@RaoulGMI Good Morning! You asked what is happening to #Gold and #Silver. This is my take - a summary of the governing Thesis on TheZebergReport.com for a long time! Hope you can use the input! 🙋♂️🙂

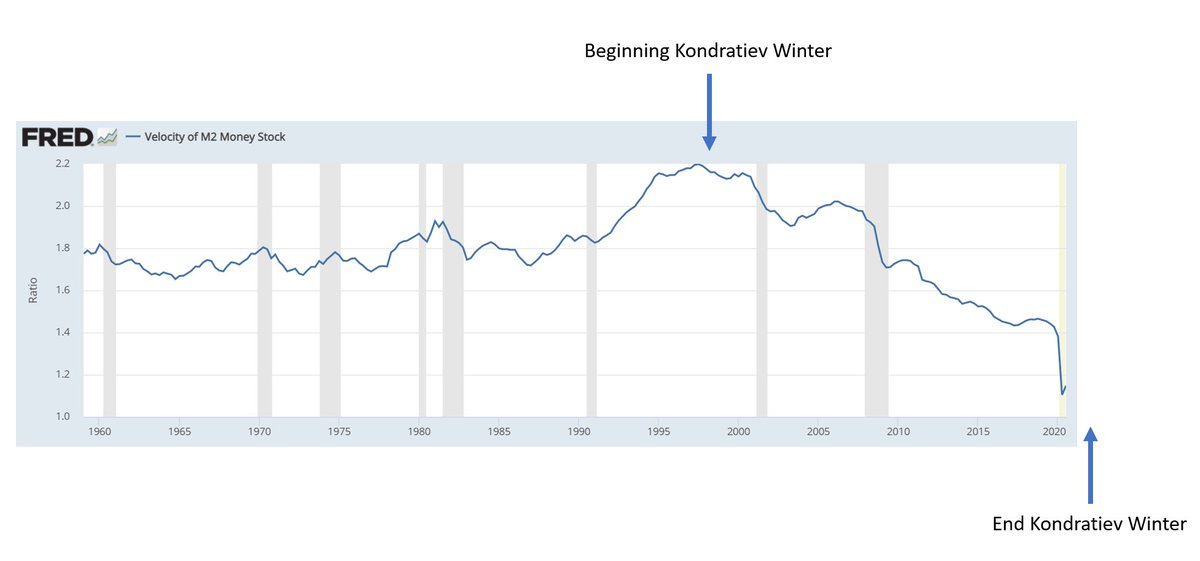

Since ~2000 we have been in Kondratiev's Winter. A period where GLOBAL DEBT causes low and falling growth rates. Central banks try to counter this by printing money (Monetary Stimulus). However, Deflationary forces from debt causes deflations to unfold - despite extreme measures

To the frustration of Central Banks, they cannot create inflation despite extreme money printing. They stimulate by infusing money into the system but cannot make the money circulate. Velocity drops dramatically. What they miss...You cannot solve a solvency problem with Liquidity

Despite Central banks efforts (especially since 2008), the above creates a DEFLATIONARY ENVIRONMENT! This can be observed across #COMMODITIES. Declining despite Money Printing...?! Now - nothing lasts forever.... and suddenly we will see the KETHCUP effect of their rogue actions

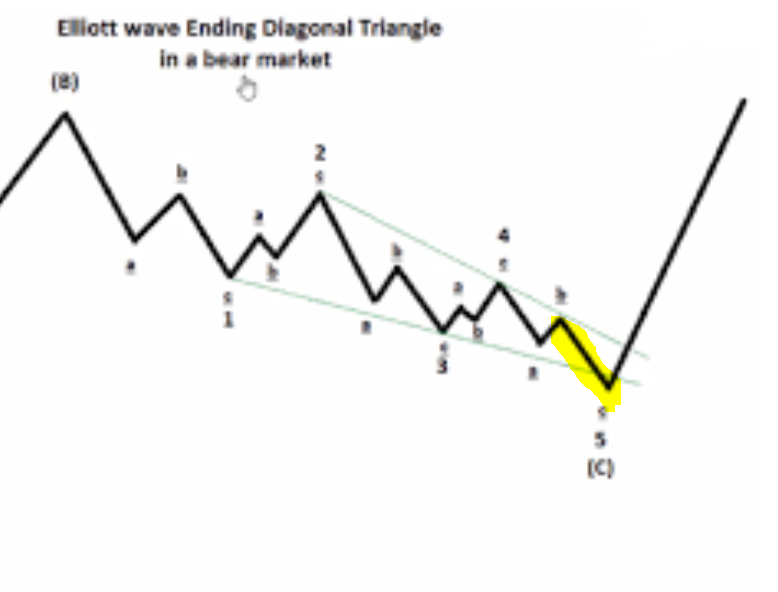

#Commodities give the major picture of where we are in the INFLATION-DEFLATION cycle! We are close to bottom (of Ending Diagonal) but not there yet! ONE MORE DEFLATIONARY BUST before MAJOR SECULAR BOTTOM! Why BUST....? Because of #Covid19 2nd wave!

The "Inflation" which QE has caused has been in #Equities. Asset Inflation! Here we are so close to a major top - which is exactly what we would expect if we are to see DEFLATION unfold. DEFLATION - where we have had INFLATION

Another indication of coming Deflation, is the #USD #DXY. Major picture gives us the BULL market since 2008. Bull Market since Money Printing started! The decline we have seen since March 2020 has been final wave C in wave 4. Major BULL RUN ahead of us.

And it seems like #DXY has just broken up - on short term charts!

Despite what we hear, #Gold does not like #Deflation - it is an INFLATION hedge. It does not like strong #USD. If we are to see strong USD and Deflation - our expectations must be, that Gold (and Silver) will perform badly!

How bad will #Gold and #Silver perform? This is where EW helps us. First we must understand, that break higher than 2011-level (for Gold) does not mean new major Bull. It is an EXPANDED FLAT correction for Gold. The CORRECTION of the CORRECTION moves higher than TOP

Applying this to Monthly chart for #Gold. Wave top B is likely in at ~2070 in August. We are now in the first phase of major decline - due to STRENGTHENING #USD and #DEFLATION ahead! EW gives us 1.27% to 1.61% of A which takes final wave C to 650-965 area during Deflationary Bust

Do we see other indications, that #Gold has been wrong - and that we have only been in BEAR MARKET RALLY? Yes - look to #Silver, #Platinum, #Miners etc. None have been supporting. In fact, they have been telling us, that it has only been bounce since 2015 -a wave B as EW tells us

So - back to your question... What is happening to #Gold? It has entered the "Bull Capitulation Phase" in final Wave C lower during #Deflationary Bust in final part of #Kondratiev Winter - while #USD is about to soar. Take care! All the best! Stay tuned on TheZebergReport.com

@threadreaderapp Unroll please 🙋♂️

• • •

Missing some Tweet in this thread? You can try to

force a refresh