Wolverhampton Wanderers 2019/20 financial results cover a season when they finished 7th in the Premier League for the second year in a row and reached the Europa League quarter-finals, but finances were significantly impacted by COVID-19. Some thoughts follow #WWFC

Since being bought by Chinese investment group Fosun International in July 2016, #WWFC is a club transformed, helped by a close relationship with super-agent Jorge Mendes. Under charismatic manager Nuno Espirito Santo, Wolves can realistically compete for European qualification.

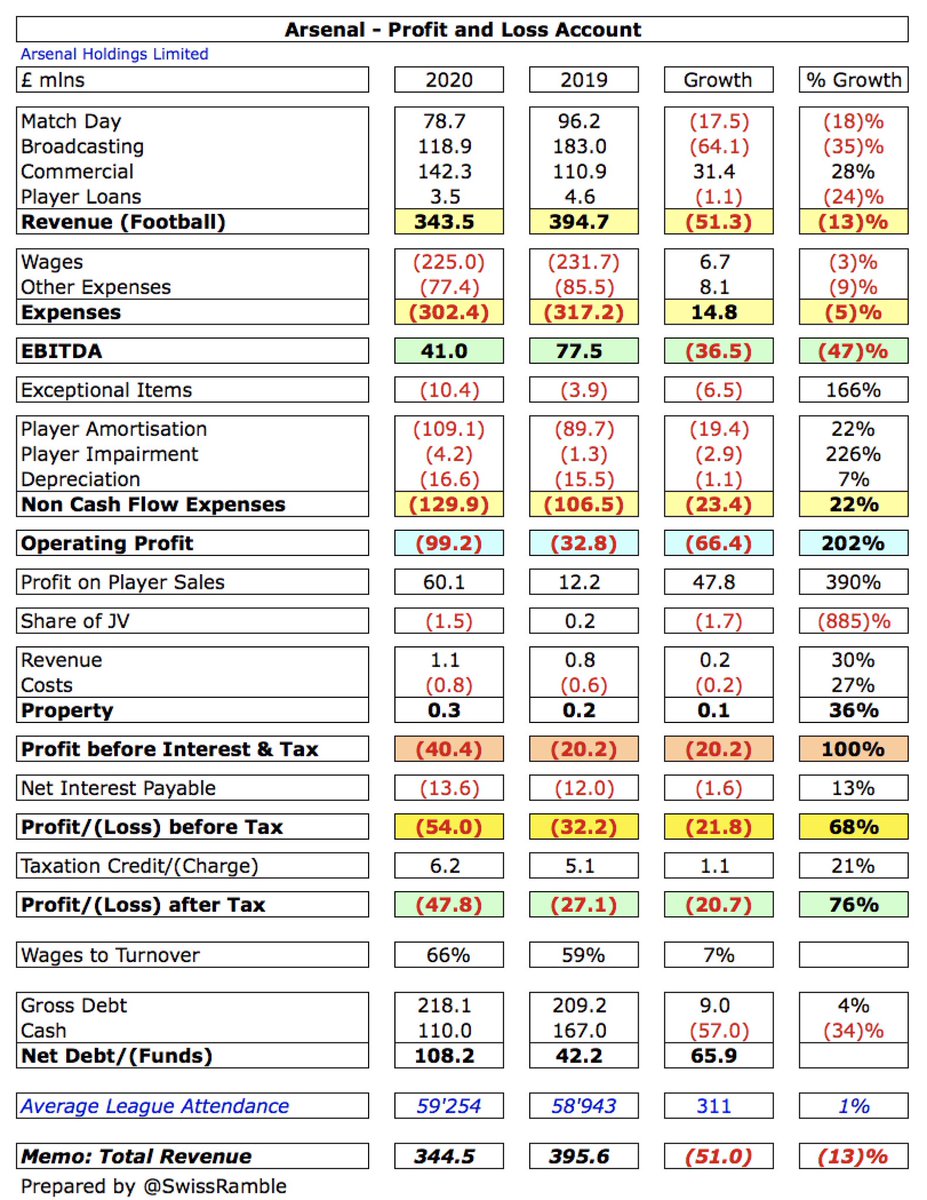

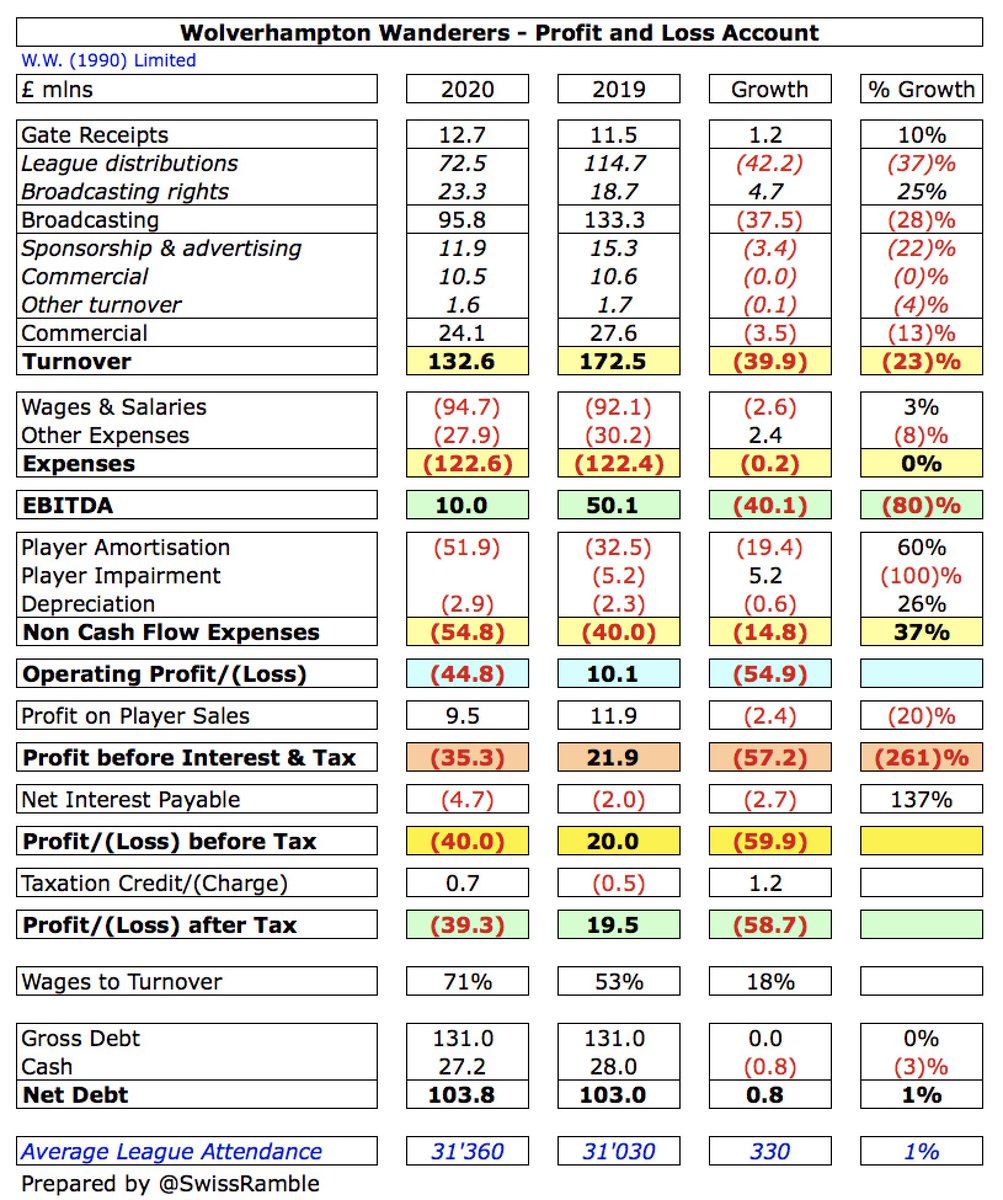

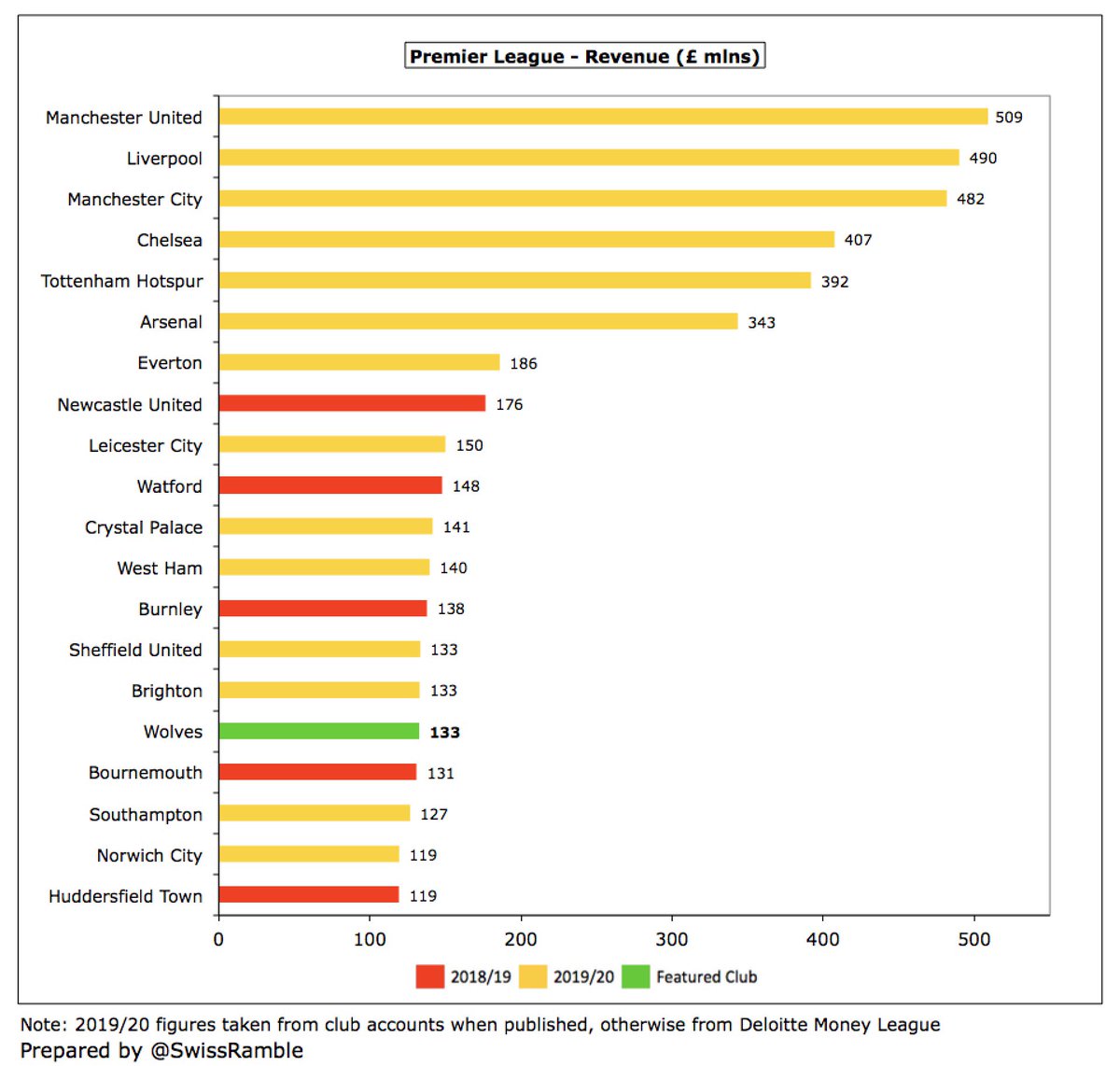

#WWFC swung from £20m profit before tax to £40m loss, as the pandemic led to revenue dropping £40m (23%) from £173m to £133m and profit on player sales fell £2m to £10m, while expenses rose £18m (11%), mainly due to investment in the squad. Loss after tax £39m.

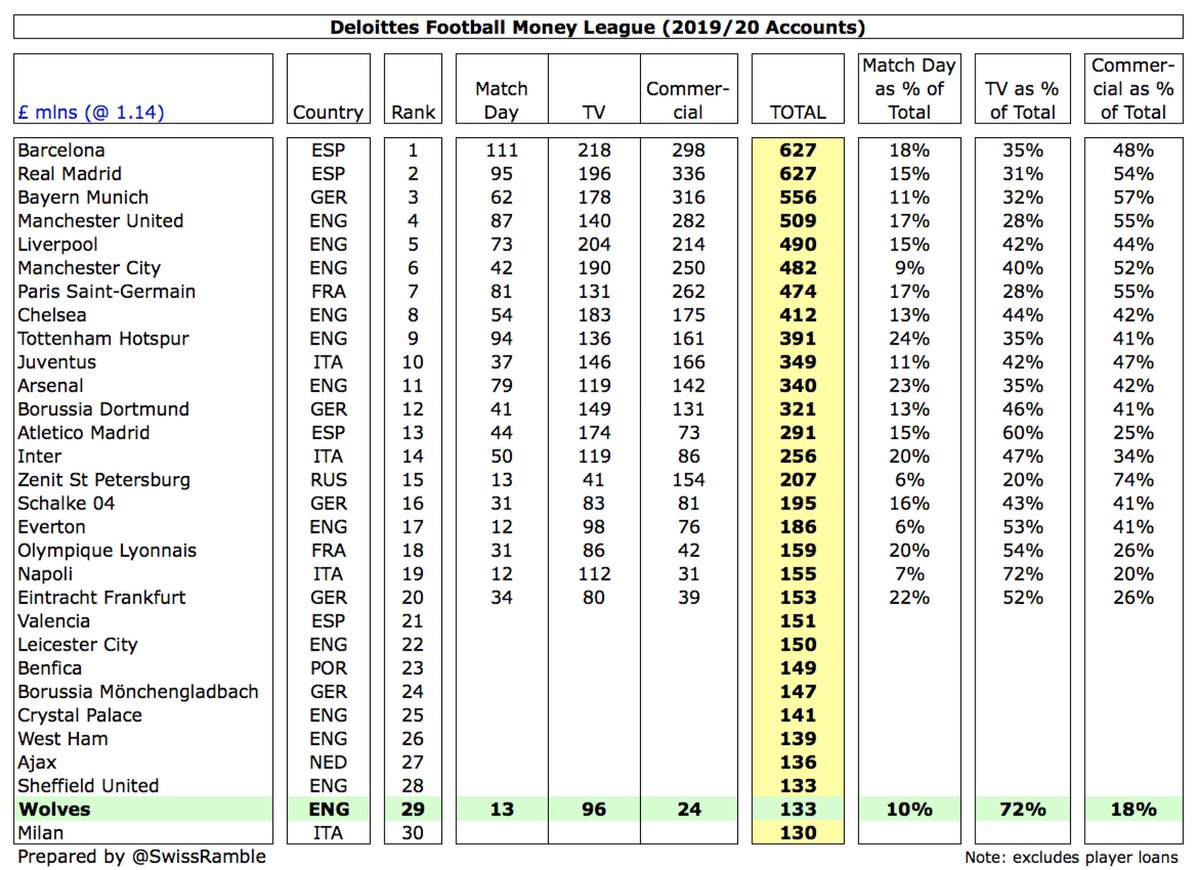

Significantly impacted by COVID, the main driver of #WWFC revenue decrease was broadcasting income, which dropped £37m (28%) from £133m to £96m, while commercial fell £4m (13%) from £28m to £24m. However, match day rose £1m (10%) from £11m to £12m after return to Europe.

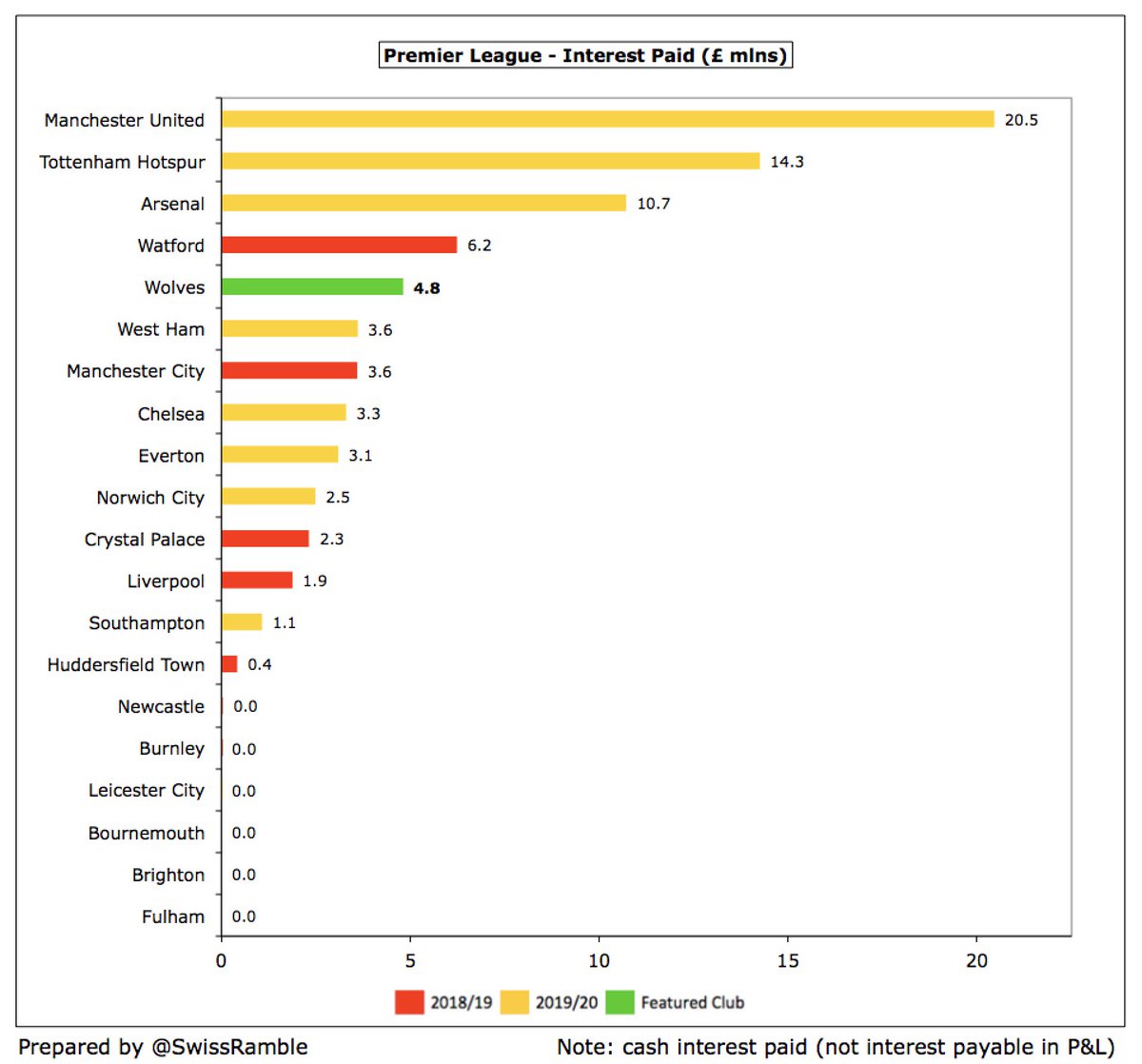

Following further investment in the squad, #WWFC wages rose £3m (3%) from £92m to £95m and player amortisation increased by £19m (60%) from £33m to £52m. (though no repeat of prior year impairment £5m). Other expenses cut £2m (8%) to £28m, but interest payable was up £3m to £5m.

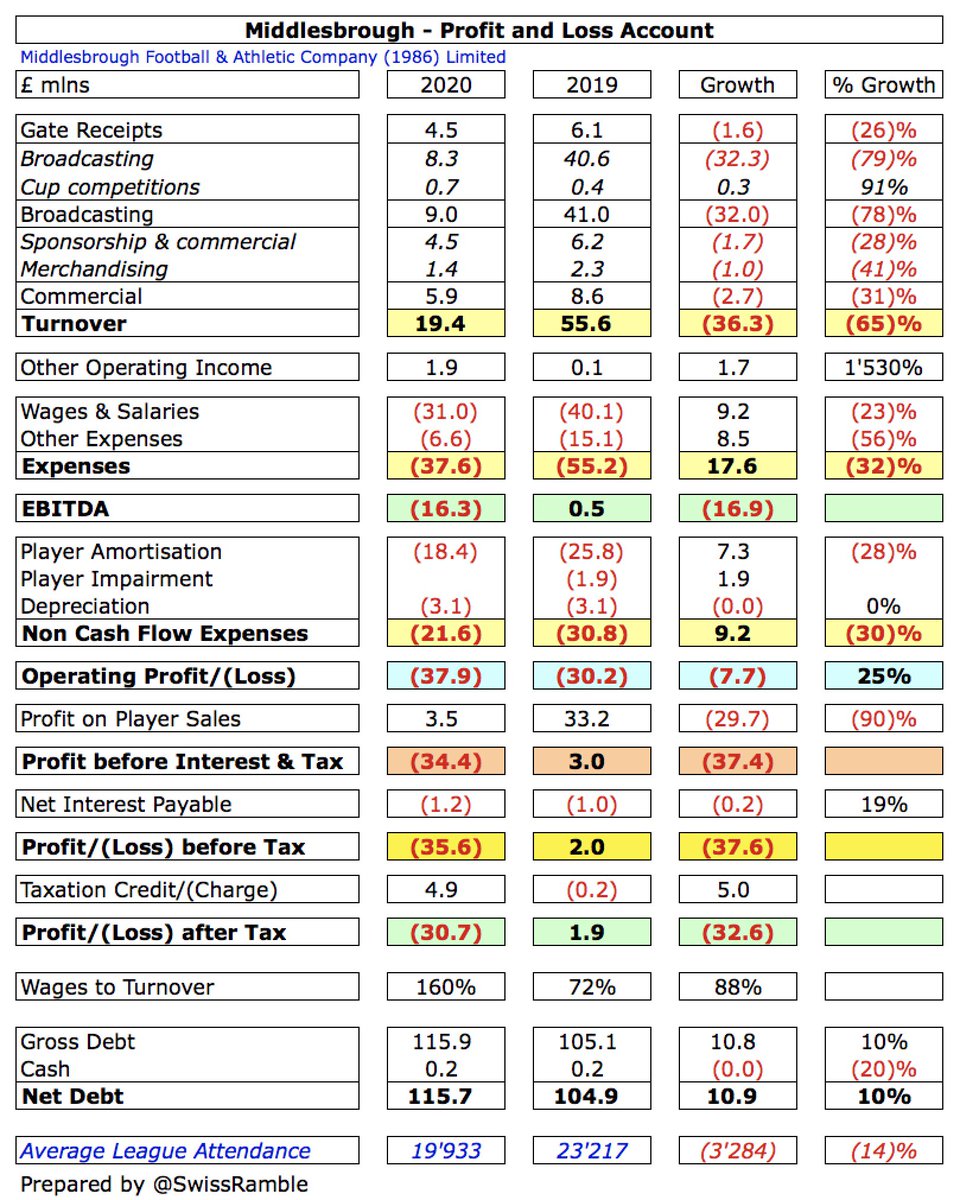

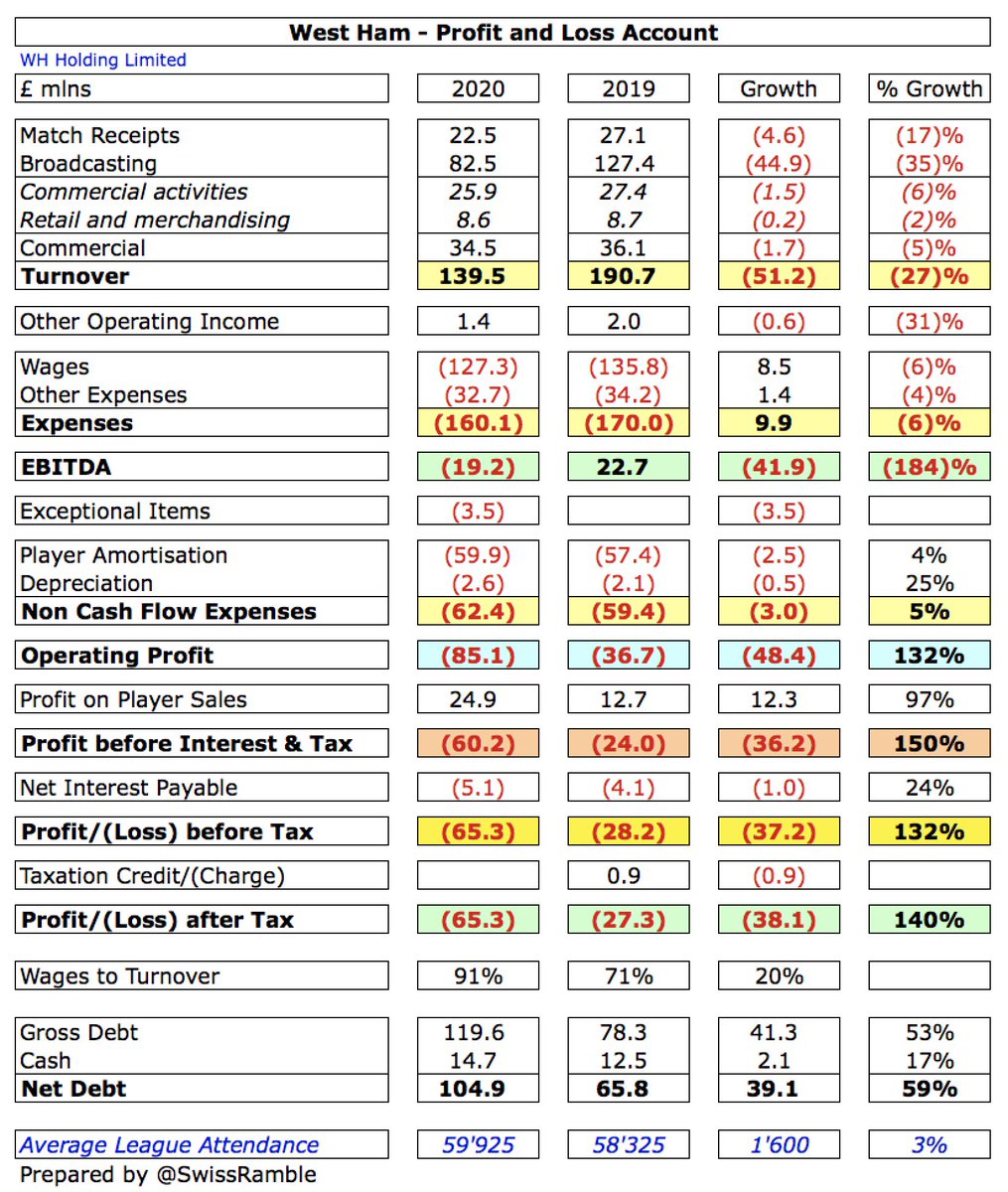

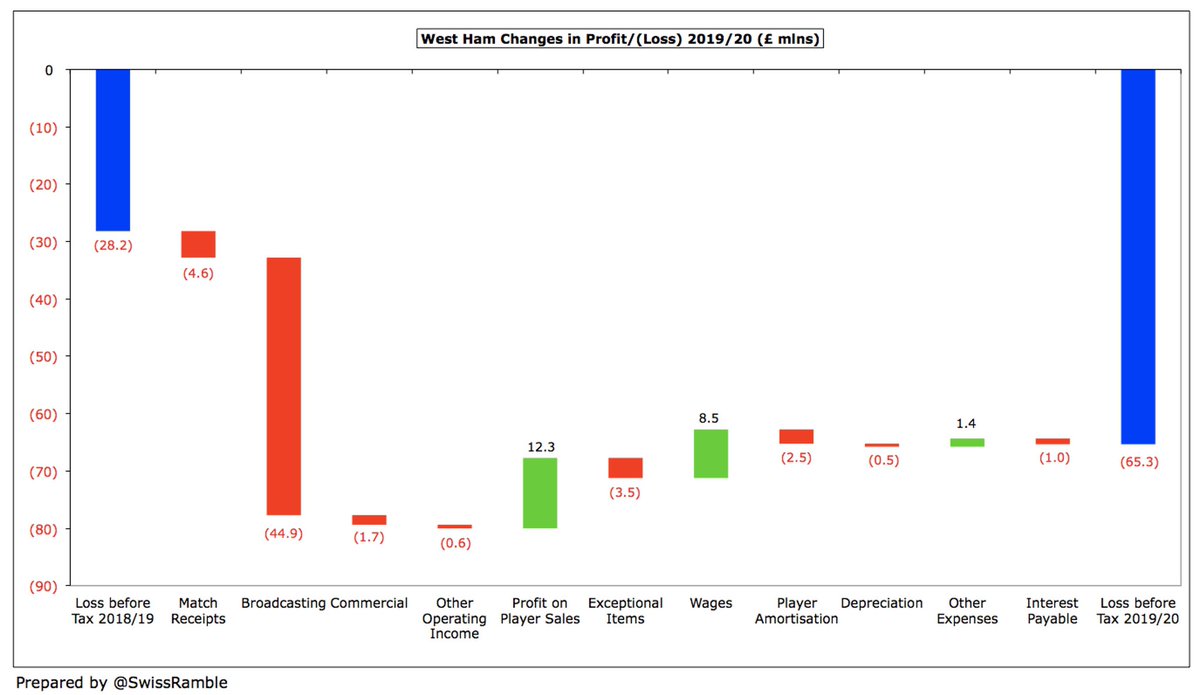

Of course, all clubs have been adversely impacted by COVID, so #WWFC £40m loss is not unusual. In fact, 7 clubs have already posted larger losses than Wolves, namely #EFC £140m, #SaintsFC £76m, #THFC £68m, #LCFC £67m, #BHAFC £67m, #WHUFC £65m and #AFC £54m.

Without COVID, #WWFC revenue would have been £58m higher at £190m (10% more than 2019), as £46m deferred to 2020/21 (broadcasting £44m, sponsorship £2m) and £12m foregone (match day £2m, TV £9m), meaning the club would have posted £18m profit, similar to prior year.

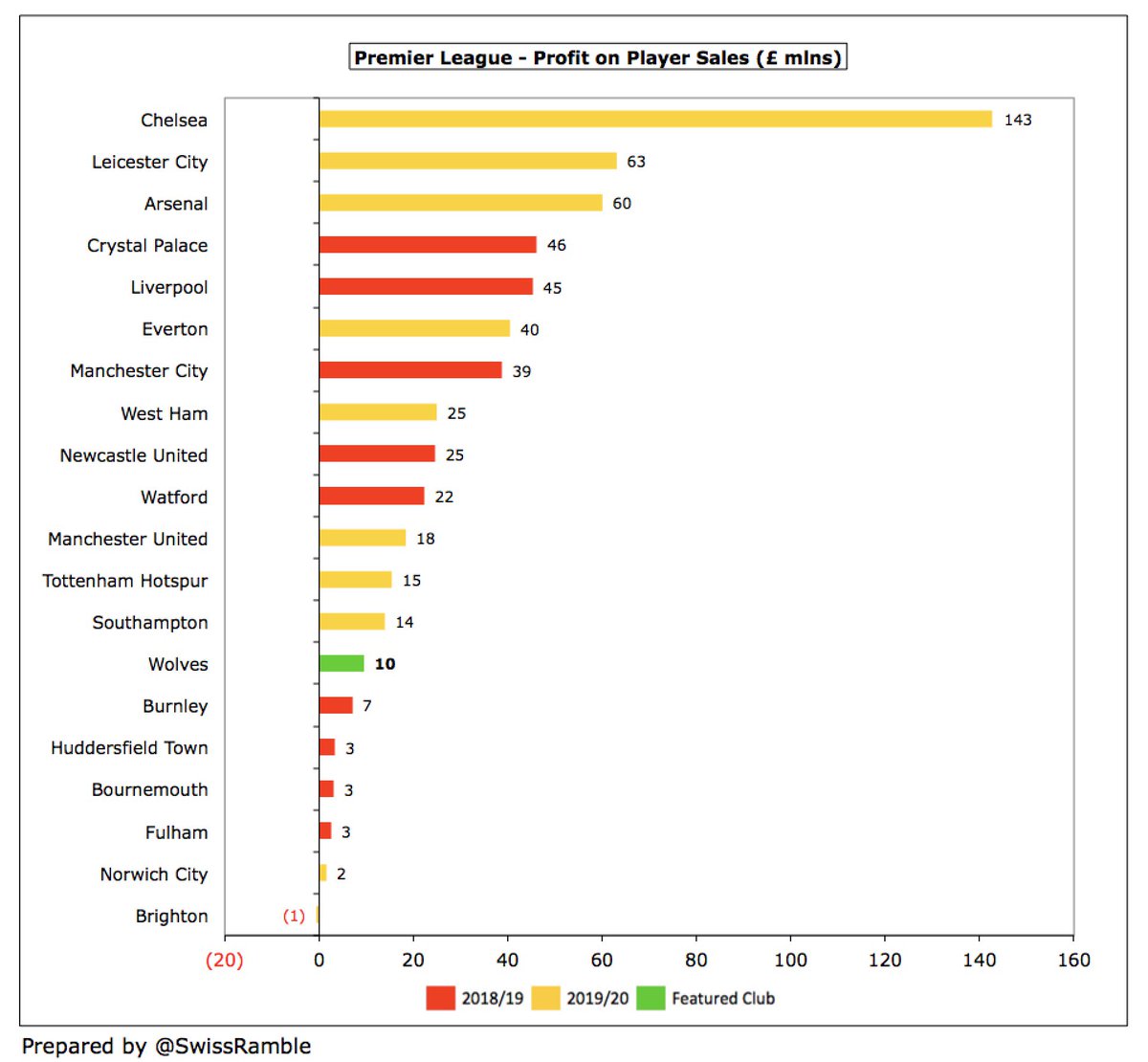

#WWFC profit on player sales fell £2m from £12m to £10m, mainly Ivan Cavaleiro to #FFC and Kortney Hause to #AVFC. This is one of the lowest profits from this activity in the Premier League, miles below the likes of #CFC £143m, #LCFC £63m and #AFC £60m.

#WWFC were very prudent under former owner Steve Morgan, regularly making (small) profits. In contrast, Fosun’s strategy of “strong investment into the squad” has led to £100m net losses in the past 4 years, but the gamble paid-off with promotion and European qualification.

#WWFC results have been impacted by exceptional items, especially a £28m player restructuring provision booked in 2013 following two successive relegations. Similarly, the hefty 2018 loss included (reported) £20m of promotion payments, while 2019 was hit by £5m player impairment.

#WWFC have rarely made big money from player sales, though this has risen to an annual average of £10m over the past 3 years. However, this season’s accounts will include £60m profit, mainly from the sales of Diego Jota to #LFC, Helder Costa to #LUFC and Matt Doherty to #THFC.

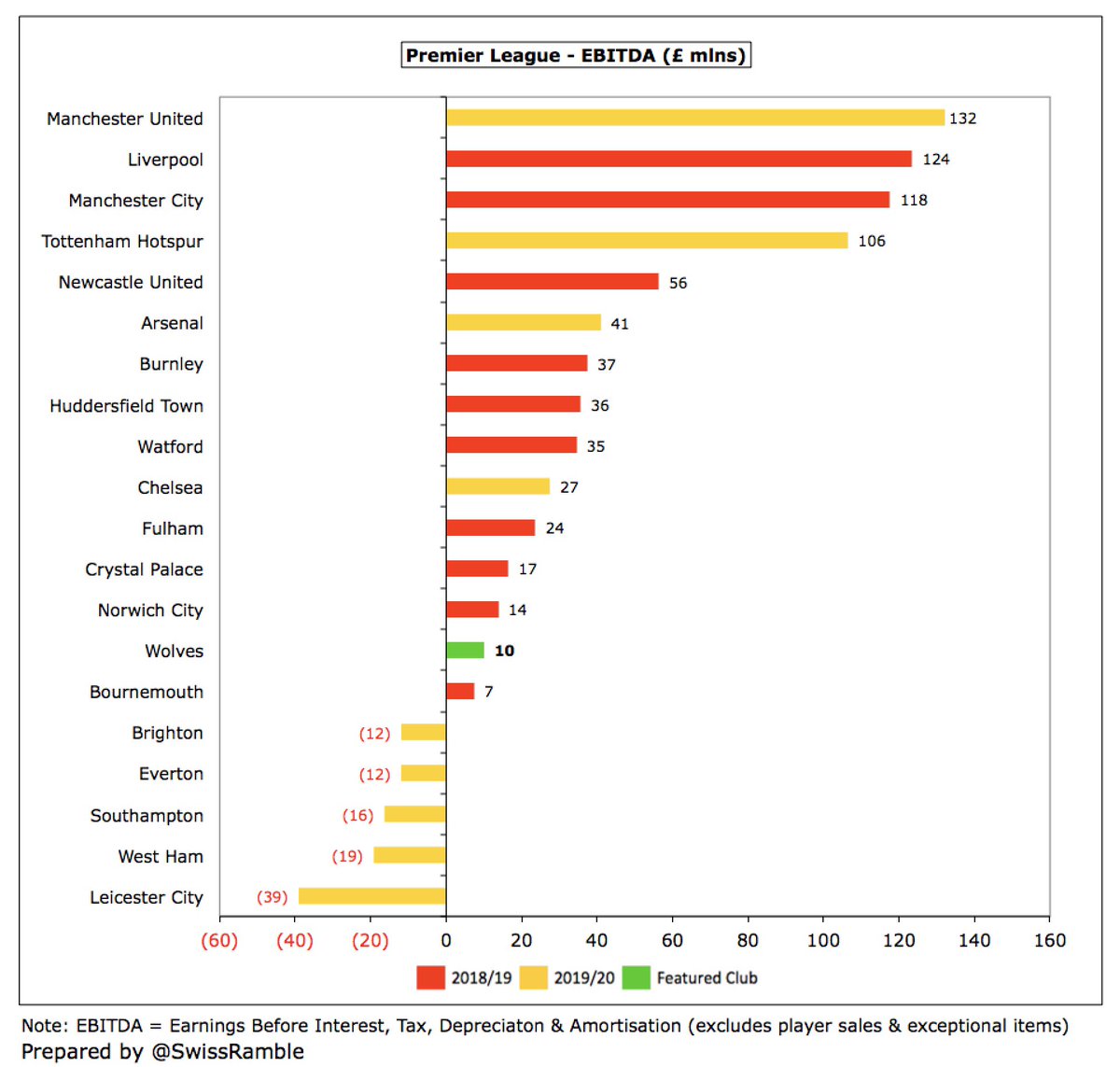

#WWFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, fell from £50m to £10m. This is towards the lower end of the Premier League, though may look better when other clubs publish 2019/20 accounts.

#WWFC went from £10m operating profit (excluding player sales and interest) to £45m loss, though many clubs had even higher losses, including 3 more than £100m: #EFC £175m, #LCFC £122m and #CFC £112m. Only PL club to make an operating profit in 2019/20 is #NCFC with just £3m.

Despite the steep decline in 2019/20, #WWFC £133m revenue is more than £100m higher than their last season in the Championship, which illustrates the huge difference in the Premier League. Even though broadcasting was significantly hit, it still accounted for 72% of revenue.

Following the decrease, #WWFC £133m revenue is one of the lowest in the Premier League, partly because their accounts close relatively early on 31st May, so more revenue has been deferred to the 2020/21 accounts than other clubs whose accounts close on 30th June or 31st July.

All Premier League clubs’ revenue is down in 2019/20, due to the pandemic impact, though #WWFC 23% reduction is one of the highest in the Premier League (larger clubs more in absolute terms). #EFC small 1% decrease is due to once-off £30m for stadium naming rights option.

As a sign of how far #WWFC have come, their £133m revenue means that they are 29th in the Deloitte Money League, which ranks clubs worldwide. This is down from previous season’s 25th place, but ahead of Milan £130m and just behind Champions League semi-finalists Ajax £136m.

#WWFC broadcasting income fell £37m (28%) from £133m to £96m, due to £44m revenue from 9 games slipping to 2020/21 accounts and £9m rebate to broadcasters, partly offset by money from the Europa League. Others will see similar falls when they publish 2019/20 accounts.

#WWFC broadcasting revenue in 2020/21 will benefit from the £44m deferred from 2019/20, as the season was extended beyond the club’s 31st May accounting close, though it will be hit by the absence of European competition.

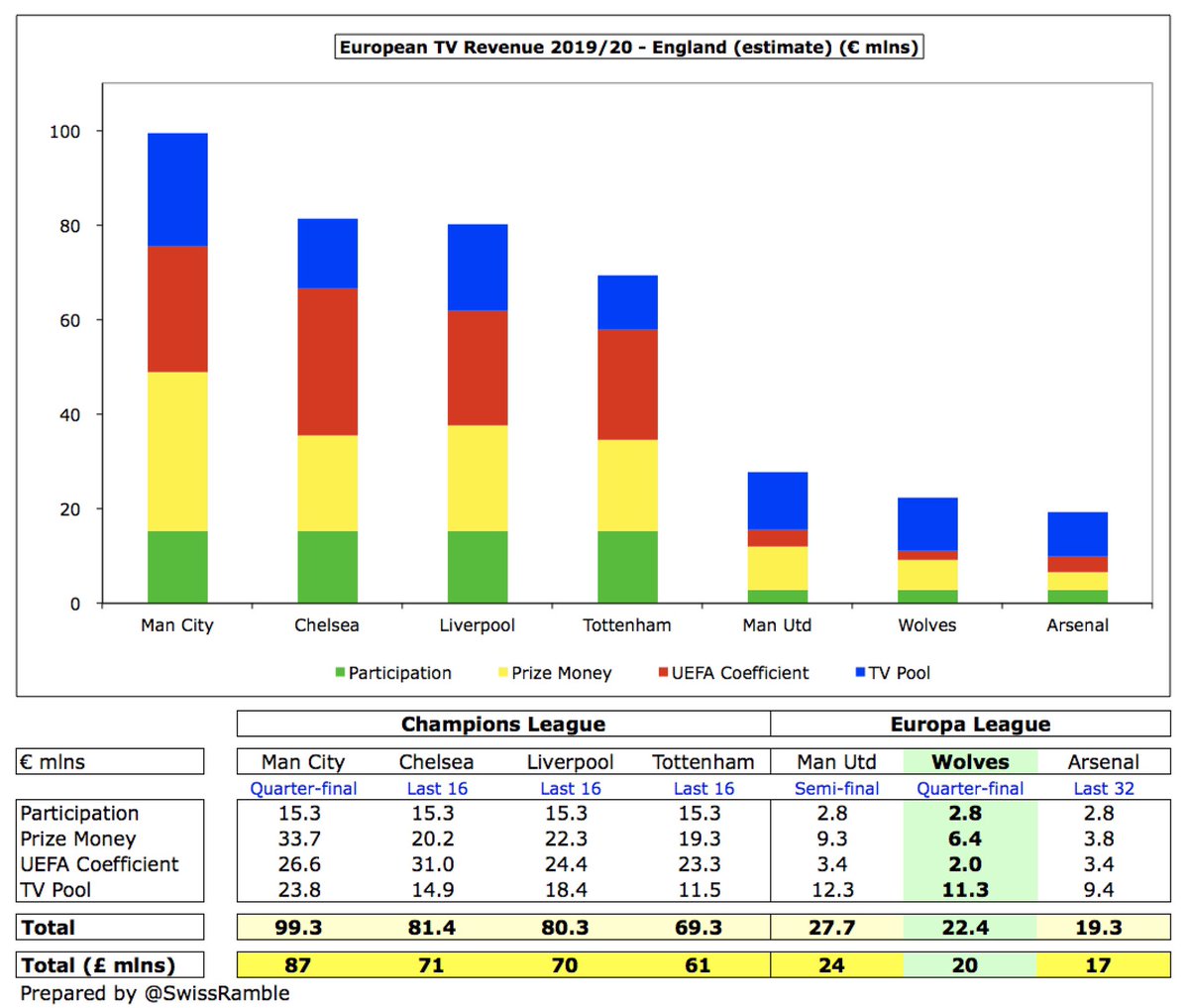

#WWFC earned estimated £20m (€22m) from Europe after reaching the Europa League quarter-final, where they were eliminated by eventual winners Sevilla. This is very good, but much lower than Champions League representatives, e.g. #MCFC £87m. Figures before 16% COVID rebate.

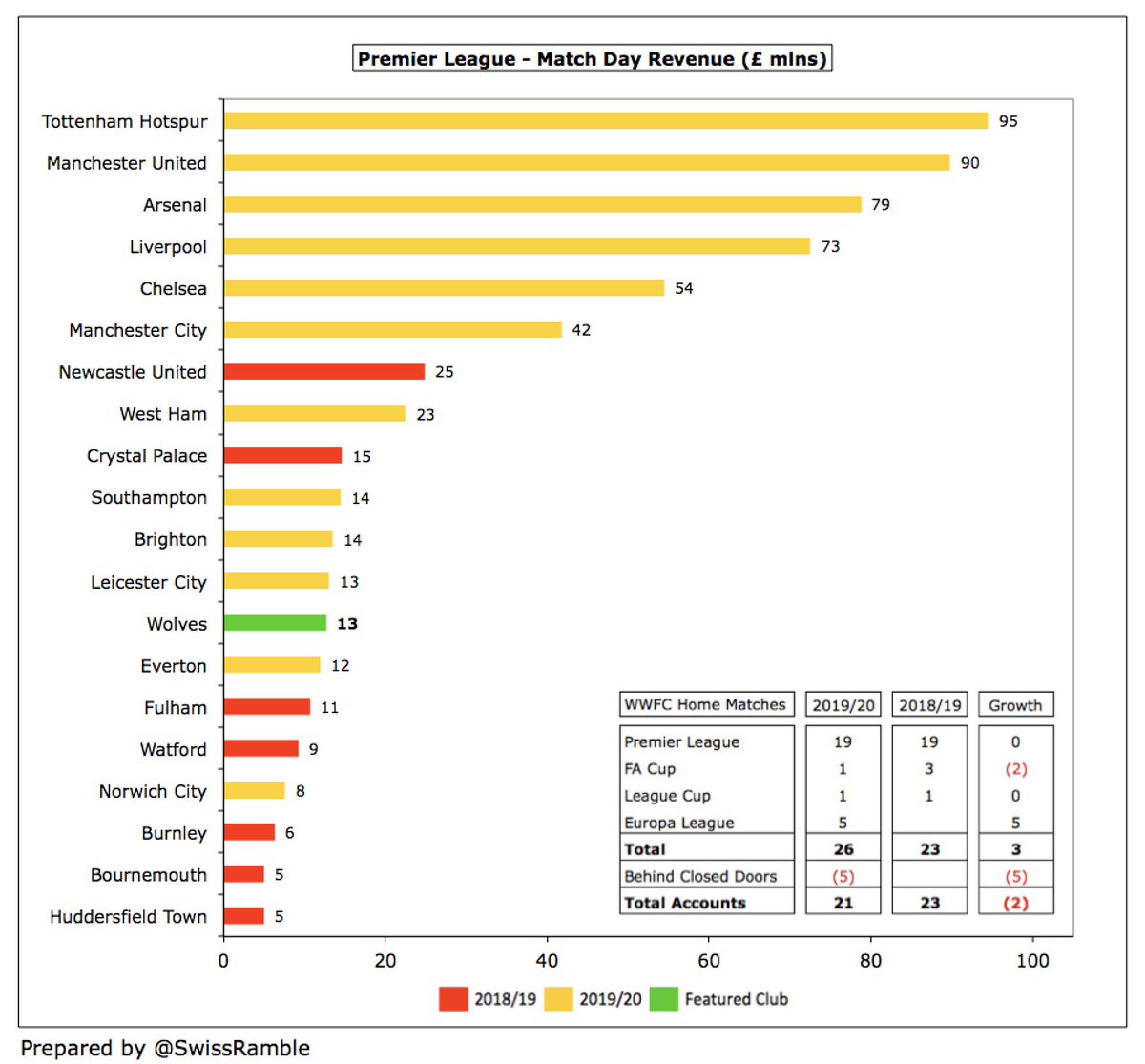

#WWFC gate receipts rose £1m (10%) to £13m, as they staged 3 more home games and most ticket prices were raised 14%. Increase would have been higher if 5 games had not been played behind closed doors. Income firmly in bottom half of Premier League, far below #THFC £95m.

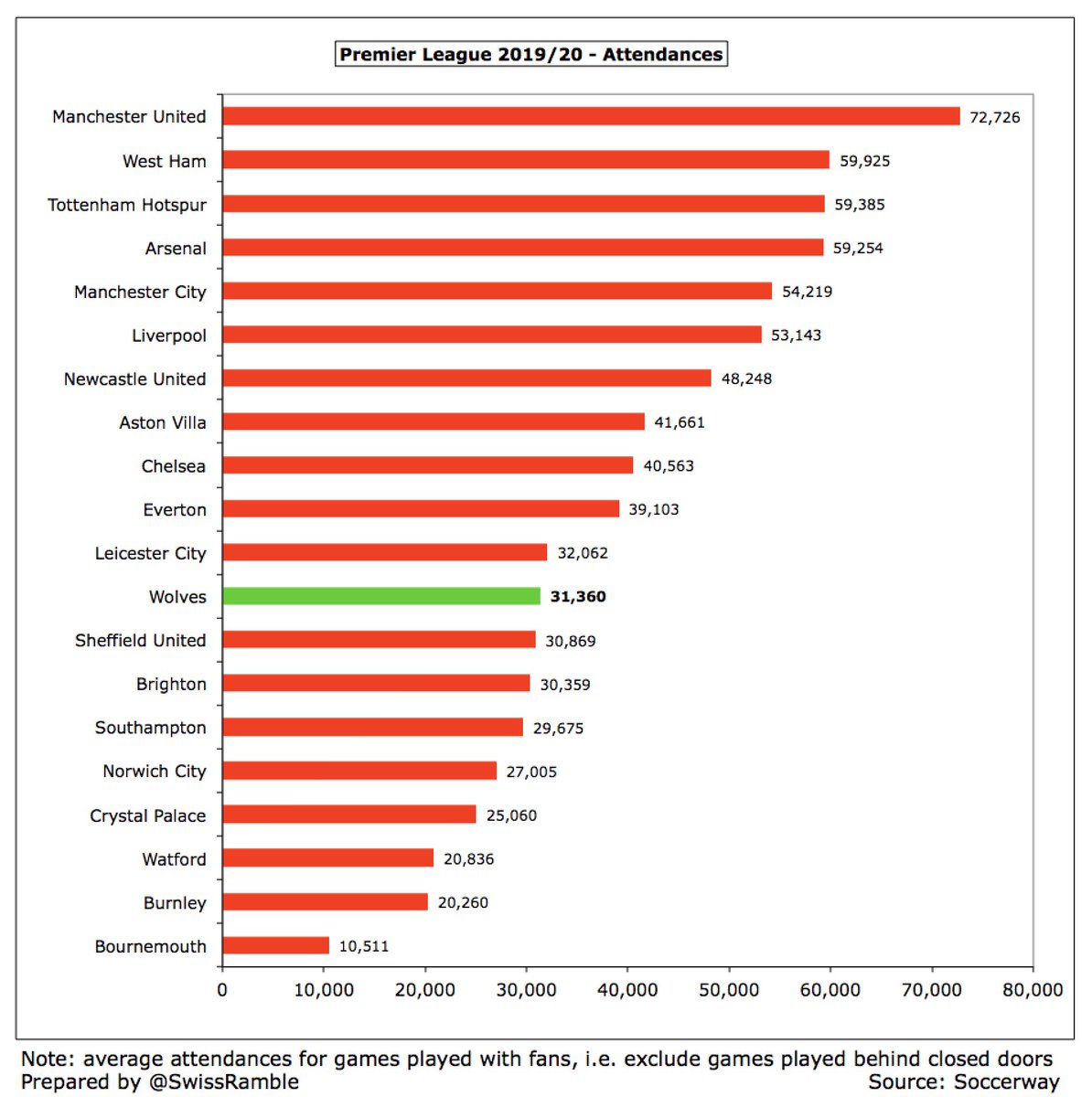

#WWFC average attendance increased from 31,030 to 31,360 (for those games played with fans), up 56% from Championship low of 20,157 in 2016. The upturn in the club’s fortunes on the pitch has firmly reversed declining crowds in lower leagues. Now 12th highest in top flight.

#WWFC commercial income fell £4m (13%) from £28m to £24m, including £12m sponsorship & advertising (£1m from Fosun), £10m commercial and £2m other. Tripled in just 4 years, though still only 12th best in the top flight, a long way behind the Big Six, e.g. #AFC £142m.

#WWFC had a new shirt sponsor in 2019/20, as ManBetX replaced W88 after just one year, increasing payment from £5m to £8m. Adidas £3m deal ended a year earlier, replaced by Castore in 2021 – only £1m but excludes retail rights. Aeroset replaced CoinDeal as sleeve sponsor in 2020.

#WWFC wage bill increased £3m (3%) from £92m to £95m, partly due to “contractual terms exercised upon competing in the Premier League”. This means that wages have grown £44m in the 2 years since promotion, while revenue is up £106m.

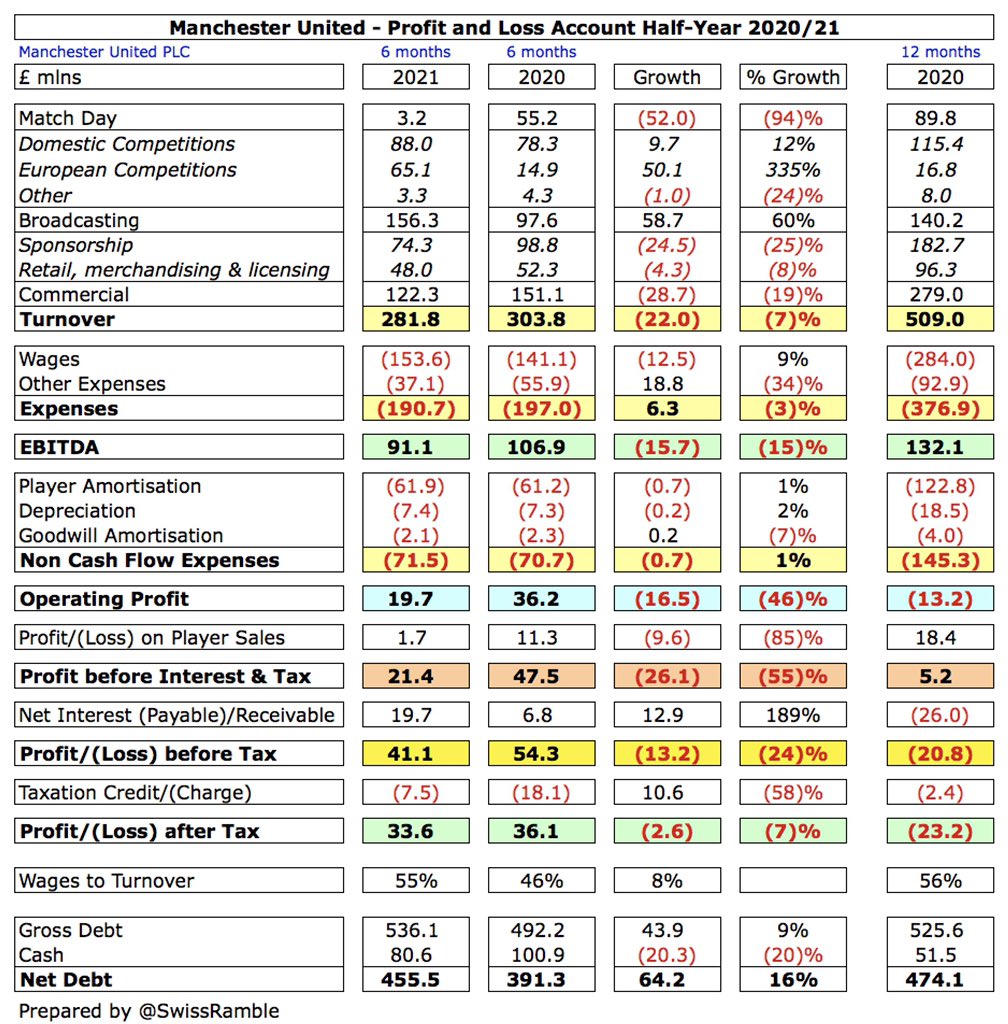

Despite the growth, #WWFC £95m wage bill is still one of the smallest in the Premier League, only around a third of the highest wages reported in the Premier League to date for 2019/20, namely #MUFC £284m and #CFC £283m. Maybe of more relevance, it’s £70m below #EFC £165m.

As a result of the revenue fall, #WWFC wages to turnover ratio increased (worsened) from 53% to 71%, though this is much better than the 192% last reported in the Championship (including promotion bonus). Would have been an impressive 50% without COVID revenue loss.

The remuneration of the #WWFC highest paid director increased by 11% from £470k to £520k, though this is on the low side in the Premier League, far away from the likes of Ed Woodward at #MUFC £3.1m and Daniel Levy at #THFC £3.0m.

#WWFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £19m (60%) from £33m to £52m, up from just £3m four years ago, though no repeat of 2019 £5m impairment. Mid-table in PL, less than half of big spenders like #CFC, #MCFC and #MUFC.

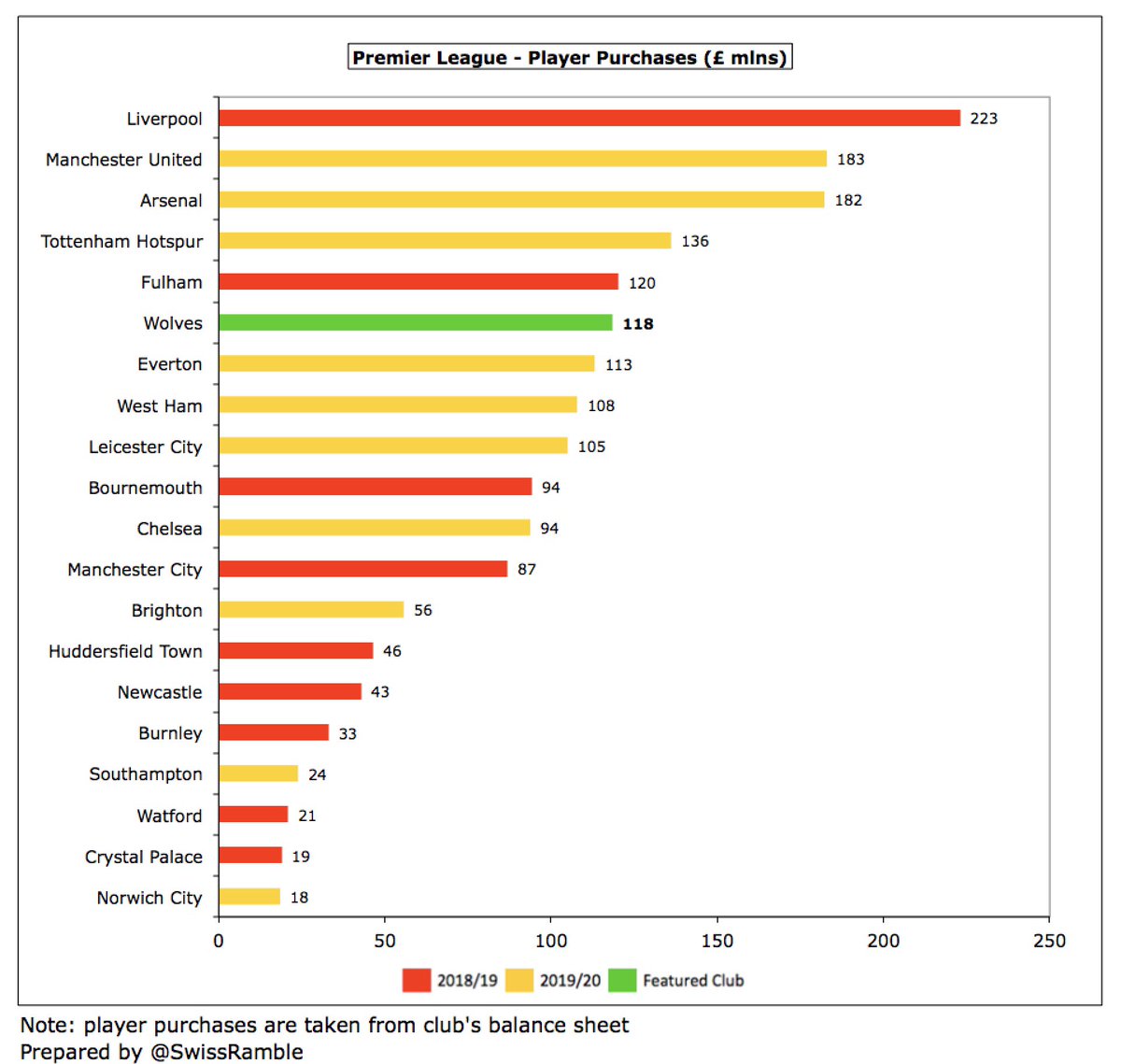

#WWFC splashed out £118m on players, including Jimenez, Cutrone, Podence, Neto, Dendoncker and Jordao, around the same as previous season’s £111m. One of the highest transfer market outlays in the Premier League, more than #EFC £113m, #WHUFC £108m, #LCFC £105m and #CFC £94m.

#WWFC transfer expenditure has surged since Fosun’s takeover, amounting to £287m in the last four years. The accounts note they have spent a further £83m after year-end, including Fabio from Porto, Semedo from Barcelona and Hoever from #LFC.

However, it is worth noting that #WWFC, like other promoted clubs, are playing catch-up in the Premier League. Their £180m gross spend in the five years up to 2019 was one of the lowest of the clubs in the top tier, miles behind the likes of #MCFC, #CFC and MUFC (nearly £900m).

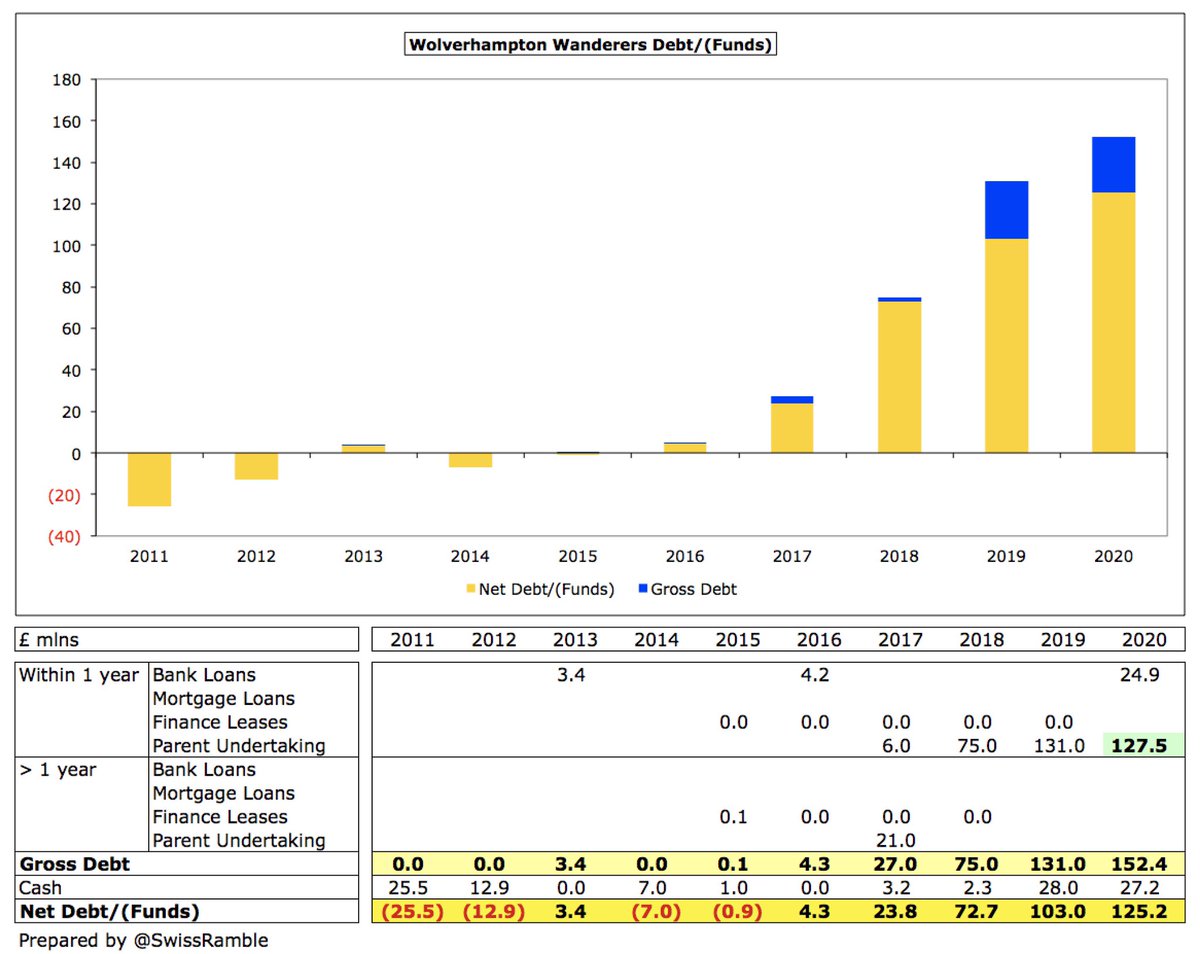

#WWFC debt rose £21m from £131m to £152m, comprising £127m owed to Fosun interest-free with no fixed repayment date and a new £25m bank loan repayable over 3 years at 4.485%. Only four years ago the debt was just £4m.

Since these accounts were finalised, #WWFC increased financing facilities from £50m to £75m, comprising £60m term loan and £15m revolving credit facility to “meet working capital requirements”. Repayable earlier if club relegated from Premier League.

#WWFC debt of £152m is 7th largest in the Premier League, though far below #THFC £831m (stadium), #MUFC £526m (Glazer’s leveraged buy-out) and #AFC £218m (stadium). #EFC £409m and #BHAFC £306m debt is very largely in the form of “friendly” owner loans.

Although #WWFC debt is on the high side, it is not a major issue, so long as Fosun continue to provide support. That said, interest payment on external loans increased from £103k to £4.8m, one of the highest in the Premier League.

#WWFC transfer debt almost doubled from £56m to £101m (only £5m in 2016), so the player purchases have been partly on credit. This is no different from other clubs, though Wolves have one of the highest payables in the PL. Net balance £84m after considering £17m receivables.

Despite the £45m operating loss, #WWFC generated £87m operating cash flow (after adding back £55m amortisation & depreciation plus £77m working capital movements), but then spent net £104m on players, £5m capex and £5m interest. This was funded by £25m additional loans.

Since Fosun bought the club, #WWFC had £248m available with £131m owner funding, £92m from operations and £25m external loans. Most of this (£193m) has been spent on players (net) with £19m going on infrastructure, £5m interest and the remainder increasing cash balance by £31m.

#WWFC cash balance fell £1m to £27m, which is mid-table in the Premier League. However, for some perspective this is a lot less than #THFC £226m (boosted by £175m COVID loan) and #AFC £110m.

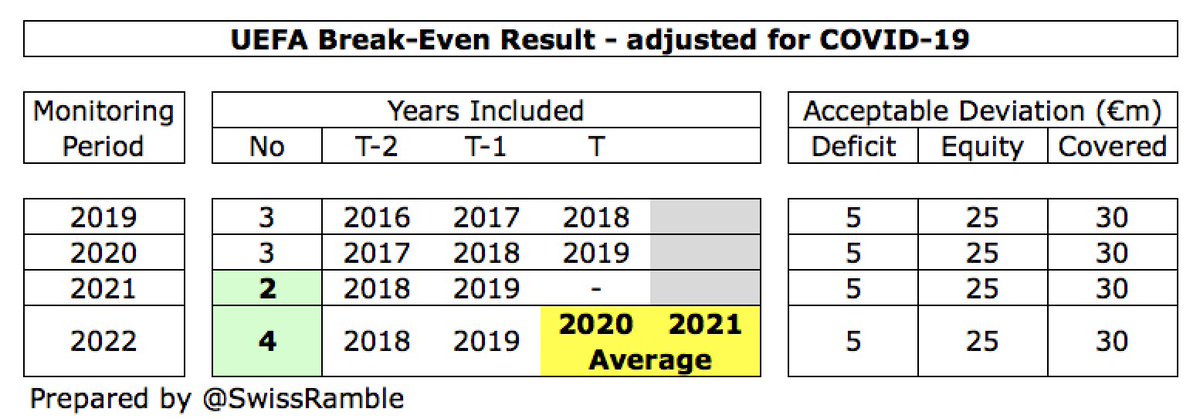

After failing to meet UEFA’s FFP targets, #WWFC were given some sanctions as part of a settlement agreement for 2020/21 and 2021/22, including a small €600k fine and break-even targets: €30m for 2019/20; aggregate within acceptable deviation for 3 years up to 2021.

However, despite their large 2019/20 loss, #WWFC should still be fine with FFP, as UEFA changed the rules to “neutralise the adverse impact of the COVID-19 pandemic by allowing clubs to adjust the break-even calculation for revenue shortfalls reported in 2020 and 2021.”

#WWFC have come a long way under Fosun, but are still reliant on their owners’ support. Their 2019/20 loss is undoubtedly high, but is by no means the worst in the Premier League in this period. In fact, they would have reported a decent profit without the impact of the pandemic.

• • •

Missing some Tweet in this thread? You can try to

force a refresh