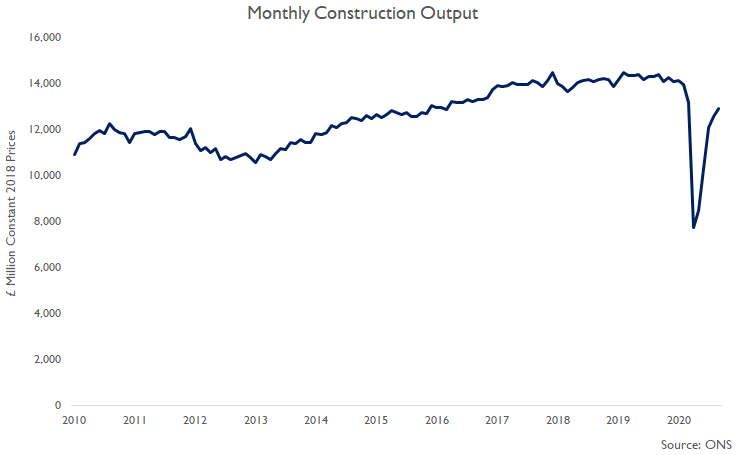

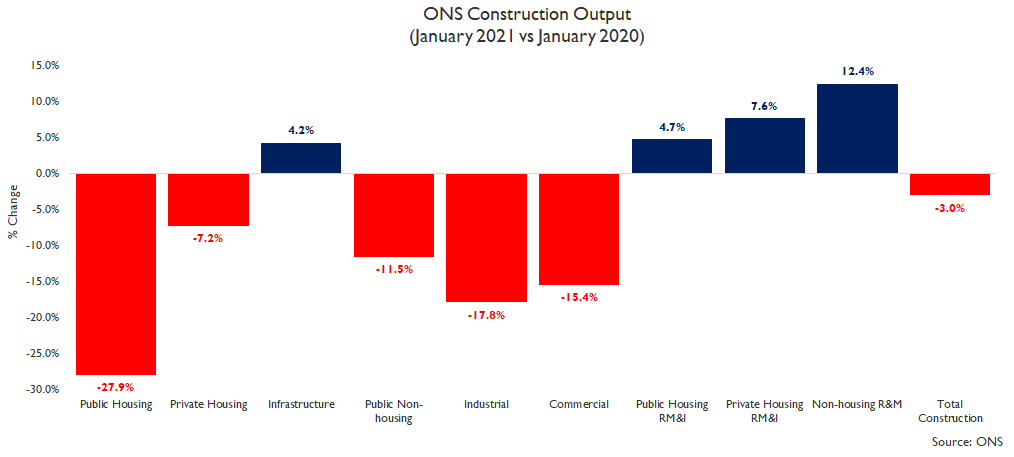

'V'-shape recovery for construction so far. Construction output in January 2021 was 0.9% higher than in December 2020 & 3.0% lower than one year earlier (pre-Covid-19) according to @ONS...

#ukconstruction #construction

ons.gov.uk/businessindust…

#ukconstruction #construction

ons.gov.uk/businessindust…

... The 0.9% monthly rise in construction activity during January 2021 (was after a 2.9% fall in December &) was mainly driven by growth in public housing repair, maintenance & improvement (cladding remediation), commercial & infrastructure...

#ukconstruction #construction

#ukconstruction #construction

... & construction output in January 2021 remained 3.0% lower than a year earlier despite activity in repair, maintenance & improvement activity & infrastructure activity that is already above pre-Covid-19 levels already because...

#ukconstruction #construction

#ukconstruction #construction

... construction output was dragged down activity in some sectors double-digit lower than a year earlier; public housing, industrial (lack of factories investment), commercial (offices, retail, leisure) & public non-housing (education & health)...

#ukconstruction #construction

#ukconstruction #construction

... Note that % changes can distort the overall picture, esp. in small sectors. In £ rather than %, during January 2021 there was £418 million less construction activity than a year ago, mainly driven by a £369 million fall in commercial activity...

#ukconstruction #construction

#ukconstruction #construction

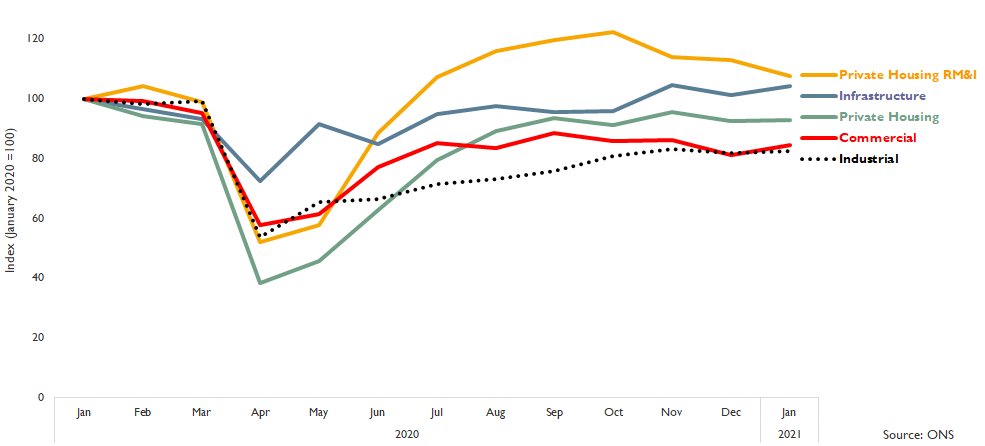

... Looking at how construction output in key sectors evolved since January 2020 (pre-Covid-19), infrastructure was the least affected sector in the initial lockdown & recovered quickly so activity is above pre-Covid-19 levels whilst...

#ukconstruction #construction

#ukconstruction #construction

... private housing repair, maintenance & improvement (rm&i) output fell sharply in the 1st lockdown, recovered to 20% higher than pre-Covid-19 in October 2020 & has been slowing since but output in January remained 7.6% higher than pre-Covid-19...

#ukconstruction #construction

#ukconstruction #construction

... & commercial (offices, retail, leisure) output fell over 40% in April 2020 in the 1st lockdown, initially recovering quickly as sites reopened & previous projects were finished but output stabilised at a level over 15% lower than pre-Covid-19.

#ukconstruction #construction

#ukconstruction #construction

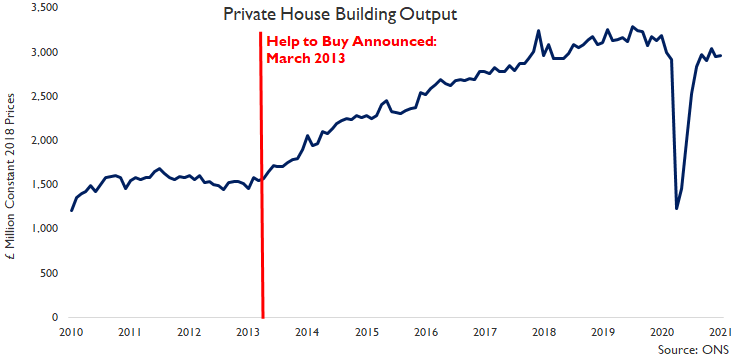

Private housing output in January 2021 was 0.2% higher than in December 2020 & 7.2% lower than a year earlier, which is a sharp recovery given that private housing output fell over 60% in April 2020 during the initial lockdown...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... & private housing output since Autumn 2020 appears to have stabilised at around 7% lower than pre-Covid-19 although continued further housing market stimulus from government may boost house building levels during the year...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

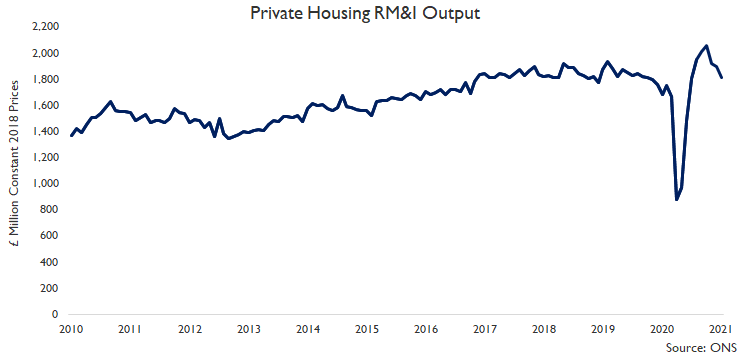

Private housing rm&i output in January 2021 was 4.6% lower than in December 2020 but remained 7.6% higher than a year ago (pre-Covid-19). It recovered sharply following the initial lockdown due to a combination of...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... pent-up demand, rising demand for additional space/workspace esp. from those working from home so rm&i activity has focused on outdoor/office-related space whilst activity such as plumbing & heating is more subdued plus...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... inability to spend instore on non-essential retail, going out & tourism/travel also boosted rm&i activity but private housing rm&i activity peaked in October 2020 so the key question going forward will be...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

... as restrictions ease & homeowners return to spending in stores, cafes, bars, restaurants & on tourism will there be a shift back away from private housing rm&i this year esp. as the pent-up demand has already fed through...

#ukconstruction #construction #ukhousing #housing

#ukconstruction #construction #ukhousing #housing

Commercial (offices, retail, leisure) construction output in January 2021 was 4.5% higher than in December 2020 (but still lower than in November) & it was 15.4% lower than it was a year ago in January 2020 (pre-Covid-19)...

#ukconstruction #construction #commercialrealestate

#ukconstruction #construction #commercialrealestate

... & in recent months small/medium-size commercial offices, retail & leisure construction activity has been affected by a lack of new projects to replace those that have recently finished whilst ...

#ukconstruction #construction #commercialrealestate

#ukconstruction #construction #commercialrealestate

... activity on larger commercial projects (esp. towers) has suffered from lower productivity due to social distancing & other safety measures affecting the number of different groups of trades in tight spaces on site plus...

#ukconstruction #construction #commercialrealestate

#ukconstruction #construction #commercialrealestate

... the additional time take for larger commercial projects (esp. towers) means that projects due to finish in 2020 are still continuing & will cost more, which has also hindered new investment in larger commercial projects.

#ukconstruction #construction #commercialrealestate

#ukconstruction #construction #commercialrealestate

• • •

Missing some Tweet in this thread? You can try to

force a refresh