coindesk.com/coinbases-cuba…

as pointed out by my friend (formerly of Treasury) @stmdc OFAC violations are strict liability- if you don't speak legal, that means if you commit the act that violates the law or regulation, that's it. Intent doesn't matter.

finally, as a regulated entity, you are expected to have proper practices and compliance in place to screen, and to self disclose violations. The enforcement against Bitgo noted that their practices were deficient and they did not self disclose violations.

Finally, & perhaps of most interest to the #crypto #bitcoin and #blockchain crowd, #custody isnt the point. The statutes at issue are very broad and include providing services transfers of "property" incl. indirect transactions. Service providers should pay close attention.

many will say "what do we do?" The first thing to do is ask your compliance officer. If you don't have one, go get one and ask her or him. Also, look at the last 2 pages of the enforcement release (lots of helpful info!) & at this document: home.treasury.gov/system/files/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh