1/21 #Ethereum⛓ has never been so cheap that the average user is now able to invest on #Defi projects

I'm pleased to share with you my TOP 10 CRYPTO list on #Ethereum that will be part of my investment plan for 2023

Nothing here is financial advice,do your own research anon 🔞

I'm pleased to share with you my TOP 10 CRYPTO list on #Ethereum that will be part of my investment plan for 2023

Nothing here is financial advice,do your own research anon 🔞

2/21 This list is my own & include projects i follow since months or years, either as an investor, contributor or just by curiosity

I'm sure there are plenty other potential 10X cryptos, but i only talk about project I deeply follow & understand

Let's start right now 👇

I'm sure there are plenty other potential 10X cryptos, but i only talk about project I deeply follow & understand

Let's start right now 👇

3/21 Yes, swap fees are cheap currently & will cost you few $

In the middle of the week at GWEI=41, swap fee is approx 9$

Do that during the weekend, swap fee will drop easily between 2$-3$

Below picture taken from this site: etherscan.io/gastracker

In the middle of the week at GWEI=41, swap fee is approx 9$

Do that during the weekend, swap fee will drop easily between 2$-3$

Below picture taken from this site: etherscan.io/gastracker

4/21 I have already covered few projects on my #Optimism TOP CRYPTO list that are also available on Mainnet such as:

#1- @ethereum $ETH

#2- @iearnfinance $YFI

#3- @AlchemixFi $ALCX

Go have a look:

#1- @ethereum $ETH

#2- @iearnfinance $YFI

#3- @AlchemixFi $ALCX

Go have a look:

https://twitter.com/Subli_Defi/status/1600174788529381378?s=20

5/21 For @AlchemixFi i like to add some info about their new tokenomics detailed in this article: alchemixfi.medium.com/vealcx-update-…

$veALCX primary features:

- Boosted yield

- Staking 80% $ALCX/20% $ETH LP token on @Balancer

- Bi-weekly gauge to direct liquidity mining

- Gov. voting

$veALCX primary features:

- Boosted yield

- Staking 80% $ALCX/20% $ETH LP token on @Balancer

- Bi-weekly gauge to direct liquidity mining

- Gov. voting

6/21 Plus:

- Revenue sharing

- Staked $ETH vault from @LidoFinance

- $FRAX incorporated into $alUSD

- New strategy added with @VesperFi

- New synthetic asset $alOHM

- OP Incentives (refer to above link)

- Revenue sharing

- Staked $ETH vault from @LidoFinance

- $FRAX incorporated into $alUSD

- New strategy added with @VesperFi

- New synthetic asset $alOHM

- OP Incentives (refer to above link)

7/21

#4- @redactedcartel $BTRFLY

Why? Incubated by @neworderDAO, this project keeps fascinating me, technically, business wise & is part of the best #defi protocols ever imo

Catalyst: Roadmap 2023 ➡

#4- @redactedcartel $BTRFLY

Why? Incubated by @neworderDAO, this project keeps fascinating me, technically, business wise & is part of the best #defi protocols ever imo

Catalyst: Roadmap 2023 ➡

https://twitter.com/Subli_Defi/status/1604782742800998400?s=20

8/21 $BTRFLY Metrics:

Estimation of Annual revenue in $ETH: Approx 3m$

Market Cap: 19m$

▶P/S = 6.3

When listing @tokenterminal ?

Remember, lockers earn revenue sharing 👇

Estimation of Annual revenue in $ETH: Approx 3m$

Market Cap: 19m$

▶P/S = 6.3

When listing @tokenterminal ?

Remember, lockers earn revenue sharing 👇

9/21

#5- @CurveFinance

Why? Curve is the leading DEX for correlated assets (stablecoin, ETH/Derivatives_ETH, etc...)

Catalyst: The new stablecoin $crvUSD. I suggest you take time to read the full report made by @CurveCap as it brings a lot of ALPHA:

curve.substack.com/p/november-22-…

#5- @CurveFinance

Why? Curve is the leading DEX for correlated assets (stablecoin, ETH/Derivatives_ETH, etc...)

Catalyst: The new stablecoin $crvUSD. I suggest you take time to read the full report made by @CurveCap as it brings a lot of ALPHA:

curve.substack.com/p/november-22-…

10/21 $CRV Metrics:

Market Cap: 344m$

P/S= 6.7

Revenue sharing: 50% to LPers / 50% to veCRV holders

Listen to the top 8 moments during the live between @flywheelpod & @CurveFinance

Market Cap: 344m$

P/S= 6.7

Revenue sharing: 50% to LPers / 50% to veCRV holders

Listen to the top 8 moments during the live between @flywheelpod & @CurveFinance

https://twitter.com/flywheelpod/status/1610747578047406080?s=20

11/21

#6- @0xconcentrator $CTR

Why? Yield optimizer built on top of @ConvexFinance @CurveFinance & @fraxfinance to accumulate blue chips tokens of your choice $CRV / $FXS

Catalyst? Addition of $frxETH (staked $ETH on Frax), BLUSD-LUSD pool, @CurveFinance flywheel

#6- @0xconcentrator $CTR

Why? Yield optimizer built on top of @ConvexFinance @CurveFinance & @fraxfinance to accumulate blue chips tokens of your choice $CRV / $FXS

Catalyst? Addition of $frxETH (staked $ETH on Frax), BLUSD-LUSD pool, @CurveFinance flywheel

12/21 $CTR metrics:

Market Cap: 1,4m$

Annual Revenue estimation: 300k$

▶P/S = 4,7

Revenue sharing: 50% goes to $CTR lockers

@ConvexFinance TVL: 3,000m$

@0xconcentrator TVL: 52m$ (1,7% of Convex TVL)... do you see the potential upside?

Market Cap: 1,4m$

Annual Revenue estimation: 300k$

▶P/S = 4,7

Revenue sharing: 50% goes to $CTR lockers

@ConvexFinance TVL: 3,000m$

@0xconcentrator TVL: 52m$ (1,7% of Convex TVL)... do you see the potential upside?

13/21

#7- @0xC_Lever $CLEV

Why? Clever allows you to take a leverage position with no risk of liquidation on blue chips assets such as $CVX, $CRV & $#Stable

Catalyst: Close synergy with @fraxfinance & @ConvexFinance

medium.com/@0xC_Lever/fra…

#7- @0xC_Lever $CLEV

Why? Clever allows you to take a leverage position with no risk of liquidation on blue chips assets such as $CVX, $CRV & $#Stable

Catalyst: Close synergy with @fraxfinance & @ConvexFinance

medium.com/@0xC_Lever/fra…

14/21 $CLEV metrics:

Market cap: 1,2m$

Protocol revenue: Not fully turned out right now. Waiting for nex gauges to be launched. These gauges will allow to receive $CRV incentives to LPers.

Gauges proposal:

gov.curve.fi/t/proposal-to-…

Market cap: 1,2m$

Protocol revenue: Not fully turned out right now. Waiting for nex gauges to be launched. These gauges will allow to receive $CRV incentives to LPers.

Gauges proposal:

gov.curve.fi/t/proposal-to-…

15/21

#8- @pendle_fi

Why? It's a derivative protocol allowing you to trade your future yield & at the same time setup fixed yield on your farming position => Did they just invent the Decentralized Saving Account?

Catalyst: V2 recently released

#8- @pendle_fi

Why? It's a derivative protocol allowing you to trade your future yield & at the same time setup fixed yield on your farming position => Did they just invent the Decentralized Saving Account?

Catalyst: V2 recently released

https://twitter.com/Subli_Defi/status/1597953745295650816?s=20

16/21$PENDLE metrics:

Market Cap: 4.8m$

Protocol Revenue: 350k$1/year with V1

P/S: 13.7

Lockers earn:

- Boosted yield up to 2,5x

- Share of protocol revenue: Currently set at 100%

- Only 10% of circulating supply currently locked

Market Cap: 4.8m$

Protocol Revenue: 350k$1/year with V1

P/S: 13.7

Lockers earn:

- Boosted yield up to 2,5x

- Share of protocol revenue: Currently set at 100%

- Only 10% of circulating supply currently locked

17/21

#9- @fraxfinance

Why? Unique protocol with all three of the biggest use cases of DeFi, i.e., the ‘Holy Trinity of DeFi’

– liquidity structures, lending markets and stablecoins.

Catalyst? 2023 Roadmap

#9- @fraxfinance

Why? Unique protocol with all three of the biggest use cases of DeFi, i.e., the ‘Holy Trinity of DeFi’

– liquidity structures, lending markets and stablecoins.

https://twitter.com/ReveloIntel/status/1612267920846880769?s=20

Catalyst? 2023 Roadmap

18/21 $FXS Metrics:

Market Cap: 420m$

Protocol Revenue: 5m$

P/S = 105

Fraxswap, Fraxlend, frxETH will lead to more revenues to veFXS holders. Check this great summary from @OuroborosCap8

Market Cap: 420m$

Protocol Revenue: 5m$

P/S = 105

Fraxswap, Fraxlend, frxETH will lead to more revenues to veFXS holders. Check this great summary from @OuroborosCap8

https://twitter.com/OuroborosCap8/status/1580081909886988288?s=20

19/21

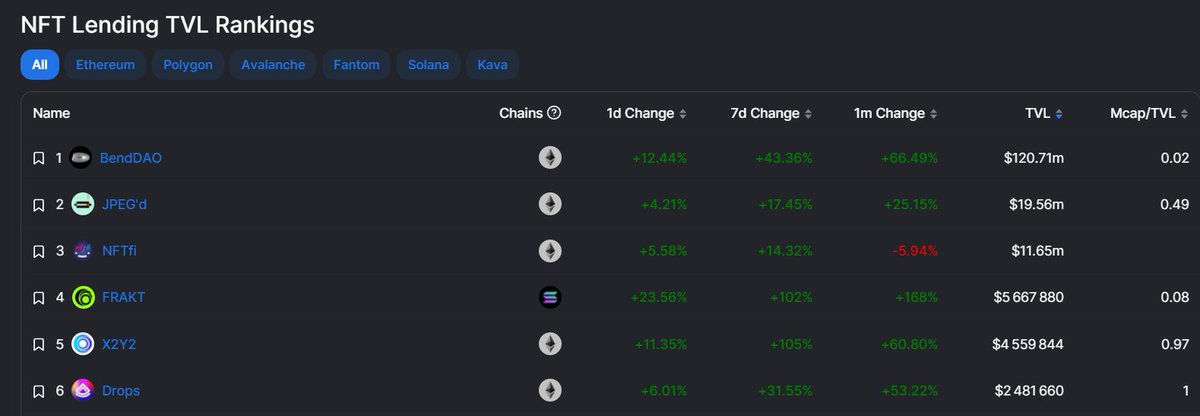

#10- @spice_finance is a Yield Aggregator for NFT Lending

Why? No token yet, launched planned 30th of January. Well known investors. Launch info:

Catalyst? #defi for #NFT keeps growing, with the primitives protocols being Lending platform

#10- @spice_finance is a Yield Aggregator for NFT Lending

Why? No token yet, launched planned 30th of January. Well known investors. Launch info:

https://twitter.com/spice_finance/status/1611045101890830341?s=20

Catalyst? #defi for #NFT keeps growing, with the primitives protocols being Lending platform

20/21 Here is a great thread about NFT Fi done by @korpi87

https://twitter.com/korpi87/status/1612126086749622272?s=20

21/21 I've been preparing this thread since end of December, and some of these crypto are already x2! Don't fomo guys!

If you like this thread, i'd be grateful if you could support my research by retweeting the 1st post:

If you like this thread, i'd be grateful if you could support my research by retweeting the 1st post:

https://twitter.com/Subli_Defi/status/1613818929658621952?s=20

Tagging some people who follow those projects as well and from which you can learn a lot!

@crypto_condom

@crypthoem

@rektdiomedes

@ThorHartvigsen

@DAdvisoor

@crypto_linn

@LadyofCrypto1

@Cryptoyieldinfo

@Dynamo_Patrick

@tehMoonwalkeR

@HsakaTrades

@crypto_condom

@crypthoem

@rektdiomedes

@ThorHartvigsen

@DAdvisoor

@crypto_linn

@LadyofCrypto1

@Cryptoyieldinfo

@Dynamo_Patrick

@tehMoonwalkeR

@HsakaTrades

@TheDeFinvestor

@alpha_pls

@blocmatesdotcom

@CroissantEth

@milesdeutscher

@shivsakhuja

@phtevenstrong

Cheers guys. Let's continue to build to prepare ourselves for the next leg!

@alpha_pls

@blocmatesdotcom

@CroissantEth

@milesdeutscher

@shivsakhuja

@phtevenstrong

Cheers guys. Let's continue to build to prepare ourselves for the next leg!

• • •

Missing some Tweet in this thread? You can try to

force a refresh