1/31 Telegram's $TON has been outperforming $ETH yet nobody on CT is talking about it... So here you go!

Telegram has been quietly developing the @ton_blockchain ecosystem💎

🧵Here's a DEEP DIVE on Telegram's positioning in Defi and what I think their strategy is ->

Telegram has been quietly developing the @ton_blockchain ecosystem💎

🧵Here's a DEEP DIVE on Telegram's positioning in Defi and what I think their strategy is ->

2/31

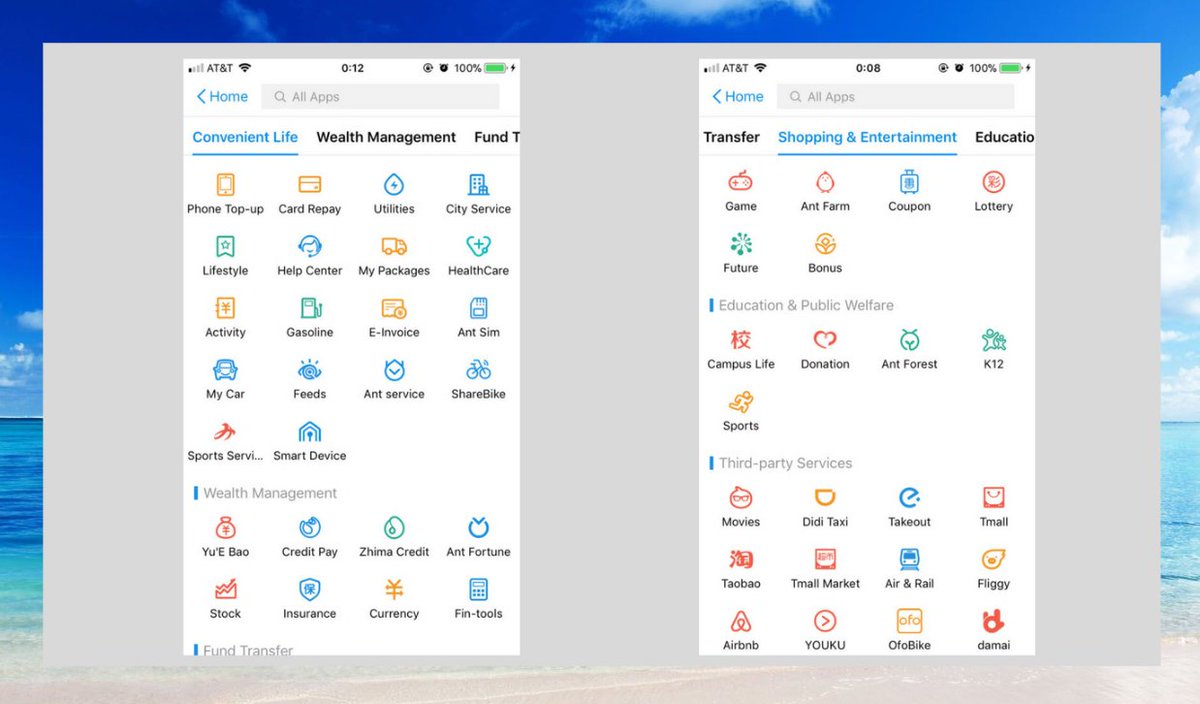

Messaging apps are a part of people's daily lives and many are now looking to integrate with payment solutions to offer more convenience, becoming superapps

Superapps provide multiple services for personal and commercial use - think a swiss-army knife.

Messaging apps are a part of people's daily lives and many are now looking to integrate with payment solutions to offer more convenience, becoming superapps

Superapps provide multiple services for personal and commercial use - think a swiss-army knife.

3/31

Particularly in Asia, superapps are dominating the tech space - WeChat, Line, Gojek, Kakao...

However, regulations overseeing superapps are very strict, especially when payment data is involved

(US: Federal Reserve, EU: PSD2, APAC: PS Act)

But Telegram is dodging that..

Particularly in Asia, superapps are dominating the tech space - WeChat, Line, Gojek, Kakao...

However, regulations overseeing superapps are very strict, especially when payment data is involved

(US: Federal Reserve, EU: PSD2, APAC: PS Act)

But Telegram is dodging that..

4/31

Enter Defi.

With the anonymity and security offered by Defi, this becomes an opportunity for messaging apps to finally integrate payment solutions.

The Open Network (TON) is one such project designed by Telegram.

Enter Defi.

With the anonymity and security offered by Defi, this becomes an opportunity for messaging apps to finally integrate payment solutions.

The Open Network (TON) is one such project designed by Telegram.

5/31

As an extra layer of decentralization, they recently added anon number auctions, purchasable with $TON coins on fragment.com/numbers

These can be used to sign up for Telegram without needing SIM cards.

As an extra layer of decentralization, they recently added anon number auctions, purchasable with $TON coins on fragment.com/numbers

These can be used to sign up for Telegram without needing SIM cards.

https://twitter.com/ton_blockchain/status/1600560335710208014

6/31

Telegram’s emergence in DeFi signals a growing trend: another messaging app — KakaoTalk — also announced its own EVM L1 chain, Klaytn in 2019

KakaoTalk is the superapp owned by South Korean conglomerate Kakao.

Telegram’s emergence in DeFi signals a growing trend: another messaging app — KakaoTalk — also announced its own EVM L1 chain, Klaytn in 2019

KakaoTalk is the superapp owned by South Korean conglomerate Kakao.

7/31

Another example - Line, a superapp jointly owned by Japanese conglomerate Softbank and South Korean conglomerate Naver Corporation.

They launched LINE blockchain and even their own exchange "BitMax". "Bitfront" was also backed by them, albeit not very successful 👀

Another example - Line, a superapp jointly owned by Japanese conglomerate Softbank and South Korean conglomerate Naver Corporation.

They launched LINE blockchain and even their own exchange "BitMax". "Bitfront" was also backed by them, albeit not very successful 👀

8/31

TON is a fast, scalable and fault-tolerant L1 PoS/PoW blockchain infrastructure that developers can use to create dApps. (I'll get into the Pos/PoW later)

It's an open protocol with a built-in payment system and tools for user governance, app development and crypto economy

TON is a fast, scalable and fault-tolerant L1 PoS/PoW blockchain infrastructure that developers can use to create dApps. (I'll get into the Pos/PoW later)

It's an open protocol with a built-in payment system and tools for user governance, app development and crypto economy

9/31

TON started back in 2018 with the goal to facilitate the exchange of values, by leveraging off their already large userbase.

Their progress was halted when their ICO in 2018 went sour after the SEC deemed it a security.

sec.gov/news/press-rel…

TON started back in 2018 with the goal to facilitate the exchange of values, by leveraging off their already large userbase.

Their progress was halted when their ICO in 2018 went sour after the SEC deemed it a security.

sec.gov/news/press-rel…

10/31

However, in 2020 TON was open-sourced and resumed development with its mainnet launching in May 2021.

The TON Foundation was formed as a non-profit community focused on further support and development of the network.

However, in 2020 TON was open-sourced and resumed development with its mainnet launching in May 2021.

The TON Foundation was formed as a non-profit community focused on further support and development of the network.

12/31

1. dApps

TON has its own Appstore offering everything from Wallets, Exchanges, NFTs, Utility dApps, Bridges, Mining, Explorers...

TON might be on the same level as Cronos or Solana in terms of dApp variety - ton.app

1. dApps

TON has its own Appstore offering everything from Wallets, Exchanges, NFTs, Utility dApps, Bridges, Mining, Explorers...

TON might be on the same level as Cronos or Solana in terms of dApp variety - ton.app

13/31

TON has developed plenty of both custodial and non-custodial app and web wallets for Android, iOS, Web, MacOS, Linux, etc.

TON's wallet bot can be used directly in Telegram, essentially making Telegram a custodial wallet.

TON has developed plenty of both custodial and non-custodial app and web wallets for Android, iOS, Web, MacOS, Linux, etc.

TON's wallet bot can be used directly in Telegram, essentially making Telegram a custodial wallet.

https://twitter.com/ton_blockchain/status/1518940393370537985

14/31

The iOS/Android/Web TON wallets function similar to Metamask or Trust wallet so I won't dive into it too much.

✨BUT✨

Their Wallet bot and CryptoBot is why I believe Telegram might quickly catch up in the Defi race.

The iOS/Android/Web TON wallets function similar to Metamask or Trust wallet so I won't dive into it too much.

✨BUT✨

Their Wallet bot and CryptoBot is why I believe Telegram might quickly catch up in the Defi race.

https://twitter.com/0xsurferboy/status/1602305672376250368

15/31

2. Username/DNS Auctions

Users can buy/sell individual and channel usernames using Toncoin on Fragment, an auction marketplace or on their NFT marketplace.

The concept is similar to ENS, except its for telegram usernames.

fragment.com

2. Username/DNS Auctions

Users can buy/sell individual and channel usernames using Toncoin on Fragment, an auction marketplace or on their NFT marketplace.

The concept is similar to ENS, except its for telegram usernames.

fragment.com

16/31

The username auction feels like a monetization method and a way to create some form of ownership, in this case, over usernames.

But it worked considering they sold >$50M in usernames in under a month, with some usernames selling at crazy prices 👇

The username auction feels like a monetization method and a way to create some form of ownership, in this case, over usernames.

But it worked considering they sold >$50M in usernames in under a month, with some usernames selling at crazy prices 👇

17/31

The .Ton DNS works exactly like ENS - you can register or purchase one as an NFT.

The .TON name provides users with easy-to-remember names that aren't just strings of numbers and letters, as with .ETH

Again, Telegram is looking to add more decentralized components.

The .Ton DNS works exactly like ENS - you can register or purchase one as an NFT.

The .TON name provides users with easy-to-remember names that aren't just strings of numbers and letters, as with .ETH

Again, Telegram is looking to add more decentralized components.

18/31

3. Toncoin ($TON)

$TON is the native coin powering TONchain ecosystem - used to develop services and pay for fees and services. It can be bought, sold, and traded.

Before diving into the tokenomics...

Remember the SEC saga in 9/31? What happened after the lawsuit?

3. Toncoin ($TON)

$TON is the native coin powering TONchain ecosystem - used to develop services and pay for fees and services. It can be bought, sold, and traded.

Before diving into the tokenomics...

Remember the SEC saga in 9/31? What happened after the lawsuit?

19/31

Previously $GRAM, 99% of the entire 5B supply was concentrated between ~100 whales... I'd assume tokenomics back then was downbad.

And after the SEC dispute, Telegram basically rugged, returning only 70% to investors

More info on the ICO: icodrops.com/telegram-ico-t…

Previously $GRAM, 99% of the entire 5B supply was concentrated between ~100 whales... I'd assume tokenomics back then was downbad.

And after the SEC dispute, Telegram basically rugged, returning only 70% to investors

More info on the ICO: icodrops.com/telegram-ico-t…

20/31

Then Toncoin came around, and according to them, is different from $GRAM because its not a direct investment in Telegram itself.

How $TON was distributed was by mining "giver" smart contracts

ton.org/docs/ko/develo…

Then Toncoin came around, and according to them, is different from $GRAM because its not a direct investment in Telegram itself.

How $TON was distributed was by mining "giver" smart contracts

ton.org/docs/ko/develo…

21/31

Interestingly, Tonchain's infrastructure was designed in a way that enabled both PoS and PoW consensus to generate new blocks.

In June 2022, all 5B $TON was mined, but the new $TON will only enter circulation via PoS validation, slowing inflation to only 0.6% annually.

Interestingly, Tonchain's infrastructure was designed in a way that enabled both PoS and PoW consensus to generate new blocks.

In June 2022, all 5B $TON was mined, but the new $TON will only enter circulation via PoS validation, slowing inflation to only 0.6% annually.

22/31

This is the current distribution of $TON:

Total Supply - 5B

Circulating Supply - 1.22B

Total Validator Stake - >112M

PoW Giver Distribution - >34.4M

TON Foundation Holdings - >74.9M

The rest are held by exchanges/individual wallets.

This is the current distribution of $TON:

Total Supply - 5B

Circulating Supply - 1.22B

Total Validator Stake - >112M

PoW Giver Distribution - >34.4M

TON Foundation Holdings - >74.9M

The rest are held by exchanges/individual wallets.

23/31

$TON can be bridged to ERC- and BEP-20. Data on Tonchain's explorer (toncoin.tonscan.io) is not available yet.

Looking at the ERC-20 & BEP-20 $TONs, you'd realise an address holding 38.94% of ERC-20 circulating supply

That's FTX

coincarp.com/currencies/ton…

$TON can be bridged to ERC- and BEP-20. Data on Tonchain's explorer (toncoin.tonscan.io) is not available yet.

Looking at the ERC-20 & BEP-20 $TONs, you'd realise an address holding 38.94% of ERC-20 circulating supply

That's FTX

coincarp.com/currencies/ton…

24/31

The distribution of BEP-20 $TON looks better, with the top 100 holders having only 67.29% of BEP-20 circulating supply

coincarp.com/currencies/ton…

The distribution of BEP-20 $TON looks better, with the top 100 holders having only 67.29% of BEP-20 circulating supply

coincarp.com/currencies/ton…

25/31

Link to FTX address (0x97f991971a37d4ca58064e6a98fc563f03a71e5c) holding $TON: etherscan.io/tokenholdings?…

Link to FTX address (0x97f991971a37d4ca58064e6a98fc563f03a71e5c) holding $TON: etherscan.io/tokenholdings?…

26/31

While TON might seem like any other ecosystem, what sets TON apart, is its integration with the Telegram messenger, essentially achieving the "one-stop shop" superapp status

While TON might seem like any other ecosystem, what sets TON apart, is its integration with the Telegram messenger, essentially achieving the "one-stop shop" superapp status

27/31

A major hurdle to global crypto adoption is the high barrier to entry.

Reiterating 2/31, Telegram is trying to provide CONVENIENCE, with a goal to become a superapp.

My view is that Telegram might have killed 2 birds with 1 stone by venturing into DeFi:

A major hurdle to global crypto adoption is the high barrier to entry.

Reiterating 2/31, Telegram is trying to provide CONVENIENCE, with a goal to become a superapp.

My view is that Telegram might have killed 2 birds with 1 stone by venturing into DeFi:

28/31

(1) - Dodging regulation. Looking at WeChat Pay or KakaoPay, they all require payment licenses they are dabbling with TradFi payments.

Going straight to DeFi skips the regulation part, since everything is anonymous

(1) - Dodging regulation. Looking at WeChat Pay or KakaoPay, they all require payment licenses they are dabbling with TradFi payments.

Going straight to DeFi skips the regulation part, since everything is anonymous

29/31

(2) - Mass DeFi adoption. Integrating everything into telegram makes DeFi super accessible.

They can leverage the 700M+ users already on Telegram (DAU of 55.2M). By comparison, Ethereum's DAU is 420K.

Telegram could beat ETH by converting just 0.76% of their DAU to DeFi

(2) - Mass DeFi adoption. Integrating everything into telegram makes DeFi super accessible.

They can leverage the 700M+ users already on Telegram (DAU of 55.2M). By comparison, Ethereum's DAU is 420K.

Telegram could beat ETH by converting just 0.76% of their DAU to DeFi

30/31 What's next for TONchain?

While not explicitly mentioned in their roadmap, Durov (CEO of telegram) has announced that Telegram is working on building a DEX & non-custodial wallet following FTX's collapse.

This is likely powered by the Tonchain.

While not explicitly mentioned in their roadmap, Durov (CEO of telegram) has announced that Telegram is working on building a DEX & non-custodial wallet following FTX's collapse.

This is likely powered by the Tonchain.

https://twitter.com/durov/status/1598002700586975232

31/31

I put in a lot of effort into these threads.

If you found them helpful please do leave a ❤️& Retweet the first tweet below if you can 🙏

Follow me @0xsurferboy for more analytical threads.

I put in a lot of effort into these threads.

If you found them helpful please do leave a ❤️& Retweet the first tweet below if you can 🙏

Follow me @0xsurferboy for more analytical threads.

https://twitter.com/0xsurferboy/status/1602317403018231808

Tags for awareness.

Would appreciate feedback/additional research🙏@ramahluwalia @bloomstarbms @DefiIgnas @Arthur_0x @samczsun @CryptoKaleo @DeFiSurfer808 @ceterispar1bus @ton_blockchain @0xFlips @durov @Crypto_McKenna @alphaketchum @OnChainWizard @CryptoBullet1 @thedailydegenhq

Would appreciate feedback/additional research🙏@ramahluwalia @bloomstarbms @DefiIgnas @Arthur_0x @samczsun @CryptoKaleo @DeFiSurfer808 @ceterispar1bus @ton_blockchain @0xFlips @durov @Crypto_McKenna @alphaketchum @OnChainWizard @CryptoBullet1 @thedailydegenhq

#telegram #TONcoin #crypto #cryptocurrecy #stablecoin #USDC #USDT #BUSD #binance #FTX #Metamask #Arbitrum #Airdrop #blockchain #Celsius #BlockFi #Genesis #Bitboy #Web3 #FOMC #Bybit #uniswap #BNB #MAGIC

• • •

Missing some Tweet in this thread? You can try to

force a refresh