On Wednesday, we got a CPI print of 7% over the duration of a year. Fastest since 1982! Surely, everybody can see, that #inflation is here to stay!?

NO!

WHY?

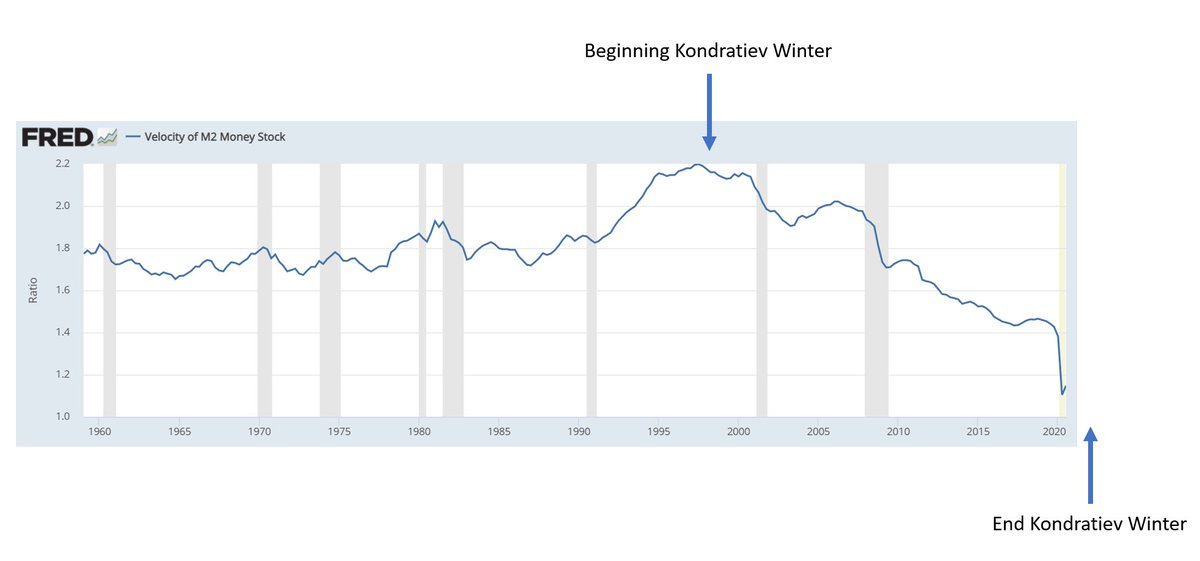

Because of the real gauges of inflation which tells us, that current inflation is due to Supply and Demand issues!

NO!

WHY?

Because of the real gauges of inflation which tells us, that current inflation is due to Supply and Demand issues!

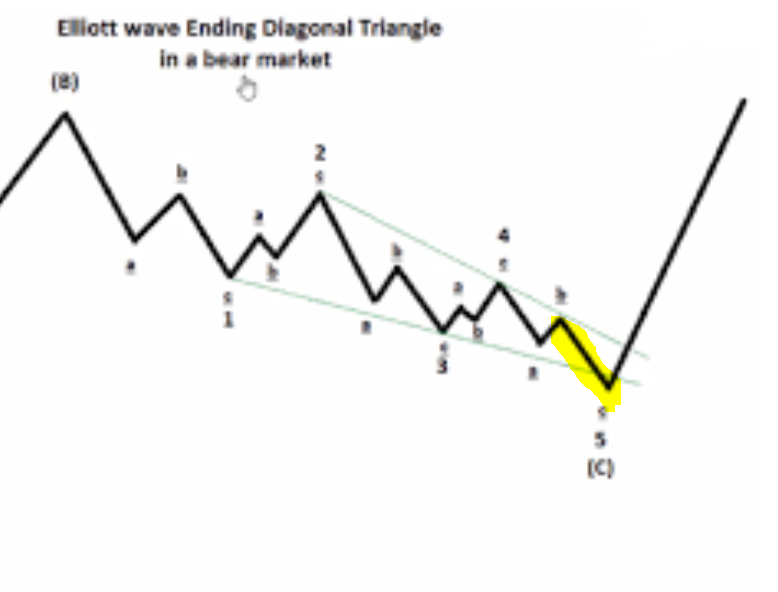

Gold Miners will soar, when REAL ECONOMIC INFLATION is here. For now, they are dead in the water - which is 100% in line with Elliott Wave predictions. "Wave C" is unfolding in 5 waves down. As surplus demand is being flushed from the system, Deflation will reemerge

Beautiful chart for GDX. Observe top in 2011 and nice decline into wave A. Then a clear ABC-correction into top in 2020, before Miners again have started a decline. Observe top in 2020! Right at 61.8% fib. Beautiful! 😉

Decline in wave C should take us just below bottom from 2015

Decline in wave C should take us just below bottom from 2015

So WHY should we see this decline? Because REAL INFLATION is not here. We see abnormality as S-D is out of sync pushing temp. inflation up. This will solve itself and meanwhile #Fed is now getting scared and hawkish! These 2 combined effects will cause MAJOR DEFLATIONARY BUST

So steer clear of the inflation chit-chat - and observe the charts. We will see a major deflationary bust, as #Fed will hugely overreact due to the current inflation spike. This MONETARY POLICY MISTAKE, WILL CRUSH MARKETS. Take care!!

But.... Not yet! We are not at the Bust Top yet! We are about to see markets take off in another push higher into a epic top in this EVERYTHING BUBBLE!

Emerging Markets (as example) give us this perspective!

Stay tuned on TheZebergReport.com

Emerging Markets (as example) give us this perspective!

Stay tuned on TheZebergReport.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh