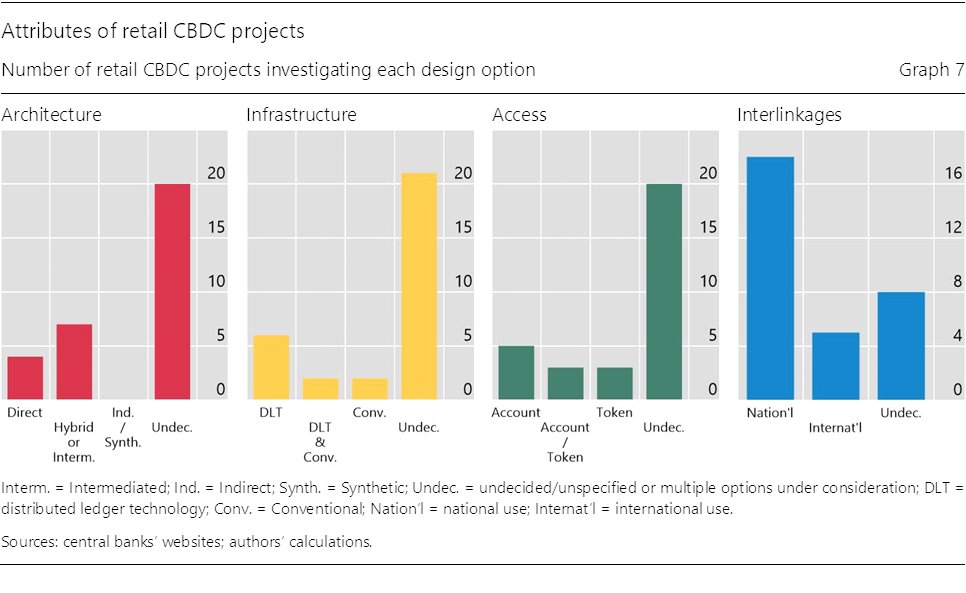

The fundamental design choice for a #CBDC is the architecture: what is the operational role of the central bank and the private sector?

ideas.repec.org/p/bis/biswps/9…

In the “Direct” model, the central bank takes a substantial operational role: the CBDC represents a… (1/6)

ideas.repec.org/p/bis/biswps/9…

In the “Direct” model, the central bank takes a substantial operational role: the CBDC represents a… (1/6)

direct claim on the central bank, which maintains retail accounts and executes all payments.

The “Hybrid” architecture we introduce is an intermediate solution. A CBDC represents a direct claim on the central bank. Private sector intermediaries handle payments, but…(2/6)

The “Hybrid” architecture we introduce is an intermediate solution. A CBDC represents a direct claim on the central bank. Private sector intermediaries handle payments, but…(2/6)

the central bank retains a copy of all retail CBDC holdings. This allows it to transfer retail CBDC holdings from one PSP to another in the event of a technical failure.

Some central banks might shy away from running a record of all retail data,…(3/6)

Some central banks might shy away from running a record of all retail data,…(3/6)

for example due to issues with privacy and data security. A variant is “intermediated” architecture, one in which the central bank records wholesale balances only.

Last, there is also an alternative to CBDC, fully backed payment accounts. In this… (4/6)

Last, there is also an alternative to CBDC, fully backed payment accounts. In this… (4/6)

“Indirect” (or "Synthetic"), the consumers' claim is on an intermediary, with the central bank keeping track only of wholesale accounts. Because households do not own central bank money, this design is not a CBDC.

For a discussion of… (5/6)

For a discussion of… (5/6)

the respective advantages and disadvantages, see: ideas.repec.org/p/bis/biswps/9…. (6/6)

• • •

Missing some Tweet in this thread? You can try to

force a refresh