On the #FederalReserve hawkish pivot 1/n

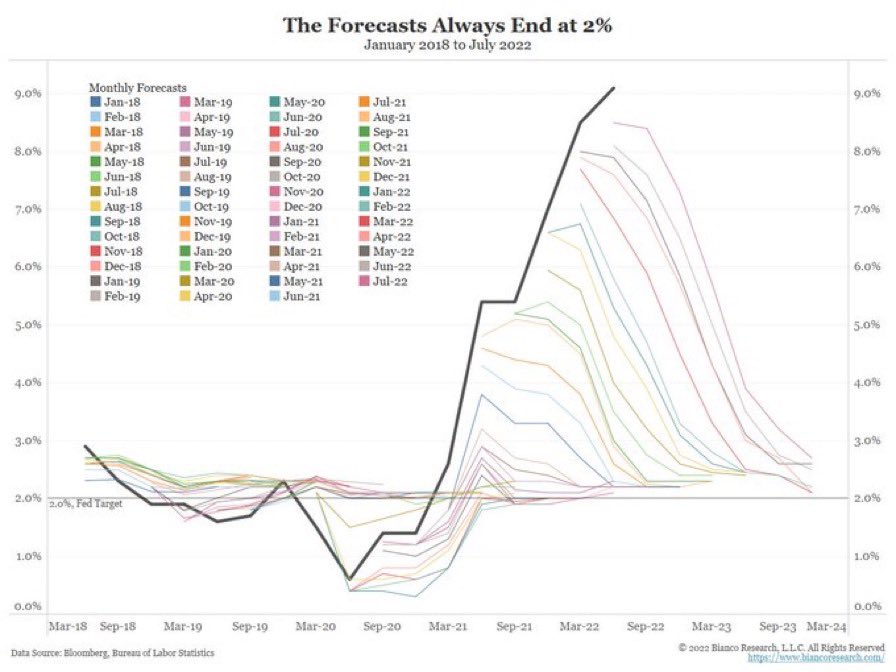

It's about the destination now

Forget the speed of rate hikes

Focus on the terminal rate and

how long the Fed must stay there

= how much cumulative pain is needed to crush #inflation

It's about the destination now

Forget the speed of rate hikes

Focus on the terminal rate and

how long the Fed must stay there

= how much cumulative pain is needed to crush #inflation

1/n

Powell: 'If we were to overtighten, we could use our tools to support the economy later on.'

Or in other words, we are willing to risk a #recession to get the 'job done' and push #inflation to target.

Powell: 'If we were to overtighten, we could use our tools to support the economy later on.'

Or in other words, we are willing to risk a #recession to get the 'job done' and push #inflation to target.

1/n

Interesting end to the presser with one journalist stating #equities were up after #FOMC - which was not true -

Powell repeated virtually all hawkish sentences he had made during the press conference. He cares about (tighter) financial conditions, not about equities.

Interesting end to the presser with one journalist stating #equities were up after #FOMC - which was not true -

Powell repeated virtually all hawkish sentences he had made during the press conference. He cares about (tighter) financial conditions, not about equities.

Yet, we are now really close to a significant and broad-based decline in #inflation numbers, meaning another pivot dream is already in the making.

Join @true_insights_ to learn how to position for this

true-insights.net

Join @true_insights_ to learn how to position for this

true-insights.net

• • •

Missing some Tweet in this thread? You can try to

force a refresh