Excellent TD #Uranium presentation by Grant Isaac of Cameco $CCO $CCJ today (replay coming). Here are some points:

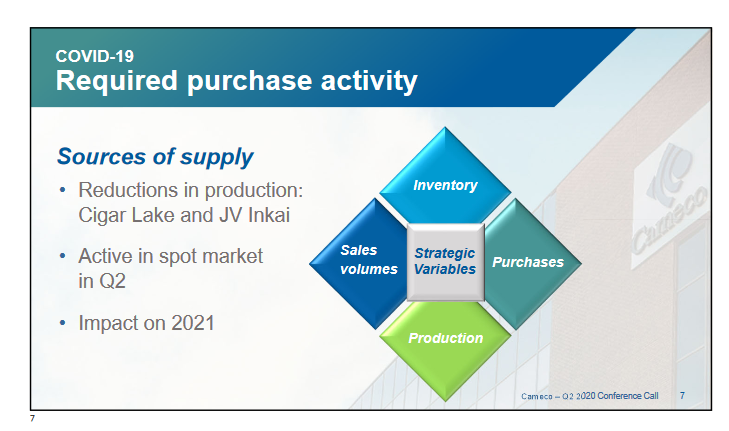

- Cigar remains down, no restart date yet or estimate on rate of production recovery after it restarts

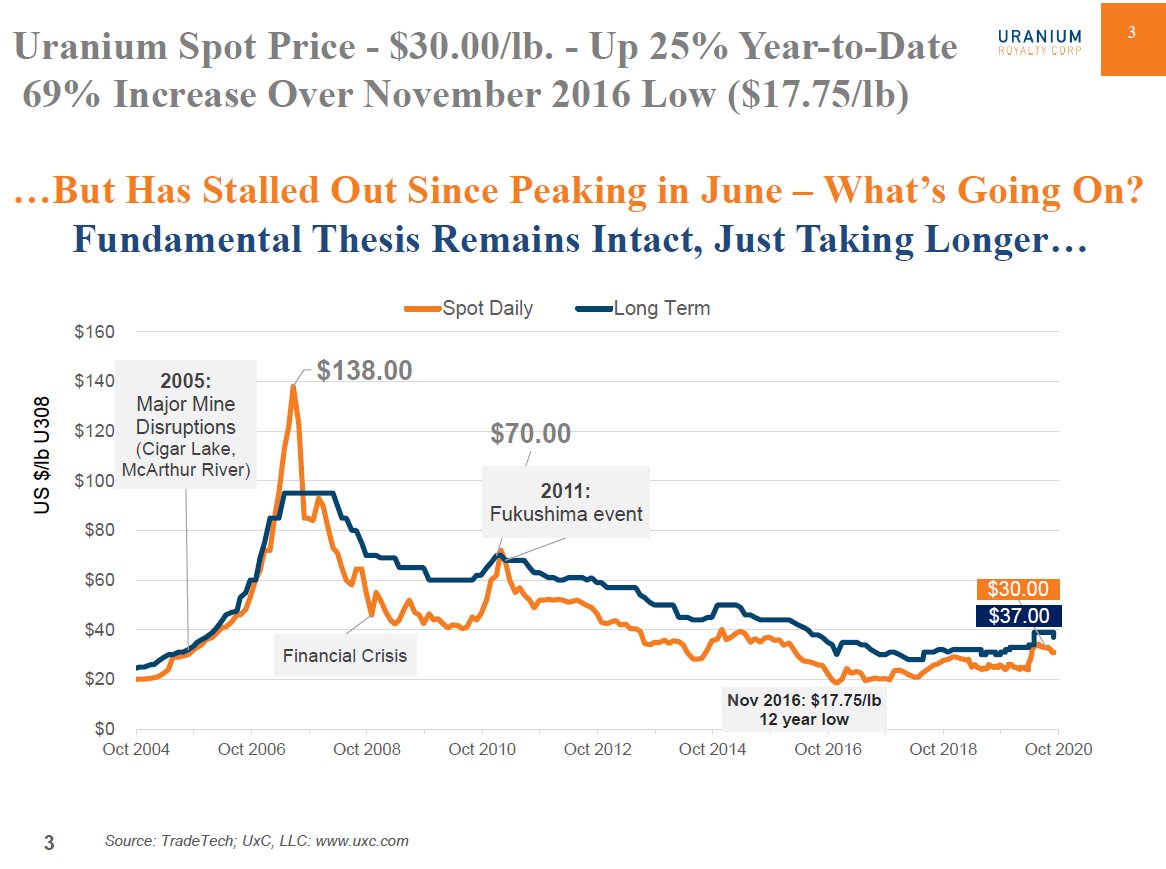

- SWU/Conversion robust⤴️ & expect U price to follow↗️

.../2

- Cigar remains down, no restart date yet or estimate on rate of production recovery after it restarts

- SWU/Conversion robust⤴️ & expect U price to follow↗️

.../2

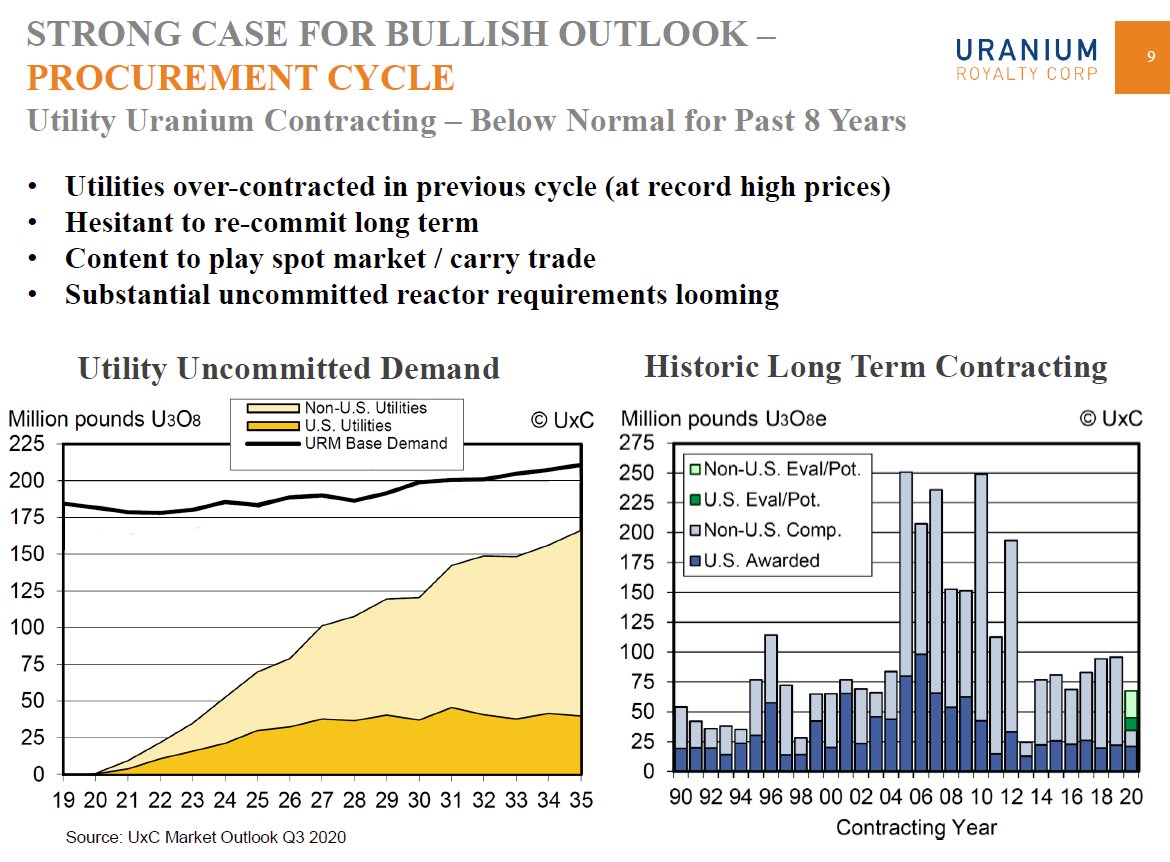

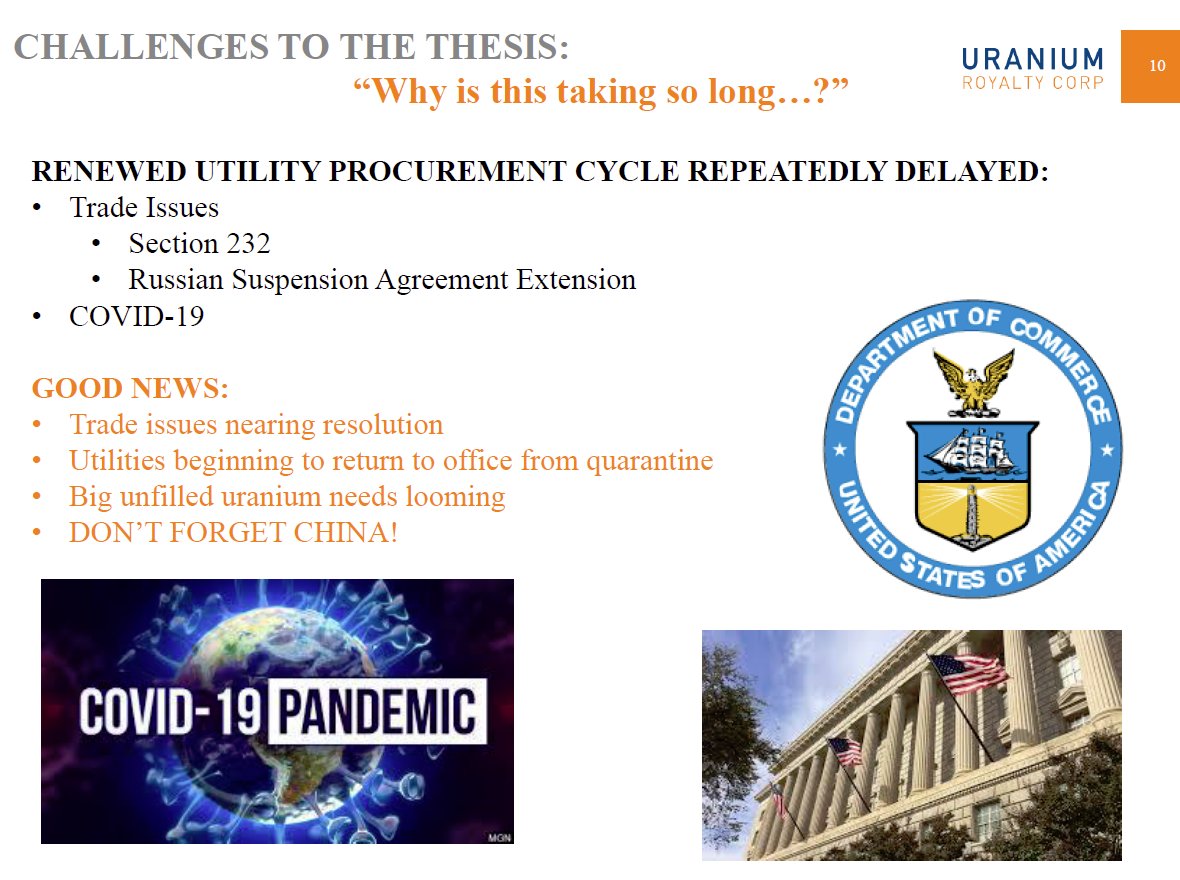

2/ - On-market term contracting not there yet but Off-market pipeline is back to pre-Fukushima levels

- Substantial uncovered demand with #nuclear utilities so far purchasing just 20% of needs. Delayed contracting will lead to more rapid price rise when contracting heats up

.../3

- Substantial uncovered demand with #nuclear utilities so far purchasing just 20% of needs. Delayed contracting will lead to more rapid price rise when contracting heats up

.../3

3/ - Cameco is not looking to increase their contracting beyond current 20M lbs/yr over next 5 years as that would force them to buy more Spot market material = Strategic patience

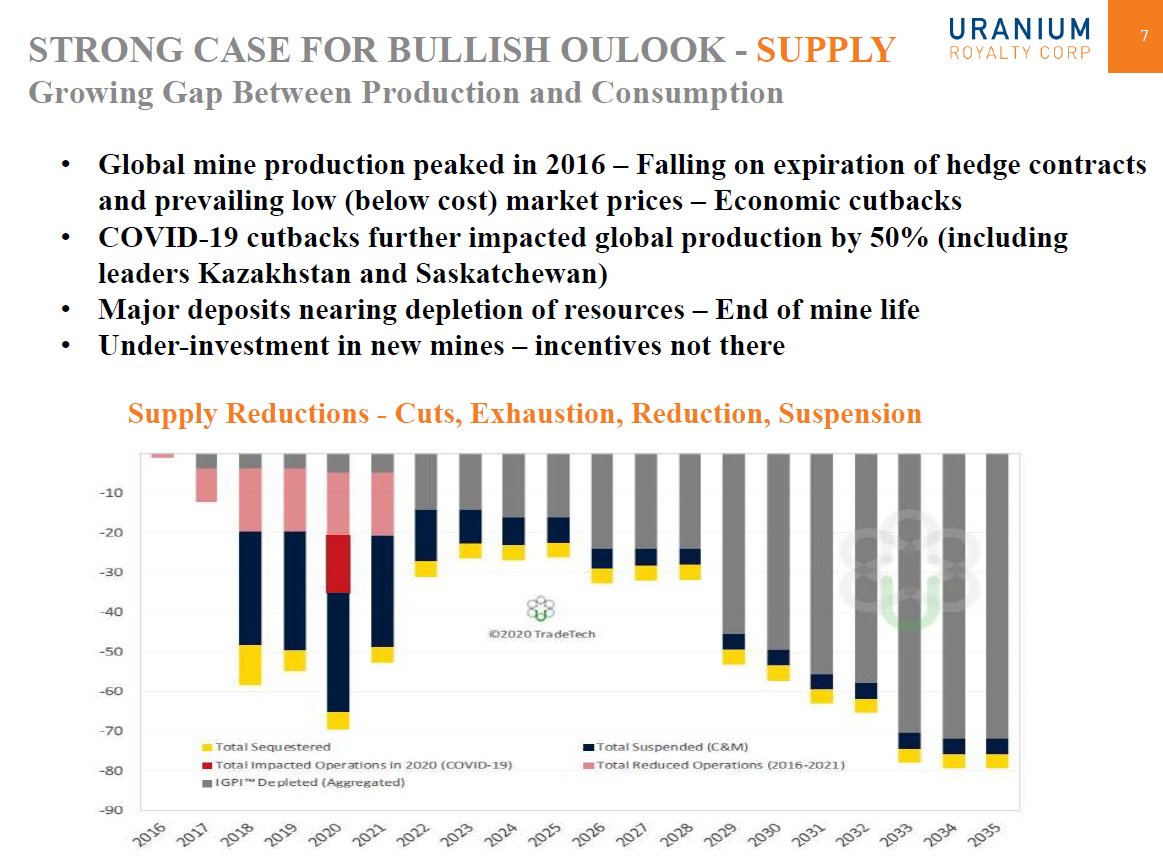

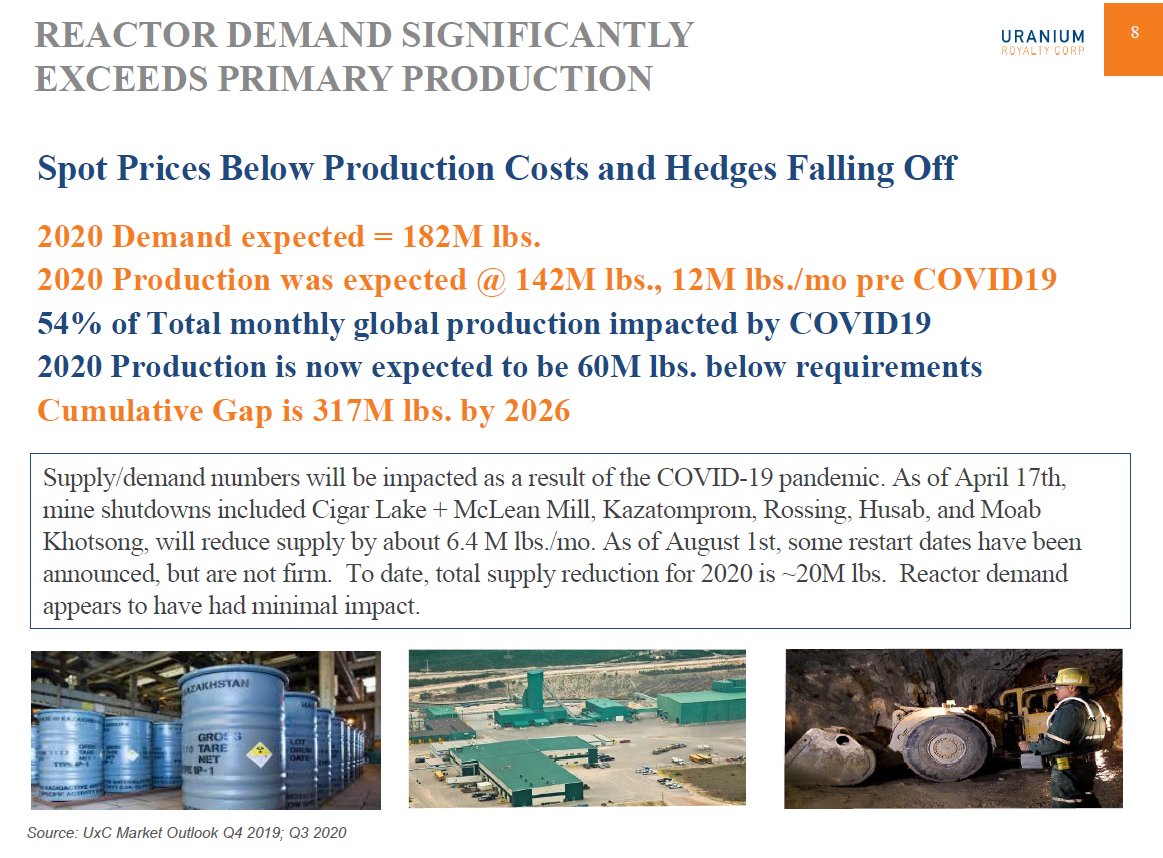

- 2020 global production down to 120M lbs & 2021 supply risk (COVID) greater than demand risk

.../4

- 2020 global production down to 120M lbs & 2021 supply risk (COVID) greater than demand risk

.../4

4/ - Primary mined #Uranium supply in deficit & expected to recover to 150M lbs/yr by 2026, still below demand

- Secondary supply has fallen from 70M lbs/yr down to 30M lbs/yr & expected to continue to fall to 20M lbs/yr. Underfeeding falling as enrichment contracting rises

.../5

- Secondary supply has fallen from 70M lbs/yr down to 30M lbs/yr & expected to continue to fall to 20M lbs/yr. Underfeeding falling as enrichment contracting rises

.../5

5/ - Enrichers are primarily selling underfeeding supply into term contracts, and appears they've over-contracted that secondary supply, not able to fulfill those contracts. Spot volume from underfeeding down to 5-7M lbs/yr.

- #Uranium inventories are low across the board

.../6

- #Uranium inventories are low across the board

.../6

6/ - When will utilities return & #uranium prices rise? Historically its shock driven. Utilities not seeing need to panic yet based on RFP's in the market. Delay is piling up future contracting demand which will lead to a much steeper rise in U prices when contracting begins.⤴️

• • •

Missing some Tweet in this thread? You can try to

force a refresh