Nottingham Forest’s 2019/20 financials covered the third season under the ownership of Evangelos Marinakis (80%) and Sokratis Kominakis (20%), when they narrowly missed out on the Championship play-offs, finishing 7th, their highest position since 2013. Some thoughts follow #NFFC

#NFFC loss improved by £9m from £25m to £16m, mainly due to a £5m loan write-off. Revenue slightly increased from £25.3m to £25.7m and profit on player sales rose £0.7m to £11.3m, while expenses were down £3m (5%).

There was “significant lost revenue” due to the COVID-19 pandemic (ticketing, retail, catering and hospitality), but #NFFC noted that the impact is not immediately visible, as the club had been “on track to report a record turnover” before the season was suspended in March.

Most #NFFC revenue streams fell slightly: player loans down £0.3m (20%) to £1.3m, match day £0.2m (3%) to £7.4m and commercial £0.1m (2%) to £6.9m. In contrast, broadcasting, defined as grants & royalties plus TV & radio, rose £1.0m (11%) to £10.2m.

However, investment in the squad led to the #NFFC wage bill increasing £1.9m (5%) to £38.1m, offset by player amortisation and depreciation falling £1.9m (21%) to £7.0m. Other expenses also cut £2.2m (15%) to £12.5m, while interest payable was reduced £0.9m to £0.3m.

Despite the improvement, #NFFC loss of £16m is still firmly in the bottom half of the Championship, though this result may well look better when other clubs publish their COVID-impacted 2019/20 accounts. In fact, even before the pandemic, many clubs had losses above £20m.

It is also worth noting that some clubs’ figures were boosted by once-off accounting profits from the sale of stadiums, training grounds and land, especially #DCFC £40m, #SWFC £38m and #AVFC £36m, so their underlying figures were even worse than reported.

Excluding property sales, just 4 Championship clubs are profitable with only Hull City managing to make money to date in 2019/20. The sad reality is that almost all clubs in this division lose money, as they strive to remain competitive in pursuit of promotion to the top flight.

#NFFC figures were boosted by £11.3m profit on player sales, up from £10.6m the prior season, mainly the sales of Appiah to Almeria, Osborn to #SUFC, Soudani to Olympiacos and Chema to Getafe. This was pretty good, but a fair bit lower than Bristol City £26m and Hull City £23m.

These player sales are important for #NFFC, as they have only reported a profit once since 2005 – and that was entirely due to a £40m loan write-off in 2017. Otherwise, the club has consistently lost money, amounting to £102m in the last decade, including £47m under Marinakis.

#NFFC losses would have been much higher without the owners writing-off £68m of loans in the last 5 years: 2016 £18m, 2017 £40m, £2018 £5m and 2020 £5m. The largest write-off came in 2017 when Greek owner Evangelos Marinakis bought the club from Fawaz Al Hasawi.

Player sales have also become increasingly important for #NFFC, who have averaged £12m profits in the last 4 seasons, up from just £3m in the preceding 6 years. In the same way, this season will include £14m sale of Matty Cash to #AVFC (pure profit, as he is an academy product).

#NFFC underlying profitability is poor, as shown by their operating losses (excluding player sales and exceptional items). This has been consistently negative, though slightly improved in 2020 from £34m to £32m. In fairness, only one Championship club made an operating profit.

Since the new owners bought the club in 2017, #NFFC revenue has grown £4.9m (23%) from £20.8m to £25.7m with increases in all revenue streams: broadcasting £2.0m (24%), commercial £1.6m (31%), match day £0.8m (13%) and player loans £0.4m (45%).

Despite the growth, #NFFC £26m revenue is mid-table in the Championship, significantly below clubs benefiting from parachute payments following relegation from the Premier League, e.g. in 2018/19 WBA £71m, Stoke City £71m and Swansea City £68m.

Championship revenue is hugely influenced by Premier League parachute payments, making it difficult for clubs like #NFFC to compete. Seven clubs benefited from these in 2019/20, led by Cardiff City, #FFC £42m and #HTAFC (£42m), followed by Stoke City, Swansea City and WBA (£34m).

If parachute payments were excluded, #NFFC £26m would have the 9th highest revenue in the Championship. They would still be a fair way below the leading clubs, though the gap to the highest placed Leeds United (in 2018/19) would be reduced to “only” £23m.

#NFFC broadcasting income rose £1.0m (11%) to £10.2m, comprising grants & royalties £9.1m and TV & radio £1.1m. Most Championship clubs earn between £8m and £10m in TV money, but there is a big gap to the clubs with parachute payments (over £50m for WBA, Swansea and Stoke).

#NFFC match day income fell £0.2m (3%) to £7.4m, largely due to playing 5 home games behind closed doors because of the pandemic, though is still highest reported to date in 2019/20 Championship. Small price increase, first in several years. Many fans kept money within the club.

#NFFC average attendance fell slightly from 28,144 to 27,723 for games played with fans, though still 2nd highest in Championship (only behind #LUFC 35,322) and 40% higher than 19,676 low four years ago. Season card sales capped at 20,000 due to planned stadium redevelopment.

#NFFC plans to redevelop the City Ground, increasing capacity to 35,000, have been delayed, but the club is optimistic that the planning application will be approved this year. The objective is to increase revenue via improved hospitality and executive boxes.

#NFFC commercial income flat at £6.9m, though up a third in the last 2 years (from £5.2m in 2018). This is around mid-table in the Championship, which is disappointing for a club with Forest’s great tradition (two European cups). For example, only half of Bristol City’s £14m.

#NFFC recently terminated “the biggest shirt sponsorship deal in the club’s history” with Football Index after the online betting company went into administration. More encouragingly, Macron extended the kit deal by 5 years to 2026. UK Meds first back-of-shirt deal from 2019/20.

#NFFC wage bill rose £2m (5%) from £36m to £38m, a new club record. This means that wages have increased £10m (37%) in the last two years, while revenue has only grown £3m (13%) in that period, which neatly highlights Forest’s financial challenge.

Despite the growth, #NFFC £38m wage bill is only 11th highest in the Championship, so they punched above their weight last season. Still a long way below the likes of Aston Villa £83m, Stoke City £56m (both with parachute payments) and Norwich City £51m (promotion bonus).

#NFFC wages to turnover ratio increased from 143% to 148%. The last time Forest’s wages were less than revenue was back in 2009 (93%). This is pretty much par for the course in the Championship, where 16 clubs are above 100%, much worse than UEFA’s recommended 70% upper limit.

#NFFC have not divulged any directors’ remuneration, down from £932k the previous year (highest paid director £307k). The directors at some clubs received a tidy sum, e.g. Reading £1.5m, WBA £953k, Birmingham City £932k and Stoke City £858k.

#NFFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, fell £2.1m (26%) from £8.1m to £6.0m. This had fallen to £2m in 2017, due to a transfer embargo for previous FFP breaches impacting three windows. Also £0.4m player impairment.

Following this decrease, #NFFC player amortisation of £6m is in the bottom half of the Championship, significantly lower than big-spending Stoke City £29m, Swansea City £28m, Middlesbrough £26m and Aston Villa £26m.

#NFFC mentioned “further strong investment into the first team squad”, but their £6m on player purchases was relatively low for the Championship and much less than the prior season’s £23m. Included Carl Jenkinson, Brice Samba, Nuno Da Costa and Samba Sow.

#NFFC average annual gross spend on players over last 4 years increased to £10m, more than twice £4m in preceding 6 years, though higher sales of £13m meant £3m net sales. Since these accounts, the club has spent decent money on Harry Arter, Loic Mbe Soh and Scott McKenna.

#NFFC gross debt fell £7m from £39m to £32m, comprising £29m from the owners (NF Football Investments Ltd), £2.5m promissory notes and £0.5m owed to other related parties. The owners’ debt was down £2m, as they provided a new £19m loan, but converted £21m to equity.

#NFFC debt would be much higher without the current owners converting £40m debt to equity in the past 3 years, which makes £106m capitalised since 2013. In addition, £68m of loans have been written-off in the last 5 years, including £5m in 2019/20.

#NFFC £32m gross debt is not that large for the Championship, far below the likes of #BRFC £142m, Stoke City £141m, #Boro £105m and Birmingham City £97m. As a technical aside, Forest’s holding company has £73m debt. Not an issue – so long as owners continue to provide support.

Although debt is high in the Championship, most of it has been provided by owners who charge little or no interest, though #NFFC paid £317k in 2019/20. Only two clubs have interest payments above £1m: Hull City £1.7m and Bristol City £1.1m.

#NFFC also managed to reduce transfer debt from £19m to £12m, though this is up from just £4m in 2018, which means that much of the player recruitment was done on credit. Partly offset by £3m owed to Forest by other clubs, so net £9m payable. Also have £6m contingent liabilities.

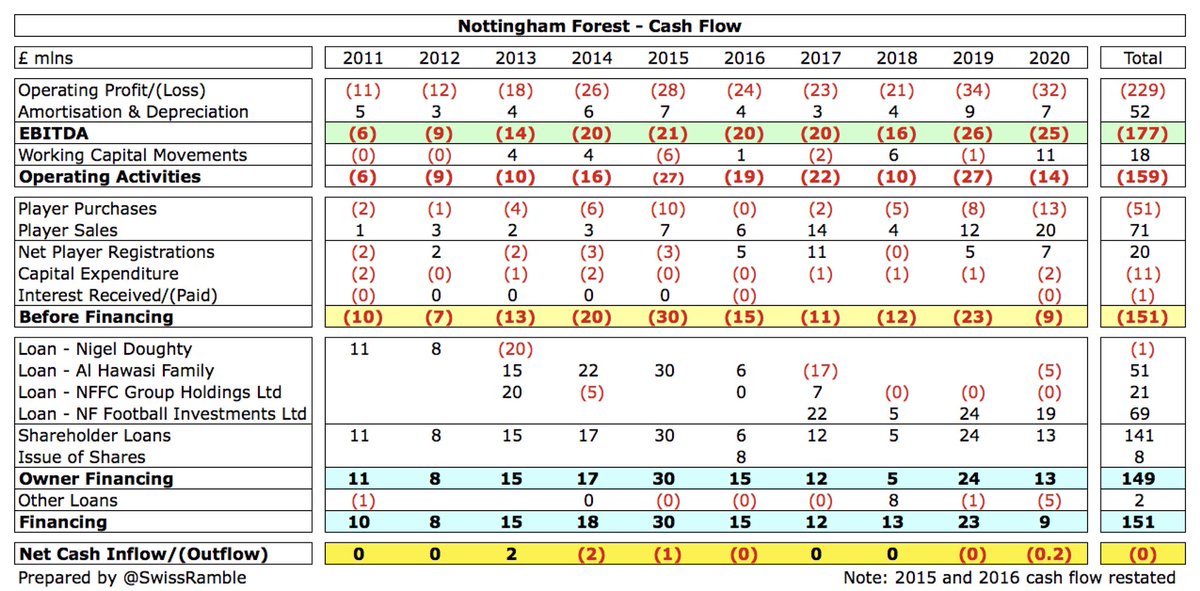

#NFFC broke-even from a cash flow perspective, but only thanks to £19m additional loans from the owners and £7m from player sales (net). This was needed to cover £14m losses from operational activities, plus £2m spent on infrastructure and £11m repayment of other loans.

The reality is that #NFFC is still “dependent on funding from its parent company”. In the last 10 years various owners have pumped £149m into the club. The vast majority of that has been used to simply cover operating losses with only £11m on improving infrastructure.

#NFFC cash balance fell slightly from £0.6m to £0.4m. This is on the low side, but in fairness 16 clubs in the Championship had less than £2m cash in the bank, so this was not exceptional (though not a great buffer in the current climate).

#NFFC board stated that the losses are within the limits of the EFL’s Profitability and Sustainability Rules. If required, continuing compliance will be achieved by taking “tough decisions” on player sales, “notwithstanding substantial investment in the playing squad”.

I calculate #NFFC have just met FFP targets. Reported £47m losses over 3-year monitoring period less estimated £18m allowable deductions for academy, community, infrastructure and COVID, but excluding £10m loan write-offs (like QPR) would take FFP losses to £39m, bang on target.

As a technical aside, this analysis is based on #NFFC accounts for Nottingham Forest Football Club Ltd, owned by NF Football Investments Ltd. Revenue, wages and loss are almost identical, though debt is £41m higher.in the holding company.

Like most Championship clubs, #NFFC make large losses, which will be worse in 2020/21, when the pandemic impact will be more apparent. The club will have to rely on the support of their owners for the foreseeable future, while they compete against those with parachute payments.

• • •

Missing some Tweet in this thread? You can try to

force a refresh