The great thing about #crypto bear markets is that you don’t have to dig to find 100x opportunities

In many cases, the blue chips will get you there

In fact, here’s how the “bluest” chip of them all – #Ethereum – could reach $150K within the next decade

In many cases, the blue chips will get you there

In fact, here’s how the “bluest” chip of them all – #Ethereum – could reach $150K within the next decade

2/

$ETH has the potential to exceed $150K per coin for one simple reason:

👉 It’s going to be the native currency of the Internet

In other words, there’s a strong chance that it will be used as the medium of exchange for all online transactions within the next 10 -30 years

$ETH has the potential to exceed $150K per coin for one simple reason:

👉 It’s going to be the native currency of the Internet

In other words, there’s a strong chance that it will be used as the medium of exchange for all online transactions within the next 10 -30 years

3/

Why do I say this? A few reasons:

• The internet is broken

• #Blockchains allow us to create a better internet

• This new internet needs #cryptocurrency to function

• $ETH is best positioned to be that currency

• This will make #ETH worth >$150K

Let’s explore each

Why do I say this? A few reasons:

• The internet is broken

• #Blockchains allow us to create a better internet

• This new internet needs #cryptocurrency to function

• $ETH is best positioned to be that currency

• This will make #ETH worth >$150K

Let’s explore each

4/

🔶 The Internet is Broken

The Internet has three flaws:

• It can’t natively store information

• We built a system on top of the internet to store information

• The system gives too much power to 3rd parties

🔶 The Internet is Broken

The Internet has three flaws:

• It can’t natively store information

• We built a system on top of the internet to store information

• The system gives too much power to 3rd parties

5/

◾ The Internet Can’t Natively Store Information

At its core, the internet is nothing more than a collection of computers that are connected to each other through a global network of wires

Wires, by themselves, cannot store information

◾ The Internet Can’t Natively Store Information

At its core, the internet is nothing more than a collection of computers that are connected to each other through a global network of wires

Wires, by themselves, cannot store information

6/

If you’re old enough to remember, this makes intuitive sense. After all, there was no way to record a TV show until someone invented the VHS player, and no way to take messages over the phone until someone invented the answering machine.

If you’re old enough to remember, this makes intuitive sense. After all, there was no way to record a TV show until someone invented the VHS player, and no way to take messages over the phone until someone invented the answering machine.

7/

◾ We Built a System on Top of the Internet to Store Information

To get around this problem, companies store your data on their privately-owned computers

For instance, your $ is stored on servers owned by a bank & your data is stored on servers owned by Big Tech

◾ We Built a System on Top of the Internet to Store Information

To get around this problem, companies store your data on their privately-owned computers

For instance, your $ is stored on servers owned by a bank & your data is stored on servers owned by Big Tech

8/

◾ The System Gives too much Power to 3rd Parties

This gives these entities too much power and introduces a host of concerns such as:

• Asset Seizure

• Limited Privacy

• Limited Access

• Censorship

• Hidden Taxes

#

◾ The System Gives too much Power to 3rd Parties

This gives these entities too much power and introduces a host of concerns such as:

• Asset Seizure

• Limited Privacy

• Limited Access

• Censorship

• Hidden Taxes

#

9/

🔶 Blockchains Allow us to Create a Better Internet

#Blockchains - in the form of smart contract platforms or “Layer 1s” - are revolutionary because they are computer networks that can store data directly within the system

As such, they don’t need centralized third parties

🔶 Blockchains Allow us to Create a Better Internet

#Blockchains - in the form of smart contract platforms or “Layer 1s” - are revolutionary because they are computer networks that can store data directly within the system

As such, they don’t need centralized third parties

10/

Instead of hosting data on centralized servers owned by Apple, Google, Microsoft, BoA, Chase, etc… #blockchains store it on multiple computers located all over the world

This means that no one party controls the network and no one can ever turn it off or shut it down

Instead of hosting data on centralized servers owned by Apple, Google, Microsoft, BoA, Chase, etc… #blockchains store it on multiple computers located all over the world

This means that no one party controls the network and no one can ever turn it off or shut it down

11/

This allows us to create an entirely new Internet that doesn’t need:

• Banks: Money can be created, traded and stored on the network

• Big Tech: Users can host their own data

• Governments: The system can enforce its own rules

This allows us to create an entirely new Internet that doesn’t need:

• Banks: Money can be created, traded and stored on the network

• Big Tech: Users can host their own data

• Governments: The system can enforce its own rules

12/

🔶 This New Internet Runs on Crypto

The new Internet will use #cryptocurrencies as money

This is not a choice, but a technical requirement, as cryptocurrencies are required to operate Layer 1s

(to understand why, check out: torygreen.substack.com/p/the-complete…).

🔶 This New Internet Runs on Crypto

The new Internet will use #cryptocurrencies as money

This is not a choice, but a technical requirement, as cryptocurrencies are required to operate Layer 1s

(to understand why, check out: torygreen.substack.com/p/the-complete…).

13/

🔶 $ETH May Become the Reserve Currency of the Internet

$ETH is the most likely candidate to be the Internet’s money as it has:

• Proven P/M fit

• Established Moat

• Consistent growth

• Robust architecture

• Pending improvements

Let’s dig into each

🔶 $ETH May Become the Reserve Currency of the Internet

$ETH is the most likely candidate to be the Internet’s money as it has:

• Proven P/M fit

• Established Moat

• Consistent growth

• Robust architecture

• Pending improvements

Let’s dig into each

14/

◾ Proven P/M Fit

#Ether is already being used as money:

• Store-of-Value: It’s the preferred form of collateral for #DeFi

• Unit of account: Most #NFTs are priced in $ETH

• Medium of exchange: Many decentralized applications only accept #ETH as a medium of exchange

◾ Proven P/M Fit

#Ether is already being used as money:

• Store-of-Value: It’s the preferred form of collateral for #DeFi

• Unit of account: Most #NFTs are priced in $ETH

• Medium of exchange: Many decentralized applications only accept #ETH as a medium of exchange

15/

◾ Ethereum is the Dominant Smart Contract Platform

#Ethereum is the dominant Layer1 across a variety of metrics:

• # of dapps

• # of addresses

• TVL and NFT share

• Mindshare

• Community support

◾ Ethereum is the Dominant Smart Contract Platform

#Ethereum is the dominant Layer1 across a variety of metrics:

• # of dapps

• # of addresses

• TVL and NFT share

• Mindshare

• Community support

16/

🔹 Robust ecosystem of decentralized apps

There are over 3,500 dapps in the Ethereum ecosystem with 1.75K daily active users. In #DeFi alone, Ethereum boasts 1.6x more dapps than its closest competitor

🔹 Robust ecosystem of decentralized apps

There are over 3,500 dapps in the Ethereum ecosystem with 1.75K daily active users. In #DeFi alone, Ethereum boasts 1.6x more dapps than its closest competitor

17/

🔹 Second most wallets of any Layer 1

When measured by the number of unique addresses, #Ethereum has the second most wallets of any smart contract platform, with 214 million registered wallets

🔹 Second most wallets of any Layer 1

When measured by the number of unique addresses, #Ethereum has the second most wallets of any smart contract platform, with 214 million registered wallets

18/

🔹 Entrenched economic moat across multiple sectors

At $148B Ethereum has the highest market capitalization of any Layer 1 — over 3x greater than its closest competitor.

🔹 Entrenched economic moat across multiple sectors

At $148B Ethereum has the highest market capitalization of any Layer 1 — over 3x greater than its closest competitor.

19/

The protocol is also the clear market leader in #DeFi with a 60% share of TVL and the all-time sales leader in #NFTs with 74% of sales.

The protocol is also the clear market leader in #DeFi with a 60% share of TVL and the all-time sales leader in #NFTs with 74% of sales.

20/

🔹 Highest mindshare of all Layer 1s

#Ethereum is the most well-known smart contract platform and 2nd most recognized #cryptocurrency after Bitcoin.

It has twice as many social engagements (e.g. favorites, likes, comments, replies, retweets) — than its closest competitor

🔹 Highest mindshare of all Layer 1s

#Ethereum is the most well-known smart contract platform and 2nd most recognized #cryptocurrency after Bitcoin.

It has twice as many social engagements (e.g. favorites, likes, comments, replies, retweets) — than its closest competitor

21/

🔹 Robust communities on Discord, Reddit and Twitter

Ethereum has a very strong community with 1.6 million Reddit subscribers and 3 million Twitter followers

🔹 Robust communities on Discord, Reddit and Twitter

Ethereum has a very strong community with 1.6 million Reddit subscribers and 3 million Twitter followers

22/

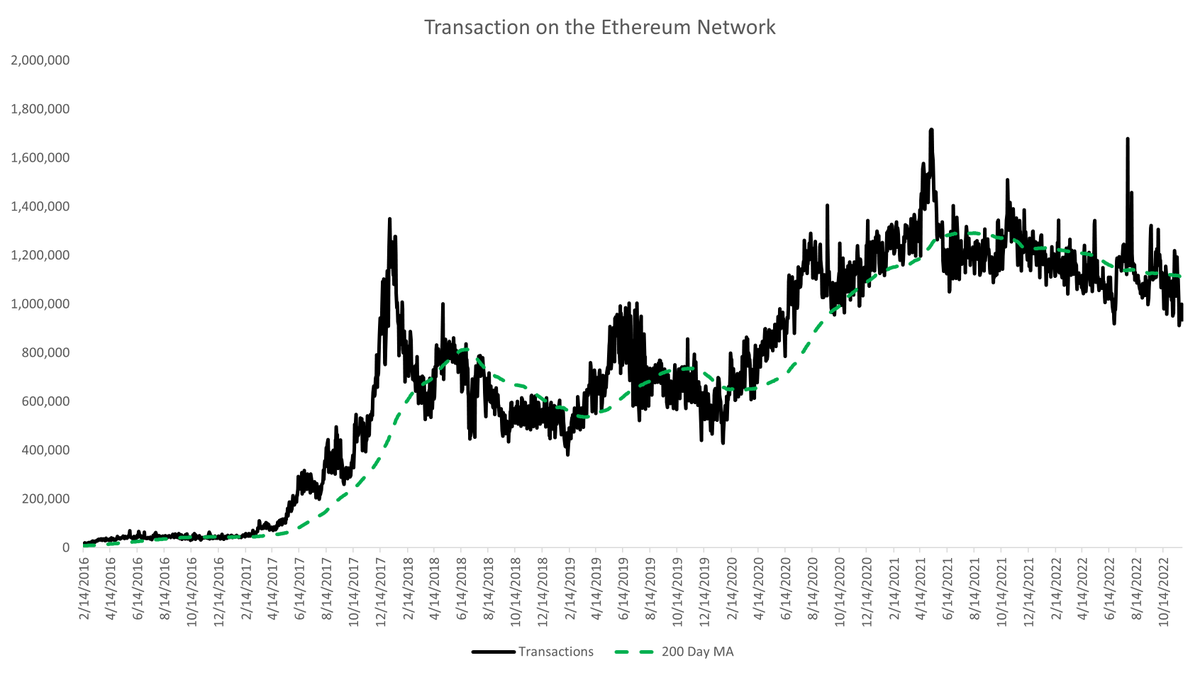

◾ Ethereum has Shown Consistent Growth over the Last Five Years

While #Ethereum’s market share and price have waxed and waned, it has continued to show consistent growth across a variety of metrics

◾ Ethereum has Shown Consistent Growth over the Last Five Years

While #Ethereum’s market share and price have waxed and waned, it has continued to show consistent growth across a variety of metrics

23/

In particular, the protocol has achieved:

• 2.7% monthly user growth

• 3.6% monthly growth in its #dapp ecosystem

• 3.6% monthly growth in social communities

This is an encouraging sign, as it shows that #Ethereum is building through both bear and bull markets.

In particular, the protocol has achieved:

• 2.7% monthly user growth

• 3.6% monthly growth in its #dapp ecosystem

• 3.6% monthly growth in social communities

This is an encouraging sign, as it shows that #Ethereum is building through both bear and bull markets.

24/

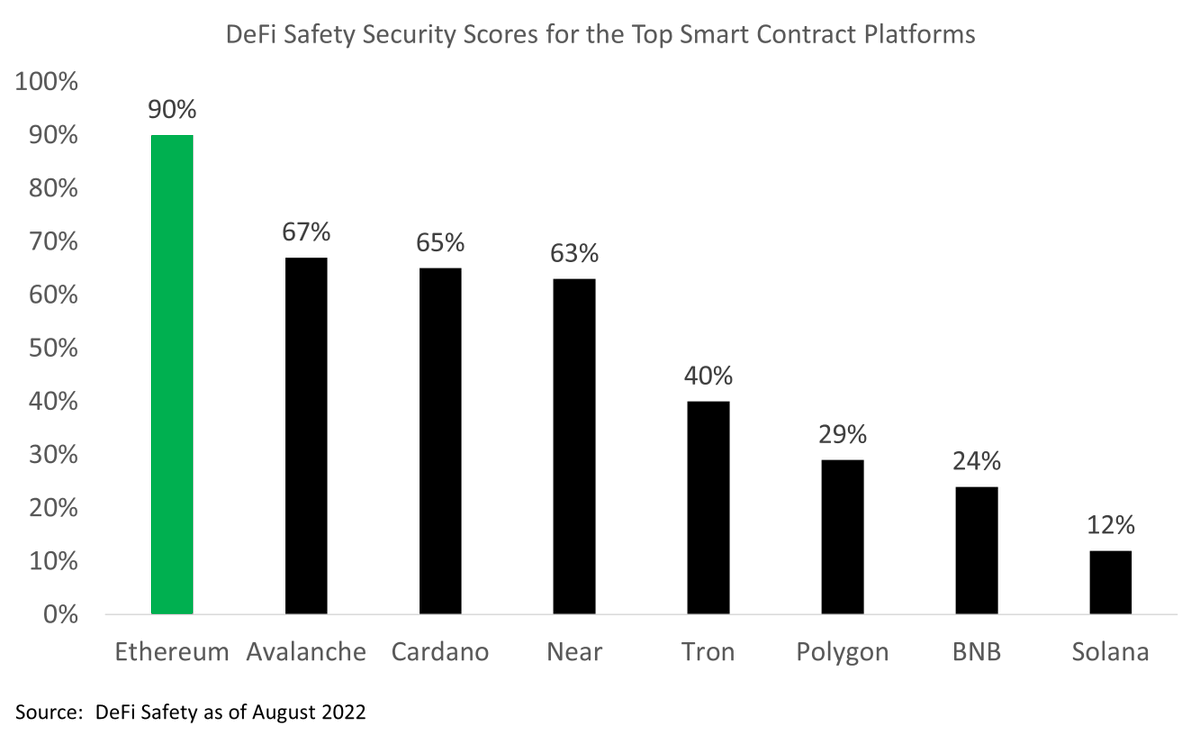

◾ Ethereum has one of the Best Technical Architectures

In addition to being the most used platform, Ethereum may also be the most architecturally sound.

According to DeFi Safety, it is the highest-ranking #L1 with a security score of 90%.

◾ Ethereum has one of the Best Technical Architectures

In addition to being the most used platform, Ethereum may also be the most architecturally sound.

According to DeFi Safety, it is the highest-ranking #L1 with a security score of 90%.

25/

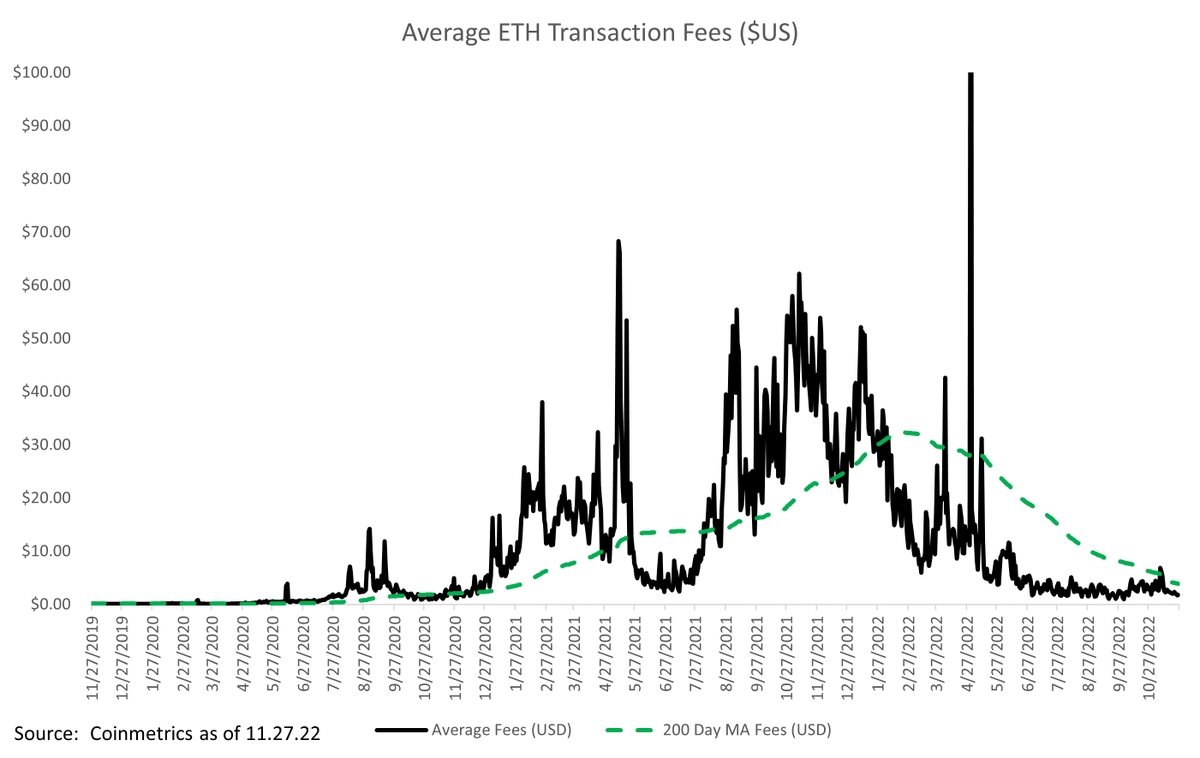

◾ ETH 2.0 offers Line-of-Sight Improvements to Ethereum’s Greatest Challenges

Ethereum is not without its challenges

Perhaps the most pressing of these is its high fees

Although fees today are relatively low, they were $10 — $30 for much of 2021 and 2022

◾ ETH 2.0 offers Line-of-Sight Improvements to Ethereum’s Greatest Challenges

Ethereum is not without its challenges

Perhaps the most pressing of these is its high fees

Although fees today are relatively low, they were $10 — $30 for much of 2021 and 2022

26/

Fortunately, the protocol is in the middle of an upgrade (which Vitalik estimates is 55% complete).

When complete, many estimate that #Ethereum will be able to achieve a throughput in excess of 100K TPS, making it one of the fastest (and cheapest) Layer 1s

Fortunately, the protocol is in the middle of an upgrade (which Vitalik estimates is 55% complete).

When complete, many estimate that #Ethereum will be able to achieve a throughput in excess of 100K TPS, making it one of the fastest (and cheapest) Layer 1s

27/

🔶 Ether Has the Potential to be Worth > $150K per Coin

As the native currency of the Internet, I believe that #Ether has the potential to be worth > $150K per coin

🔶 Ether Has the Potential to be Worth > $150K per Coin

As the native currency of the Internet, I believe that #Ether has the potential to be worth > $150K per coin

28/

This is based on the following assumptions:

• The TAM for #cryptocurrencies is $138T

• The SOM is $35T

• Ether has the potential to capture 60% share

• The supply of #Ether will likely stabilize around 122M coins

Let’s walk through each of these assumptions

This is based on the following assumptions:

• The TAM for #cryptocurrencies is $138T

• The SOM is $35T

• Ether has the potential to capture 60% share

• The supply of #Ether will likely stabilize around 122M coins

Let’s walk through each of these assumptions

29/

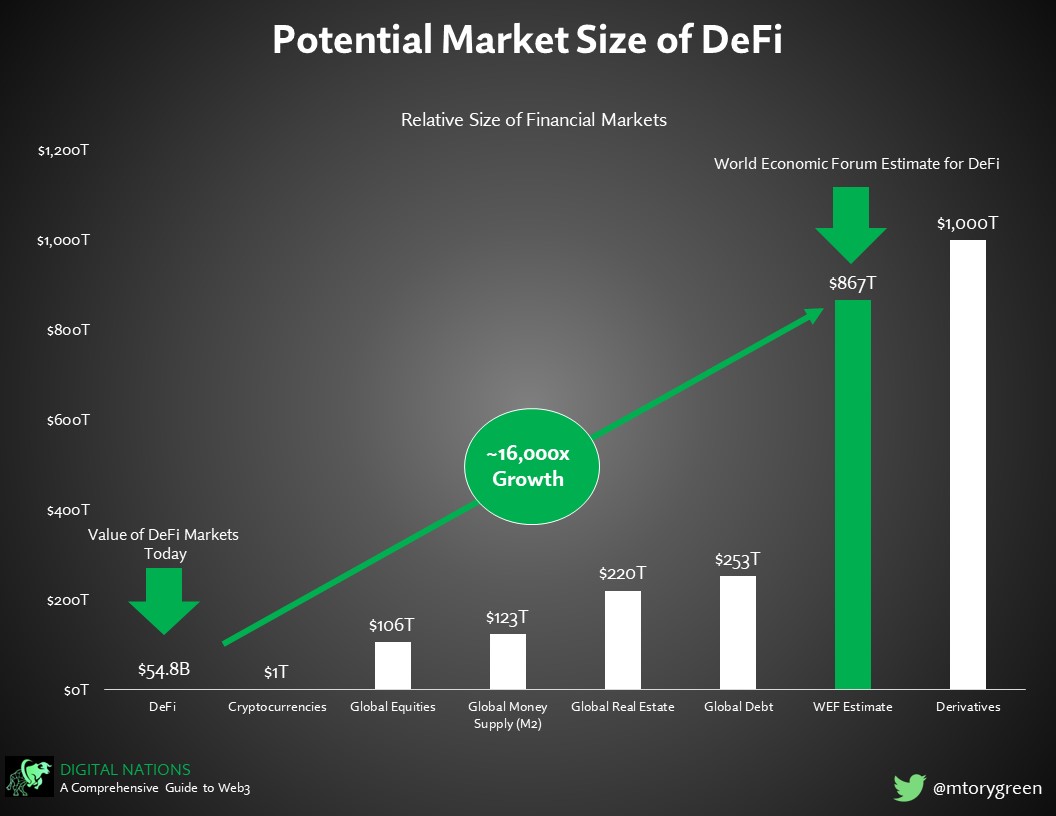

◾ The TAM for #Cryptocurrencies is $138 Trillion

The total addressable market opportunity for Layer 1 coins is immense. In short, they can function as a replacement for traditional money and, as such, could capture a significant share of global M3.

◾ The TAM for #Cryptocurrencies is $138 Trillion

The total addressable market opportunity for Layer 1 coins is immense. In short, they can function as a replacement for traditional money and, as such, could capture a significant share of global M3.

30/

In fact, if we compare Ether to fiat currencies using the six properties of money, we see that it is superior in almost every category

As such, we can make a reasonable argument that the TAM for #Ether is $137T, the global M3 base.

In fact, if we compare Ether to fiat currencies using the six properties of money, we see that it is superior in almost every category

As such, we can make a reasonable argument that the TAM for #Ether is $137T, the global M3 base.

31/

◾ The SOM for #Cryptocurrencies is $35 Trillion

While the thought of the digital currencies replacing physical ones may seem ridiculous, such a feat is not without precedent as there is a long history of disruptive technologies stealing market share from incumbents

◾ The SOM for #Cryptocurrencies is $35 Trillion

While the thought of the digital currencies replacing physical ones may seem ridiculous, such a feat is not without precedent as there is a long history of disruptive technologies stealing market share from incumbents

32/

For instance:

• Digital entertainment is 72% of all entertainment revenue

• Online advertising makes up 2/3rds of total advertising

• Global eCommerce sales are approximately 20% of total retail sales and expected to grow to nearly 25% by 2025

For instance:

• Digital entertainment is 72% of all entertainment revenue

• Online advertising makes up 2/3rds of total advertising

• Global eCommerce sales are approximately 20% of total retail sales and expected to grow to nearly 25% by 2025

33/

As #cryptocurrencies mature, they too will likely begin to take share. While how much is still up for debate, we can start to make some predictions using digital penetration in other industries.

As #cryptocurrencies mature, they too will likely begin to take share. While how much is still up for debate, we can start to make some predictions using digital penetration in other industries.

34/

Let’s take a conservative estimate though, and assume that cryptocurrencies can capture 25% of the global M3 base within the next 10–30 years (in line with the penetration of eCommerce into physical commerce)

That will yield a SOM of $34.5 trillion.

Let’s take a conservative estimate though, and assume that cryptocurrencies can capture 25% of the global M3 base within the next 10–30 years (in line with the penetration of eCommerce into physical commerce)

That will yield a SOM of $34.5 trillion.

35/

◾ Ether has the Potential to Reach an FDV of $20.7T

How much of this $34.5T will Ether capture?

As argued above, #Ether is well-positioned to become the dominant currency for online transactions

In mature industries, market leaders tend capture 30% to 60% market share

◾ Ether has the Potential to Reach an FDV of $20.7T

How much of this $34.5T will Ether capture?

As argued above, #Ether is well-positioned to become the dominant currency for online transactions

In mature industries, market leaders tend capture 30% to 60% market share

36/

Right now, Ether holds a bit more than that, with a market share of 60% of #DeFi and 74% of #NFTs.

If we assume that the coin can maintain a 60% share going forward, it would achieve a potential FDV of $20.7 trillion.

Right now, Ether holds a bit more than that, with a market share of 60% of #DeFi and 74% of #NFTs.

If we assume that the coin can maintain a 60% share going forward, it would achieve a potential FDV of $20.7 trillion.

37/

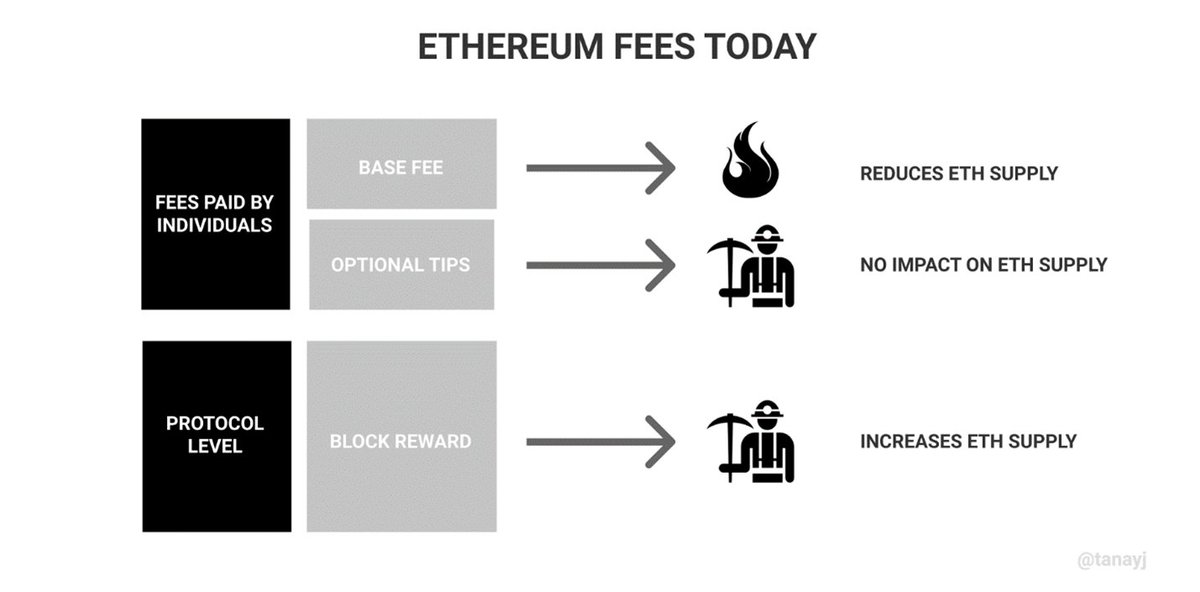

◾ The Long-Term Supply of Ether Will Likely Stabilize around 122M Coins

Calculating the LT supply of #Ether is challenging as the coin has both inflationary and deflationary mechanics

Historically, more coins have been created than burned, making $ETH inflationary

◾ The Long-Term Supply of Ether Will Likely Stabilize around 122M Coins

Calculating the LT supply of #Ether is challenging as the coin has both inflationary and deflationary mechanics

Historically, more coins have been created than burned, making $ETH inflationary

38/

That said, the recent switch to Proof-of-Stake has accelerated the burn rate, and many argue that this will ultimately make #Ether a deflationary currency

To be conservative, we’ll make the assumption that the long-term supply stays stable at 122.3M

That said, the recent switch to Proof-of-Stake has accelerated the burn rate, and many argue that this will ultimately make #Ether a deflationary currency

To be conservative, we’ll make the assumption that the long-term supply stays stable at 122.3M

39/

◾ The Potential Value of $ETH is $169,137.57

Taking the estimated fully-diluted market capitalization of $20.7 trillion and dividing by a total supply of 122.3 tokens gives us a potential price of $169,137.57, a 139.3x increase over today!

◾ The Potential Value of $ETH is $169,137.57

Taking the estimated fully-diluted market capitalization of $20.7 trillion and dividing by a total supply of 122.3 tokens gives us a potential price of $169,137.57, a 139.3x increase over today!

40/

This is not out of line with other estimates, including Cathie Wood’s prediction that #Ether could exceed 20 trillion in market cap within the next 10 years

This is not out of line with other estimates, including Cathie Wood’s prediction that #Ether could exceed 20 trillion in market cap within the next 10 years

42/

Note: This is obviously not financial or investment advice nor a recommendation to purchase ETH – it’s just a few thoughts of how things could potentially play out

Like with any forecast, it’s a guess and just as many things could go wrong and drive the price to $0

Note: This is obviously not financial or investment advice nor a recommendation to purchase ETH – it’s just a few thoughts of how things could potentially play out

Like with any forecast, it’s a guess and just as many things could go wrong and drive the price to $0

43/

If you want to learn more about #Ethereum, check out these accounts:

@Crypto_Wolf_Of

@DocumentEther

@ethereum

@ethereumJoseph

@EthereumMemes

@iamDCinvestor

@rovercrc

@RyanSAdanns

@sassal0x

@thedailygwei

@TrustlessState

@VitalikButerin

If you want to learn more about #Ethereum, check out these accounts:

@Crypto_Wolf_Of

@DocumentEther

@ethereum

@ethereumJoseph

@EthereumMemes

@iamDCinvestor

@rovercrc

@RyanSAdanns

@sassal0x

@thedailygwei

@TrustlessState

@VitalikButerin

I hope you've found this thread helpful.

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

https://twitter.com/MTorygreen/status/1599810926588223495

• • •

Missing some Tweet in this thread? You can try to

force a refresh