In 5-15 years at the end of the economic cycle, when $SPY $DIA $QQQ $VTI $VOO is 2-4x higher than it is today, will you even remember all of the people calling this a bubble?

My Oct chart shows the 8 year resistance that I said could become a floor if Dems won... it has. #stocks

My Oct chart shows the 8 year resistance that I said could become a floor if Dems won... it has. #stocks

I also see people calling for a bubble in $EEM $VWO #emergingmarkets.

Emerging markets just broke out.

THEY 👏

JUST 👏

BROKE 👏

OUT 👏

OF 👏

A 👏

14 YEAR 👏

BASE 👏

Emerging markets just broke out.

THEY 👏

JUST 👏

BROKE 👏

OUT 👏

OF 👏

A 👏

14 YEAR 👏

BASE 👏

You're not in a #bubble if #stocks are just starting to break out, or haven't even done so yet.

Are some stocks too expensive? Yeah.

Are you in a global #stockmarket bubble? NO

Find the right places to be.

#StocksToWatch

Are some stocks too expensive? Yeah.

Are you in a global #stockmarket bubble? NO

Find the right places to be.

#StocksToWatch

https://twitter.com/allstarcharts/status/1360258491894661123?s=19

The $VIX just finished the week at it's lowest level since Nov. Both readings under 20 are lowest it's been since before pandemic. The bull market is receiving final confirmation signals as we develop into a slow ride higher.

Teach the bears how to read charts, or ignore them.

Teach the bears how to read charts, or ignore them.

Until the charts from my first tweet breakdown, you should treat everyone calling this a bubble as someone to be ignored, poor at technical analysis, and poor at fundamental analysis.

$SPY $QQQ $VOO $VTI #StocksToWatch #StockMarket

$SPY $QQQ $VOO $VTI #StocksToWatch #StockMarket

https://twitter.com/RyanDetrick/status/1360293683669647363?s=19

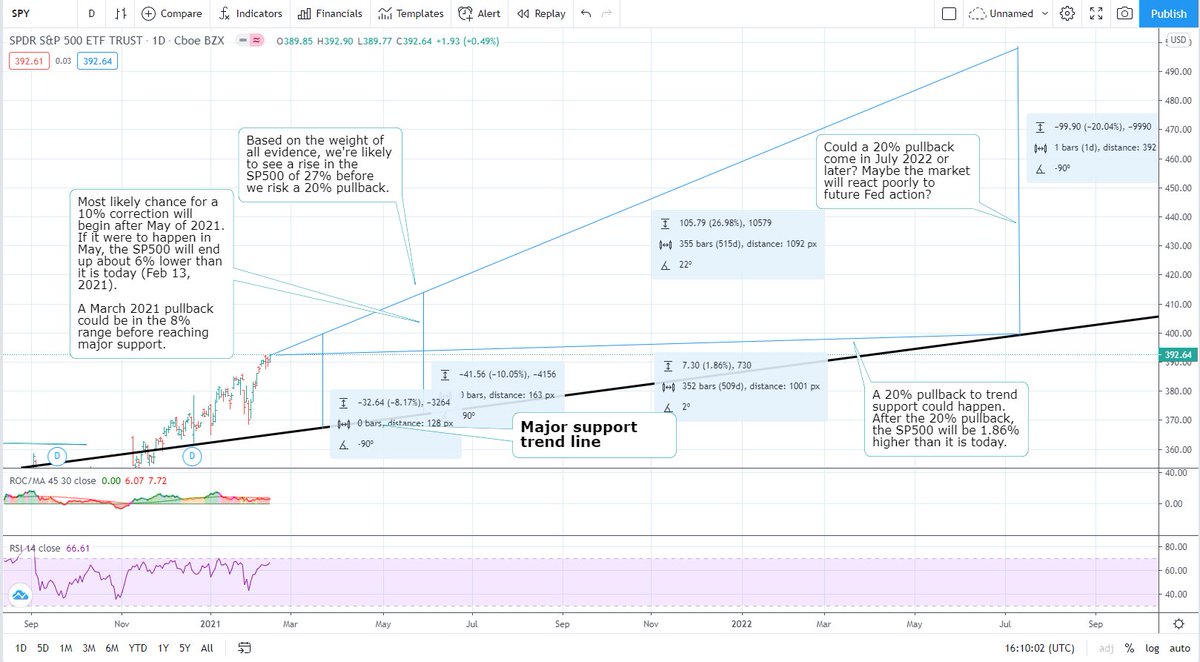

I just read a post from someone waiting to buy #stocks when the #stockmarket has a 20% correction. He's likely to be waiting a very long time for his opportunity. The major $SPY support from my first post is 7% lower from here. If we break that, then we reassess.

Major support from my first tweet:

March '21 pullback in #stocks could reach 8%

May '21 $SPY pullback could reach 10%

A 20% correction is unlikely until July 2022 or later, after correction the #stockmarket will be 2% higher than it is today.

Reassess if support is breached.

March '21 pullback in #stocks could reach 8%

May '21 $SPY pullback could reach 10%

A 20% correction is unlikely until July 2022 or later, after correction the #stockmarket will be 2% higher than it is today.

Reassess if support is breached.

This isn't financial advice, I'm unlicensed, and I don't charge for advice. But what is my history on calling the market?

In August of 19 I said the 2/10 curve would invert and it would be the nail in the coffin, for an upcoming recession. That happened.

In August of 19 I said the 2/10 curve would invert and it would be the nail in the coffin, for an upcoming recession. That happened.

https://twitter.com/rationalsquad/status/1161484200765198336

In Dec of '19, just before the fastest drop in #stockmarket history I noted that a recession was coming. I didn't need to know about #coronavirus. The recession was coming either way.

As my text to friend shows, I called a fast run to the end.

IT HAPPENED

As my text to friend shows, I called a fast run to the end.

IT HAPPENED

https://twitter.com/rationalsquad/status/1207491993829548037?s=20

Jan 13 of 2020, one month before a 35%+ correction, I called the #stockmarket an "irrational meltup" when Trump, Powell, and most, were talking about how great the economy was.

I've got heavily invested throughout 2020. Today, I'm even more bullish.

I've got heavily invested throughout 2020. Today, I'm even more bullish.

https://twitter.com/rationalsquad/status/1216816733631152139?s=20

When the #stockmarket was down 10% in Feb 2020, I told you I was looking to buy the dip 25-50% lower. I did that.

Now I'm saying that the #BullMarket is established: stocks might look expensive, massive liquidity will keep them high. $SPY $QQQ $EEM $VWO

Now I'm saying that the #BullMarket is established: stocks might look expensive, massive liquidity will keep them high. $SPY $QQQ $EEM $VWO

https://twitter.com/rationalsquad/status/1275777615450824705?s=20

I manage several portfolios with a lower risk tolerance, here's some funds I invest in where I like the risk/reward:

American: $VFH $VBR $VOE $VFQY

International: $VSGX

Emerging markets: $LDEM $EWY $FRDM $VWO

Alternatives: $CMDY $DBA $RINF

Bonds: $EMLC $VTIP

#StocksToBuy

American: $VFH $VBR $VOE $VFQY

International: $VSGX

Emerging markets: $LDEM $EWY $FRDM $VWO

Alternatives: $CMDY $DBA $RINF

Bonds: $EMLC $VTIP

#StocksToBuy

I manage a #climatechange fund and frequently post my assessment of various #climatecrisis stocks. I put an emphasis on established growth, trading at a value.

Here's my most recent update of the top #renewable stocks to own.

Disclosure: I own them.

Here's my most recent update of the top #renewable stocks to own.

Disclosure: I own them.

https://twitter.com/rationalsquad/status/1360263212260872195?s=20

I forgot to mention, I also like $VPL. Japan is 58% of VPL and #Japan hasn't even fully broken out of a 30 year base.

17% is Australia which is just breaking out of a 14 year base.

These are affordable companies, in a bull market, with a falling #USD tailwind.

17% is Australia which is just breaking out of a 14 year base.

These are affordable companies, in a bull market, with a falling #USD tailwind.

But what about the high valuation of #stocks?

- govts injected unprecedented levels of $$ into the global economy

- valuations have been rising for 30 yrs

- ZIRP forces you out of bonds/cash

- Ignore the Buffett indicator, it's been wrong for years.

- govts injected unprecedented levels of $$ into the global economy

- valuations have been rising for 30 yrs

- ZIRP forces you out of bonds/cash

- Ignore the Buffett indicator, it's been wrong for years.

https://twitter.com/awealthofcs/status/593053000718942209?s=20

This chart helps you understand that massive liquidity has led to higher valuations in stocks.

The $SPY $SPX #SP500 is NOT AT ALL TIME HIGHS if you price it in M2 money supply.

The all time high was pre #COVID19.

The $SPY $SPX #SP500 is NOT AT ALL TIME HIGHS if you price it in M2 money supply.

The all time high was pre #COVID19.

• • •

Missing some Tweet in this thread? You can try to

force a refresh