@winstonlaw |AdjunctProfessor @NYUStern / @NYUlaw /@fsulaw |No legal/financial advice |#crypto |#Miami |#Phish | all views are my views | all errors are mine.

2 subscribers

How to get URL link on X (Twitter) App

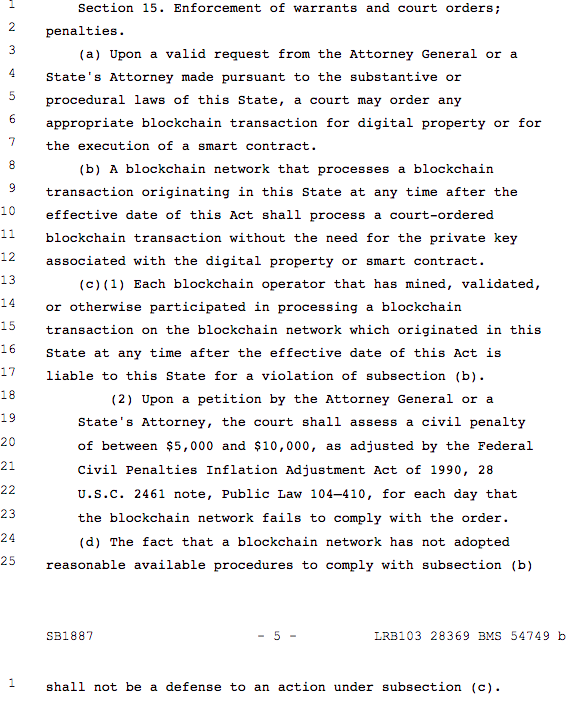

https://twitter.com/MikeSeligEsq/status/1902783703807668695including the creation of legal securities without law. Huh? Yep. Sound the alarm. Batten the hatches. It’s time for a thread /2

https://twitter.com/laurabrooksie1/status/1803238438772076809The letter indicates 2 things. 1. that the investigation captioned "In the Matter of Ethereum 2.0 (C-08950)" is "concluded," and that 2. the SEC "do[es] not intend to recommend an enforcement action [against Consensys] with respect to this investigation" These are both great /2

First, establish an government wide-policy. What do we want? Are we pro -innovation? Do want to protecting consumers? Do we want to strike a balance in the middle?Do we want to facilitate experimentation? How much control will the govt take over these experiments? /2

First, establish an government wide-policy. What do we want? Are we pro -innovation? Do want to protecting consumers? Do we want to strike a balance in the middle?Do we want to facilitate experimentation? How much control will the govt take over these experiments? /2

31 CFR 515.201, (i.e. Cuban Assets Control Regulations) prohibits transactions by foreign countries and their nationals including "...transfers, withdrawals, or exportations of, any property," /2

31 CFR 515.201, (i.e. Cuban Assets Control Regulations) prohibits transactions by foreign countries and their nationals including "...transfers, withdrawals, or exportations of, any property," /2

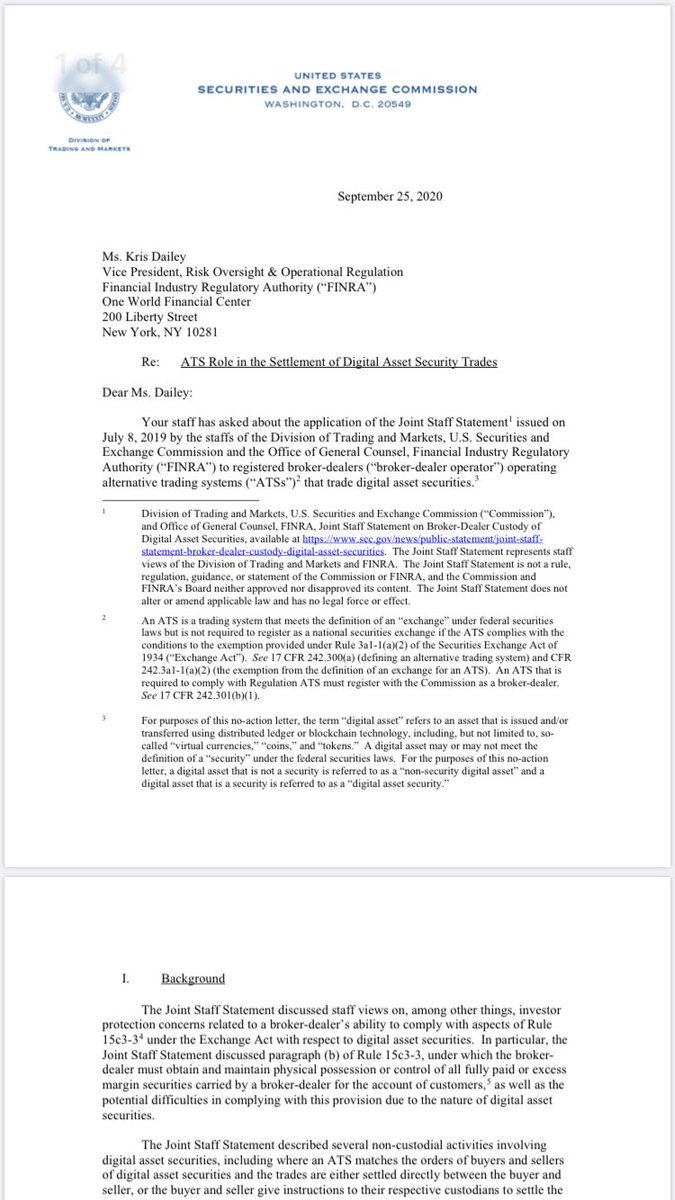

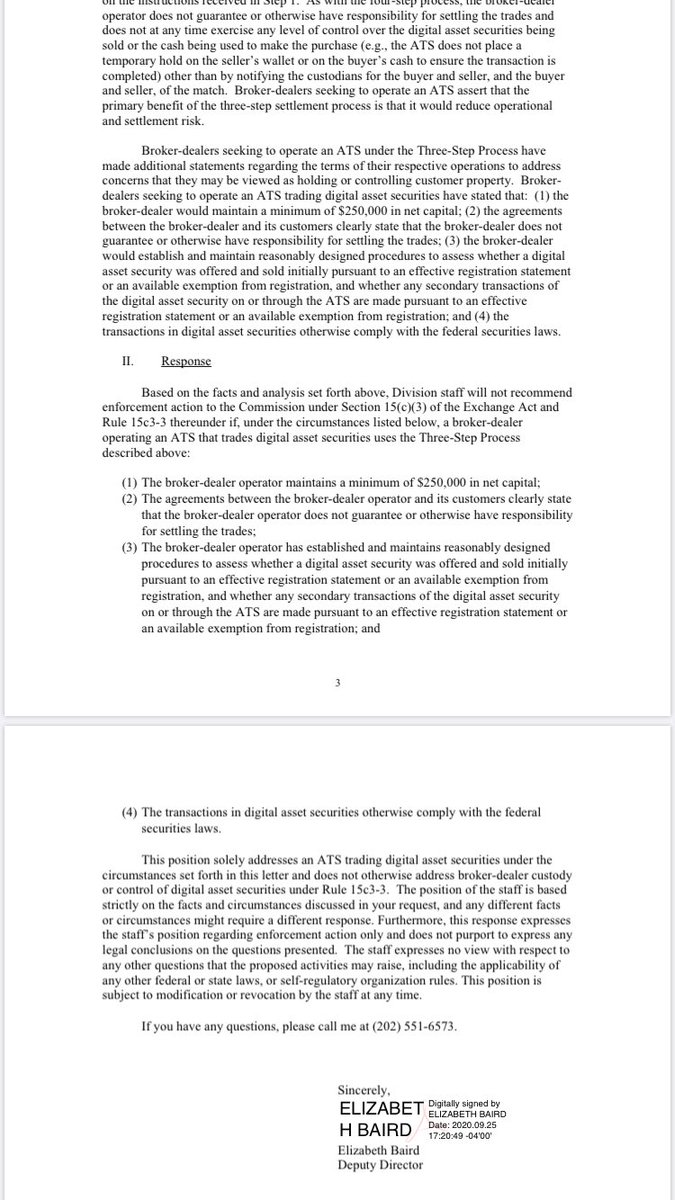

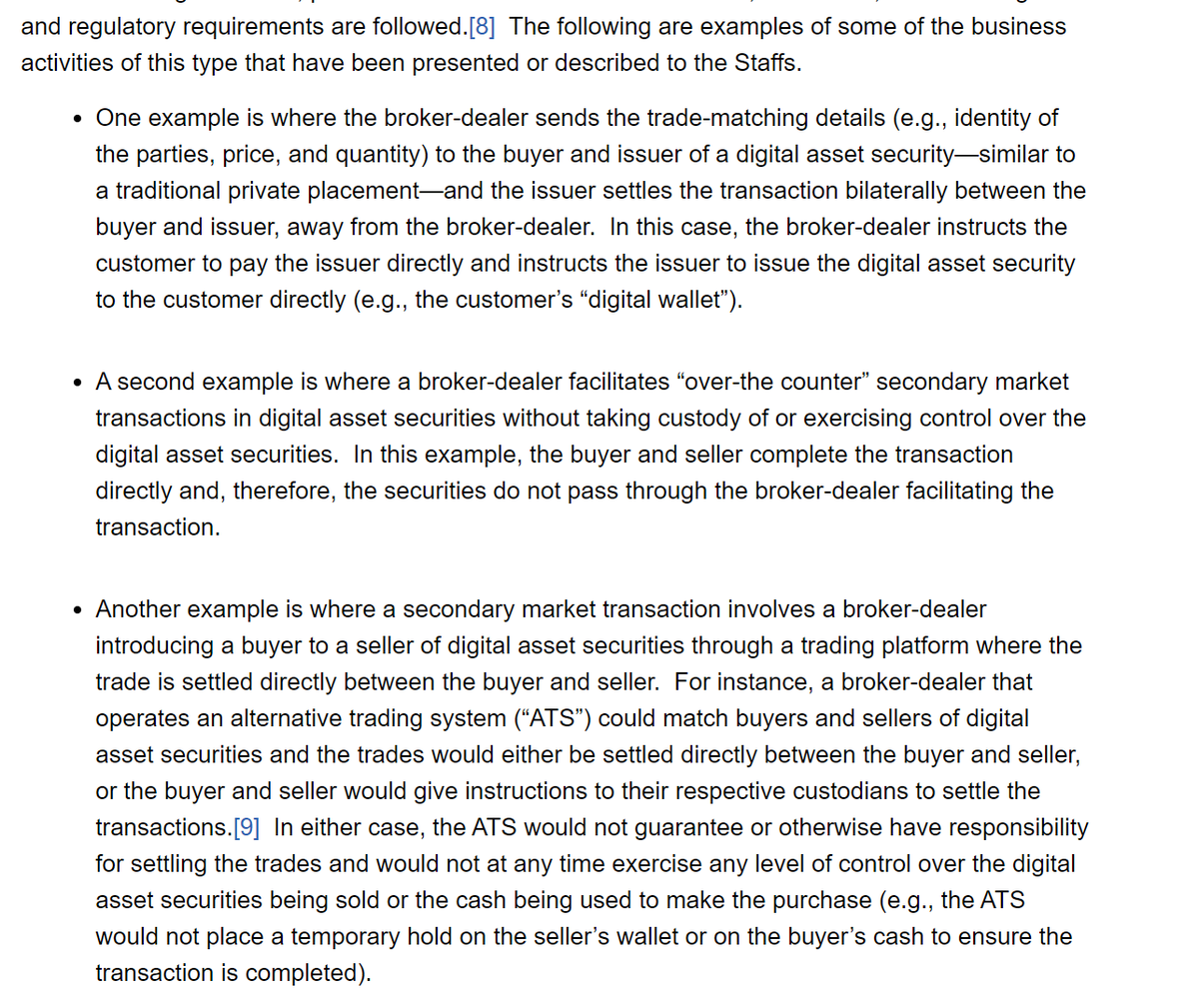

/1 since the Joint Staff Statement (July 8, 2019) which addressed BD custody & handling of trades of digital asset securities (sec.gov/news/public-st…) which emphasized consumer protection, it has not been clear how transactions on ATS should be conducted:

/1 since the Joint Staff Statement (July 8, 2019) which addressed BD custody & handling of trades of digital asset securities (sec.gov/news/public-st…) which emphasized consumer protection, it has not been clear how transactions on ATS should be conducted:

https://twitter.com/masonic_tweets/status/1309166410573197312Short answer- everyone. #Developers #investors & #lawyers all need to understand #blockchain & #smartcontract governance to understand what it means to build on top of others' tech. Can you patent new art built on a blockchain? Will your software work if the underlying chain /2

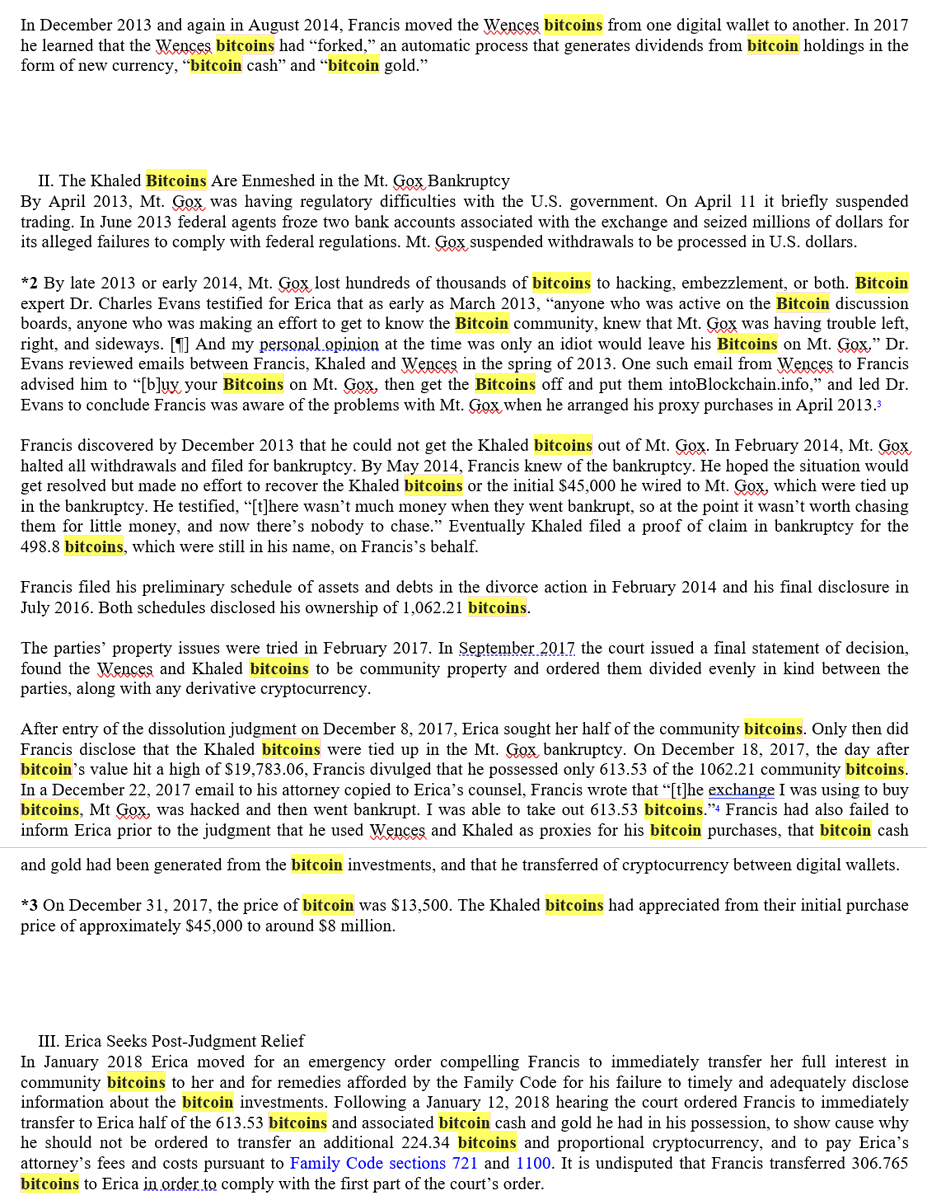

Here, the divorcing spouse had some #bitcoin tied up in #MtGox and some held on private wallets. One spouse did not disclose the holdings until after the divorce, and the other spouse immediately sought an award of 1/2 and attorney's fees. Court agreed, noting that divorcing /2

Here, the divorcing spouse had some #bitcoin tied up in #MtGox and some held on private wallets. One spouse did not disclose the holdings until after the divorce, and the other spouse immediately sought an award of 1/2 and attorney's fees. Court agreed, noting that divorcing /2

Court ruled that there was no agreement to give Plaintiff #Bitcoingold; there was no "contractual obligation to support or provide services for any particular cryptocurrency." Merger clause barred parol evidence & there was no contractual duty. That's breach of contract /2

Court ruled that there was no agreement to give Plaintiff #Bitcoingold; there was no "contractual obligation to support or provide services for any particular cryptocurrency." Merger clause barred parol evidence & there was no contractual duty. That's breach of contract /2