#China's August urban surveyed unemployment rate 5.3%[Est. 5.4%;Prev. 5.4%]

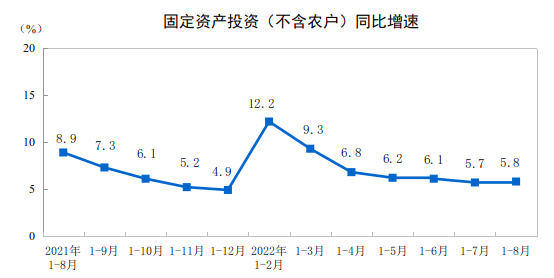

Jan-Aug urban fixed investment +5.8% y/y [Est.+5.5%;Prev.+5.7%]

Aug industrial value-added +4.2% y/y [Est.+3.8%;Prev.+3.8%]

Aug retail sales +5.4% y/y [Est.+3.5%;Prev.+2.7%]

1/n #GDP #EconTwitter 🇨🇳

Jan-Aug urban fixed investment +5.8% y/y [Est.+5.5%;Prev.+5.7%]

Aug industrial value-added +4.2% y/y [Est.+3.8%;Prev.+3.8%]

Aug retail sales +5.4% y/y [Est.+3.5%;Prev.+2.7%]

1/n #GDP #EconTwitter 🇨🇳

China produced 5.74 million tons of non-ferrous metal in August, which rose by 6.7%, the most since January 2021.

Jan-Aug non-ferrous metal productions +1.9% to 44 million tons.

2/ #China #copper #aluminum

Jan-Aug non-ferrous metal productions +1.9% to 44 million tons.

2/ #China #copper #aluminum

In Aug, #China's total retail sales were recorded at 3.6258 trillion yuan, up 5.4% y/y but dropped 0.05% m/m.

Among them, retail sales of goods were 3.25 trillion yuan, which rose by 5.1% y/y; The total revenue for the catering industry was 374.8 billion yuan, surged 8.4% y/y.

3/

Among them, retail sales of goods were 3.25 trillion yuan, which rose by 5.1% y/y; The total revenue for the catering industry was 374.8 billion yuan, surged 8.4% y/y.

3/

#China's Aug industry output increased by 4.2% y/y or rose by 0.32% m/m.

#Crudeoil refinery -6.5% to 53.6 million tons per day.

Power generation +9.9% to 0.825 TWh.

Vehicle production +39% to 2.426 mln units.

#Steel production -1.5% to 1.083 trillion tons.

4/ #OOTT #EconTwitter🇨🇳

#Crudeoil refinery -6.5% to 53.6 million tons per day.

Power generation +9.9% to 0.825 TWh.

Vehicle production +39% to 2.426 mln units.

#Steel production -1.5% to 1.083 trillion tons.

4/ #OOTT #EconTwitter🇨🇳

#China's Jan-Aug nationwide fixed-asset investment increased by 5.8% y/y to 36.71 trillion yuan, recovered by 0.36% m/m.

The investments in the #manufacturing industry added 10% y/y, and the electricity, heating, gas & water supply rose 15% y/y

5/ #econtwitter #investment 🇨🇳

The investments in the #manufacturing industry added 10% y/y, and the electricity, heating, gas & water supply rose 15% y/y

5/ #econtwitter #investment 🇨🇳

#China's Jan-August #realestate development investment fell by 7.4% y/y to 9.08 trillion yuan.

Residential housing sales areas dropped by 23% y/y to 8.79 million square meters, and the total sales dropped 27.9% y/y to 8.59 trillion yuan.

Sentiment 95.07📉

6/ #property #housing 🇨🇳

Residential housing sales areas dropped by 23% y/y to 8.79 million square meters, and the total sales dropped 27.9% y/y to 8.59 trillion yuan.

Sentiment 95.07📉

6/ #property #housing 🇨🇳

• • •

Missing some Tweet in this thread? You can try to

force a refresh