Our weekly NEXT WEEK, The Bear's take, The Bull's take, Our take is here

For more info read our newsletter coming out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

For more info read our newsletter coming out later today

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

NEXT WEEK

The Bear's take:

• Rates, inflation, dollar, employment ↑

• Geopolitical tensions

• $VIX above TL and 20DMA

• All indices broke below 20DMA

• Negative #Gamma regime

• Dealers are now net short

•Quadruple witching: large negative stack at 3900

$ES_F $SPX $SPY

The Bear's take:

• Rates, inflation, dollar, employment ↑

• Geopolitical tensions

• $VIX above TL and 20DMA

• All indices broke below 20DMA

• Negative #Gamma regime

• Dealers are now net short

•Quadruple witching: large negative stack at 3900

$ES_F $SPX $SPY

NEXT WEEK

The Bull's take

•Commodities/Oil/ $DXY are ↓

• Indexes on lower weekly volume

• Breadth indicators still holding

• Indexes are at important supports

• Seasonality favors ↑movement

• Lower #CPI would push the market ↑

• Market ↑ on 50 bps rate hike

#SPX

The Bull's take

•Commodities/Oil/ $DXY are ↓

• Indexes on lower weekly volume

• Breadth indicators still holding

• Indexes are at important supports

• Seasonality favors ↑movement

• Lower #CPI would push the market ↑

• Market ↑ on 50 bps rate hike

#SPX

NEXT WEEK

Our take

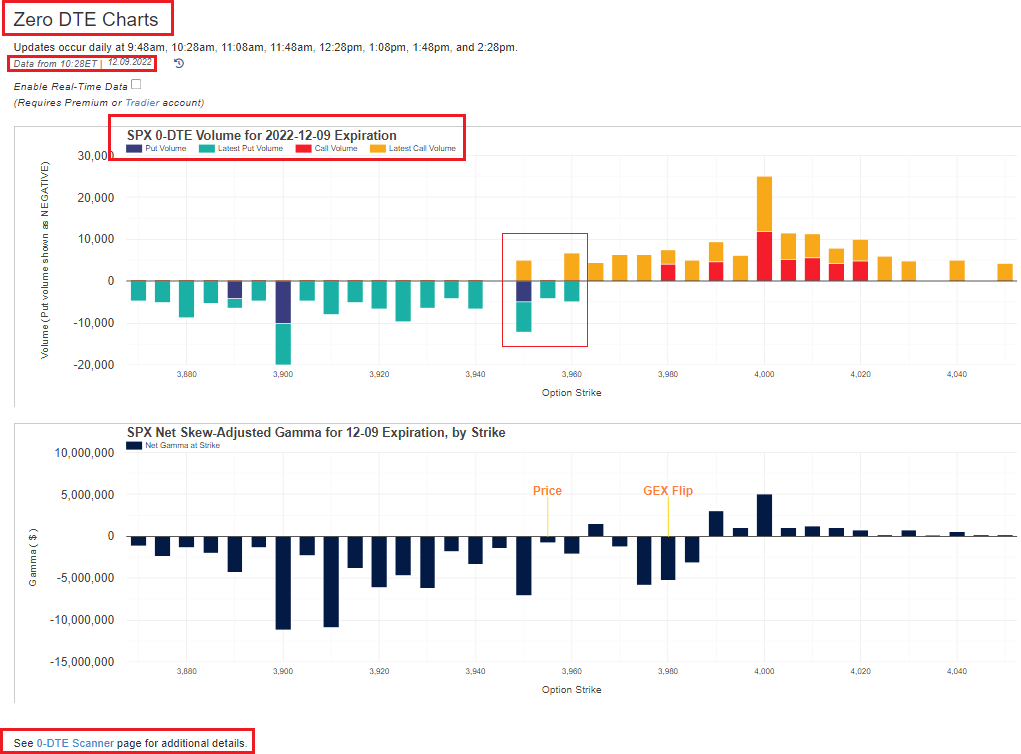

•Decisive week, all about #Gamma-Quadwitching

• $GEX may change after #CPI and #FOMC

• Still looking for an up market EOY

•We'll change stance with breaks below these levels:

$SPX ↓ 3900

$DJI ↓ 33000

#S5TH ↓ 50%

#S5FI ↓ 70%

•CPI could come low

#SPX

Our take

•Decisive week, all about #Gamma-Quadwitching

• $GEX may change after #CPI and #FOMC

• Still looking for an up market EOY

•We'll change stance with breaks below these levels:

$SPX ↓ 3900

$DJI ↓ 33000

#S5TH ↓ 50%

#S5FI ↓ 70%

•CPI could come low

#SPX

Tough week ahead

Quadruple witching will dictate action. Those options trade through Thursday, and settle at Friday's opening prices, most of the hedging will be done on Thursday

unroll

@threadreaderapp

$SPX $ES $SPY #SPX #ES_F #SPY #trading #options #futures #VIX $VIX

Quadruple witching will dictate action. Those options trade through Thursday, and settle at Friday's opening prices, most of the hedging will be done on Thursday

unroll

@threadreaderapp

$SPX $ES $SPY #SPX #ES_F #SPY #trading #options #futures #VIX $VIX

• • •

Missing some Tweet in this thread? You can try to

force a refresh