1/ This is a thread on concerns I have with #ESG investing and the role of #markets in a functional, #capitalist #democracy. Warning: it’s long and nothing in here is necessarily original on its own, but I wanted to tie together some thoughts.

2/ At the outset, I want to make clear that the following is my analysis, not my firm’s. If ESG factors matter to you, by all means invest accordingly. I also care about environmental, social and governance issues. My guess is almost everyone does to varying degrees.

3/ Additionally, over the last 5+ years I have invested in firms benefitting from cost declines in renewable power, advised clients to do so and at one point was trying to raise an energy transition fund.

4/ This is a short way of saying I am neither uninformed nor an anti-environmentalist by any stretch of the imagination. But my work was based on fundamental research and – at the time – compelling valuations, rather than an overarching policy preference.

5/ As I hope I make clear below, my concerns aren’t so much with specific ESG priorities, but rather the top-down and opaque imposition of these factors into the broader investing process. And with that, let’s begin…

6/ I’m an investor with a contrarian streak. My approach is to figure out where markets may have materially mispriced something and then to take calculated risks that would benefit from catalysts bringing a return to rationality.

7/ Most of the time this is hard because markets are rational and efficient. But as any investor knows, they are also prone to irrational extremes, as well as inefficiencies often driven by technical factors (like liquidity).

press.princeton.edu/books/paperbac…

press.princeton.edu/books/paperbac…

8/ The reason markets are usually rational and efficient is because the wisdom of the crowd is incorporated in prices. And the crowd is often more accurate and insightful than any one investor – especially over the long-term.

amazon.com/Wisdom-Crowds-…

amazon.com/Wisdom-Crowds-…

9/That said, the crowd’s collective wisdom sometimes morphs into collective foolishness, especially during periods when seductive narratives and ample liquidity trump fundamentals.

press.princeton.edu/books/hardcove…

press.princeton.edu/books/hardcove…

10/ Most bouts of irrationality are harmless and entertaining (like $GME and $AMC), except for those holding when the music inevitably stops. Sometimes frenzies result in productive investments, though investors incur losses - like fiber optic cables during the '90s Tech Bubble.

11/ But as we all know, market frenzies can sometimes be destructive – especially when the harm reaches beyond the group of involved companies and investors. Like the 2007-8 US housing/financial crisis.

12/ Widespread financial misjudgments are bad for society, as they result in malinvestment, the destruction of capital and, unconscionably in the past few crises, socialized losses.

13/ When this happens, we often get intense public backlash to the market-based system. “Occupy Wall Street”, “Democratic Socialism”. This is unsurprising but unfortunate.

14/ Historically, the sensible deployment of capital and socialized gains are trademarks of a functional free-market economy. Promising firms attract investor funds, enabling productive innovations.

15/ Yes, in a capitalist system some will succeed more than others, but we all reap the benefits of new products and services. I’d go further and argue that ever since the inception of market-based economies, the human condition has been improving.

16/ You can basically trace a chart back of global progress in living conditions, for which I’ll use GDP as a rough proxy, with the beginning of financial market operations in Belgium and Amsterdam in the 16th and early 17th centuries.

17/ Market-based economies excel for many reasons. Three high-level ones: (1) Profit is a motivating factor that leads to hard work and innovation. But funding that work used to be arduous and personally risky. Ever heard of debtor’s prison?

18/ The advent of the “joint-stock company” enabled start-up risks and potential profits/losses to be spread across investors – allowing entrepreneurs to raise funds for ventures without assuming personal liability.

amazon.com/Ascent-Money-F…

amazon.com/Ascent-Money-F…

19/ (2) Capital allocation decisions are decentralized: The wisdom of many investors – motivated by profit and prudence – is usually superior to the subjective decisions of state or central planners.

20/ Anyone who doesn’t get this needs to revisit the last 100 years of history.

21/ (3) The market signal: Let’s say a company develops a successful new product/service and gets rewarded by investors. Businesses respond to the market signal, iterating and competing. Investors and companies can redeploy profits into further innovations.

22/ This create a virtuous cycle of wealth creation, improvements in living standards and economic progress.

23/ Again, markets aren’t always right. My wife’s claims to the contrary, no one is. But by decentralizing decisions and enabling the input of the masses, free markets have a track record of producing beneficial results for investors and society over time.

24/ My fear is that we are now in the early stages of a detrimental shift: from a dynamic free market economy to an inefficient, centrally planned one. Where investors’ collective wisdom is being replaced by the questionable preferences of an elite few.

This brings us to #ESG

This brings us to #ESG

25/ Let’s start with a seemingly simple question: what would you think makes more sense to overweight in an #ESG fund? (A) Well-governed firms whose products provide basic sustenance to billions the world over?

26/ Or (B) firms with dual class share structures, whose services are addictive and eroding public discourse and trust in democracies, and who have repeatedly recoiled at the idea of working with Western governments? Surprisingly, or maybe not… B wins.

27/ In the largest #ESG EFT, the iShares ESG Aware MSCI USA ETF $ESGU, Facebook $FB and Alphabet $GOOGL make up about 6% while Exxon $XOM and Chevron $CVX combine for 1%.

28/ Apple $AAPL is close to another 6% of $ESGU despite kowtowing to China’s censors and sourcing products from suppliers with potentially suspect labor practices.

29/ In Vanguard’s ESG U.S. Stock ETF $ESGV, the total weighting of conventional #energy is 0%. Likewise in the largest active ESG active mutual fund, the $29b Parnassus Core Equity Fund. Similar examples are easy to come by.

30/ Let’s be honest. #ESG as implemented is more like EEESG. But who’s to say ESG factors should prioritize environmental considerations over all others? How are ESG factors even balanced?

31/ Unfortunately, this is not straightforward. Below is part of the ESG evaluation rubric from MSCI, which manages the underlying ESG Index tracked by $ESGU. As a former lawyer, I give these charts and the accompanying document an A for obfuscation.

msci.com/documents/1296…

msci.com/documents/1296…

32/ Unlike GAAP accounting, ESG reporting is not standardized. Despite ongoing efforts from groups like PRI, my belief is that in finance, when you move outside the realm of numbers, you quickly move into the realm of qualitative and subjective judgments. unpri.org

33/ I’m not the only one to come to this conclusion. This is what BlackRock’s former CIO for Sustainable Investing – Tariq Fancy – had to say recently in a scathing essay on #ESG:

34/ "Unfortunately, there’s no clear definition of what [ESG] means — and much of it is believed to be a surface-level, box-ticking compliance activity."

medium.com/@sosofancy/the…

medium.com/@sosofancy/the…

35/ While investing is a serious analytical business, it’s not a hard science where you can quantify things that are subjective by nature. But qualitative judgments are fine. I make them all the time when investing.

36/ And if you are choosing to invest in an ESG fund, you are making some qualitative judgment about your priorities. Which is great – you should, it’s your money! One’s personal beliefs should align with their portfolio – you have to be able to sleep well at night.

37/ Unlike many allocators, at least the Parnassus fund I mentioned is transparent about how they screen firms: The fund excludes stocks “that derive 10% or more of their revenue from alcohol, fossil fuels, gambling, nuclear power, tobacco or weapons.”

parnassus.com/esg/introducti…

parnassus.com/esg/introducti…

38/ As “Parnassus believes that these companies … don’t provide a net-positive contribution to society.” I disagree about nuclear and fossil fuels, but no one is forcing me or anyone else to invest. So if no one is forced to invest in ESG funds, why is any of this problematic?

39/ Well, for one my suspicion is a lot of money flows into ESG products thanks to their marketing appeal, more than a careful consideration of their actual impact. But again, investors should be free to choose how and what they invest in.

40/ Second and more concerning is the implementation of ESG principles in non-ESG products. Investors managing over $80 trillion in assets have signed up to the UN supported Principles for Responsible Investment initiative.

unpri.org/signatories/si…

unpri.org/signatories/si…

41/ This includes BlackRock, Vanguard and State Street, as well as many endowments and pensions. This is seemingly good, and PRI’s aims are noble.

42/ But when we have most of the world’s large asset managers agreeing to integrate subjective ESG factors into firmwide investment analysis processes, we – as a society – may get some unintended results.

cfainstitute.org/-/media/docume…

cfainstitute.org/-/media/docume…

43/ The most notable unintended results (though I’m sure some would say intended) are in the commodities and heavy industrials complex given the almost universal consensus of ESG adherents that carbon emissions are an unforgiveable sin.

44/ Let’s put aside the question of the fiduciary duty asset managers have to their clients. For now, suffice to say that prioritizing ESG factors may not always be consistent with promoting client financial interests. Especially for those invested in non-ESG products.

45/ And let’s also put aside questions of whether major ESG proponents actually lead the kind of low carbon lifestyles it would take to make a serious near-term dent in emissions. My hope is that many do, but my guess is that many don’t.

https://twitter.com/StuLoren/status/1445783166246137856?s=20

46/ I’m going to highlight #BlackRock here because its CEO Larry Fink is the most vocal and impactful large investor on #ESG issues, particularly related to #climate.

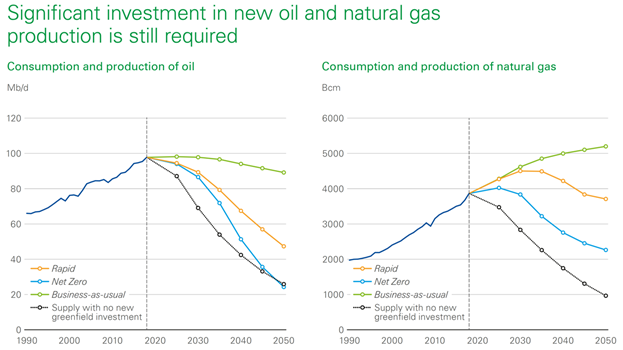

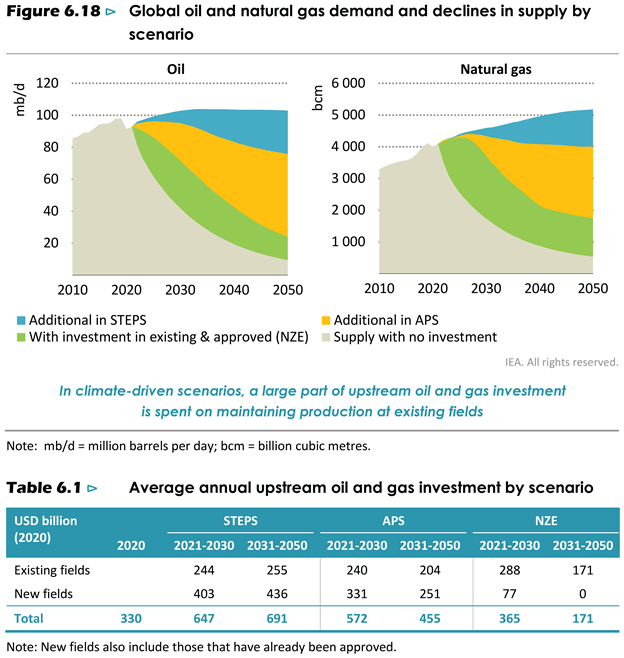

47/ In his 2020 letter to the CEO community, Fink wrote at length about “climate risk” and accelerating the path to a “net zero economy.”

blackrock.com/corporate/inve…

blackrock.com/corporate/inve…

48/ Even if well-intentioned and sensible, do we really want a handful of senior management at BlackRock and the world’s largest asset allocators pushing for such impactful policy-related changes? Isn’t this the role of government?

49/ By virtue of managing tens of trillions of dollars in investor capital, BlackRock and other large PRI signatories have an outsized voice in company affairs. They clearly view environmental risks as a long-term investment risk and are engaging companies accordingly.

50/ In Fink’s words again: “Investors are increasingly... recognizing that climate risk is investment risk... Our investment conviction is that sustainability- and climate-integrated portfolios can provide better risk-adjusted returns to investors.”

blackrock.com/us/individual/…

blackrock.com/us/individual/…

51/ Just as a quick aside, I think it’s a faulty hindsight narrative to say that climate risks are investment risks. Energy, industrials and other cyclical firms performed poorly in the last decade not because of their climate attributes.

52/ Rather, we were in a low growth, low interest rate environment with oversupplied commodity markets. This type of macro backdrop favors growth and duration over value and cyclicals.

https://twitter.com/StuLoren/status/1438517277788307459?s=20

53/ And climate risk leading to investment risk has at least been poor foresight to date. This year, firms with higher carbon emissions have been market leaders.

54/ As I’ve covered in prior threads, I expect energy and cyclical sector outperformance to continue due to an inflationary macroeconomic regime and demand for commodities outstripping supply.

https://twitter.com/StuLoren/status/1438509174065799169?s=20

55/ So I wonder how popular will $ESG funds continue to be if the holdings are green, but the returns are red?

56/ Anyways, as the ESG voices like Fink’s have become more prominent and impactful, it’s fair to ask some critical questions. What have we got as a result of the call for curtailing emissions? A loud signal to energy and materials industry leaders to reign in capex.

57/ What have we got as a result of large-scale managers either divesting from energy and materials firms or supporting activist board engagement pushing for lower carbon business transformations? A higher cost of capital for industry operators.

nytimes.com/2021/06/09/bus…

nytimes.com/2021/06/09/bus…

58/ Unfortunately, by raising these industries’ cost of capital and decreasing their willingness to invest in new production, ESG-minded asset managers are indirectly increasing the cost of living for many in society who can least afford it. An "ESG consumption tax."

59/ Yes, I'm aware that lower commodity prices and investors pushing for greater capital discipline have contributed to the emerging commodities deficit, but ESG priorities have surely also helped get us here.

economist.com/leaders/2021/1…

economist.com/leaders/2021/1…

60/ Based on ESG portfolio constructs and asset manager comments/actions, it sure seems like the movement is prioritizing environmental considerations at the expense of societal and governance ones.

61/ But who is to say that emissions reductions to benefit future generations are a more important priority than improving the quality of life for current ones? I have a son and care deeply about his future, but I can’t put myself in the shoes of someone in poverty today.

62/ According to the World Bank, 43% of the global population lives on less than $5.50 a day and 9.3% on less than $1.90.

blogs.worldbank.org/opendata/march…

blogs.worldbank.org/opendata/march…

63/ As reported a few days ago in the WSJ, 40% of Americans are experiencing financial distress, and 19% of households have lost all savings since Covid.

wsj.com/articles/close…

wsj.com/articles/close…

64/ Per the World Bank and BP, 13% of the world population (940m people) lacks electricity access.

ourworldindata.org/energy-access#…

ourworldindata.org/energy-access#…

65/ As seen in the below charts, the differences in electricity and energy consumption between people living in developed market countries vs emerging market ones are orders of magnitude.

66/ Again, who is to say that access to affordable energy and poverty alleviation aren’t basic human rights that also warrant ESG consideration? Is it ideal that ESG priorities have contributed to the rise in daily living costs and a potential future energy shortfall?

67/ Both BP and @IEA in their widely followed energy outlook reports predict that even in a rapid transition scenario, the world will be short on energy supplies if we do not ramp up investment in fossil fuel production. Especially over the next decade.

68/ I think there’s a reasonable argument that the environmental benefits of ESG shareholder activism are negated by the societal costs of declining resources affordability. But I also don’t know how any one investor or firm can truly weigh these factors.

69/ Perhaps the climate-at-all-costs course is worth embarking on. But should it be the BlackRocks of the world moving us in this direction? Such impactful decisions involving complicated tradeoffs are the responsibilities and moral burdens of global governments.

70/ And what if BlackRock’s and its peers’ approach is wrong? In their view, fiduciary duty and ESG priorities are one in the same, under the logic that what’s good for all stakeholders per the ESG framework is good for business and thus long-term profitability.

71/ In Larry Fink’s 2020 letter to clients, he wrote: “Investment stewardship plays a key role in how we fulfill our fiduciary duty to our clients..."

blackrock.com/corporate/inve…

blackrock.com/corporate/inve…

72/ "We engage with companies regarding governance and sustainable business practices that we believe promote durable, long-term profitability.”

73/ Again, who’s to say BlackRock is weighing these factors right or wrong? If the push for climate goals results in higher energy and materials costs, which hits consumers and businesses, how is that net better for society, let alone the economy or long-term profitability?

74/ I think it's notable that prior to the #ESG rhetoric shifting into its current high gear, U.S. #emissions were actually falling drastically thanks to free-market dynamics. Largely due to cheap natural gas supplanting coal in the power sector.

eia.gov/todayinenergy/…

eia.gov/todayinenergy/…

75/ And there were geopolitical benefits as well to the U.S. shale revolution (though I’m not sure where #nationalsecurity falls in the ESG framework…).

https://twitter.com/StuLoren/status/1445783106162671617?s=20

76/ The free market was also working with wind, solar and battery storage cost declines. See the below chart from Lazard’s widely followed Levelized Cost of Energy Report.

lazard.com/perspective/le…

lazard.com/perspective/le…

77/ For those truly concerned about the climate, #nuclear power has been viable for over half a century, producing reliable, reasonably priced, emissions free baseload power. You’d think environmentally conscious investors would be flocking to support it…

78/ Rather than asset managers imposing restraints on business operations, I think we should be focusing on free-market technology solutions. Over time, the most reliable and cheapest sources of energy will ultimately prevail.

79/ And if trends continue, there’s no reason to believe renewables and nuclear won’t play a major role.

80/ But we talk about the “energy transition” because we can’t have a top-down “energy replacement” without resulting in some major, disruptive setbacks of the like we are experiencing today.

81/ If free markets are ultimately considered to be an insufficient means to achieve carbon reduction, then governments should perhaps focus on implementing policies such as carbon taxes and more thoughtful and politically viable energy market reforms.

82/ I worry about the consequences of politically unaccountable asset managers working to impose societal-wide changes. At least governments can be voted out if their policies fail or are unpopular. To whom are these asset managers accountable?

83/ If the climate push by BlackRock and peers leads to higher costs for consumers and businesses without discernable benefits (after all China is ramping up coal usage again) the blowback may undermine the initial climate transition goals and our political-economy itself.

84/ Tying this to the beginning. Recall the three high-level tenets of a free-market economy: 1) profit motivation; 2) decentralized decision making; and 3) the market signal.

85/ The ESG movement as currently pursued by large asset managers threatens all three.

86/ 1) ESG priorities are supplanting profit; 2) decision making is becoming centralized across large asset managers who apply the same ESG pressures to their holdings; and 3) the market signal is getting muddied by considerations outside business fundamentals.

87/ Now, as a contrarian investor, this has made the market rife with opportunities over the last year, as it has increased the level of inefficiency and irrationality. But I’m not that excited about the broader implications.

88/ If the ESG movement ultimately results in bad outcomes for society (like sharply rising energy and commodities costs, along with supply chain mayhem) it will further erode confidence in our market-based economy.

89/ As someone who strongly believes in the benefits of a free-market economy and has an appreciation for history, I’m worried about the potential for the ESG push to undermine the viability of our form of markets and government.

90/ I’m of the view that economics explains much of history. People who are content don't become rebels. Countries at a sufficient level of wellbeing rarely start wars. If ESG contributes to key resource shortages, it is creating a less stable world.

https://twitter.com/StuLoren/status/1438509174065799169?s=20

91/ If the free-market system is thought to have morphed into a ESG-driven market system that leads to a decline in living standards, the next big blowback won’t be like “Occupy Wall Street” or the “Democratic Socialism” movements, it will #populism.

92/ Pick up a history book. Instability and lower living standards almost always lead to a rise in #populism. If Western Europe wasn’t immune to this in the 20th century, why should anyone think the US is in the 21st? This history is less than a lifetime ago.

93/ In turn, populism almost always leads to worse conditions than its leaders and supporters hoped to fix in the first place. As populist leaders are long on rhetoric but short on actual policy solutions.

94/ Additionally, populism almost always results in free market interference. Whatever is to be gained in the short term by centrally planned decisions/policies quickly erodes, leaving everyone worse off for the long-term.

95/ It turns out that governing and balancing competing interests is hard. Much harder than a three-letter slogan… Democracies and free markets usually get things right over time. I hope we don’t deviate too much from an admittedly bumpy path, but one with a proven track record.

96/ If you’re still reading… you can probably gather I’m worried about the convergence of trends I’ve covered above, so I wanted to throw out one potential solution. One I NEVER thought I’d be considering years ago.

97/ #Antitrust was not my favorite law school course. The topic is dry and as a free-market oriented guy, it’s just not something that I’m naturally all that excited about.

98/ My antitrust law professor was @elhauge - a great teacher, all around nice person and brilliant mind – who at least for me, brought some life to the otherwise dull antitrust party.

hls.harvard.edu/faculty/direct…

hls.harvard.edu/faculty/direct…

99/ In the years since I graduated, Prof Elhauge has become a leader in scholarship critically examining the anticompetitive impact of horizontal share ownership by the likes of BlackRock, Vanguard and State Street. With the rise of ETFs and indexing, this is a growing issue.

100/ In @elhauge's words now: “Horizontal shareholding poses the greatest anticompetitive threat of our time, mainly because it is the one anticompetitive problem we are doing nothing about.”

promarket.org/2019/01/07/gre…

promarket.org/2019/01/07/gre…

101/ "The leading shareholders of large competing firms often comprise the same set of institutional investors. Common sense and economic theory indicates that firms with the same leading shareholders are less likely to compete vigorously against each other."

102/ "What can antitrust law do about horizontal shareholding? Quite a lot, in fact. The Clayton Act bans any stock acquisition that may substantially lessen competition, and Supreme Court case law makes clear that continuing to hold stock is an “acquisition.”"

103/ "Even critics acknowledge that the plain meaning of the Clayton Act would ban horizontal shareholding—if they were convinced that it empirically had anticompetitive effects."

104/ For a more detailed analysis on problems with horizontal ownership and enforcement remedies under antitrust law see @elhauge's Harvard Business Law Review Article: How Horizontal Shareholding Harms Our Economy - And Why Antitrust Law Can Fix It.

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

105/ In short, per @FTC guidance, rising prices can evidence anticompetitive practices: “It is illegal for businesses to act together in ways that can limit competition, lead to higher prices, or hinder other businesses from entering the market.”

ftc.gov/enforcement/an…

ftc.gov/enforcement/an…

106/ If BlackRock and other large asset managers are imposing ESG priorities onto energy and materials firms, which results in lower output and investment in future production, and in turn higher consumer prices, this would seemingly call for antitrust review.

107/ For what it’s worth, BlackRock, Vanguard and State Street together own over 20% of Exxon $XOM and Chevron $CVX. The three own equal or more amounts of shale firms like Pioneer $PXD, Diamondback $FANG and EOG $EOG.

108/ Perhaps further scrutiny of the effects of overlapping/horizontal share ownership are worthy of a antitrust challenge by aggrieved consumers. Courts might be receptive to examining such a novel legal argument.

109/ All I can say is it’s a lot more interesting and compelling of an antitrust theory to me than the so-called “Hipster Antitrust Movement,” which is seeking to punish popular companies that have helped improve consumer welfare, in part by lowering prices!

110/ In sum: if you care about #ESG issues I sincerely hope you invest and live your life accordingly. I mean it when I say that that’s great. Many ESG issues matter to me as well.

111/ But if you care about market structure and viability issues, the implementation of ESG in its current form should be a concern.

112/112 If you made it all the way through all this, thanks for your time and interest. And have a field day with the comments and critiques! Always open to hearing out arguments why I am wrong.

• • •

Missing some Tweet in this thread? You can try to

force a refresh