*8.5% of vaccinated people in Pfizers #Covid study released today developed Autoimmune diseases.

Thread 🧵(1 of 5)

Thread 🧵(1 of 5)

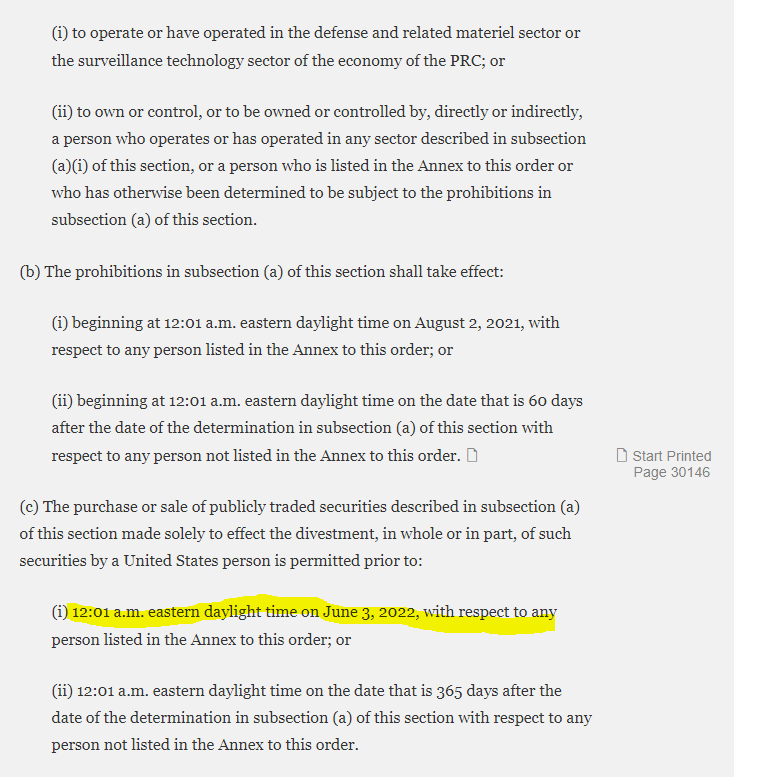

*4.7% of people developed blood Lymphatic Disorders

*2.6% of people suffered tachycardia 🫀

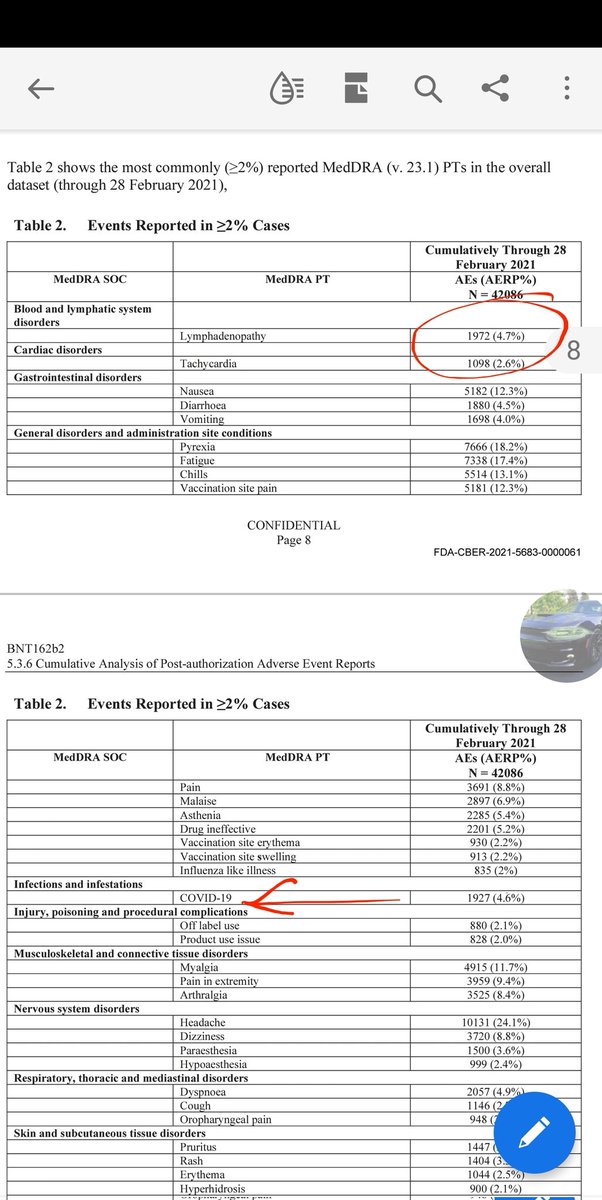

*4.6% of #vaccinated people developed #covid

*2.6% of people suffered tachycardia 🫀

*4.6% of #vaccinated people developed #covid

1.07% of vaccinated people in the #pfizer study developed Bells Palsy or Facial Paralysis...

*23 our of 270 #pregnant #women suffered spontaneous #abortions.

*75 developed serious diseases as shown in the #pfizer #VaccineSideEffects first 10,000 pages.

I've gone through 20 pages so far to find this...

*75 developed serious diseases as shown in the #pfizer #VaccineSideEffects first 10,000 pages.

I've gone through 20 pages so far to find this...

Post 1:

Small correction tho; its 8.5% of ‘Musculoskeletal Adverse Events of Special Interest’

2.5% of Autoimmune

Thank you @HangLoose1337 I mistyped

Small correction tho; its 8.5% of ‘Musculoskeletal Adverse Events of Special Interest’

2.5% of Autoimmune

Thank you @HangLoose1337 I mistyped

Pfizer #vaccine data RELEASE DOCUMENT.

Of particular interest is page 30.

You’re welcome.

phmpt.org/wp-content/upl…

Of particular interest is page 30.

You’re welcome.

phmpt.org/wp-content/upl…

Welcome to the land of the brainwashed. Where people glaze over the 100000 other side effects that cause death and disease, because they believe the miscarriages are a low %... wow.

• • •

Missing some Tweet in this thread? You can try to

force a refresh