Why do I think #Gold, #Bitcoin are about to tumble? Because of my cross-market-analyses approach with >100 charts pointing to a deflationary bust AND the Elliott Wave structures for Gold, Bitcoin and USD. Let's try investigate 1) Deflationary Thesis and 2) Elliott Wave-structures

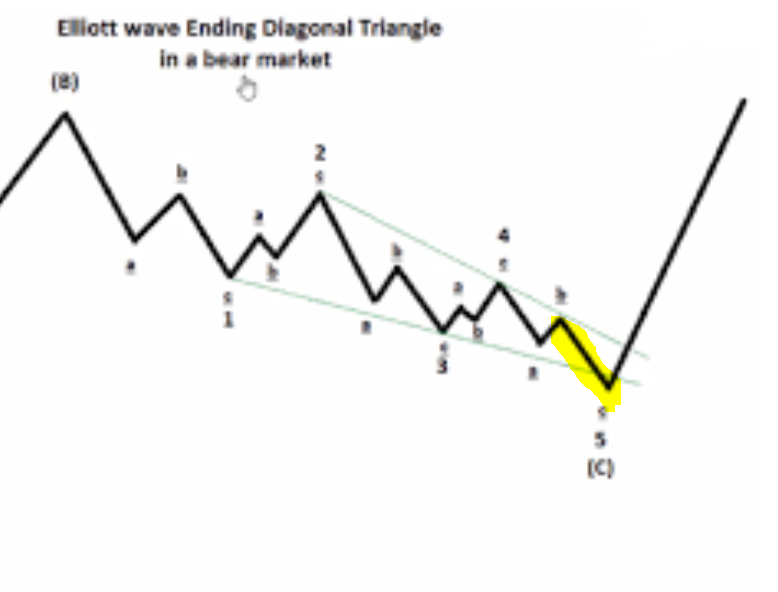

The Deflationary Thesis is due to the patterns shaping up in all commodities. Commodities drive inflation. First GSCI Commodity Index - a very clear Ending Diagonal Triangle (Descending Wedge). Calls for DEFLATIONARY BUST before MAJOR SECULAR BOTTOM. TheZebergReport.com

#Wheat which is part of #Commodities setting direction for Inflation. Same pattern! Descending Wedge. Calls for Deflationary Bust - before Major SECULAR BOTTOM. Deflation before New Inflationary Regime! TheZebergReport.com

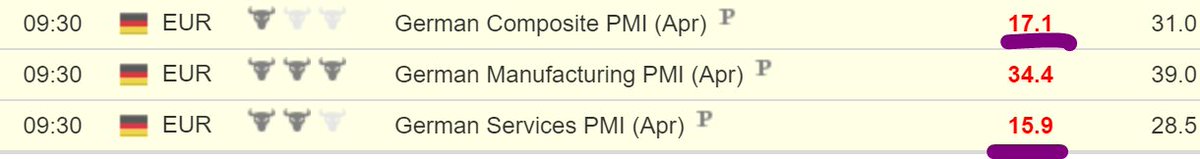

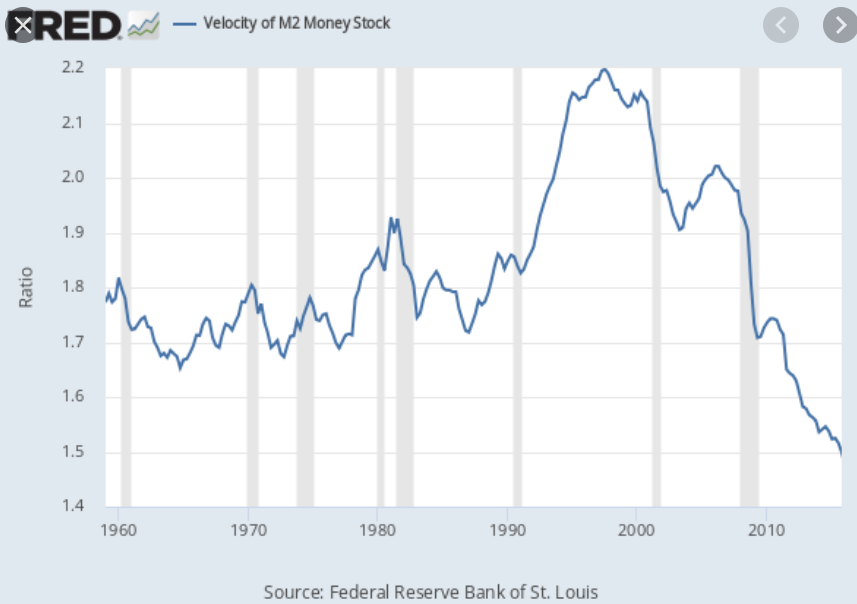

Same patterns over and over again in all #Commodities. But how can we have #DEFLATION when Fed is printing insane amounts of money? Because of VELOCITY OF MONEY. Circulation of money coming to halt due to ... well LOCKDOWNS! Velocity dropping like a stone TheZebergReport.com

So - deflationary Bust is very likely according to our thesis at TheZebergReport. Not for years - but likely for 2-4 months of quick developments just like in Feb-March 2020. Which assets did well during this period? Well - USD soared in few weeks! TheZebergReport.com

#Gold performed horrendously! #Silver ditto. This is understandable. When Deflations soars - #LIQUIDITY (#USD) is in severe demand and shortage. Gold and Silver provide an access to liquidity - but must be SOLD to get USD. TheZebergReport.com

So... if we are to see another #Deflationary Bust - likely due to Lockdowns - what are we to expect of #USD, #Bitcoin, #Gold, #Silver, #Equities? 🤔Well - our thesis at TheZebergReport.com is: UP, DOWN, DOWN, DOWN, DOWN! Question is only BY HOW MUCH! TheZebergReport.com

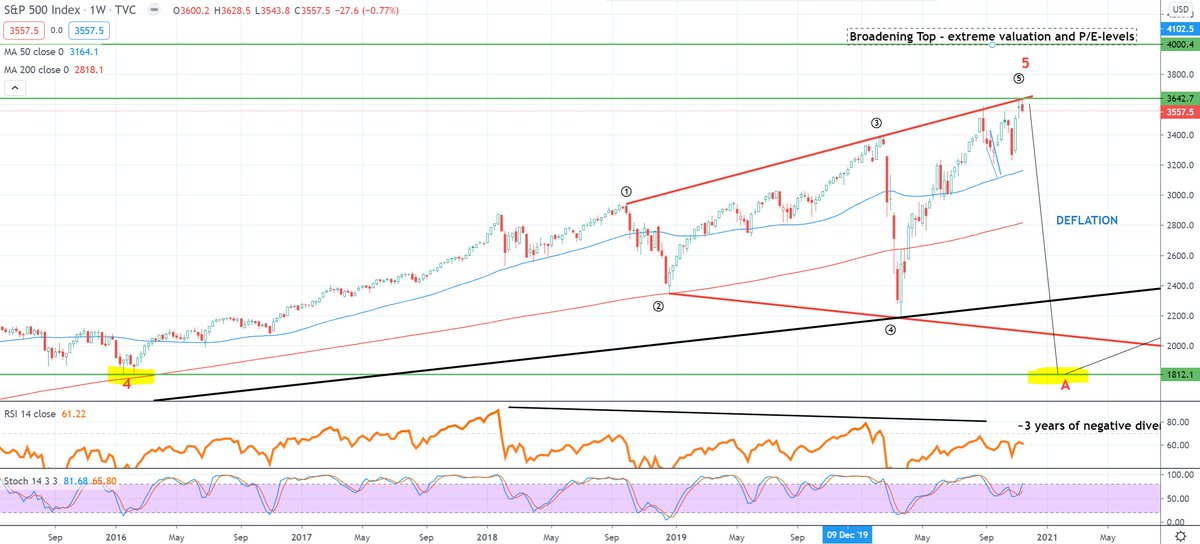

Now - this is where we zoom into the charts for the respective assets. First #Equities - defined by #SP500. We have MAJOR Broadening Top + extreme Valuation PE-levels. Elliott Wave gives us bottom of wave 4 as target ~1800. This is a major move! TheZebergReport.com

Now ONLY place we have seen inflation is in assets or equities. Is it unlikely, that assets will decline strongly if #Delfation is soars? ASSET DEFLATION?! Didn't we see the prelude of this already in Feb-March - the speed? We think this is very likely at TheZebergReport.com

So - #equities about to drop hard during Asset Deflation! Much harder than in Feb-March according to the Broadening Top pattern. But - surely #Gold will do better during deflation than #Equities which may see ~50% drop, right? TheZebergReport.com

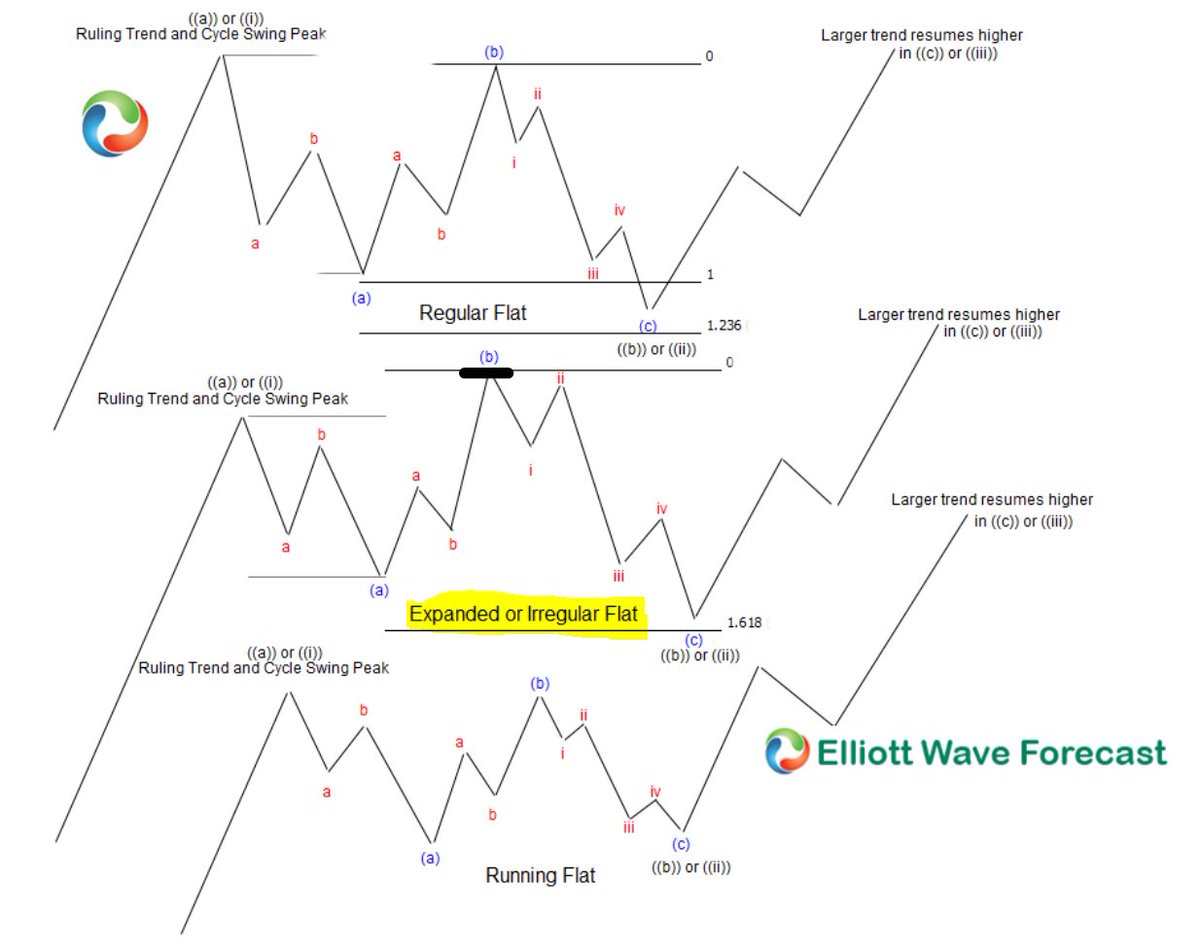

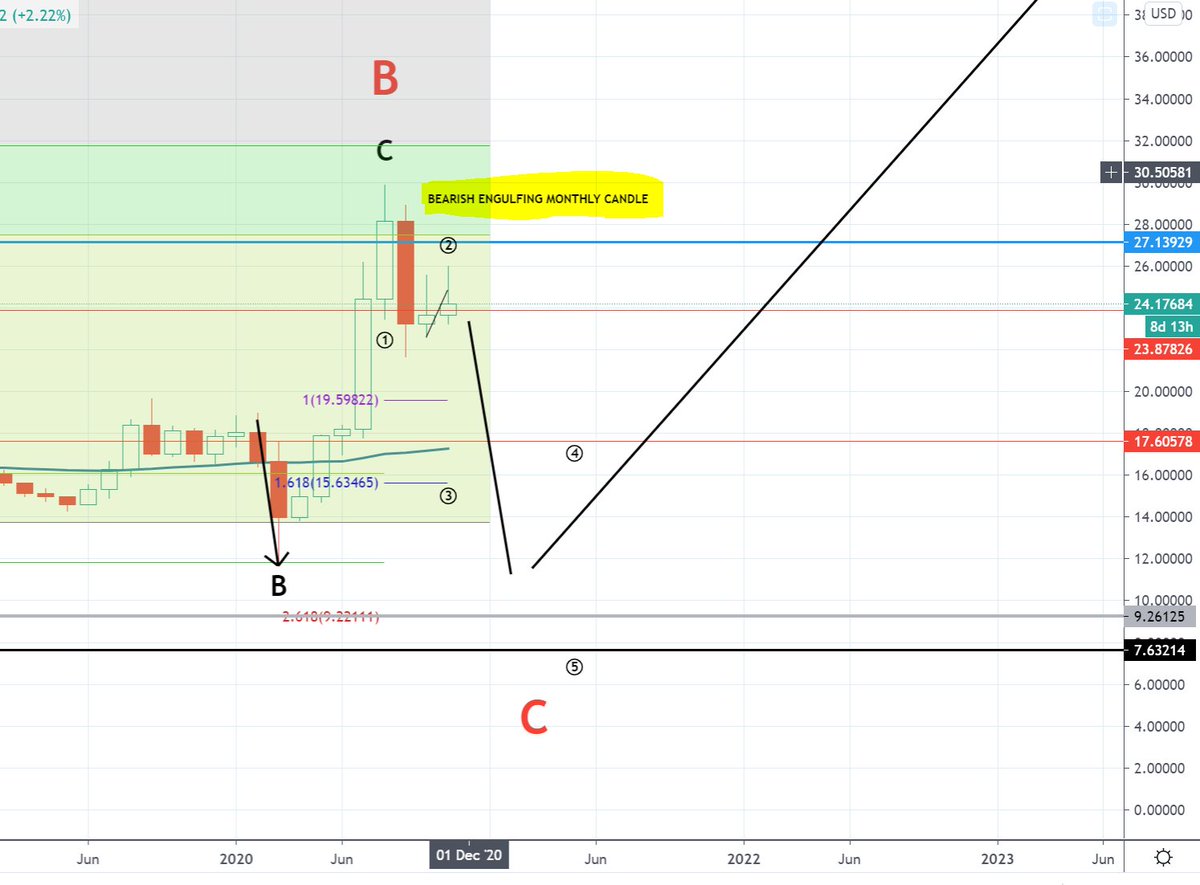

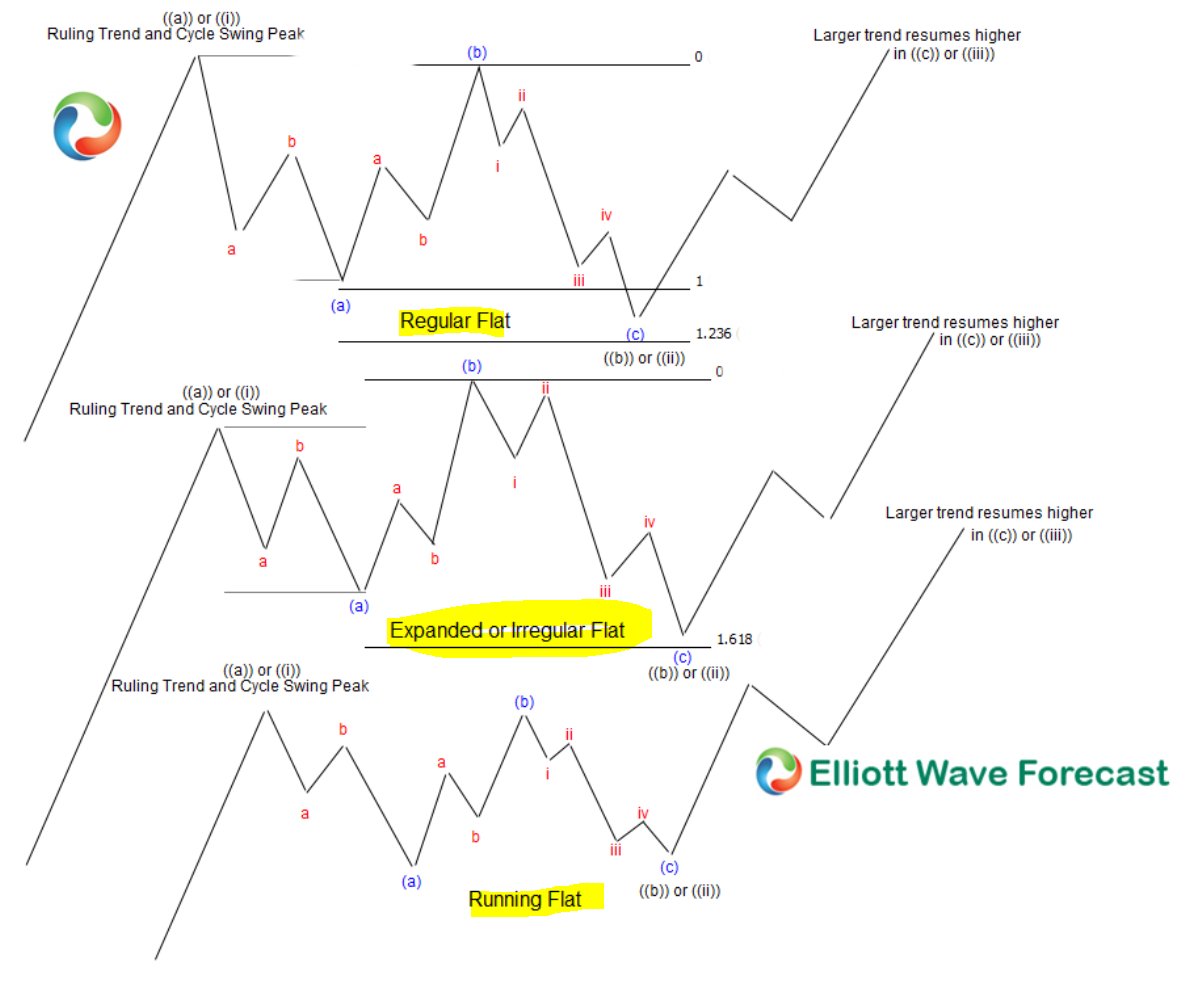

No #Gold will likely follow #Equities in strong move lower as in Feb-March! This is where we turn to Elliott Wave structures. Gold has rallied higher than 2011-top. But is it still in an EXPANDED OR IRREGULAR FLAT CORRECTION STRUCTURE. Major decline ahead! TheZebergReport.com

But #Gold is in a major BULL MARKET (or this is what I'm told🙃). Well tell that to #Silver, #Miners, #Platinum etc. All these have only been CORRECTING since 2015-bottom. Ex. Silver(below)has only retraced 38.2% of 2011-15 decline. Gold is only one above. TheZebergReport.com

Also - observe MAJOR Topping Patterns shaping up in both #Gold and #Silver. Are you really sure....that illiquid Asset Deflation cannot bring Gold and Silver down hard? We think it will at TheZebergReport.com

But #Bitcoin will do better. Will not be affected to same degree by deflation and it has disconnected from #Gold? Sorry - but this is gibberish!! Bitcoin dropped ~63% in a matter of WEEKS during first Deflation phase in Feb-March. NO REASON TO BELIEVE ANYTHING DIFFERENT THIS TIME

Remember the EW-structures? We are currently seeing final phases of either REGULAR, IRREGULAR OR RUNNING FLAT develop in #Bitcoin. #Lumber and #Rice (below) have provided the path for what we will see in Bitcoin as wave B is in. Strong decline! TheZebergReport.com

Really..... a strong decline in #Bitcoin during an ASSET DEFLATION event? Who would think so...? When it dropped ~63% during Asset Deflation in Feb-March 2020. How can "We expect Bitcoin to rally" to be the correct expectation?

So - back to beginning! 1) Why DEFLATION? Because of the structures in ALL Commodity charts! 2) Why #Equities, #Gold, #Silver, #Bitcoin down? Because that is what they do during Asset Deflation. AND THIS ASSET DEFLATION EVENT WILL BE THE BIG ONE! TheZebergReport.com

Stay tuned at TheZebergReport.com. Every week, we follow up on where we are in this major event. At bottom of Deflationary Bust, some FANTASTIC Buying Opportunities will present themselves! We will get subscribers on right side of DEFLATION - before new INFLATIONARY REGIME

That is all from this update! If you like these updates - then try out our subscription at TheZebergReport.com. You will be able to ask questions on the Live Show - and we will identify some FANTASTIC trades as #Deflation unfolds! Have a great Sunday!

#Bitcoin Bulls hope USD #DXY does not strengthen! Weaker USD - stronger Bitcoin. Stronger USD - weaker Bitcoin. Soaring USD - Crashing Bitcoin! USD to strengthen during Deflationary Bust! TheZebergReport.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh