Agha Hasan Abedi — legendary banker & founding President of #BCCI (Bank of Credit & Commerce International) — the world’s 7th largest privately owned bank.

A bank run by Pakistanis 🇵🇰 & financed by the Ruling Family of Abu Dhabi 🇦🇪 & prominent family offices of Saudi Arabia 🇸🇦.

A bank run by Pakistanis 🇵🇰 & financed by the Ruling Family of Abu Dhabi 🇦🇪 & prominent family offices of Saudi Arabia 🇸🇦.

https://twitter.com/pak_investor/status/1603650672284602368

Founded in 1972, during a meeting of senior bankers in Beirut, #Lebanon 🇱🇧, #BCCI went on to open up branches & launch full-fledged commercial banking operations in 73 countries around the world by 1989. This included opening the first branch of a foreign-owned bank in #China 🇨🇳.

In the mid-1980’s, Agha Hasan Abedi (or Agha Sahib as he was called fondly by colleagues), negotiated the acquisition of a very unique banking operation in the #UnitedStates 🇺🇸. The bank acquired had licenses to operate in 15-16 states in the US. An unprecedented transaction.

By 1988/89, before the onset of Gulf War I, Agha Sahib negotiated the buyout of @CNN with its founder Ted Turner. #BCCI was to acquire CNN through a subsidiary. The acquisition of CNN by a Gulf-owned, Pakistani-run bank would’ve given Muslims unprecedented global media influence.

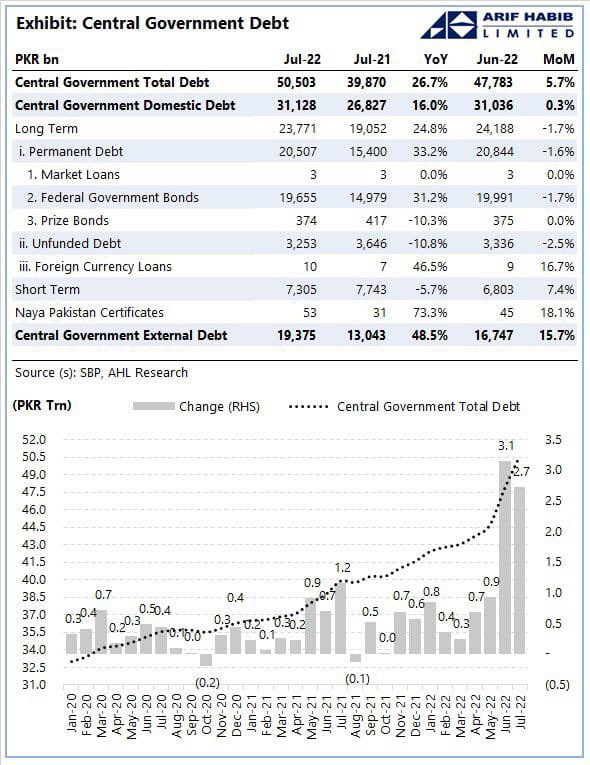

Those of us who today are used to watching #Pakistan 🇵🇰 being bailed out every few years by #SaudiArabia 🇸🇦, #UAE 🇦🇪, & #China 🇨🇳 should know that in the 1980’s, it was #BCCI that came to the rescue of Pakistan & @StateBank_Pak at least 3 times when our FX reserves had plummeted.

Very few young #Pakistanis know that Ghulam Ishaq Khan Institute of Engineering Sciences & Technology (#GIK) was financed by #BCCI in order to assist #Pakistan in establishing a state-of-the-art tech university that would provide support & human capital to 🇵🇰‘s nuclear program.

Not many Pakistanis know that the visionary President of #BCCI funded & established the National University of Computing & Emerging Sciences (also known as “BCCI FAST”) in #Pakistan in 1980. #FAST has probably the largest contribution towards 🇵🇰‘s IT sector till-date.

Probably a handful of stock market analysts & investors in #Pakistan are aware of the fact that it was Agha Sahib & #BCCI that on President Gen. Zia-ul-Haq’s request (in order to provide 🇵🇰 with much-needed 💵 FX), agreed to buy & expand the Attock Group (cement, oil, refinery).

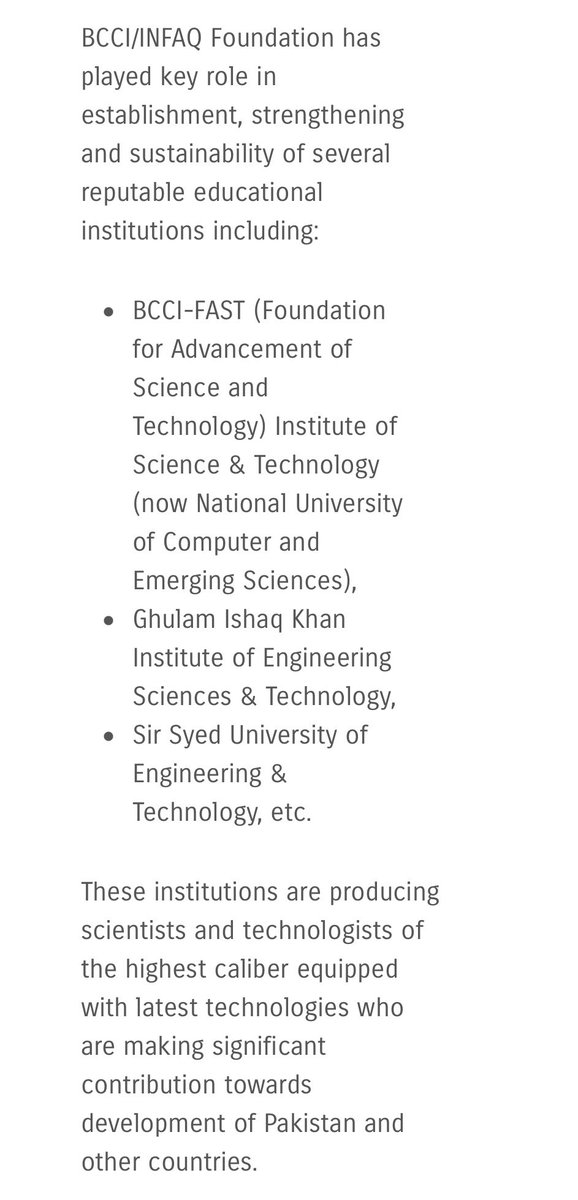

At critical points in time, during Afghan War I, when the #SovietUnion had invaded & occupied #Afghanistan 🇦🇫, it was #BCCI that provided financial intermediation services to the Government of #Pakistan & Pak Army in their fight against the Red Army stationed next-door in Kabul.

At one point in time, Pakistan’s “strategic programme” was struggling due to paucity of funds. On President Ghulam Ishaq Khan’s request, Agha Sahib & BCCI provided much-needed financial assistance/facilitation due to its presence in 73 countries globally. Can’t say more on this.

The focus on #philanthropy & #giving was so embedded within #BCCI’s culture, that each bank employee used to get 2.5% additional funds on top of monthly salaries which they were then instructed by BCCI’s President to pay out themselves as Zakat to deserving people around them.

The concept of #caring for #BCCI’s employees was taken to the next level by Agha Sahib. He instituted comprehensive health insurance for all employees + parents. The family of any employee who happened to pass away whilst employed would get his/her last-drawn salary for 5 years.

#BCCI’s general managers (country heads) of its various banking operations around the globe used to directly manage relationships with prominent stakeholders within those host countries including Presidents / PM’s / Army Chiefs / FM’s Finance. They were fully trusted & empowered.

Many of them were young: early 30’s - 40’s. Probably one of the reasons why many of them went on to become CEO’s and senior executives of Pakistani and global banks later on, after #BCCI’s forced closure in 1991. Agha Sahib trained & gave the world thousands of prominent bankers.

Not only that, but #BCCI Foundation (aka INFAQ Foundation) seed-funded & continues to provide funding today to many prominent #Pakistani philanthropic initiatives in the education and healthcare sectors, such as: SIUT, @SKMCH, @HussainiBlood, Kidney Centre, @nicvd_karachi etc.

Such was the love & passion for #Pakistan 🇵🇰 to succeed amongst #BCCI executives & sponsors alike, that they immediately agreed to Agha Sahib’s suggestion for the entire net income of BCCI’s highly profitable Pakistan operations to be donated to charitable causes in Pakistan.

Just to give readers an idea about how profitable #BCCI’s Pakistan operations were: 🇵🇰 net annual profit was greater than the combined net profit of all other foreign banks operating in Pakistan.

All major GOP sovereign bond issuance mandates were won by BCCI. No competition.

All major GOP sovereign bond issuance mandates were won by BCCI. No competition.

Going to take a break now and make myself a cup of coffee ☕️ before I continue writing a bit more in this thread 🧵 on the Bank of Credit & Commerce International (#BCCI) and its charismatic founding President Agha Hasan Abedi. Thanks to @pak_investor for the inspiration.

Ok. So, continuing from where I left off, #BCCI was the single most profitable bank in Pakistan, bigger than all foreign banks combined (and there were quite a few foreign banks operating in #Pakistan during the period 1975-1990 including Citibank & ANZ Grindlays amongst others).

The situation was more or less the same in every foreign market #BCCI went into, whether it was the Middle East, UK & Europe, Asia, Africa, or Latin America. Year after year, BCCI and its (primarily) Pakistani management were outplaying, outmanoeuvring, & overtaking legacy banks.

Western financial institutions & senior American/British/European bankers were astounded by the rapid success of this obscure, previously unknown Middle-Eastern funded, Pakistani-managed international bank which was now present in 78 countries (I had incorrectly mentioned 73).

Everyone who was anyone on Wall Street 🇺🇸, in the City 🇬🇧, and in the other important global financial & private banking capitals of Frankfurt 🇩🇪, Paris 🇫🇷, Zurich 🇨🇭, Vienna 🇦🇹, Luxembourg 🇱🇺, and Hong Kong 🇭🇰 felt intense & growing competition from this new kid on the block.

They were right to feel the heat; #BCCI had quickly become the 4th largest geographically dispersed bank in the world within a period of 20 years since its founding in 1972. Everyone from Citibank to HSBC & Banco Santander to Barclays were getting hammered by Pakistani bankers.

Not only that, #BCCI had started to be known as the Third World Bank in many developing nations around the world (Asia, Africa, and Central & South America).

Agha Sahib urged BCCI’s CEOs in the Third World to structure Balance of Payments support facilities for host countries.

Agha Sahib urged BCCI’s CEOs in the Third World to structure Balance of Payments support facilities for host countries.

When @WorldBank & @IMFNews played hardball in bailing out Third World countries, & other Western institutions & bilateral sovereign lenders dillydallied, Agha Sahib or one of his senior lieutenants would fly in from Abu Dhabi or London & BCCI would become a lender of last resort.

I have personally spoken to many former #BCCI executives, some of whom worked directly under Agha Hasan Abedi, and each one of them confirmed that BCCI had inadvertently become a direct competitor of the @IMFNews & @WorldBank. This probably didn’t go down too well with the West.

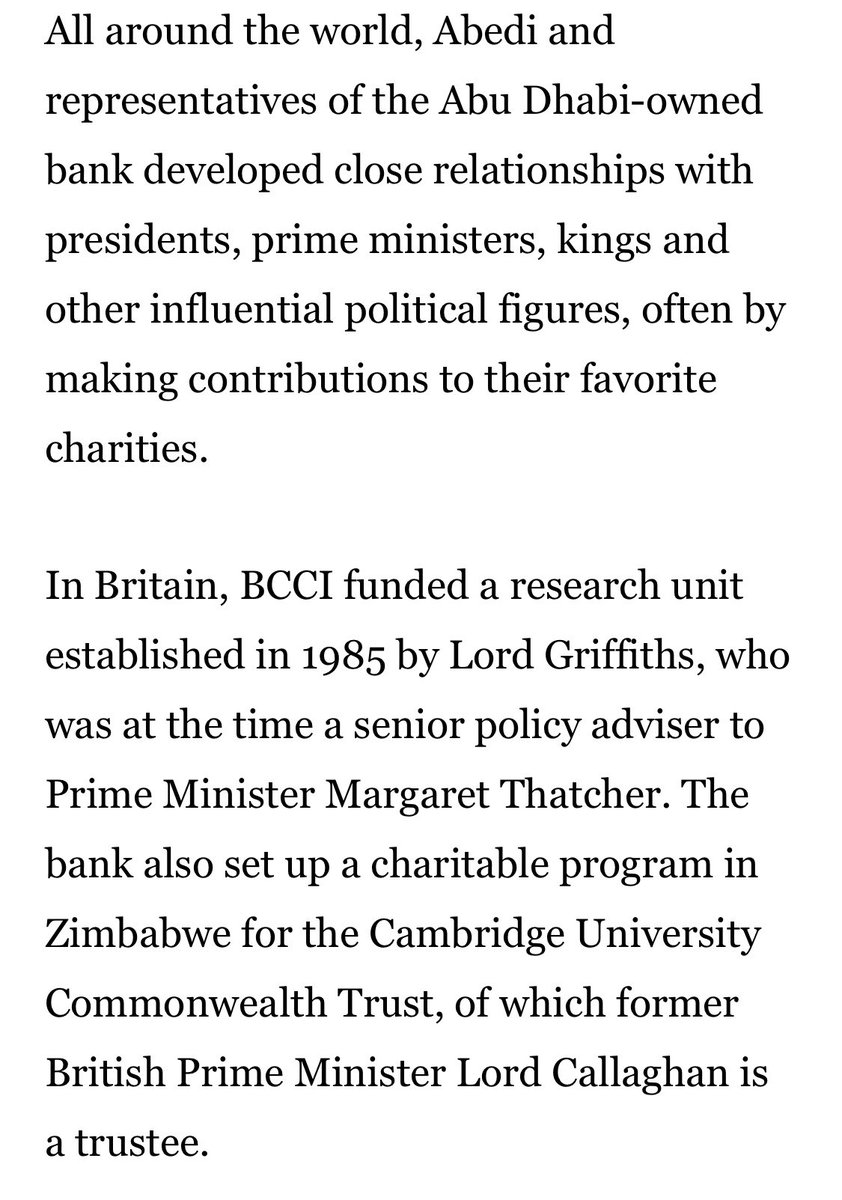

Another issue that had started to irk Western officials was that over the years, due to #BCCI’s growing presence globally and diplomatic support received from Abu Dhabi, Riyadh, and Islamabad, Agha Sahib had cultivated very close relationships with influential global leaders.

Some of the very close associates of Agha Sahib were former US 🇺🇸 President & Democrat Jimmy Carter, as well as former British 🇬🇧 Prime Minister James Callaghan of the Labour Party. #BCCI did phenomenal philanthropic work in association with these two influential statesmen.

Wherever they travelled globally in #BCCI’s Boeing jet 🛩️, Agha Sahib & former President Jimmy Carter were treated as equals by their hosts.

President Carter remained an outspoken ally & supporter of Agha Sahib till the very end, & refused to believe any malicious media stories.

President Carter remained an outspoken ally & supporter of Agha Sahib till the very end, & refused to believe any malicious media stories.

Agha Sahib was a peacemaker, & worked hard to forge close relationships with influential global religious figures such as Pope John Paul II.

The President of #BCCI was known as a mystical figure. He preached #humility & #giving to his colleagues whom he called his “BCCI Family”.

The President of #BCCI was known as a mystical figure. He preached #humility & #giving to his colleagues whom he called his “BCCI Family”.

People often ask as to how #BCCI managed to become a Top 10 global bank in only 20 years. What was BCCI’s secret to success? What was BCCI & its management doing that other Western lenders were not able to do in a 100 years or more?

Three words:

Customer Service Excellence.

Three words:

Customer Service Excellence.

The beauty of the man is such that he repeated this “service excellence” success not once but twice, once at @UBLDigital (now the 3rd largest bank in #Pakistan) and then at #BCCI. UBL was financed by the Saigol family and managed by the young, former HBL-banker Agha Hasan Abedi.

A real-life example of what “customer service excellence” actually meant at #BCCI.

Another bank’s client was struggling to wire transfer tuition fees to his son in New Haven; deadline looming. He came to BCCI (LDA Plaza). The Manager knew him; he called up his NYC counterpart.

Another bank’s client was struggling to wire transfer tuition fees to his son in New Haven; deadline looming. He came to BCCI (LDA Plaza). The Manager knew him; he called up his NYC counterpart.

Explained the predicament to his colleague, requested him to catch a ✈️ to Connecticut immediately whilst carrying physical 💵 to be delivered to the client’s son at @Yale.

NYC Manager executed the transaction same-day & notified his colleague back in Lahore that it was done ☑️

NYC Manager executed the transaction same-day & notified his colleague back in Lahore that it was done ☑️

This is just one of many examples of the personalised service that #BCCI used to provide to Corporates, High Net Worth Individuals, and retail customers alike. There was little to no discrimination. Clients who banked once with BCCI became customers of the bank for life.

On the other hand, Western banks used to openly discriminate amongst its clientele, with the large corporates & HNWI’s receiving overtly preferential treatment as compared to retail & SME customers. In the UK 🇬🇧, you had to actually pay 💷 to see a Branch Manager.

Imagine that!

Imagine that!

#BCCI and Agha Hasan Abedi shattered the concept of favouritism and preferentialism in banking. BCCI became a bank for everyone, particularly for Third World Countries and those who previously didn’t enjoy full & unfettered access to banking services.

People often ask me, who were the business world beneficiaries of #BCCI? Well, you’ll be surprised how some of the top conglomerates of #Pakistan, #GCC, #India, #Bangladesh, Africa, UK, & Latin America were funded & financed by BCCI at a time that many foreign banks shunned them.

I’ll give an example from the #UK 🇬🇧. Most must’ve heard of Bestway Group (owner of the cement company Bestway - $BWCL & United Bank Limited - $UBL).

Sir Anwar Parvez’s business (he later became Agha Sahib’s brother-in-law — AHA & SAP’s wives were sisters) was financed by BCCI.

Sir Anwar Parvez’s business (he later became Agha Sahib’s brother-in-law — AHA & SAP’s wives were sisters) was financed by BCCI.

Now an example from #Pakistan 🇵🇰. Most, if not all large Pakistani conglomerates & family businesses today, at some point or the other in their history, were either financed by the 1st bank founded by Agha Sahib (@UBLDigital), or by #BCCI.

Ask the patriarchs, they will tell you.

Ask the patriarchs, they will tell you.

Let’s move on to one of the most prominent examples of #BCCI’s role as the world’s foremost Third World Bank. This example is from #India 🇮🇳, and was directly quoted / reminded to my uncle (who used to be a senior lieutenant of Agha Sahib based in Abu Dhabi) by Anil Ambani.

Anil Ambani is the younger son of one of India’s most successful businessmen: Dhirubhai H. Ambani, Founder & Chairman of the @reliancegroup.

Anil met my uncle in Abu Dhabi when he was managing Dhabi Group (owner of @BankAlfalahPAK, Warid later acquired by @jazzpk, & @WateenTel).

Anil met my uncle in Abu Dhabi when he was managing Dhabi Group (owner of @BankAlfalahPAK, Warid later acquired by @jazzpk, & @WateenTel).

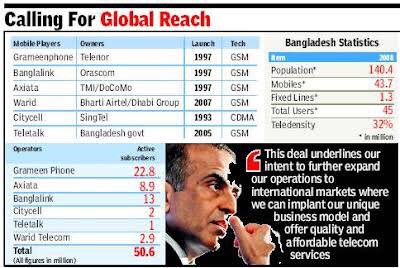

At the time, Warid Telecom had rapidly expanded into Africa (#Congo, #Uganda 🇺🇬, & #IvoryCoast 🇨🇮). The company was now looking to raise further equity to fund its expansion in the continent.

Anil D. Ambani was in the midst of expanding his Reliance Communications into Africa.

Anil D. Ambani was in the midst of expanding his Reliance Communications into Africa.

During the meeting with Anil Ambani, in which my father was also present (he was second-in-command at Dhabi Group and former global treasurer of #BCCI based out of London & Abu Dhabi), Anil reminded my uncle that he had met him in London about two and a half decades ago.

The meeting had taken place at #BCCI’s Headquarters on Leadenhall Street. Anil was accompanying his father Dhirubhai Ambani, whereas my uncle was assisting Agha Sahib & the bank’s CFO.

Dhirubhai was in the midst of raising debt & equity for a very large petrochemicals project.

Dhirubhai was in the midst of raising debt & equity for a very large petrochemicals project.

However, #Indian banks were not supporting him as they deemed the project too complex and the execution part too risky. None of the major Indian lenders were willing to take a bet on Dhirubhai’s entrepreneurial capabilities to execute such a large project finance transaction.

After hearing him out patiently in a 2-hour meeting, Agha Sahib offered lunch to Dhirubhai & young @Wharton grad Anil. The Ambani’s were informed by my uncle that Agha Sahib would revert back to them regarding his decision the next day. They were requested to stay back in London.

The project required significant debt funding as well as mezzanine finance due to its long gestation period. A major project finance transaction that had very few backers in the banking world.

Agha Sahib asked my uncle to invite the Ambani’s over again for tea ☕️ the next day.

Agha Sahib asked my uncle to invite the Ambani’s over again for tea ☕️ the next day.

The following day, the meeting lasted only 45 mins. Agha Sahib conveyed his decision to an ecstatic Dhirubhai Ambani & his son Anil: #BCCI, the world’s Third World Bank, was going to fund @reliancegroup’s major petrochemicals project. Dhirubhai had achieved the impossible.

During the meeting, astonished as to how a #Pakistani-run bank was taking such a big risk on an #Indian conglomerate, Dhirubhai asked Agha Sahib why he agreed to fund his mega-project?

Agha Sahib responded that #BCCI is a bank for everyone, & especially one for the Global South.

Agha Sahib responded that #BCCI is a bank for everyone, & especially one for the Global South.

He asked Dhirubhai Ambani if he recalled noticing him staring deeply into Dhirubhai’s eyes for a longer than usual period of time during yesterday’s meeting. Dhirubhai responded in the affirmative. Agha Sahib stated that he could tell Dhirubhai was honest & wouldn’t cheat us.

Whilst narrating this story to my uncle 25 years later, Anil Ambani (at the time one of #India’s richest businessmen alongside his brother Mukesh), made it a point to let him know that a large part of @reliancegroup’s success was due to #BCCI & Agha Sahib’s trust in his father.

After @anmol_ambani’s father had narrated this memorable story to my uncle & my father, they then told him the story of how Anil’s father Dhirubhai Ambani had returned the favour & helped #BCCI become one of the very first foreign banks to obtain a banking licence in #India 🇮🇳.

A few years after that history-making meeting between Agha Sahib & Dhirubhai Ambani in London, Agha Sahib called Mr. Ambani who was based in Bombay at the time. He had a request: “We’ve applied to @RBI for a banking licence & it seems to be stuck in bureaucracy. Need your help”.

@anilambani’s father assured Agha Sahib that he would look into it & that the #BCCI licence application was now to be considered his own bank’s application. One of his sons was dispatched to New Delhi to meet with government & central bank officials. They returned empty-handed.

At the time, @INCIndia was in power in #India 🇮🇳, with either Indira Gandhi or @RahulGandhi & @priyankagandhi’s father Rajiv Gandhi as the Prime Minister.

Dhirubhai Ambani had a good relationship with the family; he decided to take on the #BCCI bank licence project himself.

Dhirubhai Ambani had a good relationship with the family; he decided to take on the #BCCI bank licence project himself.

Ever grateful to Agha Sahib & #BCCI for supporting him at a time when other banks had pulled back & disappeared, Dhirubhai Ambani moved his camp office to New Delhi for 3 months. Whilst there, he met & lobbied the Gandhi family along with important govt. & central bank officials.

Lo and behold, one day Agha Sahib received a call at BCCI’s London HQ from Dhirubhai Ambani. Mr. Ambani happily conveyed the good news to Agha Sahib: #BCCI was to become one of the very first foreign banks to be granted a full-fledged commercial banking licence in #India 🇮🇳!

My uncle & my father thanked @anilambani for remembering how #BCCI & their mentor Agha Sahib had helped Dhirubhai Ambani & @reliancegroup at a time when no one came forward.

They also told him that they had never forgotten how @anmol_ambani’s grandfather had returned the favour.

They also told him that they had never forgotten how @anmol_ambani’s grandfather had returned the favour.

My uncle praised @anilambani & said “Ambani Sahib’s sons are just like him; they never forgot Agha Sahib & #BCCI.”

He also told him that he felt sad that Pakistanis had forgotten the legendary banker & Third World Bank, despite what Agha Sahib & BCCI had done for #Pakistan 🇵🇰.

He also told him that he felt sad that Pakistanis had forgotten the legendary banker & Third World Bank, despite what Agha Sahib & BCCI had done for #Pakistan 🇵🇰.

Despite @reliancegroup not being the successful partner of Warid in #Africa & #Bangladesh 🇧🇩 — Sunil Mittal of @airtelindia acquired stakes in those telco’s — my uncle & my father maintain cordial relations with @anilambani, thus continuing Agha Sahib & Dhirubhai Ambani’s legacy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh