Fast #import growth has overshadowed some very good news in #Pakistan. The latest release of disaggregated #trade data by @StateBank_Pak reveals that the first nine months of FY22 showed #record high #exports in real terms, since there's statistics.

Short 🧵👇 w/ more results.

Short 🧵👇 w/ more results.

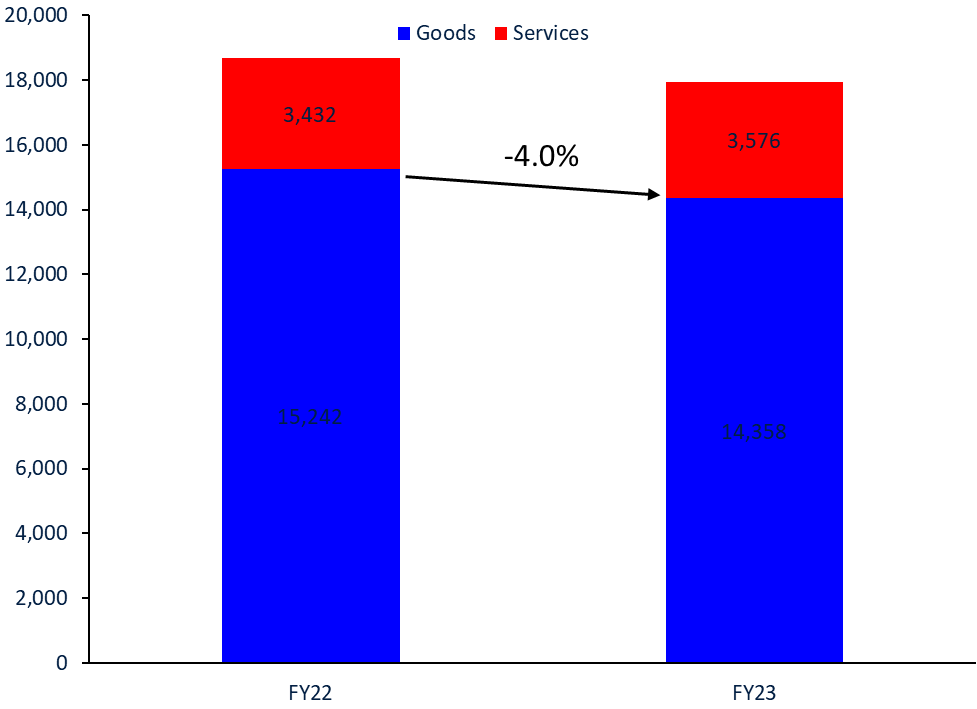

1\ #exports grew by 24.8% in the first 9 months of FY22 w.r.t. same period of FY21, reaching 23.7 bn for goods and 5.2 bn for services.

#Pakistan #trade

#Pakistan #trade

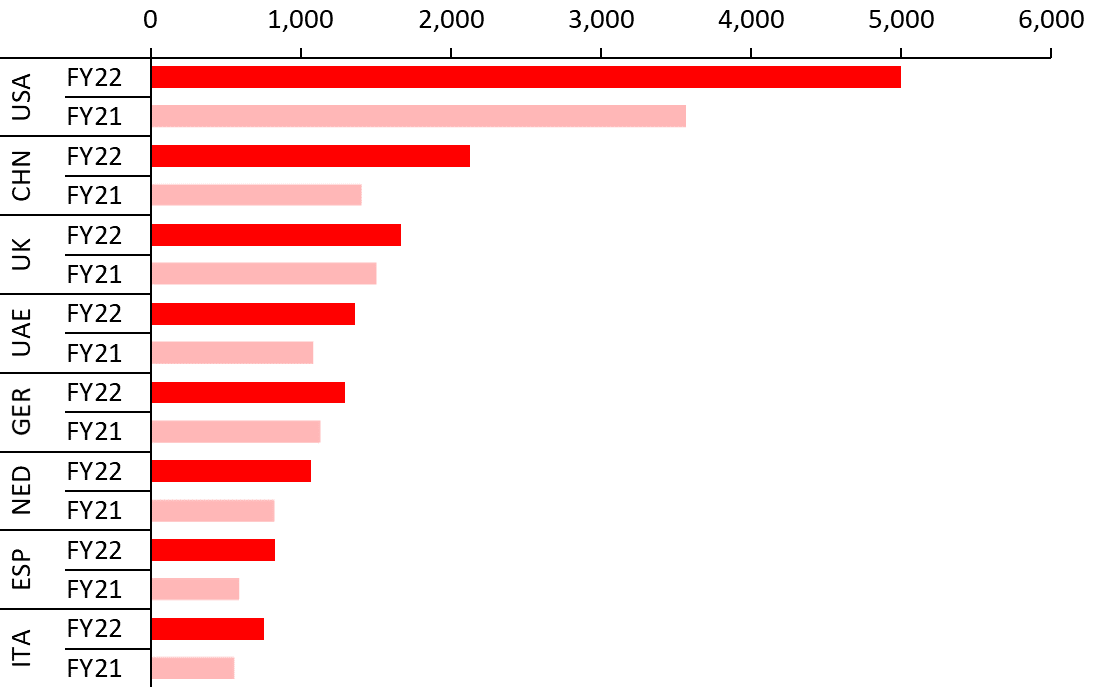

2\ All top destinations show fast #export growth. Shipments to the #USA and to #China in particular.

3\ #textile #exports and #vegetable exports continue driving the growth, and pointing to the need of #diversification efforts

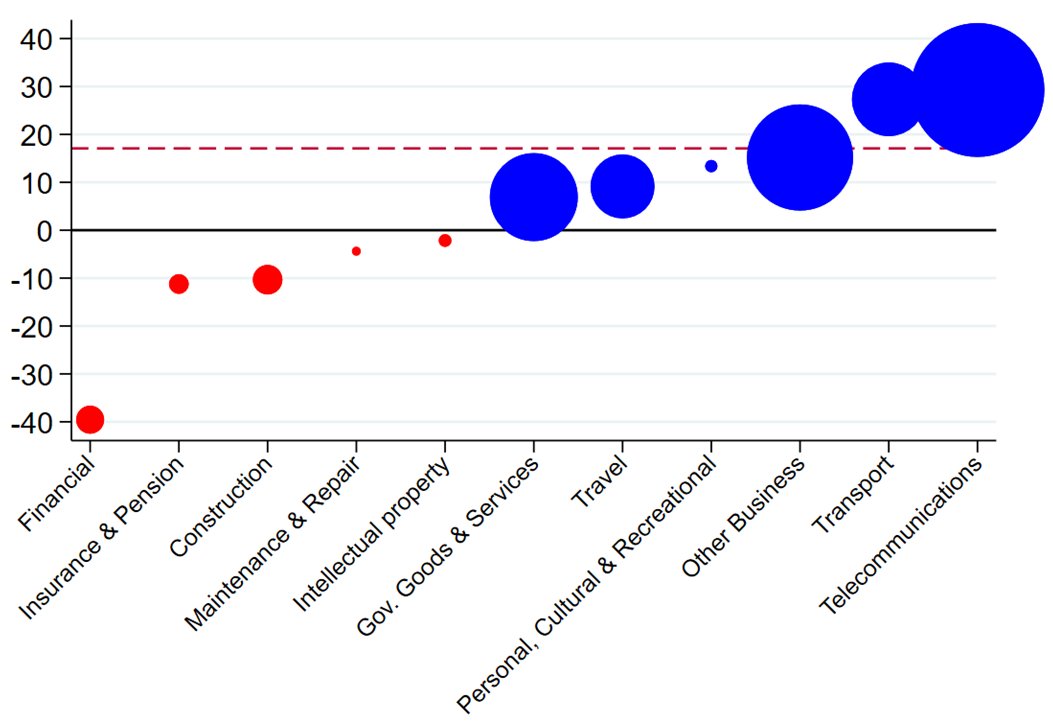

4\ In #services the transformation continues, with telecom and business services #exports growing fast. #knowledge intensive #exports keep scaling up. Maintaining this momentum is crucial. Keeping access to #inputs, investing in #connectivity will be crucial.

5\ Challenge, from an #external sustainability point of view is that #imports have grown even faster, at 39.9% w.r.t. first 9 months of FY21.

6\ Oil/mineral #imports driving the growth...

8\ while #imports of #machinery continue to support the expansion of #production capacity, particularly for the #export-oriented #textile sector.

9\9 Sustaining the growth of #exports will require being careful about the way #imports are contained. Resorting to #import #duty increases will most likely backfire as they will hurt #exports. After all, #import duties are #export taxes in disguise. \end.

• • •

Missing some Tweet in this thread? You can try to

force a refresh